Head and Shoulder Tops

The Pattern: The head and shoulders top

pattern forms in an uptrend and signals a trend reversal when the neckline is

broken to the downside. The pattern consists of three tops - the left shoulder,

the head, and the right shoulder. Ideally, the right shoulder will be formed at

a lower high than the left shoulder, but this is not crucial. The head must be

higher than both shoulders or the pattern is invalid.

Volume: Volume should be strong on the left shoulder. The head should

have volume that is equal to or greater than the volume on the left shoulder.

The right shoulder should have a level of volume that is much lighter than the

head or left shoulder.

Entry Point: A short position should be taken when the neckline is

broken to the downside.

Target: Take the difference of the head and the neckline, and subtract

that result from the neckline to arrive at your target.

OII formed a head and shoulder pattern that consisted of a right shoulder that was lower than the left shoulder. The volume pattern formed in textbook style. The neckline was violated and the stock subsequently marched downhill, straight to the target.

LVLT formed a head and shoulder pattern that consisted of a right shoulder that was lower than the left shoulder. The volume pattern formed in textbook style. The neckline was violated and the stock plummeted to the target the very next day. You could have covered your short if you had the opportunity to watch the stock during the day. One week later, LVLT hit the target for the second time.

There is a head and shoulders formation on this chart of GSF.

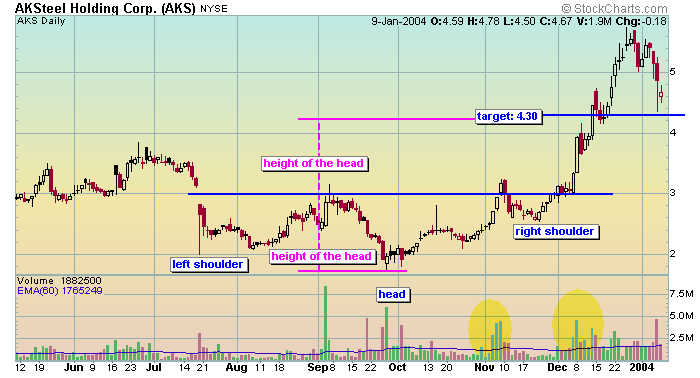

Head and Shoulder Bottoms

The Pattern: The head and shoulders

bottom pattern forms in a downtrend and signals a trend reversal when the

neckline is broken to the upside. The pattern consists of three tops - the left

shoulder, the head, and the right shoulder. Ideally, the right shoulder will be

formed at a higher low than the left shoulder, but this is not crucial. The

head must be lower than both shoulders or the pattern is invalid.

Volume: Volume is not as important on the left side of the pattern as it

is on the right. On the right side of the head you want to see a large surge,

or consistent level of buying to stabilize the fall. The volume pattern on the

right shoulder must be large and consistent enough to push the stock over the

neckline.

Entry Point: A long position should be initiated when the stock trades

above the neckline provided it occurs on strong volume.

The Target: Take the difference of the head and the neckline and add

that result to the neckline to arrive at your target.

AKS formed a head and shoulders pattern that consisted of a left shoulder that was lower than the right shoulder. The pattern formed with strong volume on the left shoulder, strong volume on the right side of the head, and strong volume on the right shoulder. The neckline was broken with a surge in volume. AKS had little difficulty hitting the target.

MAG formed a head and shoulders pattern that consisted of a left shoulder that was higher than the right shoulder - remember, it isn't crucial that the right shoulder be higher than the left. The volume pattern formed in textbook style with strong down volume on the left shoulder, strong up volume on the head, and strong up volume on the right shoulder. The neckline was broken and the stock went on to exceed the target.

There is a head and shoulders bottom formation on this chart of DGIN.

Trading 101 Chart Patterns Triple Tops and Bottoms