Double Tops

The Pattern: Double tops occur in

uptrends and signal a reversal of the previous trend. The pattern consists of

two consecutive tops that peak at almost the same level.

Volume:

The first peak should be formed on strong buying volume while the

second peak should be formed on a noticeable drop in volume, as compared to the

first peak.

Entry Point: The optimal entry point is a short position when the stock

trades through and below the current uptrend (thin red line).

Target: The target can be measured by taking the difference from the top

of the peak and support (thick blue line), and subtracting that figure from

support to arrive at your target.

BBOX traded into a double top formation that occurred with stronger volume on the left peak and low volume on the right peak. It subsequently went on to trade below the uptrend (thin red line) and fell just shy of hitting the target - targets are not an exact science. Sometimes they get hit, sometimes they don't, and sometimes they get exceeded.

AT traded into a double top formation that occurred with volume that was very similar on each peak. The important distinction here is that AT formed the second peak on a three day buying spree, and then subsequently collapsed. AT traded through and below the uptrend (thin red line) and hit it's target in approximately four-weeks.

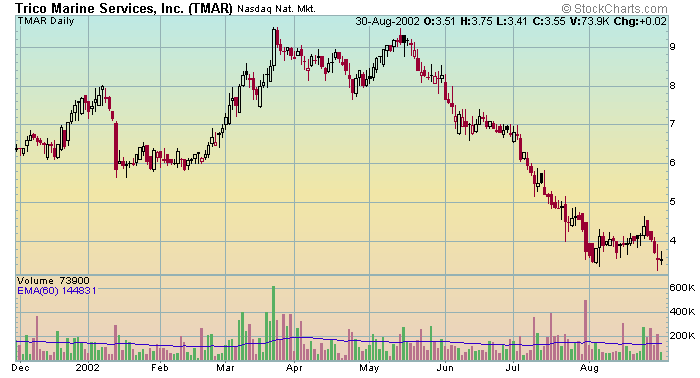

There is a double top formation on this chart of TMAR.

Double Bottoms

The Pattern: Double bottoms occur in

downtrends and signal a reversal of the previous trend. The pattern consists of

two consecutive bottoms that don't necessarily have to occur at the same level.

The first bottom signals the end of the prior trend. Ideally, you want to see

the second bottom occur at a level slightly higher than the first bottom.

Volume:

The first bottom should begin on

strong selling volume and end on strong buying volume. The

second bottom should occur on lighter selling volume, and end on equal or

greater buying volume.

Entry Point: The optimal entry point is a long position when the stock

trades through and above the current downtrend (thin red line).

Target: With double bottoms you can determine two targets. The first

target would be calculated by subtracting the higher bottom from resistance

(thick blue line) and adding that figure to resistance. The second target can

be determined by subtracting the lower bottom from resistance and adding that

figure to resistance.

HYSL traded into a double bottom formation that occurred with strong selling and strong buying volume on the left bottom. The right bottom began with light selling volume and ended with strong buying volume. Since the bottoms occurred at nearly the same price you can use one target. HYSL subsequently went on to trade above the downtrend (thin red line) and just came shy of hitting the target two-weeks later. HYSL eventually hit the target in the middle of September.

YHOO traded into a double bottom formation that occurred with strong selling and strong buying volume on the left bottom. The right bottom began with light selling volume and ended with strong buying volume. We can calculate two targets, since YHOO traded into a double bottom pattern with two distinct price levels. It subsequently went on to trade above the downtrend (thin red line) and hit the targets in two and four-weeks, respectively.

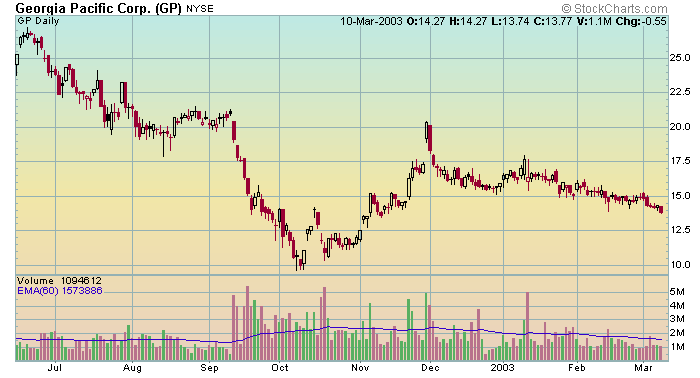

There is a double bottom reversal formation on this chart of GP. answer.

Trading 101 Chart Patterns Head and Shoulders