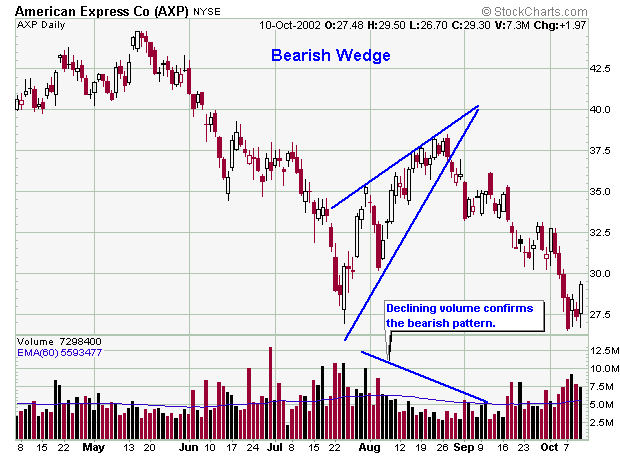

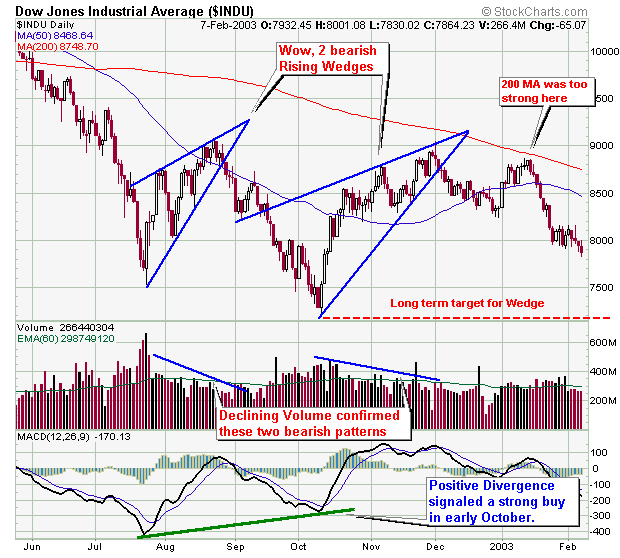

Rising wedges are bearish biased patterns that are characterized by a

series of higher highs and higher lows that converge in an upward pattern. Two

trendlines can be drawn connecting the highs and the lows resulting in an

upward sloping triangle. These upward trendlines should be tested several

times with the most reliable formations touching the trendlines at least 5

times. The time length or duration of the pattern should be at least three

weeks, anything shorter is a pennant. The volume tends to decrease during the

formation of the pattern.

Rising wedges should only be shorted once a downside breakout has occurred

as this lowers the risk substantially – see the table of statistics below. If

one misses the breakdown, he/she may have a second chance to short the stock

on a retest or pullback to the pattern – this happens about half the time per

the statistics below. Downside breakouts generally occur about 2/3 of the way

through the pattern to the apex. Also note that downside breakouts do not need

to be confirmed with high volume, as stocks can fall under their own weight.

Rising Wedges can are prone to premature breakouts either up or down as is any

pattern and this does not signal the end to the pattern. However, if a a

breakaway gap forms whereby the stock gaps up out of the pattern, this ends

the pattern. A generic price target would be a fall to the bottom of the

pattern, however some wedges may find support at one of the three Fibonacci

numbers of 38.2, 50, and 62.8% - however the 38.2 and 50% levels seem to be

the most like place to bounce.

All the statistical information for the chart patterns is referenced form the book: Encyclopedia of Chart Patterns by Thomas N. Bulkowski - Publisher: John Wiley & Sons. Click the title to buy this excellent book.

Statistics: based on a population of 179 examples in 500 stocks from 1991 - 1996.

| STATISTICAL DESCRIPTION |

STATISTICAL %

|

| Failure rate |

24%

|

| Failure rate if waited for downside breakout |

6%

|

| Average decline after downside breakout |

19%

|

| Most likely decline after downside breakout |

15%

|

| Average # that meet price target |

63%

|

| Average # that pulled back to retest the breakpoint |

53%

|

| Average downside breakout distance to the apex |

61%

|

| Premature downside breakouts |

22%

|

Based on the statistics above it is obviously best to wait for the

downside breakout confirmation before going short.

The other things that stand out is the low “most likely” decline of 15%.

However, I wonder if this number is biased to the time from of study or 1991 -

1996. During this time period, there were periods of big declines, however the

general market trend was up in contrast to the total market meltdown we have

seen in the last few years. Therefore I wonder the Rising Wedge pattern would

have performed better with contemporary data.

The number showing a downward volume trend 74%. Therefore, the majority of Rising Wedges have a downward volume trend as do most technical patterns, so this is not surprising.

| STATISTICAL DESCRIPTION |

STATISTICAL TIME

|

| Average formation length |

1.5 months

|

| Average time for triangle to pullback to restest the breakout price |

10 days

|

| Average time for successful breakouts to achieve their ultimate high |

Average time is 2.5 months to hit their highs

|

Even though the average time for pullback completion takes about 10

days, note that pullback will begin much sooner than this, such as only a few

days after breakout. Therefore, if you short a Rising Wedge after it breaks

down, don’t ‘freak out’ if it starts to pullback, or if the volume is low –

per the volume statistics above.

For swing trading, it is so important to let your winners run and sell you

losers quickly. Most novice traders hold on to their losers too long - why

does this happen??? After a trader has a string of losses, he/she surrenders

to emotion which causes the trader to lose objectivity. In this example, once

the trader surrenders to emotion, he/she will feel a psychological need to

quickly lock in some profits to feel better to make up for the losses i.e. the

trader does not let his winners run.

Do not fall into this destructive trap – sell your losers quickly and let

your winners run – trade objectively, not emotionally. It’s also a lot easier

to let a position run rather than constantly trading in and out of positions

quickly – at least it is for me and is the reason I do not day trade.

Now that you understand something about descending triangles, it's time

for some real chart examples. Please note that I will be adding

more examples as I find them.