Beta is a risk measure comparing the volatility of a stock's price movement to the general market.

Overview

- Beta is derived from a formula that measures the volatility of a stock compared to the volatility of the market in general (as measured by a market index such as the S&P 500, DJIA, etc). Beta's companion measure for volatility is alpha.

- The Beta for a stock may vary in up- versus down-markets.

- Monthly data is preferred.

Beta provides a good idea of a stock's inherent risk or sensitivity to general market fluctuations.

Signals

High beta stocks react strongly to variations in the market, and low beta stocks are less affected by market variations.

- If Beta is 1, then an issue has the same volatility as the general market. It is either growing at the same rate or declining at the same rate.

- If Beta is greater than 1, then an issue is more volatile. At 1.25 it will probably move 25% more than the market. If the market is in an up trend, then the security will gain 25% more than the general market.

- If Beta is less than 1, then an issue is less volatile. At 0.5 it probably will move only 50% or a half of the market. If the market is In a downtrend, it will only lose 50% of what the general market loses.

- If beta is less than 0, then the stock is moving in a reverse pattern to the index. When the index moves up the stock declines and vice versa.

Calculating Beta

To calculate the 200-day Beta for a stock (in comparison to the S&P index), you would compute the 200 one-day percentage changes in S&P and the 200 one-day percentage changes in the stock. These calculations produce 200 ordered pairs that are then charted as a scatter graph, and the slope of the least-squares-fit line is the value for beta. (Alpha is the y-intercept of the least-squares-fit line.)

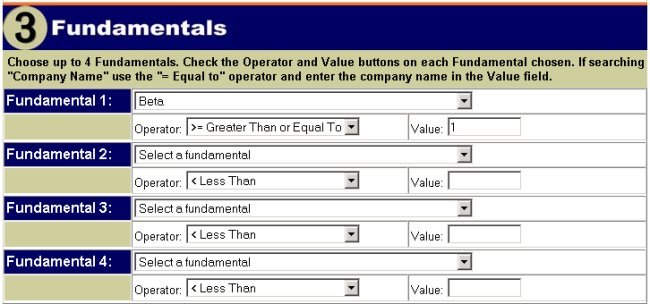

Filtering Beta

- Filter Beta = 1, results return companies that are either growing at the same rate or declining at the same rate.

- If Beta is greater than 1, results return at 1.25 it will probably move 25% more than the market. If the market is in an up trend, then the security will gain 25% more than the general market.

- If Beta is less than 1, results return at 0.5 it probably will move only 50% or a half of the market. If the market is In a downtrend, it will only lose 50% of what the general market loses.

- If beta is less than 0, result return stocks that are moving in a reverse pattern to the index. When the index moves up the stock declines and vice versa.

Sample Filter using only Beta: