Forums

(http://www.elitetrader.com/vb/index.php)

-

Journals (http://www.elitetrader.com/vb/forumdisplay.php?forumid=29)

-- AHG

- Profitable Strategy for Struggling Traders

(http://www.elitetrader.com/vb/showthread.php?threadid=99283)

AHG - Profitable Strategy for Struggling Traders

The intention of this post is to help struggling traders turn their trading

around. It's my way of paying it forward and contributing to a board that

consistently complaints about the lack of useful trading information.

The strategy works in most trending markets but with your help we can make a

great thing even better. It is by no means complete but very much functional and

consistently profitable once some of the trader's skills are polished.

It's simply a collection of ideas, personal experience, trial and errors,

backtesting and things I put together that changed my trading around over the

years.

I'm open to suggestions and ideas on how to improve what I consider a very good

system for daytrading the market. Particularly, the e-minis.

Let's try to keep it civil and friendly as my priority here is simply to help

and improve the system. It's long overdo that I do some contributions and well,

tonight is the night.

Hope it helps and since I designed it I will indulge myself by calling it, for

now...

Anek's Holy Grail v 1.0 ![]() or AHG

for short. As we improve it we can increase the version number. Rest assure,

it's a good working strategy for trading and has been my bread and butter for

quite some time. I see no reason for this changing.

or AHG

for short. As we improve it we can increase the version number. Rest assure,

it's a good working strategy for trading and has been my bread and butter for

quite some time. I see no reason for this changing.

Help me help you and feel free to help us help more by chipping in with ideas.

I shall begin by placing the first stone......

STEP 1 THE TREND

- Determine if there is a MEANINGFUL TREND present

There are two types.

The meaningful ones:

Downtrend = lower highs, lower lows

Uptrend = higher highs, higher lows

The ones you should ignore (for now) because they require greater

skill to consistently profit from or

simply, the sideway ones:

Congestion/Indecision = higher lows, lower highs (Symmetric Triangle

formations)

Consolidation = horizontal lows/highs

As you get more experienced you can profit off consolidation by fading

support/resistance but for now, stick only to

the meaningful trends.

Again, as you get more experienced you can profit off symmetric

triangles (HL LH) because they tend to give birth

to POWERFUL new trends but for now I would rather you stick to the

meaningful trends.

STEP 2 ONCE A TREND HAS BEEN DETERMINED HOW DO WE PLAY IT

- If a MEANINGFUL TREND has been found we need a logical entry.

Let's start with the UPTREND.

We BUY a pullback and we are nimble with our target.

Where exactly ? Well, it can be a 50% Fib retracement from the recent

High to Low swing, or stochastics crossing, whatever you feel

comfortable with. We take advantage of minor WEAKNESS in a STRONG

TREND to get a good fill.

What's your target ? It can be a few ticks below previous resistance,

it can be an upper bollinger band. This is entirely up to you

and only in time you will master this. You could trail the stop to

ride those breakouts, all very discretionary.

Stop ? Whatever would make it a lower low aka a CHANGE of trend.

Now, lets talk about the evil twin, the DOWNTREND.

We SHORT a pop up and again, we are nimble with our target.

Where exactly ? Well, it can be a 50% Fib retracement from High to

Low, Stochastics Crossing, whatever you feel

comfortable with. We take advantage of STRENGTH in a WEAK TREND to

get a good fill.

What's your target ? It can be a few ticks above previous support, it

can be a lower bollinger band. This is entirely up to you

and only in time you will master this. You could trail the stop to

ride those breakdowns, all very discretionary.

Stop ? Whatever would make it a higher high aka a CHANGE of trend.

Important, we never go against the trend. When the trend is strong we

buy a pullback. When the trend is weak we short a pop up.

No exceptions, don't play hero or Nostradamus. There is not a soul on

earth who can predict the market consistently and what we want is consistency,

so be smart about this.

If STOPPED OUT, meaning, a CHANGE of a trend, we stay ON THE SIDELINES

until a NEW MEANINGFUL TREND is defined and we take our stop

like responsible traders. If we get faked out, so be it, plan your

trade and trade your plan. Losses are inevitable and quite

alright as long as we limit them to small numbers.

Who is our enemy ? You got it, REVERSALS. REVERSALS stop us out.

Lucky for us, they are not very common which is exactly why this

strategy works. Some days will be filled with them and sadly I don't

know how to overcome this. On days like this, I lose money.

Surprisingly so, people call reversals all the time then you wonder

why 90% of traders lose money ? We never call a top, we never

call a bottom, we never say "Oh it's too high" or "It's too low", the

market has no boundaries. Yes, you heard that right, NO BOUNDARIES.

There are so many variables in the market it is IMPOSSIBLE to predict

accurately on a consistently basis therefore the best I can do is

examine what is happening NOW and try to profit from some possible

volatility and situate myself in a strategic place, with patience

and conviction.

STEP 3 INDICATORS

I'm not a big fan of technical indicators, mostly because I have no

interest in using something that tells me what happened 10 years ago.

Price action is all I need and when using tick/share charts I don't

need to use a volume indicator.

However, there are some I use for strength/weakness references,

entries and exits.

For example:

BOLLINGER BANDS with 2.5 Standard Deviation. (I feel 2.0 gets hit far

too often and distracts me with noise)

When price is continuously hitting a band, pay attention. It's trying

to tell you which side is stronger. If you are having difficulty

identifying the current trend or suspect a reversal, the constant

hitting of a particular band can provide great info as to where

momentum is headed.

TRENDLINES, as many as you need to determine the current trend.

STOCHASTICS, a cross can be a powerful tool when you are looking for

an entry in a strong trend. I like 5,3,3 but use whatever you feel

comfortable with.

FIBONACCI RETRACEMENT LINES, my favorite. 50% from last swing

low/high and you got an excellent entry point. Problem is sometimes the

trend is so strong it won't even give you your wish and you miss the fill.

STEP 4 MONEY MANAGEMENT

As you get more experienced, I highly recommend you use an average up

approach. More on this later, until then, use the same car size

on every play and for God's sake DO NOT AVERAGE DOWN unless you are

just trying to get fills for your intended car size, never

surpassing it. I previously stated and those that known me for a

while know I advocate averaging up. I feel this is an advanced money

management technique and for now I am not disccusing it to avoid

confusion/mistakes.

STEP 5 DISCIPLINE

I'll be blunt. Trading is not for the irresponsible. Break the rules

and you will eventually lose big, period. Trading will forgive

you if you were wrong on a play even several ones, it won't forgive or tolerate

idiocy and stupidity. All I need to say on this and you have been

warned.

STEP 6 CHART TYPES

Longbars are evil, therefore I highly recommend tick/share charts so

you can split that data and examine it with care. For the YM

I recommend 75 or 89 tick charts. This differs greatly from one

instrument to the other, the more volume/activity it has the greater

the ticks size you will need. Use what you feel comfortable with.

Bye for now,

Anek

A nice start. Good wishes for the thread.

__________________

------------------------

The things people believe in are usually just

what they instinctively feel is right; the justifications and arguments are the

least important part of the belief.

That's why you can win the argument, prove them wrong, and still they believe

what they did in the first place. You've attacked the wrong thing.

So what do you do? Agree to disagree. Or fight. - C. Zakalwe.

Re: AHG - Profitable Strategy for Struggling Traders

Quote from Anekdoten:

It's simply a collection of ideas, personal experience, trial and errors, backtesting and things I put together that changed my trading around over the years.

I'm open to suggestions and ideas on how to improve what I consider a very good system for daytrading the market. Particularly, the e-minis.

Quote from kiwi_trader:

A nice start. Good wishes for the thread.

Good luck with this, bro.

Market Profile?

I'm encouraged by your post, because it confirms that a successful trading

system can really be that simple.

Since you said you were looking to enhance the system, have you ever considered

the following as filters:

1. Market Profile - Used to identify when the market is seeking new value

(trending) vs. when it is within a value area (congestion). You can also look at

the TPO's to find S/R areas. I'm trying to learn MP right now myself, with the

intention of trying to identify higher probability trend environments.

