X-Swing Template

by Ana Maria Gallo

Last Spring, I had the pleasure of collaborating with

Alan Robinson on

EVRAA, a

Wyckoff interpretation of volume plotted directly on a

chart. Alan you may know as "rabbit" in the Ensign

EChat rooms. (Editor's note: Text that is underlined

and blue in color is a hyperlink to additional information

on the Internet. Click the link for additional material to

read.)

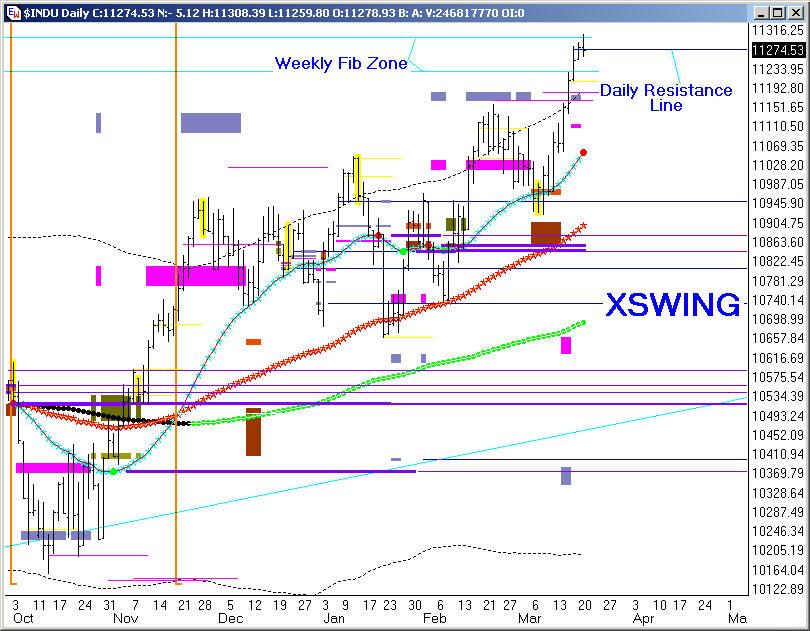

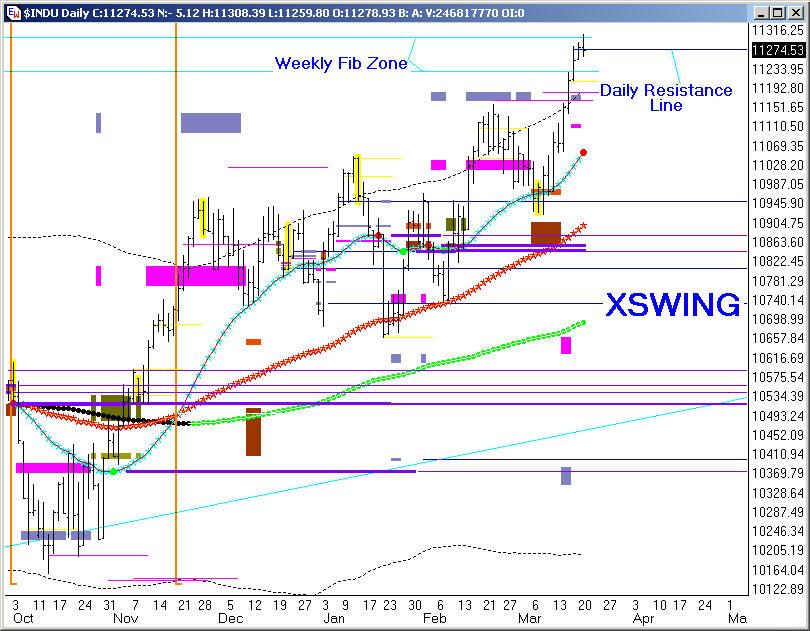

This past year, Alan and I had great fun working on a

visually intuitive template Alan calls "X-Swing". X-Swing

overlays multi-time moving averages and uses prior swings to

alert the user of trend reversals and congestion zones.

Cross-overs are used as future support

and resistance, a key difference that distinguishes this

approach from typical moving average methods. It also

includes a chart-only

VolSum,

highlighting potential volume exhaustion points with a

yellow bar on the chart. The use of alerts and DYOs (the

Design Your Own studies feature in Ensign Windows) automates

finding these key levels and marking them on the chart.

