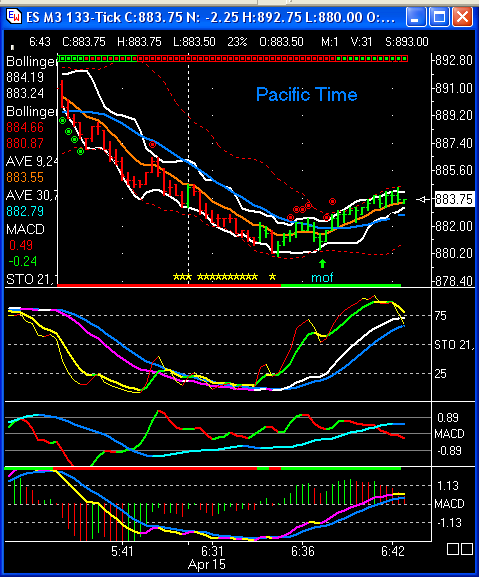

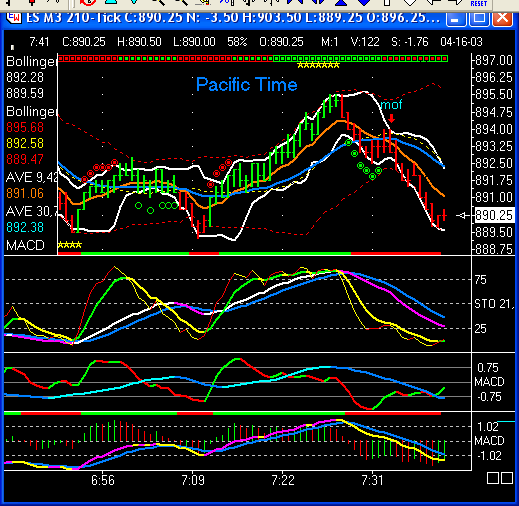

MOF Defined

Indicator Reference:

Bollinger Bands: 8, 1.8

Fast stochastic: 7,3,3 exponential

(smoothed for Ensign)

Slow stochastic: 21, 10, 4

exponential (smoothed for Ensign)

MOF is an

acronym for money on the floor, a fancy name

coined some months ago which has stuck. The

thought was that it is money just lying

there on the floor waiting to be picked up,

or in other words, a very high percentage

trade.

The trade

works in any time frame, although I believe

it is especially suited for tick charts 133t

and higher. There will usually be 2-8 such

setups on a 210 tick chart (my favorite) in

a typical day.

The setup

is simply described as the first band touch

after the slow stochastic has crossed from

up to down or down to up, preferably from an

overbought or oversold condition. For

example, for a long, the slow stochastic

drops to below 30 and then the two lines

cross upward, price goes up a bit then pulls

back to touch the lower bollinger band. If

the slow stochastic is still crossed up at

that point, the long entry is entered at the

band, or as close to it as you can get. This

situation will usually be the first higher

low marking the end of a downtrend. There

are no other specific rules. MOF setup

examples are shown on the charts below.