In the 1600s, the Japanese developed a method

of technical analysis to analyze the price of

rice contracts. This technique is called

candlestick charting. Candlestick charts are

simply a new way of looking at price; they don't

involve any calculations.

Candlestick charts are much more visually

appealing than a standard two-dimensional bar

chart. As in a standard bar chart, there are

four elements necessary to construct a

candlestick chart, the OPEN, HIGH, LOW and

CLOSING price for a given time period. Below are

examples of candlesticks and a definition for

each candlestick component:

The body of the candlestick is called the

real body, and represents the range between the

open and closing prices.

A black or filled-in body represents that the

close during that time period was lower than the

open, (normally considered bearish) and when the

body is open or white, that means the close was

higher than the open (normally bullish).

The thin vertical line above and/or below the

real body is called the upper/lower shadow,

representing the high/low price extremes for the

period (one period of time measures the duration

of selling or buying within the market). As a

trader, you can use any time period you want,

time intervals may be a tick chart, 1 min, 5min,

10 min, 1 hour, 4 hour, 1 day,…

|

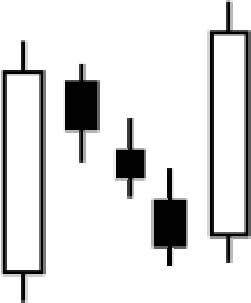

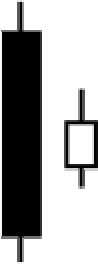

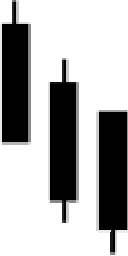

Bearish 3 Pattern: A

long black body followed by several

small bodys and endingin another long

black body. The small bodys are usually

contained within the first black body's

range.

Interpretation: A bearish

continuation pattern. |

|

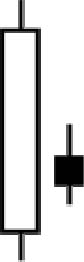

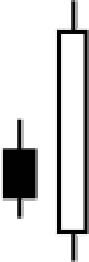

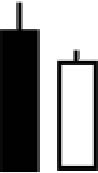

Bearish Harami Pattern:

A very large white

body followed by a small black bodythat

is contained within the previous bar.

Interpretation: A bearish pattern

when preceded by an uptrend. |

|

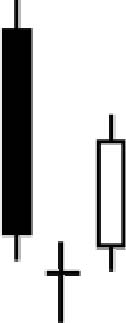

Bearish Harami Cross Pattern:

A Doji contained within a large white

body.

Interpretation: A top reversal signal

|

|

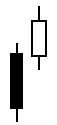

Big Black Candle Pattern:

An unusually long black bodywitha wide

range.Prices open near the high and

close near the low.

Interpretation: A bearish pattern.

|

|

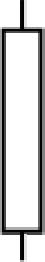

Big White Candle Pattern:

A very long white bodywitha wide

range between high and low.Prices open

near the low and close near the high.

Interpretation: A bullish pattern.

|

|

BlackBody Pattern:

This candlestick is formed when the

closing price is lower than the opening

price.

Interpretation: A bearish signal.

More important when part of a pattern.

|

|

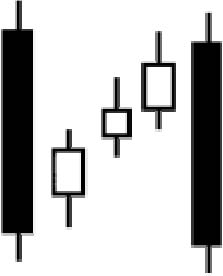

Bullish 3 Pattern: A

long white body followed by three small

bodies, ending in another long white

body. The three small bodies are

contained within the first white body.

Interpretation: A bullish

continuation pattern. |

|

Bullish Harami Pattern:

A very large black bodyis followed by a

small white body and is contained within

the black body.

Interpretation: A bullish pattern

when preceded by a downtrend. |

|

Bullish Harami Cross Pattern:

A Doji contained within a large black

body.

Interpretation: A bottom reversal

pattern. |

|

Dark Cloud Cover Pattern:

A long white body followed by a black

body.The following black candlestick

opens higher than the white

candlestick's highand closes at least

50% into the white candlestick's body.

Interpretation: A bearish reversal

signal during an uptrend. |

|

Doji Pattern:

The open and close are the same.

Interpretation: Dojis are usually

components of many candlestick patterns.

This candlestick assumes more importance

the longer the verticle line. |

|

Doji Star Pattern: A

Doji which gaps above or below a white

or black candlestick.

Interpretation: A reversal signal

confirmed by the next candlestick (eg. a

long white candlestick would confirm a

reversal up). |

|

Engulfing Bearish Line Pattern:

A small white body followed by and

contained within a large black body.

Interpretation: A top reversal

signal. |

|

Engulfing Bullish Line Pattern:

A small black body followed byand

contained within a large white body.

