Important Bull Market Results

Overall performance rank for up/down breakouts (1 is best): 23 out of

23; 13 out of 21

Break even failure rate for up/down breakouts: 19%; 14%

Average rise/decline: 28%; 15%

Throwback/pullback rate: 52%; 51%

Percentage meeting price target for up/down breakouts: 63%; 44%

Identification Guidelines

|

Characteristic |

Discussion |

|

Price trend |

Can be up or down leading

to the pattern |

|

Shape |

A megaphone tilted down with

the top horizontal. |

|

Trendlines |

The top trendline is horizontal,

the bottom one slopes downward. |

|

Touches |

At least two peaks and two

valleys should touch their respective trendline. |

|

Volume shape |

Trends upward 54% to 59% of the time

with a dome shape. |

|

Breakout |

Upward 51% of the time. |

Trading Tips

|

Trading Tactic |

Explanation |

|

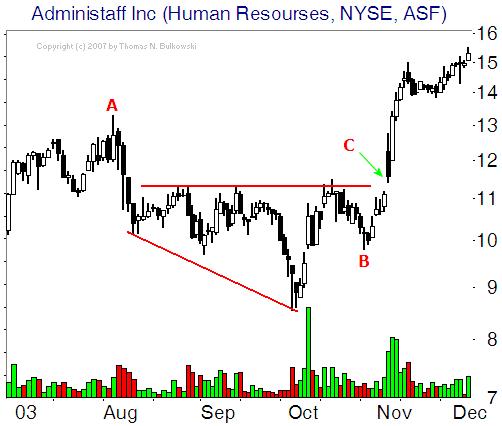

Measure rule |

Compute the height from the horizontal trendline

(B in the Measure Rule figure to the right) to the

lowest valley (A) and multiply it by the above “

percentage meeting price target.”

Add the result to the horizontal trendline (B, upward

breakouts) or subtract it from the lowest valley (A,

downward breakouts) to get the price target (C).

|

|

Intraformation trade |

Buy at the bottom trendline

when price starts rising and sell or sell short once price turns at the horizontal trendline. |

|

Buy at 3rd touch |

When price touches the bottom

trendline for the third time and begins rising, buy. |

|

Partial rise |

A partial rise works 54% of

the time. |

|

Partial decline |

A partial decline works 63%

of the time. |

|

Price trend |

The best performing patterns are those with an

intermediate- or long-term (over three months) price trend leading to the pattern.

|

|

Yearly middle |

For both breakout directions, the

middle third of the yearly price range performs best. For downward breakouts, the highest third also performs well. |

|

Volume trend |

A rising volume trend results in

the best postbreakout performance. |

|

Throwbacks and Pullbacks |

Throwbacks and pullbacks hurt postbreakout

performance. |

|