Here are some of the basic concepts that you will need to know:

Each bar represents price performance for a specific period. These periods may be as long as a month or as short as a minute, daily bars being the most popular.

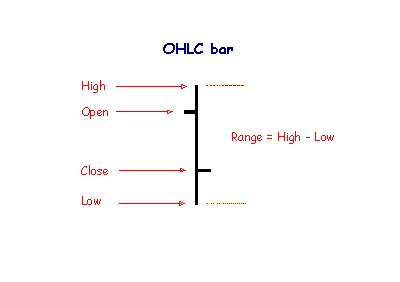

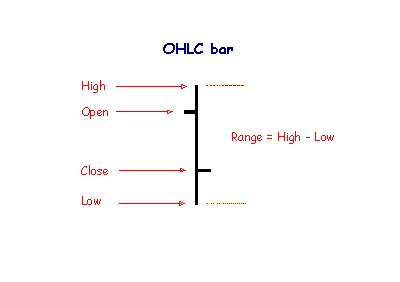

OHLC stands for the 4 elements displayed on a typical price bar:

Opening price is taken from the first trade of the day (or period). The public tend to place orders at the opening of the market, reacting to the previous day’s close. Closing price is taken from the last trade of the day (or period). Institutional investors normally watch developments during the day and place orders towards the close. Opening price indicates the emotional direction of the market and the closing price represents (in most cases) a more reasoned and well-researched view.

Open and close are only significant for periods with a definite break before the next opening, as with days or weeks. They should be ignored in analyzing intra-day charts or markets that are open 24 hours a day.

The range is the difference between the highest and lowest prices traded during a day (or period).

For every transaction there must be a buyer and a seller - so the actual number of buyers and sellers is always equal. If there are more potential buyers than sellers at the current price, buying pressure will force the price upwards until equilibrium is re-established. The opposite occurs if there are more sellers than buyers - prices will be forced downward. The side that outweighs the other is said to have control.

We can identify control from the position of the closing price in relation to:

If an excess of buyers forces price to rise, some buyers will be deterred by the higher prices and withdraw, and more sellers may be enticed into the market. The rate of withdrawal/entry in response to changing prices is referred to as the commitment (or eagerness) of the party in control.

If buyers are strongly committed they will not deterred by rising prices and will continue to bid the price up, with little profit-taking. Likewise, if sellers are committed they will not be deterred by lower prices and will continue to sell the stock down.

The market provides a number of clues as to the commitment of buyers and sellers:

Because of the complexity of trading positions, especially when trading in futures and options, traders avoid the terms buy and sell, and refer to long and short positions.

Going long means buying an asset, a call option or a futures contract with a view to profiting from a rise in the price of the underlying asset.

Going short means selling an asset, buying a put option, selling a call option, or entering a futures contract with a view to profiting from a decline in the price of the underlying asset. Short-selling requires that you borrow stock for delivery, as you have sold an asset you do not own. The intention is to buy later, when the price has fallen, in order to repay the borrowed stock. Short positions are normally only of a few days duration and should only be attempted by experienced traders with the assistance of their broker.

If you are only trading the long side of the market, short signals should be interpreted as a signal to close any long position.

Entry = Open a long or short position.

Exit = Quit a long or short position.

Take profits = Reduce a long or short position.

Technical Charting Archives : October 1,1999