2. Normal S/R swing lows/highs (higher timeframe, maybe a 400 tick chart) -

Avoid taking signals if you're approaching a major S/R line (where reversals or

stalls are likely).

3. Divergence on a higher timeframe momentum scillator to filter out lower

probablity entries? I have a hard seeing/trusting these divergences myself, but

I know that other people use them successfully.

Please note that the above suggestions are not based on extensive experience...

I've been studing futures trading for about three years now and they are simply

based on what I've learned and my observations. The first two I am trying to

incorporate in my simulated trading.

Re: Market Profile?

Quote from mikehbeck808:

I'm encouraged by your post, because it confirms that a successful trading system can really be that simple.

Since you said you were looking to enhance the system, have you ever considered the following as filters:

1. Market Profile - Used to identify when the market is seeking new value (trending) vs. when it is within a value area (congestion). You can also look at the TPO's to find S/R areas. I'm trying to learn MP right now myself, with the intention of trying to identify higher probability trend environments.

2. Normal S/R swing lows/highs (higher timeframe, maybe a 400 tick chart) - Avoid taking signals if you're approaching a major S/R line (where reversals or stalls are likely).

3. Divergence on a higher timeframe momentum scillator to filter out lower probablity entries? I have a hard seeing/trusting these divergences myself, but I know that other people use them successfully.

Please note that the above suggestions are not based on extensive experience... I've been studing futures trading for about three years now and they are simply based on what I've learned and my observations. The first two I am trying to incorporate in my simulated trading.

Today's scalps....

Green vertical denotes a long signal.

Red vertical denotes a short signal.

One of the longs was a loser, little trend change hesitation there, the rest got

their targets.

At this time of the day I usually close the platform. 3:21PM EST now.

Quote from Anekdoten:

Today's scalps....

Green vertical denotes a long signal.

Red vertical denotes a short signal.

One of the longs was a loser, little trend change hesitation there, the rest got their targets.

At this time of the day I usually close the platform. 3:21PM EST now.

Quote from mikehbeck808:

Can you comment on the 4th short signal... looks like the market made a higher low, but you sold short again.

Also the 2nd long signal came after a minor lower high and lower low.

I'm not trying to be critical, I'm wondering if maybe you require a certain number of bars to pass or maybe a trendline break before you consider a HH/HL to be a valid change of direction when the market was previously trending down.

Re: Market Profile?

Quote from mikehbeck808:

I'm encouraged by your post, because it confirms that a successful trading system can really be that simple.

Since you said you were looking to enhance the system, have you ever considered the following as filters:

1. Market Profile - Used to identify when the market is seeking new value (trending) vs. when it is within a value area (congestion). You can also look at the TPO's to find S/R areas. I'm trying to learn MP right now myself, with the intention of trying to identify higher probability trend environments.

2. Normal S/R swing lows/highs (higher timeframe, maybe a 400 tick chart) - Avoid taking signals if you're approaching a major S/R line (where reversals or stalls are likely).

3. Divergence on a higher timeframe momentum scillator to filter out lower probablity entries? I have a hard seeing/trusting these divergences myself, but I know that other people use them successfully.

Please note that the above suggestions are not based on extensive experience... I've been studing futures trading for about three years now and they are simply based on what I've learned and my observations. The first two I am trying to incorporate in my simulated trading.

Re: Re: Market Profile?

Quote from dandxg:

I just started working with MP. Today, from my limited exp. with it, was just balance YM. I just scalped around a bit, although not really my favorite. No trend to be had.

I am hopeful that MP can help my filter my entry signals. So far so good.

Quote from Anekdoten:

Do you think in the screenshots I should stick ONLY to the basic plays to avoid confusion ?

I could use your opinions here.

I was just speaking to a fellow trader and he suggested that the more things get added the more complicated the system can get. He is absolutely right, so I got to make sure that any enhancement is worth the trouble to avoid technical complexities. As it is now, it's very simple and relaxing. The earth the stars and the moon must not be aligned for now and that's exactly what I want to avoid, yet I can't say no to any improvement as long as things stay moderately simple.

Mike,

Sometimes it's hard to get a good fill because logical trading is no secret to

experienced traders. What I do to overcome this is I try to anticipate where

price might be if a 50% retracement occurs or a stoch cross and situate myself

with a limit order in the race not only to get a good position in the queue but

to get filled on those quick whipsaws that are brutally fast yet golden.

This is all scalping so every tick counts.

For what is worth, all my entries are limits, all my targets are limits and all

my stops are market.

Anek

It would be more encouraging if you didn't ignore people's requests for

your personal background. Hook. N Sinker asked some very good questions, and you

ignored him. You presented your methods as profitable, successful and what we

should do.

Without this, all these things you are posting is gibberish, unproven and

useless until proven otherwise.

Then to mikeh, you respond about what you think reliable or successful. So why

are you the judge of what is profitable? You are a relative unknown here, so

there is no evidence you know more than anyone else.

If you are looking to moderate a fruitful thread, you need not to be the expert

.

Attached please find one of the main reasons as to why my signals switched

from shorts to longs today.

The trendline also marks the three tops I spoke about.

Quote from rcanfiel:

It would be more encouraging if you didn't ignore people's requests for your personal background. Hook. N Sinker asked some very good questions, and you ignored him. You presented your methods as profitable, successful and what we should do.

Without this, all these things you are posting is gibberish, unproven and useless until proven otherwise.

Then to mikeh, you respond about what you think reliable or successful. So why are you the judge of what is profitable? You are a relative unknown here, so there is no evidence you know more than anyone else.

If you are looking to moderate a fruitful thread, you need not to be the expert .

Quote from rcanfiel:

It would be more encouraging if you didn't ignore people's requests for your personal background. Hook. N Sinker asked some very good questions, and you ignored him. You presented your methods as profitable, successful and what we should do.

Without this, all these things you are posting is gibberish, unproven and useless until proven otherwise.

Then to mikeh, you respond about what you think reliable or successful. So why are you the judge of what is profitable? You are a relative unknown here, so there is no evidence you know more than anyone else.

If you are looking to moderate a fruitful thread, you need not to be the expert .

Quote from jimmygold:

Anyway, Anek I really appreciate this new thread and look forward to learn and contribute on an ongoing basis !!

Quote from mikehbeck808:

Yikes, that's some serious negativity. I wasn't trying to moderate, just participate. The original post openely invited questions and observations (isn't that what makes a successful thread?), so I decided to stop lurking for a moment and contribute. I didn't realize I had to prove I was an expert before posting... if that were a requirement elitetrader would be a ghost town.

I openly disclosed that my opinions are not based on real-market experience (just observation and simulated trading), which I dare say is more honest than most of the jokers on this site, so I never claimed to be the judge of anything. I just got very excited by a generous post from someone who is disclosing a logical trading methodology which happens to be extremely similar to a method I've been refining and practicing for several months now. To me that's exciting and encouraging. I don't need someone to show me their bank statement to believe a market approach works, especially if it confirms what I've already noted about market behavior.

Until the OP begins asking for money for his insights, he doesn't have to prove anything to us. It's very easy to try out new methods without risking real $$ on a market simulator. I view threads like this and others that have been started by other generous people to be exactly what they are: a rare gift. Take it or leave it.

Quote from Anekdoten:

Attached please find one of the main reasons as to why my signals switched from shorts to longs today.

The trendline also marks the three tops I spoke about.

Quote from abaker:

Hi Anek,

On your chart you pointed to a possible trend change.

What caused you to see that. Was it the two higher lows and one higher high(between 13:16 and 13:20), together with the strong upcandle that broke the 50% level of the last down swing?

Great day today, nothing but lower highs and lower lows. No reversal yet but the YM approaching the 900 support area so congestion to be expected. The morning however, has been nothing but paradise for the system. In fact, today so far is optimal for my style. Due to OEX and 900 support area I might skip the afternoon and keep the profits. Charts to come....

Its surprising that more people dont have the patience to wait for days like this and load up when they come along. A couple of good down days a month is all you need and there almost always is. The problem is that most people cannot be the frog. Whew. This is getting bloody.

