Triple Tops

The Pattern: Triple tops occur in

uptrends and signal a trend reversal when the uptrend is broken to the

downside. The pattern consists of three consecutive tops that should peak at

the same level or, at consecutive lower highs.

Volume:

The first peak should occur on

stronger volume than the second and third peak. The pattern

should exhibit a decrease in up volume as the three peaks are formed.

Entry Point: The optimal entry point is a short position when the stock

trades through and below the current uptrend (thin red line).

Target: The target can be measured by taking the difference from the top

of the highest peak and support (thick blue line), and subtracting that figure

from support to arrive at your target.

JCP traded into a triple top formation that occurred with strong volume on the left side of the pattern and low volume on the right side. It subsequently went on to trade below the uptrend (thin red line) and hit the target about four-weeks later.

SRDX traded into a triple top formation that occurred with stronger volume on the left peak and decreasing volume on the subsequent peaks. This pattern formed with bottoms and peaks that occurred at different levels. It is important to note that each subsequent peak has to be lower than the previous one. The bottoms can occur at the same or a higher level. It subsequently went on to trade below the uptrend (thick blue line) and hit the target five-days later. Determining targets on patterns that form with multiple peaks is more challenging that determining targets on tops that form at the same level. In this instance, you should use a combination of the height of the peaks and a recent low.

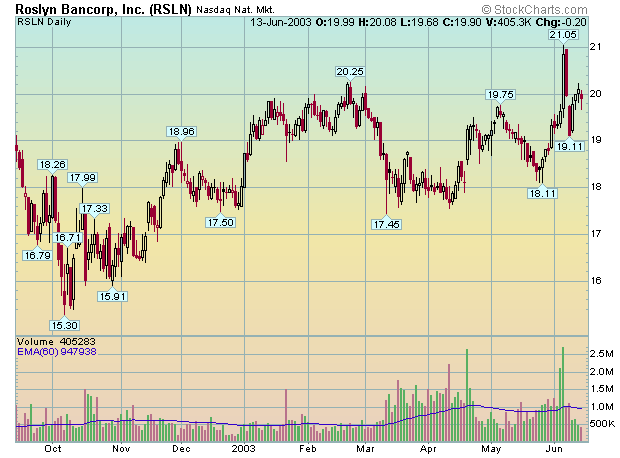

There is a triple top formation on this chart of RSLN.

Triple Bottoms

The Pattern: Triple bottoms occur in

downtrends and signal a trend reversal when the downtrend is broken to the

upside. The pattern consists of three consecutive bottoms that don't

necessarily have to occur at the same level. The first bottom signals the end

of the prior trend. Ideally, you want to see the second bottom occur at a level

slightly higher than the first bottom, and the third bottom to occur at a level

slightly higher than the second.

Volume:

The first bottom should begin on

strong selling volume and end on strong buying volume. The

second bottom should occur on lighter selling volume than the first, and the

third bottom should occur on lighter selling volume than the second. Buying

volume is of greater importance. You should look for an increase in volume as

each subsequent bottom is formed.

Entry Point: The optimal entry point is a long position when the stock

trades through and above the current downtrend (thin red line).

Target: The target can be determined by taking the difference of the

lowest bottom and resistance (thick blue line), and adding that figure to

resistance to arrive at your target.

SCHS traded into a triple bottom formation that didn't occur with a noticeable difference in down volume - remember, up volume is more important than down volume in bottom formations. As expected, up volume did increase as each bottom was formed. It subsequently went on to trade above the downtrend (thin red line) and just came shy of hitting the target two-weeks later. SCHS went on to exceed the target in early June.

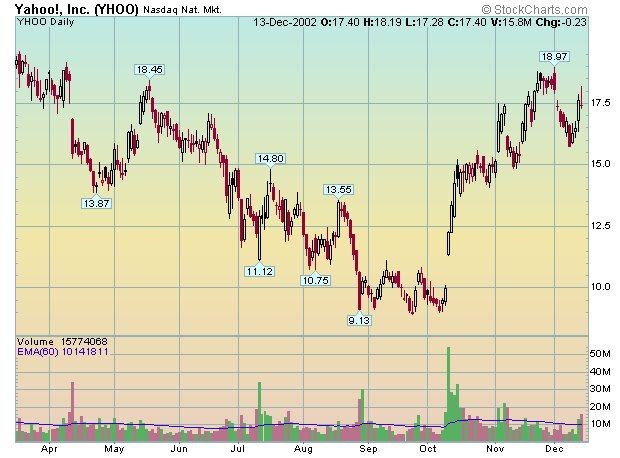

There is a triple bottom formation on this chart of YHOO.

Trading 101 Chart Patterns Ascending / Descending Triangles