Bollinger Bands were invented by John Bollinger. Used to confirm trading signals, normally from a Momentum Indicator, the bands indicate overbought and oversold levels relative to a moving average.

Bollinger Bands are calculated at a specified number of standard deviations above and below the moving average, causing them to widen when prices are volatile and contract when prices are stable.

Bollinger originally used a 20 day simple moving average and set the bands at 2 standard deviations, suited to intermediate cycles.

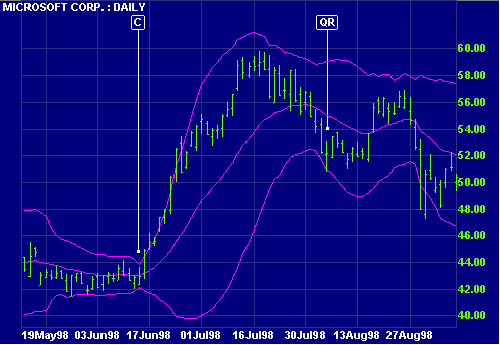

Microsoft is charted with

![]() 20 day

Bollinger bands at 2 standard deviations.

20 day

Bollinger bands at 2 standard deviations.

Contracting bands warn that the market is about to trend: the bands first converge into a narrow neck, followed by a sharp price movement. The first breakout is often a false move, preceding a strong trend in the opposite direction. A contracting range [C] is evident in June 1998: the bands converge to a width of $2, followed by a breakout in July to a new high.

A move that starts at one band normally carries through to the other, in a ranging market.

A move outside the band indicates that the trend is strong and likely to continue - unless price quickly reverses. Note the quick reversal [QR] in early August.

A trend that hugs one band signals that the trend is strong and likely to continue. Wait for divergence on a Momentum Indicator to signal the end of a trend.

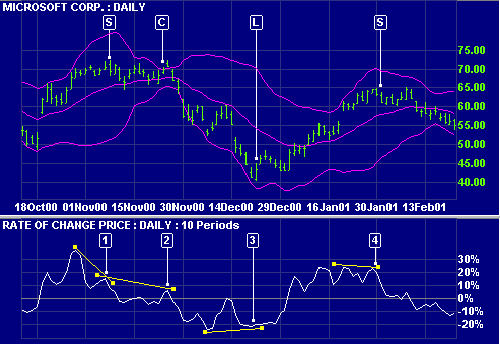

Microsoft Corporation:

![]() 20 day

Bollinger bands at 2 standard deviations and

20 day

Bollinger bands at 2 standard deviations and

![]() 10 day Rate

of Change.

10 day Rate

of Change.

www.BollingerBands.com: Bollinger Bands Tutorial

www.BollingerBands.com: Bollinger Bands Tutorial

Bollinger

Bands - Technical Analysis from A to Z

Bollinger Bands -- Chart School

Invest FAQ:Technical Analysis:Bollinger Bands

Another Look at Bollinger Bands