Quote from Bearbelly:

Its surprising that more people dont have the patience to wait for days like this and load up when they come along. A couple of good down days a month is all you need and there almost always is. The problem is that most people cannot be the frog. Whew. This is getting bloody.

Chart for 07.20.07

Vertical green line is long.

Vertical red line is short.

There is no magic in here, just the system.

Weekend is here !

PS: Note to self stop taking those lame ass MACD crosses even if the stop is

minuscule, that thing lags more than your grandma. Use strictly for trend visual

reference, mountain colors or get rid of it.

Well make up your mind.. you sound like our grandma

Quote from Anekdoten:

PS: Note to self stop taking those lame ass MACD crosses even if the stop is minuscule, that thing lags more than your grandma. Use strictly for trend visual reference, mountain colors or get rid of it.

Quote from bigbadbaz:

Well make up your mind.. you sound like our grandma

Ahhh the ole zero line conundrum.. it's all interpretation Holmes.. indicators are a good servant but a poor master

Quote from Anekdoten:

As a visual indicator it is helpful when things get hectic but the zero line cross distracts so need some discipline there. There is always room for improvement.

Quote from bigbadbaz:

Ahhh the ole zero line conundrum.. it's all interpretation Holmes.. indicators are a good servant but a poor master

If an indicator is taking trades away from you then you are letting it influence you instead of working it to unveil the price action your brain unconsciously recognizes

I got several requests via PM to post my workspace therefore I'm attaching a

screenshot to this post.

If you got questions, just use the the journal, if it's something personal then

sure PM me but i got 3 PMs that had the exact same question.

I only use one monitor when trading, big one though, and as far as the main

chart I adjust tick chart on the fly depending on volume for the day or

whichever reference I need. Usually I change from 75 to 89 to 150 200 250,

depending on price action but only one point of view and my big anchor chart

which is the 2000 tick for big S/R.

Hope it helps.

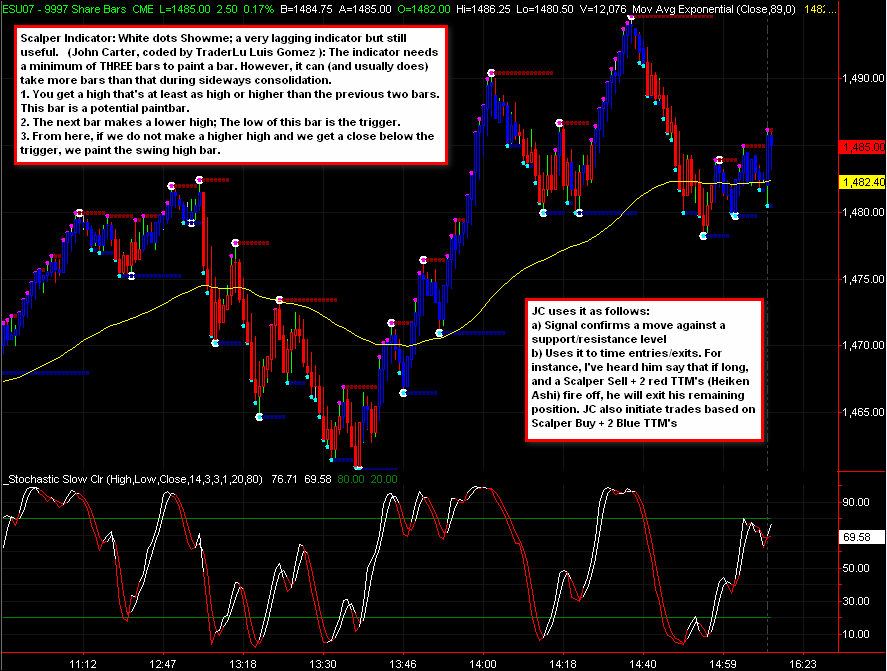

Several months ago someone in the forums posted this chart for reference and

I kept it in my archives. I'm sorry I can't remember who did but he/she deserves

the credit.

This is what it's all about, price action, all else is secondary.

Quote from rcanfiel:

You weren't the subject. But it was disappointing when someone else ("Hook) brought up valid points, and the OP blows through them. Readers have the right to ask questions like those, before newbie traders who read this start risking their capital on it.

If someone (OP) present a thread based on his methods as if they are profitable and as the solid basis, not even answering someone who asks valid questions is a poor sign.

And it remains so, to this point.

A person with some 30-40 posts saying he is profitable is a suspicious thing to ET netizens. Next thing you know, AHG will become a website, where followers are encouraged to subscribe.

I'm not sure you said fuck enough.. a real professional trader would have used it every second word not just every third or fourth

Quote from Daxtrader:

man shut the fuck up and get the fuck out of this thread. fucking assholes, always looking for complete handouts. OP, continue please.

Quote from Anekdoten:

Several months ago someone in the forums posted this chart for reference and I kept it in my archives. I'm sorry I can't remember who did but he/she deserves the credit.

This is what it's all about, price action, all else is secondary.

Quote from epiktetos:

Thats from ghkramer I think.

Good luck Anekdoten.

As a weekend exercise I continue to backtest/study fixed volume bars as I

slowly begin a transition to them. It has been almost 5 months since I began the

transition but still very much a work in progress. As they say don't fix what is

not broken but if we don't experiment or take new risks we risk never improving

our current methods.

Good friend of mine is always making fun of my ever evolving charts and well,

that is probably the reason why, I'm always experimenting.

Trades for 07.23.07

All winners except the first long.

Green lines long

Red lines short

Thick white line, change of a trend.

100% system following no deviation.

Morning > Afternoon imho

Skipping lunch helps.

Calling it a day.

I made some of the same trades today. Are you setting a target for exit? I need to start using a program that automatically enters a stop. I sometimes enter a limit order by mistake which kills the trade. Keep posting, much appreciated.

Quote from bmwhendrix:

I made some of the same trades today. Are you setting a target for exit? I need to start using a program that automatically enters a stop. I sometimes enter a limit order by mistake which kills the trade. Keep posting, much appreciated.

Tomorrow I take my volume bars chart transition live. After studying them for

5 months I think I will be able to read price action better this way.

Also asked a friend savvy in EL to help me code some slope/colors into the

stochs.

I've also said my official farewell to the old dog MACD, cant' say I will miss

you. In fact, the screen real estate is more than welcome. Since I only used

MACD as a quick trend reference I decided to add a 34 Hull Moving Average on

screen instead. Why 34 ? Because it's a fib # and it makes me a "cool trader".

Do I actually believe in this voodoo shit ? Only on fib 50% retracement

![]()

New chart attached.

Countertrending Trades, definitely not part of the system.

However some are just too pretty.

I did not trade the afternoon but after analyzing it here is one I could have

not said no to.

Of course, "Support" gave it away.

..also notice how price rebounded off the previous "major" support on the

previous up-wave. Now, don't use this info to countertrade just yet but as extra

info for your stops/targets/trails etc.

It also alerts you. For example, "hmm major support is coming, perhaps the trend

will develop into congestion or maybe even a reversal, not the right time to

trail...." Cover, wait and analyze the rebound.

Market hours were about to close in NY but how price reacts to support is very

important. For instance, if the bounce, and there is usually always a bounce at

major support, was anemic, then perhaps the bearish trend is even more powerful

than expected and you could be more greedy with your shorts, etc.; after getting

rid of your longs of course.

The market speaks but it's imperative that you listen.

I'm not saying it is but sometimes trading can really be this easy.

Hope it helps.

Quick tip.

Remember that a lower low without a lower high is not the same as a lower low

and a lower high :0 .... at the same time a higher low without a higher high is

not an uptrend. Patience is required, wait for those patterns to develop, wait

for an opportunity, look around you (s/r) aim (think of entry/stop/targets) then

fire (execute).

Ok bedtime now !

How do you get the ma line to change color? Looks nice! Appears to change

color based on the slope of the line, up or down. Nice visual of trend.

Never mind! I just added the indicator and I see the color thing is built in.

