| How I

Trade Using Multiple Timeframes

|

|

|

| Technical Analysis

Articles | Written

by David Floyd | |

How I Trade Using Multiple

Timeframes

Confluence on Three Time Frames Indicates

Solid Short Set-Up

One of the topics I will be addressing in an

upcoming segment of my ongoing FX Tutorials is

combining multiple time frames looking for

'confluence' areas where the technical picture

becomes very clear.

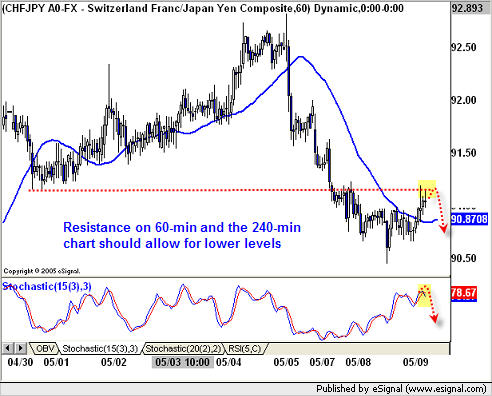

The charts below of CHF/JPY outline a very

basic, yet effective, example of several

resistance an support areas coming together at

the same time that may well result in a solid

short

Key Points:

- the 60-min chart finds resistance at a low

from back on April 30th

- the 240-min chart has fib resistance at

roughly the same area, 91.35

- the daily chart has failed at trend-line

resistance and is now set to push below bull

trend-lines (yellow highlighted area)

- momentum, as defined by the stochastics is

bearish, although the 240-min chart exhibits a

bit of upside price pressure |