Relative Strength Index

Relative Strength Index (RSI) is a popular momentum oscillator developed by

J. Welles Wilder Jr. and detailed in his book New Concepts in Technical

Trading Systems.

The Relative Strength Index compares upward movements in closing price to

downward movements over a selected period. Wilder originally used a 14 day

period, but 7 and 9 days are commonly used to trade the short cycle and 21 or 25

days for the intermediate cycle. Please note that Wilder does not use the

standard moving average formula and the time period may need

adjustment.

Relative Strength Index is smoother than the Momentum or Rate of Change

oscillators and is not as susceptible to distortion from unusually high or low

prices at the start of the window (detailed in

Momentum Construction). It is also formulated to fluctuate between 0 and

100, enabling fixed Overbought and Oversold levels.

See

Construction for further details.

Trading Signals

Different signals are used in

trending and

ranging markets. The most important signals are taken from overbought and

oversold levels,

divergences and

failure swings.

Use

trailing buy- and sell-stops to time entry into trades.

Ranging Markets

Set the Overbought level at 70 and Oversold at 30.

-

Go long when RSI falls below the 30 level and rises back above it

or on a bullish

divergence where the first trough is below 30.

-

Go short when RSI rises above the 70 level and falls back below it

or on a bearish

divergence where the first peak is above 70.

Failure swings strengthen other signals.

Trending Markets

Only take signals in the direction of the trend.

-

Go long, in an up-trend, when RSI falls below 40 and rises back above it.

-

Go short, in a down-trend, when RSI rises above 60 and falls back below

it.

Exit using a trend indicator.

Take profits on

divergences. Unless confirmed by a trend indicator, Relative Strength Index

divergences are not strong enough signals to trade in a trending market.

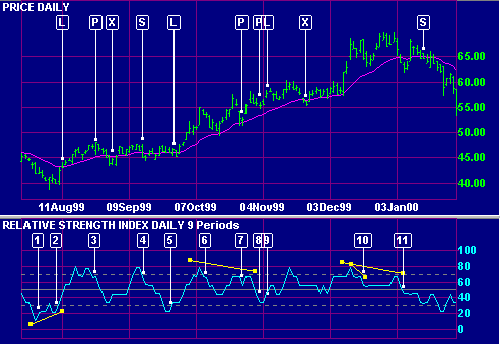

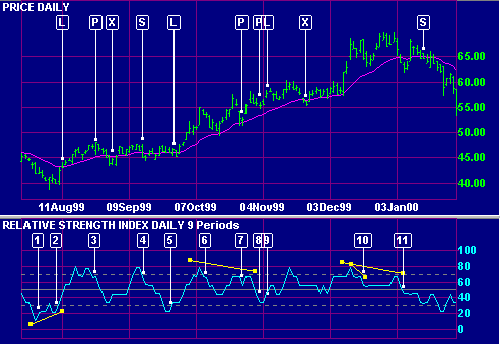

Example

Wal-Mart Stores Inc. is plotted with a

21 day

exponential moving average (MA) and

21 day

exponential moving average (MA) and  9 day Relative Strength Index. A 2-day closing

filter is used with the MA.

9 day Relative Strength Index. A 2-day closing

filter is used with the MA.

- Price is trending downwards (staying below the moving average). Do not

take long signals until the MA turns upward, otherwise we are trading against

the trend.

- A bullish

divergence on Relative Strength Index is reinforced by completion of a

failure swing at [2]. Go long [L] when the MA slopes upwards and RSI

crosses to above 40.

- RSI completes a minor failure swing at [3]. Take profits [P] and exit the

remaining position [X] when there are two closes below the MA.

Do not go short as price is trending upwards (staying above the moving

average).

- Price has started to fluctuate around the moving average, signaling a

ranging market. Go short [S] when RSI crosses from above to below 70.

- Go long [L] when RSI crosses from below to above 30.

- There has been a breakout from the trading range and price is trending

upwards. Do not close the long position.

- Take profits [P] on the bearish divergence (Price has completed a higher

peak while RSI has experienced a lower peak).

- Take profits [P]. A bearish

triple divergence is confirmed by completion of a large failure swing at

[8].

- Increase your long position [L]. RSI has crossed from below to above 40

during an up-trend.

Exit your position [X] when there are two closes below the MA. Do not go short

as the MA still slopes upwards.

- A small bearish divergence warns of a possible trend reversal.

- A bearish

triple divergence is reinforced by completion of a

failure swing at [11]. Wait until the MA has turned down and RSI has

crossed to below 60 before entering a short trade [S].

Setup

See

Indicator Panel for directions on how to set up Relative Strength Index.

The default RSI window is set at 14 days with Overbought/Oversold levels at

70% and 30%. To alter the default settings - see

Edit Indicator Settings.

Related Topics

RSI Construction

First, decide on the indicator period. Then, compare closing price [today] to

Closing price [yesterday]...

External Links

Technical Charting Archives : January 07, 2000

The Relative Strength Index

The Relative Strength Indicator (RSI)

Relative Strength Indicator

Relative Strength Index (RSI) -- Chart School

RSI is a momentum oscillator that compares the magnitude of gains against the

magnitude of losses.

Technical

Analysis from A to Z

Relative Strength Index - Steve Achelis' best-selling book, Technical Analysis

from A to Z

![]() 21 day

exponential moving average (MA) and

21 day

exponential moving average (MA) and ![]() 9 day Relative Strength Index. A 2-day closing

filter is used with the MA.

9 day Relative Strength Index. A 2-day closing

filter is used with the MA.