![]()

Quote from Jaxon:

How do you get the ma line to change color? Looks nice! Appears to change color based on the slope of the line, up or down. Nice visual of trend.

Never mind! I just added the indicator and I see the color thing is built in.

so we have a low this morning of 13892

the question is, do you play this from here as an uptrend or a downtrend?

We are congested at this point.

Clear and useful thread,thanks..except I don't quite get how you determine

your targets..are they equal to your risk that you take on every call? I use

similar method/system/ but seems like too often I "overstay market's

welcome''...keep it up![]()

Quote from Anekdoten:

We are congested at this point.

Trades for 07-24-07

Daily target reached fairly quickly based on last short so decided to call it a

day.

The long on the chart reached it's target but did not get the fill, moved the

stop to break even and finally broke down.

The rest did well, second short nothing spectacular, barely a positive trade.

Last short definitely did it.

Staying loyal to the morning > afternoon I'm taking off.

Quote from vinc:

Clear and useful thread,thanks..except I don't quite get how you determine your targets..are they equal to your risk that you take on every call? I use similar method/system/ but seems like too often I "overstay market's welcome''...keep it up

Quote from Jaxon:

cough cough!

agree

Looks like a trending afternoon, wish I saw it coming. Oh well tomorrow the

market also opens, no harm done.

What an afternoon, after I saw the avalanche coming there was no doubt in my

mind, and prob in yours, that the trend was nowhere but down.

I managed to take a few but by the time I returned to trading it was almost

over. The sad part is that it would had been a tremendous show for the journal.

Nothing but lower lows and lower highs that could had been shorted to hell on

every pop up.

However, there will be a day it happens again, hopefully soon and I will be all

over its ass. In fact, that's where my system excels at.

Have a nice night.

Little late night reading.

Advantage of scalping with the trend. Not only do you get more opportunities but

well, the chart speaks for itself and it has annotations.

If you suffer from over-trading, this chart is for you

![]()

Trend is your friend !

Thanks for the nice charts and good analyses. Here is a similar way of

looking at countertrend supports-but it is absolutely true, why fight the

trend-it is just nice to know you could. We all could be

heros sometimes - you don't need special powers - Hiro Nakamura

![]()

Quote from tmarket:

We all could be heros sometimes - you don't need special powers - Hiro Nakamura

You got to love the way they run this up and down, but take the scalp trade

when you can. The ADX was peaking and other volume indicators showing buying in

this trade, no way of knowing how far a run up (it was easily another 20 points,

but it was still countertrend. Sorry to clutter up your neat journal.

![]()

T,

Ya I see what you mean by ADX. Haven't studied it yet, need to see if the signal

is > 50% then I can consider it.

Yep, loving the morning so far, many many trades

![]()

still having a tough time. I did finally (hah!) identify the trend as down this morning, but still had trouble finding good entries... hard to believe in hindsight.

Quote from Jaxon:

still having a tough time. I did finally (hah!) identify the trend as down this morning, but still had trouble finding good entries... hard to believe in hindsight.

Trades for 07-25-07

Note1:

When a trendline is broken and the last high is a lower high it's safe to take a

short on a pop up. Unfortunately, the pop up never occurred and I could not get

my fill, but I was shooting for a good target there. Worked like a charm except

I could not capitalize from it due to no pop up. The least you want to do when

that happens is chase it.

Note2:

Change of a trend. At this point you should see why. I took a short there, lost

and took a full stop.

Note3:

At the top see those higher high tops ? Well as priced tanked I took a long when

price stabilized and worked well. Not sure if it was the most optimal play (high

stochs and all) but took my quick profits little bit below resistance and said

to myself take your break, your day is over.

As always, vertical red lines shorts, vertical green lines long, with the trend,

on the pullbacks/pop ups. Third short got stopped out. Fifth short BE trade.

Rest did well. Longs did well.

Not so hard, just need to polish those skills of constantly examining the LL HH

LH HL.

Last but not least maximum discipline at all times

Real nice market today.

Anek

PS: Morning > Afternoon but there are exceptions like yesterday (sob!)

![]()

Could not say no to this one....

Once again, trendline break on lower highs.

Trailing this baby, let us see how it goes.

Great charts. It looks like you enter your trades when the price crossed the middle of the bollinger band rather than off of the sto. Is this correct?

Not taking profits until a higher high is made.

Little lesson in letting the winners run. Hope it goes well for the

illustration.

Quote from bmwhendrix:

Great charts. It looks like you enter your trades when the price crossed the middle of the bollinger band rather than off of the sto. Is this correct?

....and the conclusion. The higher lows hinted it and the higher high confirmed it. Optimal cover point possibly the higher low formation but as you eat lunch and take the rest of the day off it's ok to say once in a while, WTF let's see if it can make a new HH, and well it did.

Quote from bmwhendrix:

rather than off of the sto. Is this correct?

How do you get those nice red and blue lines at the highs/lows? Custom t/s indicator?

Quote from bigbadbaz:

I'm not sure you said fuck enough.. a real professional trader would have used it every second word not just every third or fourth

__________________

-You're seriously damaging my calm.

Quote from Jaxon:

How do you get those nice red and blue lines at the highs/lows? Custom t/s indicator?

Thanks, I will use the HA bars. I couldn't get your linked file to work, but I found the paintbar on the Tradestation support forum. What I can't find is how you make those blue lines to mark the highs and red lines (dots) to mark the lows on your charts. Might be labeled "SHME Dynamic SR" on your chart.

following along..

thanks for the great thread!

![]()

Quote from BigBubba:

following along..

thanks for the great thread!

Quote from Jaxon:

"SHME Dynamic SR" on your chart.

Quote from TheRumpledOne:Wow... SHME PushHiLo AutoX is an old indicator... It became my Pip Scalper indicator. It shows dynamic support/resistance.

I posted it on www.kreslik.com

How are the dynamic S/R lines determined? (ie what's the code for that?)

Thanks for the thread, it's fun to follow along.

Couple of common questions sent via PM.

NEWS

I don't follow the news except when I bump into them after trading.

I used to pay attention to the time of important news releases but I don't

anymore.

If the trade goes against me I will get stopped out and if it goes in my favor I

will hit my target(s) simple. A canadian friend taught me that, you know who you

are.

The news itself is absolutely worthless to me for trading. How the market reacts

cannot be illustrated better or faster than in a clean chart.

The one exception is FOMC. I trade that differently, more like personal fun

trades with minimal car size but the point is I do pay attention for the day and

time of that particular announcement because the news can be very drastic and

basically kill all patterns within sight.

SWING TRADING

Usually I don't as I'm mostly a scalper. It's got nothing to do about holding

overnight, I just prefer the higher size small stop approach.

Ok that's about it.

Quote from tmarket:

http://www.elitetrader.com/vb/showt...=6&pagenumber=5

Quote from Bogwaluth:

How are the dynamic S/R lines determined? (ie what's the code for that?)

Thanks for the thread, it's fun to follow along.

Hi Anek

Thanks for the journal

When do you feel a bottom is a bottom. My question is easier to see on the chart

07.26.07

Bearish trending day, "we've been expecting you!"

Vertical green longs

(2nd didnt work due to reversal)

Vertical red shorts

(5th didnt work due to reversal)

Morning trades attached, afternoon will follow on next post.

The trend is your friend baby!

07.26.07 Afternoon

Highly more difficult session. In many cases due to reversals and congestion i

got chopped to death but still was able to fight through the storm to score some

good plays. Morning was by far more optimal for the system.

Shorts

First and second worked well

Third did too, took little heat but after sticking to the plan it worked well.

Fourth, a beauty.

Fifth stopped me out, hint of reversal.

Sixth worked, took little heat but worked well.

Seventh took a full stop, hint of reversal.

Longs

First, full stop, hint of reversal.

Second, worked with massive heat, price got 2 tick from the stop then KABOOM and

Ca$shing.

Third, was a beauty.

Fourth, another beauty.

Fifth, biggie stop, got killed here.

Sixth, another stop.

Morning score: 2 losers and 9 winners.

