Chaikin Oscillator

Marc Chaikin uses the Chaikin Oscillator to monitor the flow of money in and out of the market - comparing money flow to price action helps to identify tops and bottoms in short and intermediate cycles. He suggests that it be used in conjunction with a 21 day price envelope and an overbought/oversold indicator (such as Momentum or RSI).

The Chaikin Oscillator is calculated by subtracting a 10 period exponential moving average from a 3 period exponential moving average of the Accumulation Distribution line.

Trading Signals

The best signals are divergences:

-

Go long on a bullish divergence.

-

Go short on a bearish divergence.

Example

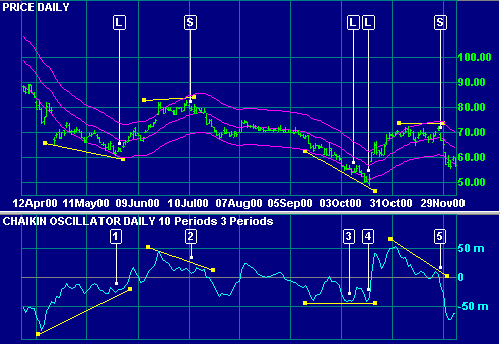

Microsoft Corporation with ![]() Price envelopes (at 10% around a 20 day exponential moving average) and

Price envelopes (at 10% around a 20 day exponential moving average) and ![]() Chaikin oscillator.

Chaikin oscillator.

- Go long [L] on bullish divergence.

- Go short [S] on bearish divergence.

- Go long [L] on bullish divergence. This position is stopped out when price falls below the recent low.

- Bullish triple divergence. Re-enter long position [L].

- Go short [S] on bearish divergence.

Related Topics

External Links

Chaikin Oscillator -- Chart School

Chaikin Oscillator - Technical Analysis from A to Z