Interpretation: A bottom reversal

signal. |

|

Evening Doji Star Pattern:

A large white body followed by a Doji

that gaps above the white body. The

third candlestick is a black body that

closes 50% or more into the white body.

Interpretation: A top reversal

signal, more bearishthan the regular

eveningstar pattern. |

|

Evening Star Pattern:

A large white body followed bya small

body that gaps above the white body. The

third candlestick is a black bodythat

closes 50% or more intothe white body.

Interpretation: A top reversal

signal. |

|

Falling Window Pattern:

A gap or "window" between the low of the

first candlestick and the high of the

second candlestick.

Interpretation: A rally to the gap is

highly probable. The gap should provide

resistance. |

|

Grave stone Doji Pattern:

The open and close are at the low of the

bar.

Interpretation: A top reversal

signal. The longer the upper wick, the

more bearish the signal. |

|

Hammer Pattern: A

small body near the high witha long

lower wick with little or no upper wick.

Interpretation: A bullish pattern

during a downtrend. |

|

Hanging Man Pattern:

A small body near the high with a long

lower wick with little or no upper wick.

The lower wick should be several times

the height of the body.

Interpretation: A bearish pattern

during an uptrend. |

|

Inverted Black Hammer Pattern:

An upside-down hammer witha black body.

Interpretation: A bottom reversal

signal with confirmation the next

trading bar. |

|

Inverted Hammer Pattern:

An upside-down hammer witha white or

black body.

Interpretation: A bottom reversal

signal with confirmation the next

trading bar. |

|

Long Legged Doji Pattern:

A Doji pattern with long upper and lower

wicks.

Interpretation: A top reversal

signal. |

|

Long Lower Shadow Pattern:

A candlestick with a long lower wick

with a length equal to or longer than

the range of the candlestick.

Interpretation: A bullish signal.

|

|

Long Upper Shadow Pattern:

A candlestick withan upper wick that has

a length equal toor greater than the

range ofthe candlestick.

Interpretation: A bearish signal.

|

|

Morning Doji Star Pattern:

A large black body followed by a Doji

that gaps below the black body. The next

candlestick is a white body that closes

50% or more into the black body.

Interpretation: A bottom reversal

signal. |

|

Morning Star Pattern:

A large black body followed by a small

body that gaps below the black body. The

following candlestick is a white body

that closes 50% or more into the black

body.

Interpretation: A bottom reversal

signal. |

|

On Neck-Line Pattern:

In a downtrend, a black candlestick is

followed by a small white candlestick

with its close near the low of the black

candlestick.

Interpretation: A bearish pattern

where the market should move lower when

the white candlestick's low is

penetrated by the next bar. |

|

Piercing Line Pattern:

A black candlestick followed by a white

candlestick that opens lower than the

black candlestick's low, but closes 50%

or more into the black body.

Interpretation: A bottom reversal

signal. |

|

Rising Window Pattern:

A gap or "window" between the high of

the first candlestick and the low of the

second candlestick.

Interpretation: A sell off to the gap

is highly likely. The gap should provide

support. |

|

Separating Lines Pattern:

In an uptrend, a black candlestick is

followed by a white candlestick with the

same opening price.

Interpretation: A continuation

pattern. The prior trend should resume.

|

|

Shaven Bottom Pattern:

A candlestick with no lower wick.

Interpretation: A bottom reversal

signal with confirmation the next

trading bar. |

|

Shaven Head Pattern:

A candlestick with no upper wick.

Interpretation: A bullish pattern

during a downtrend and a bearish pattern

duringan uptrend. |

|

Shooting Star Pattern:

A candlestick with a small body, long

upper wick, and little or no lower wick.

Interpretation: A bearish pattern

during an uptrend. |

|

Spinning Top Pattern:

A candlestick with a small body. The

size of the wicks is not critical.

Interpretation: A neutral pattern

usually associated with other

formations. |

|

Three Black Crows Pattern:

Three long black candlesticks with

consecutively lower closes that close

near their lows.

Interpretation: A top reversal

signal. |

|

Three White Soldiers Pattern:

Three white candlesticks with

consecutively higher closes that close

near their highs.

Interpretation: A bottom reversal

signal. |

|

Tweezer Bottoms Pattern:

Twoor more candlesticks with matching

bottoms.The size or color of the

candlestick does not matter.

Interpretation: A Minor reversal

signal. |

|

Tweezer Tops Pattern:

Two or more candlesticks with similar

tops.

Interpretation: A reversal signal.

|

|

White Body Pattern: A

candlestick formed when the closing

price is higher than the opening price.

Interpretation: A bullish signal.

|