Afternoon score: 5 losers and 8 winners (yes overtraded a bit but emotions got

to me, was a crazy day!)

Total score: 7 losers 17 winners

And called it a day, overall, extremely profitable day with a more dangerous and

complicated afternoon. Morning was just kindergarden stuff for the system.

Tip of the day, trade what you see, with the trend, whether is up or down, no

bias. Stick to your method and in and out, in and out. Believe in your method

and your method will believe in you.

Hope it helps, what a day!

Quote from abaker:

Hi Anek

Thanks for the journal

When do you feel a bottom is a bottom. My question is easier to see on the chart

Hi,

Love the thread, thanks.

1) Does anyone have an esig Heiken bar .efs ? (I went to the esignal forum and

found one but it overlays on regular bars and you have to paint the regular bars

background colour not to see them.....problem is if you stick a bollinger or

whatever on there it calculates based on regular price bars....)

2) I noticed you used 200 sb chart yesterday but used a 250 sb today ? Is there

any indication when to use which one ?

3) On a regular session (not like today obviously) what point values is the

usual target and stop ? ie: 10 point stops with 10 point gains, 15 point stops

with 15 point gains....etc

4) Can you go over briefly how you indentify congestion ?

5) I don't see what purpose the stoch serves or bollinger bands serve.....to me

it just looks like you see trend up so buy when the first or second bar turns

green, or if trend down short when first or second bar turns red (after a series

of atleast a few bars agains't the trend obviously first....ie: reasonable

retrace).....then you enter on bar colour change back in the direction of trend

set stop of X amount of points and set target of X amount of points....

6) Have you tried this on ES (just wondering because slippage will become an

issue on YM on real size whereas ES can take 200 - 300 cars with maybe .25

slippage max.....lol, I am only doing 1 car but just curious for someone that is

consistently profitable and wants to continue to increase their gains like

yourself.

Cheers ![]()

Quote from Razor:

Hi,

Love the thread, thanks.

1) Does anyone have an esig Heiken bar .efs ? (I went to the esignal forum and found one but it overlays on regular bars and you have to paint the regular bars background colour not to see them.....problem is if you stick a bollinger or whatever on there it calculates based on regular price bars....)

2) I noticed you used 200 sb chart yesterday but used a 250 sb today ? Is there any indication when to use which one ?

3) On a regular session (not like today obviously) what point values is the usual target and stop ? ie: 10 point stops with 10 point gains, 15 point stops with 15 point gains....etc

4) Can you go over briefly how you indentify congestion ?

5) I don't see what purpose the stoch serves or bollinger bands serve.....to me it just looks like you see trend up so buy when the first or second bar turns green, or if trend down short when first or second bar turns red (after a series of atleast a few bars agains't the trend obviously first....ie: reasonable retrace).....then you enter on bar colour change back in the direction of trend set stop of X amount of points and set target of X amount of points....

6) Have you tried this on ES (just wondering because slippage will become an issue on YM on real size whereas ES can take 200 - 300 cars with maybe .25 slippage max.....lol, I am only doing 1 car but just curious for someone that is consistently profitable and wants to continue to increase their gains like yourself.

Cheers

Cheers ![]()

Quote from Anekdoten:

1) I'm sure Esignal has HA bars. I mostly use their colors for quick reference.

2) I adjust tick/share volume depending on how I feel the current day is developing. If low volume day, might even go down to 150, 100. etc. Just looking for the right glasses you know.

3) I suggest to trade with a 1:1 risk vs reward ratio then as you get better you can increase the reward; as you get more optimal entry areas and a feel for when things are running your way. HA bars help for the runners, so do the dots I use on the bottom, HHs if you are long, LLs if you are short, etc. I believe this area is very personal but I definitely dont suggest a crazy 20 point stop and 10 point target, that's just plain bad risk management. You need to turn the odds in your favor or you won't win. Remember, the best trades always tend to work from the start causing very little heat. If your examination is correct, no need to use volatility as insurance. Big stops in contrast to targets are for the insecure.

Amateurs want to be right, professionals just want to make money, therefore, I believe a 1:1 risk vs reward is a good starting point to FORCE yourself to trade well. 1.3 risk vs 1.0 reward MAYBE for starters but never above that. As you get more experienced it is your duty, yes your duty, to start expanding that reward area, and only then is that you reach constant profitability. If you *have* to use a bigger stop then you simply need to polish your entry skills or else look for other risk management methods like adjusting stops on the fly, of course, always tightening NEVER widening. The idea is to REDUCE risk not increase it.

4) Congestion is when you see a HH and LL or HL and LH. ie Consolidation, Symmetric Triangles, etc. Uncertainty if you will.

5) I use it as guidance, indicators for me are simply confirmations, references. Price > all. If you feel better without them, by all means, get rid of them, more real estate for price ! However, I still find 5,3,3 crosses with the trend useful, I try to anticipate them all the time. Bollingers, again, another reference, when price is hugging a band, another quick reference of current momentum.

6) Absolutely, that is the plan for the future. Could not agree more.

Hope it helps.

Long live trading - Greed is good !

![]()

Another fairly easy day with strong trending moves, just how I like them.

Pretty good hit rate today, very pleased with the market.

Friday afternoon and as expected, some choppyness so heading out to relax.

Charts will come soon for sure ![]()

07-27-07

6 Winners 3 Losers, no shame in that, just filling the cup with drops, but

filling it ![]()

Yep, i deserve the loss on the last short, bad call.

Second short was a home run, 49 points.

Market was a good boy but I could have read it better so not sure why i said

earlier I was pleased with the market. Perhaps I am, and just not pleased with

myself. Oh well, the idea is to end up in the green with discipline and

patience, and that I did.

Went back to TICK charts for comparative reasons and cleaned some aspects of the

chart. Using Pivot High/Low indicator from Tradestation to compare with S/R

dots, so far I like my cleaner charts. (Sorry TRO)

Played with new stoch settings, but prefer 5,3,3 for now.

This marks the end of a full trading week. Not a single down day and without

special magic.

Same as always, system trend following, in and out without deviating from the

rules.

Anek

Akhnoten, you gotta know you got a problem when you're tweaking the indicators.

Quote from trader225:

Akhnoten, you gotta know you got a problem when you're tweaking the indicators.

Quote from Anekdoten:

I like to experiment and evolve always looking for better results. Don't see a problem with that.

Quote from trader225:

The problem is that by the time you've tweaked your indicators, the market may have changed.

Here is my chart from this morning. Looks like I made a few of the same

trades. I do not find the sto very helpful and deleted it.

I am using a long term macd as a reminder that a trend may be ending when I see

a divergence, just take it more slowly then.

Andec, thanks again for sharing

My first attempt at posting a chart.

Quote from bmwhendrix:

Here is my chart from this morning. Looks like I made a few of the same trades. I do not find the sto very helpful and deleted it.

I am using a long term macd as a reminder that a trend may be ending when I see a divergence, just take it more slowly then.

Andec, thanks again for sharing

My first attempt at posting a chart.

Anek I have a couple of questions. Do you not trade certain hours of the day

and do you use any special considerations on non-trending range days to stay out

of trades?

Thanks,

Don

Quote from bmwhendrix:

Anek I have a couple of questions. Do you not trade certain hours of the day and do you use any special considerations on non-trending range days to stay out of trades?

Thanks,

Don

07-30-07

Trades for today.

7 longs

5 winners

2 losers

1 short

1 loser

(the short. ALMOST worked, but hit my stopped then my target, evil !)

Total:

3 losers 5 winners

Most of the winners were trailed for a splendid day. Noticed I took way less

trades with the 14,3,3 stochs and eventhough my broker is not pleased, I am.

Hope it helps.

Anek

Well at this point it should be fairly easy to notice that I'm mostly doing

trend following with the stochs in its most basic form.

I do additional scalps and look for symmetric triangle formations, like one that

formed today in the afternoon below the HOD that was simply a beauty, but I

don't post that because it's a bit more advanced trading and not pertinent to

this journal.