The template can be used on all time frames and all

instruments, with only a small change to the Auto-Trends and

Pesavento Pattern studies for instruments with small ticks,

such as the Euro. Shown above is X-Swing on a Daily YM

chart. This

folder directory list has numerous examples in various

time frames for further study.

Download Template:

xSwingX.dat (for all but Euro) [right click and

Save to your Ensign Template Folder]

Download Template:

xSwingX_euro.dat (Euro & similar currencies)

complaints or questions? (just kidding)

Key Elements of the Template

- 180-bar Bollinger - Black dots and heavy

black lines

- Two moving-average pairs:

The MA pairs are used to generate "future support

and resistance" lines as well as give a visual

indication of the general price trend.

40ma, 120ma (weighted) - Red and Blue

Stars

10ma, 13ma (simple) - "gold" hashed

- Prior 40/120ma cross extensions: two types

(1) Horizontals (red/purple lines) act as future

support/resistance

(2) Verticals (orange) for reversals (or mid-point

inflections). These in particular are worth study.

Here is an example.

- Swing retrace "blocks" where swings are determined

using the 10/13 ma reversal points (gold, red, fuchsia,

purple).

Here is a guide to the retrace colors.

- Note: It is assumed that you are familiar

with Fibonacci retrace methods. If not, click

here for a short introduction.

- Optional Auto Trend study: This is not

"turned on", however, it uses 10/13 reversal points, ie,

larger swings. To turn it on, select "Auto Trends"

study and check the Trend Line box.

- A note on the colors

The central idea of this template is to do the work for

you, using colors that your eye can quickly process

without much thought. Alan uses a light gray (silver)

background with black/white candles. The examples in

this article are in white so as to print, but use what

works for you as long as the colors stand out.

- A note on learning this template

A very useful way to quickly train your eye to "see"

the features is to apply the template to your favored

time-frames and play back the charts at 10x speed using

DEMO, not at all attempting to trade it, but rather,

jotting notes where you see tags, crosses, and

reversals, as shown in the triple screen example below.

The template does not include the indicators shown in the

triple time frame example as you can readily add your own

favorites by layering them into the X-Swing template.

Interpreting the Indications

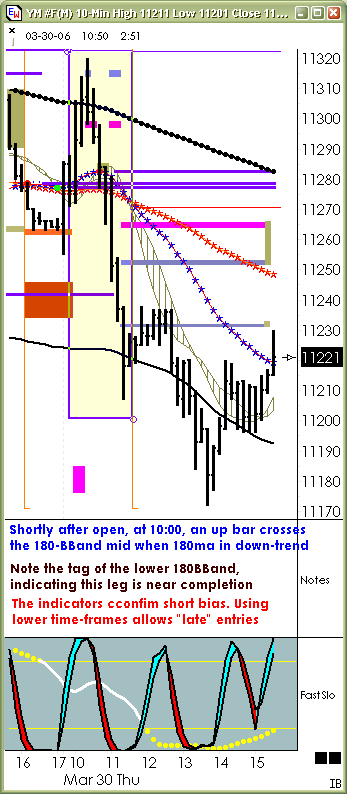

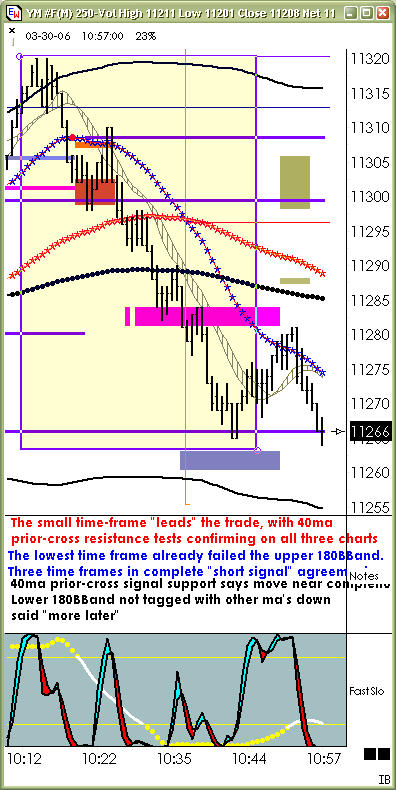

Combining the very long (180), medium (120/40), and very

short (10/13) averages are intended to quickly let

your eyes assess the bias.

