|

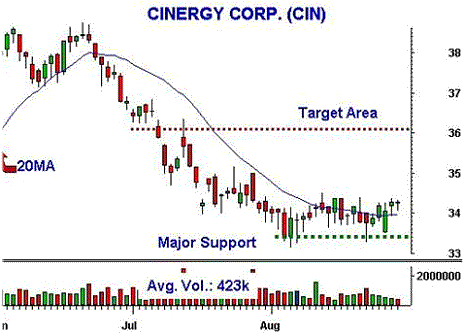

Anticipated breakout to Stage 2 from

Major Support |

Trading Strategy:

Anticipated breakout to Stage 2

from Major Support (MS). CIN has been trying to

bottom for a month and, in the process, has

built a base of MS. There is also some

interesting bar-by-bar analysis that suggests

that a bullish move might be at hand. On Aug.

22nd, at the most bearish time of the day, it

was a very bearish 10/10 bar; however, it did

not take out a prior low, and closed well off

the low, leaving a Bottoming Tail (BT). Then 3

days later, it gapped down, creating a minor

bearish mortgage play, but had no downside

follow through and closed very bullish with a

wide range body. The gap down also was a higher

low than the mentioned BT candle. Then, CIN

consolidated for two additional days in the

upper part of the week's range, above its 20MA.

These are all signs that buyers are stepping up

to support the stock at these levels.

Additionally, although not shown, the weekly

chart is also on MS, threatening a similar break

to Stage 2. There is little supply to halt a

move out.

chart courtesy of

Mastertrader.com

Tip: Simultaneous breaks

to Stage 2 out of bases on both the daily and

weekly chart have higher odds of follow through.

The Play:

Buy above previous day's high ($34.32) with a

protective stop under previous day's low.

Objective:

A move of $1.25 to $1.75.

LOW TO MEDIUM RISK

Play Review:

CIN traded well, and reached

a high gain of $1.27 yesterday, meeting the

minimum target. Trail stop to prior day's low.

|