I'm down to two indicators, stochs and heikin ashi bars and it looks like I'm

going to keep it that way, simple is better.

I'm waiting for a massively congested day to demonstrate how those can be tough

to trade with this system but all in all I feel I have covered most areas in my

charts.

Anek

Here is the symmetric triangle I mentioned earlier.

Lower Highs

Higher Lows

Price gets trapped, when it finds a direction and escapes, you got a breakout.

Especially when close to LOD or HOD areas. In this case, it was below HOD and

made a new one.

Am I getting through with this ? ![]()

Possibly the most aggressive play I did today.

Anek

Anek,

Just wanted to say a big thanks for this thread and your charts with trades. I

am finding this information very helpful and I would appreciate if you could

continue for a few more weeks so you can show us how you handle some lower

volidity days and chop days.

Thanks again ![]()

Razor,

Glad you like it. Sure, I don't feel I have covered all trading scenarios yet

but we are getting close.

Practice the skill of recognizing trends, particularly where those HH, HL, LL

and LHs are formed and in the long run you will develop a sixth sense for that

kind of action.

When price is ready to act it has a peculiar characteristic, sort of like fire

in it ass. Learn to read its behavior. Polish the skills. If you can, record

live trading days with Fraps or Camtasia, if you got Esignal then you got the

play by tick feature built in, study live action once the day is over. Every bit

helps. Study and practice, study and practice.

Those that quit before the end of the road end up losing. Perseverance and

patience is the key.

I can't remember the last time I had a losing month trading this method.

If I can do it, you can do it. It just took time to develop the skills

Anek

Anek,

I'm enjoying your thread very much; keep up the good work. Two questions:

1) Can you talk about your money/trade management? ie. setting initial stop

losses, scaling out of trades after certain profit targets are hit, and trailing

stops. Do you have hard and fast rules on managing the trade or is every trade

discretionary?

2) Do you use limit or market orders?

Thanks,

Tyler

Quote from tv92670:

Anek,

I'm enjoying your thread very much; keep up the good work. Two questions:

1) Can you talk about your money/trade management? ie. setting initial stop losses, scaling out of trades after certain profit targets are hit, and trailing stops. Do you have hard and fast rules on managing the trade or is every trade discretionary?

2) Do you use limit or market orders?

Thanks,

Tyler

Quote from Anekdoten:

Razor,

Glad you like it. Sure, I don't feel I have covered all trading scenarios yet but we are getting close.

Practice the skill of recognizing trends, particularly where those HH, HL, LL and LHs are formed and in the long run you will develop a sixth sense for that kind of action.

When price is ready to act it has a peculiar characteristic, sort of like fire in it ass. Learn to read its behavior. Polish the skills. If you can, record live trading days with Fraps or Camtasia, if you got Esignal then you got the play by tick feature built in, study live action once the day is over. Every bit helps. Study and practice, study and practice.

Those that quit before the end of the road end up losing. Perseverance and patience is the key.

I can't remember the last time I had a losing month trading this method.

If I can do it, you can do it. It just took time to develop the skills

Anek

Quote from Razor:

Cheers

PS: As a note I am trading this with the NQ right now because the dollar stops are smaller than YM.

Net -$76 Fri, Net -$28 today....almost breakeven if ya don't factor commish so not a bad start IMHO

Quote from Anekdoten:

If you post your charts perhaps I can spot the flaws if any.

Anek

Razor,

Magnifying glass is on !

I'll be watching ![]()

BTW.....

You can enhance your trading by making an effort to recognize the three most

powerful patterns in trading.

1) Symmetric Triangles

2) Double Bottoms

3) Double Tops

Anek

took one trade this morning - it was nearly a perfect setup, I was seeing lower highs, lower lows, but i shorted too close to the bottom of the bar and got stopped out almost instantly.... by a higher high! The market then continued its downtrend. I know I can't let stuff like that bother me and must keep trading and taking the signals, but this threw me off. It looks like you took a long trade at almost the same time. Is that right? 10:34 eastern time. Anyway, thanks for this thread and your advice. It is extremely helpful and is very compatible with my trading style.

Quote from Jaxon:

took one trade this morning - it was nearly a perfect setup, I was seeing lower highs, lower lows, but i shorted too close to the bottom of the bar and got stopped out almost instantly.... by a higher high! The market then continued its downtrend. I know I can't let stuff like that bother me and must keep trading and taking the signals, but this threw me off. It looks like you took a long trade at almost the same time. Is that right? 10:34 eastern time. Anyway, thanks for this thread and your advice. It is extremely helpful and is very compatible with my trading style.

Quote from Anekdoten:

Razor,

Magnifying glass is on !

I'll be watching

Triangle action NQ (11:17 est)

My two trades so far today.

#1) got in on what looked like a change in trend upwards (due to such a strong

upward move before the pullback- figured the down trend was over)....guessed

right...

#2) Took a pullback to a trendline after the trendline break....guessed right

again

Negatives, stops were 3 - 3.5 points on these trades and they only went for

+1.25 and +2.75 so stops were set bigger than actual gains....need to improve on

this.

Here they are:

http://i15.tinypic.com/4zoc4js.png

http://i14.tinypic.com/4vgmi6v

Cheers ![]()

Trades 07-31-07

Today it's a lesson on why it's important to stay neutral and trade only what

you see. It's imperative to ride those winners when possible. HA Bars are very

helpful in this area.

Again, its not about being right, it's about making money. Not the case today

but if I lose 5 times and win 3 and at the end of the day I'm green, job well

done.

4 Longs

1st Home Run ridden with HA bars

2nd Stopped out for minor gain

3rd Stopped out

4th Stopped out

4 Shorts

1st Based on double top, monstrous gain like most double tops should be played

2nd Target barely reached as a double bottom formed

3rd Home Run ridden with HA bars

4th Home Run ridden with HA bars

Notice how the doubletop/doublebottom area led to chop suey. That's my signal to

stay on the sidelines.

Total

5 Winners

1 Break even

2 Losses

Extremely profitable day and very pleased with my discipline and trading. Off to

a break then I will come to the pending posts.

Anek

Razor,

It's interesting that you chose the worst possible area to trade. Precisely the

one I stood on the sidelines, massive congestion.

I circled evidence of confusion and marked all the short opportunities with the

arrow that you had.

Hope it helps.

Quote from Anekdoten:

Razor,

It's interesting that you chose the worst possible area to trade. Precisely the one I stood on the sidelines, massive congestion.

I circled evidence of confusion and marked all the short opportunities with the arrow that you had.

Hope it helps.

Razor,

Remember that after MASSIVE moves, uncertainty usually unfolds.

It's actually a powerful tip ![]()

Hope it helps.

Anek

Anec, Here is my chart for the day. First 4 trades stopped out. Afternood was ok though. What would have kept you from the first 2 trades? The 3rd and 4th were just trying to re-enter using a tight stop. The stop I used on 20 tick charts is just too tight on the 75 tick (= to your 200). Any comments appreciated.

here is file, I hope.

Sorry, Chart not attaching!

chart?

Different file type. Try again

Anek,

I'm very new to futures trading; however, I've traded stocks and options for

years. In another post, someone mentioned you traded in the "puretick" room. Is

that where you learned to trade? Would it be worth my time to get an education

in one of the paid rooms? If so, which one would you recommend?

Thanks,

Tyler

B,

Not a bad job. This requires certain practice skill so definitely a good start.

Remember to use HA bars to let the winners run, this allows you to keep accuracy

below 50% with comfort.

Attached some opportunities I see in your chart.

Quote from tv92670:

Anek,

I'm very new to futures trading; however, I've traded stocks and options for years. In another post, someone mentioned you traded in the "puretick" room. Is that where you learned to trade? Would it be worth my time to get an education in one of the paid rooms? If so, which one would you recommend?

Thanks,

Tyler

The Titanic called, it just saw the YM underneath the sea. Man, they are

selling it hard. (Around 200 in AH)

Too bad I suck at swing trading ![]()

Anek

Quote from Razor:

Seems like I am having a mental block in believing that everytime I am about to get on the trend the trend is about to end so I am always looking to get right in on the start of the next trend....not sure how to over come this....will keep plodding ahead I guess...