- The 180 bar Bollinger Band stands out the

most. A critical idea to bear in mind is that price

likes to seek the center line, but rarely lingers,

preferring instead to swing to the opposite extreme.

Because of the long period used, reversals at the outer

bands and traverses of the mid will often result in the

strongest moves. General Bollinger Band rules apply, so

in addition to band tags look for squeezes. To better

see the value of the 180-BBand, compress the bars

closely, as in

this example. Because of the very long 180-bar

period, a look at the next time frame for more clues

helps to refine the signal.

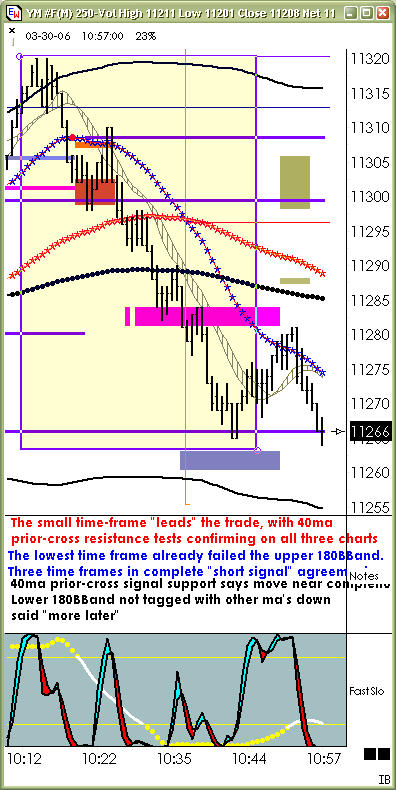

- The 40/120 "star" pair are meant to be seen

as working in tandem. Their cross is often significant

as future support, for which purple and red horizontal

extensions are drawn. Additionally, the cross relates

well to the 180 bands for timing, and for this, red

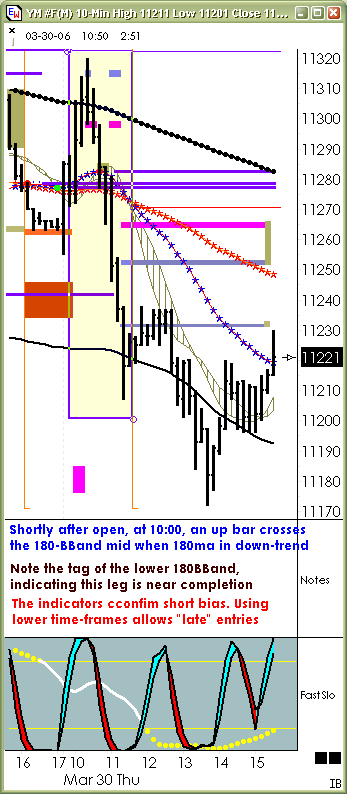

vertical bars are drawn. In the triple-screen example,

note how the vertical drop-bar indicated price tests of

the 180-mid on the 700V and 250V and a test of the lower

180BBand on the 10m chart.

- The fast 10/13 pair has various uses. Look

for 10/13 (and 40/120) proximity to the 180-BBands,

which often indicate imminent slowing or even reversal

of the price swing in progress. The 10/13 reversal tops

and bottoms are also used to project retrace levels, for

which "color blocks" are drawn on the chart. This is

done using auto-trends and Pesavento Pattern studies,

neither of which are actually drawn on the chart.

- Here is

a folder of rabbit's most recent xSwing charts,

where you can study the precise timing that can be

achieved with this approach.

Example of Triple Time Frame Use of the Template

The following example uses three time frames to select

and manage a trade: 250-Volume, 700-Volume, and 10-minute.

The 250-Volume is selected as it approximates a 1-minute

chart. Volatility, of course, can change that value. A

simple rule of thumb to use is the divide the average daily

volume by the total number of minutes traded during the

day. The second time frame is 3x the first, and the third

is 3x that.

First: (~1 minute) 100,000 Vol/450minutes

= 222 volume bars per minute, rounded to 250

Second: (~3 minute) 222 x 3 = 666, rounded to 700

volume

Third: 10 minute bars

[it may be helpful to

open

the three images in a separate window]

|