|

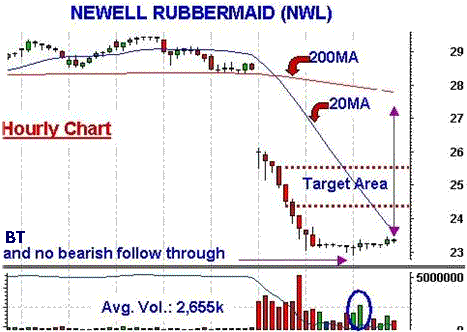

Transition to Stage 2 Breakout

|

Trading Strategy:

Transition to Stage 2 Breakout.

Here is the hourly chart because the daily

incorrectly shows the bearish gap down. The

hourly chart, however, shows a Climactic Buy

Setup (CBS), followed by almost two days of

narrow range basing. This suggests that the

selling is exhausted. Previous day it made a new

low; however, there was no follow through to it,

and it closed with a Bottoming Tail (BT). The

next hour's candlestick was a bullish engulfing

bar on Increasing Volume (+Vol.), from which it

based into the close and made a higher low. You

can also see the very oversold condition and far

distance from its 200MA, suggesting a snap back.

Because the hourly sold off in a "clean V"

fashion, there is very little supply to halt the

advance if it breaks out, giving us a great

reward-risk trade. Although not shown, the daily

chart closed with a Bullish Changing of the

Guard (+COG).

chart courtesy of

Mastertrader.com

Tip: A breakout from a

base following a CBS acts as major support to

propel the retracement.

The Play:

Buy over previous day's high, with a protective

stop under previous day low.

Objective:

$1.00 to $1.75 move.

MEDIUM RISK

Play Review:

NWL stopped at $23.36 (prior

low after two full days of trading) for a $.09

loss. |