Thanks for the feedback !

My two afternoon trades:

So 3 wins today and 1 loss but I don't think I did the system much justice.

Anek, if you get a chance please provide input on these two afternoon trades.

Red line short entry, green line cover exit on both.

Cheers ![]()

http://i11.tinypic.com/53sk37b.png

http://i10.tinypic.com/4l95xms.png

Razor,

On your first screenshot the short is simply a stop out, no escape there, it

reversed and you take your loss. However, since you didn't short the ones that

did work, you end up losing money for not being on top of the trend. Sooner or

later they all reverse, unless it's one of those massive trending days.

On your second screenshot, I'm not sure why you took that one. Can't see the

reason.

I marked congestion with a circle.

Double Bottoms/Tops with horizontals.

Arrows indicate other good places to enter.

Anek

And the second file....

anek, what broker do you suggest for futures simulation? thanks

Quote from dazed101:

anek, what broker do you suggest for futures simulation? thanks

Quote from dazed101:

anek, what broker do you suggest for futures simulation? thanks

Supposedly AHG had $17bln in borrowings, so the question is who is left holding that paper that likely is now worthless.

__________________

"Dip buying has been consistently rewarded lately and it doesn't much matter

what caused the dip."

Quote from makloda:

Supposedly AHG had $17bln in borrowings, so the question is who is left holding that paper that likely is now worthless.

Quote from Anekdoten:

Notice how the doubletop/doublebottom area led to chop suey. That's my signal to stay on the sidelines.

Anek [/B]

Quote from hulkgogan:

Hi FYI, the chop suey in your chart was actually forming a wolfwave. Given the approriate context, quite a reliable pattern.

Oops, sorry wrong symbol

Quote from Anekdoten:

Think you got the wrong thread Mak

Anek

__________________

"Dip buying has been consistently rewarded lately and it doesn't much matter

what caused the dip."

Calling it a day. Good morning for me.

Quote from pkts:

If you want to simulate during live trading you can get Interactive Brokers and use something like Bracket Trader or Ninja Trader. But you really just need the data.

If you want to trade after the market you need to buy the data from Esignal or Ensign etc.

Good luck.

For sim,I use unarmed book trader,just don't forget it's on/off.(IB)This also gives you good idea of how fast fills are,and the actual mechanics/making a trade.Great thread.Thanx.

__________________

johhny red

I traded the DIA today because I don't have a futures account open (yet),

strictly according to AHG. I traded 500 shares to simulate 1 contract and my

results: 2.91 pts and 4/5 WL. I'll take it! Note: 1.71 pts came on the last

trade of the day...I picked a good day to start

Tyler

Had a nice day as well, did +$228. Have to believe though that things will become much harder when the moves become smaller and ranges tighter....this will be the days to see how really disciplined one can be.... ;)

Trades for 08.01.07

I'm exhausted, I did not sleep all night by the massive afterhour/pre-market

move activity that was hard to ignore.

After the market closed I had to take a 3 hour nap so I apologize that this

chart is getting to you a little later than usual.

However, on a positive note, I was in perfect sync with the market today. I

annotated little hints that price gives us that might indicate a possible

reversal or choppy move. Whenever I saw things like that I made an effort to

stay on the sidelines.

Massive profits today, more like obscene. These hard strong moves are a gift

from the gods.

Tip of the day: Make an effort to spot possible reversals/choppyness by watching

erratic highs/lows.

Longs

6 for 6

No losers

Shorts

7 for 7

No losers

Total

13 for 13

(Notice the lack of bias, roughly half and half)

Don't despair, keep on using that sim. Your skill will ONLY get better. Learn to

spot the chop, it will save you AND make you money.

Keep on practicing, keep on reading, keep on noticing how those lows and highs

develop. Don't give up. If I can do it, you can do it.

Hope it helps.

Anek

PS: 199 Tick Chart, don't ask ![]()

Glad to hear you some of you guys did well.

Remember, you are JUST beginning to get your feet wet, assuming my style of

trading is new for you.

I promise you, your skill will ONLY get better.

If you keep your discipline and your money management in check it's only a

matter of time until you can mimic my performance and in many cases I'm sure,

surpass it.

Keep it simple and you will prevail.

Anek

Anek's Big Rule of 3

1) Spot the Trend, it is your ONLY friend.

Up, Down, Sideways, All over the place ? Only up or down interests us. Odds in

our favor.

2) Spot the Entry

Do we have one ? Should we have one ? Use your tools for confirmation, not the

other way around.

Your eyes go 90% of the time on price. Specifically on those highs and lows.

3) Spot the Chop

This kills us and reverses us. No one is forcing you to trade as the market is

always there.

Anek

I'm happy to see you were able to catch that big move at the close. I work

during the day, so I only get to watch the market during RTH when I can steal a

few minutes here and there, but happened to watching price action during that

monster swing during the last 30 minutes and I was hoping you and some of the

other kind folks here on ET were riding that puppy up.

Thanks again for your generosity in posting these trades over the past couple of

weeks. Your posts have inspired me! My trading approach (albeit on a simulator

for now) is becoming much more simple and effective.

Congrats Anek and thanks again for post !

Quote from mikehbeck808:

I'm happy to see you were able to catch that big move at the close. I work during the day, so I only get to watch the market during RTH when I can steal a few minutes here and there, but happened to watching price action during that monster swing during the last 30 minutes and I was hoping you and some of the other kind folks here on ET were riding that puppy up.

Thanks again for your generosity in posting these trades over the past couple of weeks. Your posts have inspired me! My trading approach (albeit on a simulator for now) is becoming much more simple and effective.

Quote from Razor:

Congrats Anek and thanks again for post !

I'm getting a LOT of questions on stops.

ie "Anek, what kind of stops do you use".

Here is the answer to one PM I just replied to, figure it can help some of my

friends so posting it here.

...........

Notice how I use stochastic crossing for entries. I feel that the

stop should be large enough to handle noise and not much else. Since

you are using the SIM I will let you be the judge of this.

It's very dependent on the type of trader, the better your

aim/precision the smaller your stop will get in time.

Start with 12-15 and adjust accordingly. No need to rush, polish those skills.

Good to hear from you.

..............

Bottomline is that as you get more experienced your entries will be more

optimal. For now, stay on the sim and you be the judge of what your entries

require.

You need just enough to handle noise, anything else and it's prob not the type

of trade you should be taking.

Aside from recognizing the current trend or lack of this is probably the most

critical area of my method. Unfortunately, it is extremely dependent on entry

and the trader. Use sim to take statistics.

For instance....

- What do the good trades usually need based on my entries ?

- Will a bigger stop had made this losing trade a winning one ? Is it worth it

based on my targets ? Will I be deviating from the initial premise to take the

trade ?

You need to ask yourself these questions and take notes. Very important.

I will rather pass on a trade that requires a big stop than take it. As a last

resort, minimal car size then. In the end, if you miss it, so be it, odds are

that the next day, market is there waiting for you to try again

![]()

It's a risk management game.

Anek

Excellent info, thanks Anek ! ![]()

Quote from Anekdoten:

I'm getting a LOT of questions on stops.

ie "Anek, what kind of stops do you use".

Here is the answer to one PM I just replied to, figure it can help some of my friends so posting it here.

...........

Notice how I use stochastic crossing for entries. I feel that the

stop should be large enough to handle noise and not much else. Since

you are using the SIM I will let you be the judge of this.

It's very dependent on the type of trader, the better your

aim/precision the smaller your stop will get in time.

Start with 12-15 and adjust accordingly. No need to rush, polish those skills.

Good to hear from you.

..............

Bottomline is that as you get more experienced your entries will be more optimal. For now, stay on the sim and you be the judge of what your entries require.

You need just enough to handle noise, anything else and it's prob not the type of trade you should be taking.

Aside from recognizing the current trend or lack of this is probably the most critical area of my method. Unfortunately, it is extremely dependent on entry and the trader. Use sim to take statistics.

For instance....

- What do the good trades usually need based on my entries ?

- Will a bigger stop had made this losing trade a winning one ? Is it worth it based on my targets ? Will I be deviating from the initial premise to take the trade ?

You need to ask yourself these questions and take notes. Very important.

I will rather pass on a trade that requires a big stop than take it. As a last resort, minimal car size then. In the end, if you miss it, so be it, odds are that the next day, market is there waiting for you to try again

It's a risk management game.

Anek

AHG tough today... 2/5 on the DIA +.21. Could've done better if I had tried

to really scalp, but instead I tried to ride the microtrends and would end up

getting stopped. Oh well, at least it was a positive day in a choppy market.

Tyler

Hi,

Only 3 trades here NQ, 2 winners but small.....ended up +$36 on the day, better

than a loss ![]()

Trades for 08-02-07

Tough day, chop land until the later afternoon. Moves were not as strong as

yesterday, except late afternoon.

If you broke even, had small losses or small wins today, give yourself an

applause.

If you made money, you are getting it and I'm proud of you. Means you are

trading with caution and taking only what should be taken, or most of it.

Longs

1st Winner

2nd Winner

3rd Loser full stop

4th BE

5th Winner

6th Loser full stop, bad stop fill too!

7th Grand slam !

8th BE

Shorts

1st Winner

2nd BE

3rd The one i forgot to mark with the vertical line, full stop

4th Winner

5th BE

6th Winner

7th Winner

8th Winner

9th Full stop

Total

9 Winners

4 Losers

4 BE, due to commissions I will count as 1 full Loser

...so 9 Winners and 5 Losers

Circles identify chop evidence. Funny how yesterday I spoke so much about the

chop, i guess I was expecting it after so many strong move days.

Exercise for today, work on spotting the chop on today's chart, yes, again

![]()

Hint of the day: Study stoch crosses with the trend, check my entries

![]() It's a good indicator, fast too,

just need to know WHEN to take those crosses. They don't always help, obviously.

It's a good indicator, fast too,

just need to know WHEN to take those crosses. They don't always help, obviously.

Real tough day unless you had full focus of those highs and lows.

Anek

Guys and Gals,

I would like to talk about Winners and Losers.

There are only five possible outcomes in trading.

1-)Big Losses

2-)Small losses

3-)Big Winners

4-)Small Winners

5-)Break even

Stay away from the first one and the rest will EMBRACE you.

When the system fails to produce profits it is probably because the market had

no direction and nothing but reversals. When this happens you WILL have a losing

day even if following the system.

We have yet to see this but when it comes I will most likely post a losing day.

However, it will most likely fall in the small losses category and that is what

is all about.

Remember....

If there are no 2 higher lows and no 2 higher highs, it's not an uptrend.

If there are no 2 lower lows and 2 lower highs, it's not a downtrend.

Don't anticipate (yet), stick to the plan.

Stay with the plan, work on those skills, this is good stuff.

Those that has seen me trade live know what I can do. This is most of what I do,

nothing else, no magic, no tricks. And last but not least, I'm giving you the

tools, the samples, the manual on how to do it.

Stay disciplined, practice, and help me make a great thing better.

Let me see you work on those skills, show me that you can do it, I ask for

nothing else in return.

Anek

Thanks Anek for the continued motivation and info, hugely appreciated.

As a note I have been trading with a completely blank chart accept for price

bars and heiken bars. I will draw in fibs and trendlines at times but that is

it, zero indicators. Do you recommend putting on the stoch and using that for

entries or if I am breakeven / winning small for right now then try and learn

with price only ?

Cheers,

Ray ![]()

Quote from Anekdoten:

Guys and Gals,

I would like to talk about Winners and Losers.

There are only four possible outcomes in trading.

1-)Big Losses

2-)Small losses

3-)Big Winners

4-)Small Winners

5-)Break even

Stay away from the first one and the rest will EMBRACE you.

When the system fails to produce profits it is probably because the market had no direction and nothing but reversals. When did happens you WILL have a losing day.

We have yet to see this but when it comes I will most likely post a losing day.

However, it will most likely fall in the small losses category and that is what is all about.

Remember....

If there are no 2 higher lows and no 2 higher highs, it's not an uptrend.

If there are no 2 lower lows and 2 lower highs, it's not a downtrend.

Don't anticipate (yet), stick to the plan.

Stay with the plan, work on those skills, this is good stuff.

Those that has seen me trade live know what I can do. This is most of what I do, nothing else, no magic, no tricks. And last but not least, I'm giving you the tools, the samples, the manual on how to do it.

Stay disciplined, practice, and help me make a great thing better.

Let me see you work on those skills, show me those profits, I ask for nothing else in return.

Anek

Razor,

I recommend that you find one and only one tool to help you find optimal

entries.

It is IMPERATIVE that you keep it simple or you will lose focus.

I use stochastic crosses when I feel a trend has been determined with an

opportunity to enter with low risk. You can clearly see this on my charts, on

most anyway.

I use Heikin Ashi to adjust my trailing stops/targets or otherwise known as

riding the winners.

I use trendlines to gauge the big picture and Fibonacci for prediction.

As it is now, I don't recommend much else. However, if any reader has found a

tool to enhance the system by all means, share it and I will promise to test it.

If it helps I will not only thank you but will use it and recommend it.

Anek

Ok this question merits it's own post.

How do you feel about averaging down ?

I feel it's the devil, and you should never ever do it. It's a recipe for

disaster and I recommend everyone following my system to stay as far away from

it as you possibly can.

Hope I'm 100% clear on this.

Anek

Anek,

Wondered if you might make a few notes on my attached chart. Last two days I

have gotten run over picking up nickels infront of an Exxon tanker truck.

Shorted one rally too many, last hour especially turned a profitable day into a

loss.

Shorted rallies..even though it seemed like a congestion pattern.

Thanks mate!

Quote from anvil993:

Anek,

Wondered if you might make a few notes on my attached chart. Last two days I have gotten run over picking up nickels infront of an Exxon tanker truck.

Shorted one rally too many, last hour especially turned a profitable day into a loss.

Shorted rallies..even though it seemed like a congestion pattern.

Thanks mate!

Quote from Anekdoten:

Anek's Big Rule of 3

1) Spot the Trend, it is your ONLY friend.

Up, Down, Sideways, All over the place ? Only up or down interests us. Odds in our favor.

2) Spot the Entry

Do we have one ? Should we have one ? Use your tools for confirmation, not the other way around.

Your eyes go 90% of the time on price. Specifically on those highs and lows.

3) Spot the Chop

This kills us and reverses us. No one is forcing you to trade as the market is always there.

Anek

Quote from Stealth Trader:

I came across this thread last night and have been scanning through the posts. What you are doing is remarkably similar to my method. So much so, if I didn't know better, I'd say someone has been looking over my shoulder!

Main differences are I don't use any indicators, although I did spend years trying prove their worth. I simply found I could trade better without them. In addition, I use regular OHLC bars set to constant volume data and monitor market internals for strength of trend. To me, HA distorts the price action, especially on reversal pattern bars, which is my mainstay for entries and stop placement.

All in all though, your method and mine are built on the same principle of HH/HL/LH/LL's. As such, I thought I would drop by and applaud you for sharing a very simple, yet quite lucrative style of extracting money out of the markets each day. I'm always amazed as to how few traders grasp the concept of price action being the closest thing to the holy grail they will ever encounter. People like you are far and few between, and those following your thread will be well served if they decide to follow the generous sharing of your wisdom. Well done, sir!

Regards,

st

Quote from Anekdoten:

ST,

Thank you for the kind words, I will study your suggestions in detail considering you trade using a similar approach.

Appreciate the input.

Anek

Quote from Stealth Trader:

No suggestions intended, just comparing the slight differences.

Keep doing what works for you.

st

Whew! Ended up a few points, but only from luck. Quite disapointed with my stop setting today, and not taking profits at resistance/support levels on such a range day. Kept holding them waiting for that rocket blast. Good to hear Anec's comments, makes me feel a little better.

Quote from bmwhendrix: