|

|

Posted - 02/14/2012 12:47:56 Posted - 02/14/2012 12:47:56   |

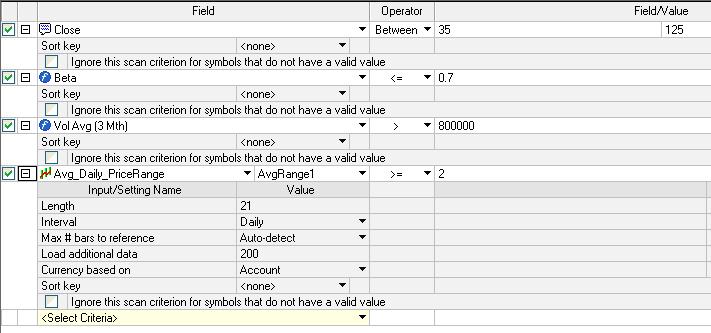

| Having

trouble finding an indicator for the Scanner that will give me >=

2.00 Intraday average price range over last 21 or 34 days. Any

suggestions? |

|

|

|

|

|

|

Posted - 02/14/2012 13:05:08 Posted - 02/14/2012 13:05:08   |

Thanks tachyonv, I'll do that until I find/write an indicator that will do it for me in the Scanner.

Appreciated.

ant___ |

|

|

|

|

|

|

|

|

|

Posted - 02/14/2012 15:30:58 Posted - 02/14/2012 15:30:58   |

Thanks Tach for Tradeable Symbols link.

Ive

got the basic scan working and installed the tradeable symbols list

indicator and filtered down to a few handfulls of symbols. I also

backtested a very simple entry and there are certainly some symbols

which are worth further investigation so I can see some $ in the method.

Now the bit I struggle with, buying near lows...... amazed that you (cant) edit CAN see entrys where you can only have a dime DD |

|

|

|

Posted - 02/14/2012 15:32:11 Posted - 02/14/2012 15:32:11   |

quote:

Originally posted by TradingDude

quote:

Originally posted by kevinkdog

Ok

Thanks, ant! I had beta wrong. And I'm using different volume avg,

and using Daily Range instead of ATR. I get LO and RRC now. I'm

guessing the diff is with ATR.

I appreciate your help!

Scans are not the same

Other difference is Beta >= 0.7(Kevin) versus Beta <= 0.70(_Ant)

AveVol 10 days vs 3 months...etc

TradingDude

Is the Beta calculation in TS the same as the one on yahoo that Tach referred to ? |

|

|

|

Posted - 02/14/2012 15:44:44 Posted - 02/14/2012 15:44:44   |

quote:

Originally posted by split

Thanks Tach for Tradeable Symbols link.

Ive got the basic scan working and installed the tradeable symbols list indicator... DD

I did a search for "tradeable symbols list indicator" and found only this thread.

What/where is it?

Thanks,

ant___ |

|

|

|

Posted - 02/14/2012 15:55:13 Posted - 02/14/2012 15:55:13   |

quote:

Originally posted by split

quote:

Originally posted by TradingDude

quote:

Originally posted by kevinkdog

Ok

Thanks, ant! I had beta wrong. And I'm using different volume avg,

and using Daily Range instead of ATR. I get LO and RRC now. I'm

guessing the diff is with ATR.

I appreciate your help!

Scans are not the same

Other difference is Beta >= 0.7(Kevin) versus Beta <= 0.70(_Ant)

AveVol 10 days vs 3 months...etc

TradingDude

Is the Beta calculation in TS the same as the one on yahoo that Tach referred to ?

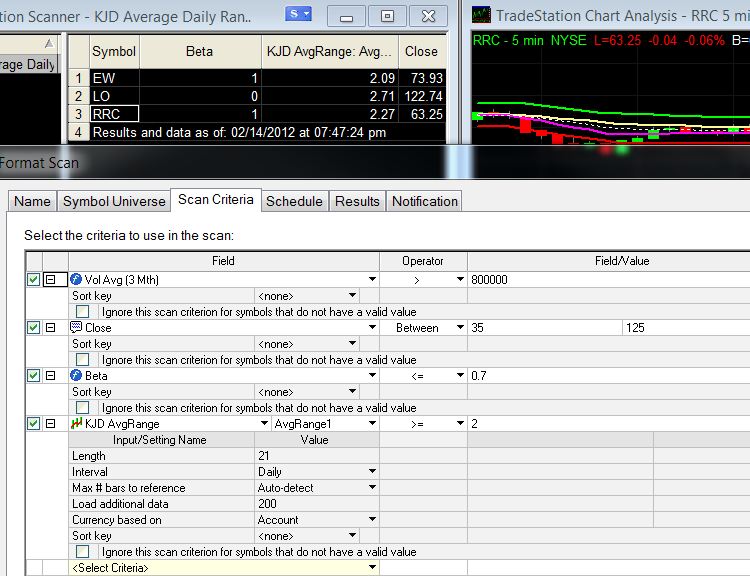

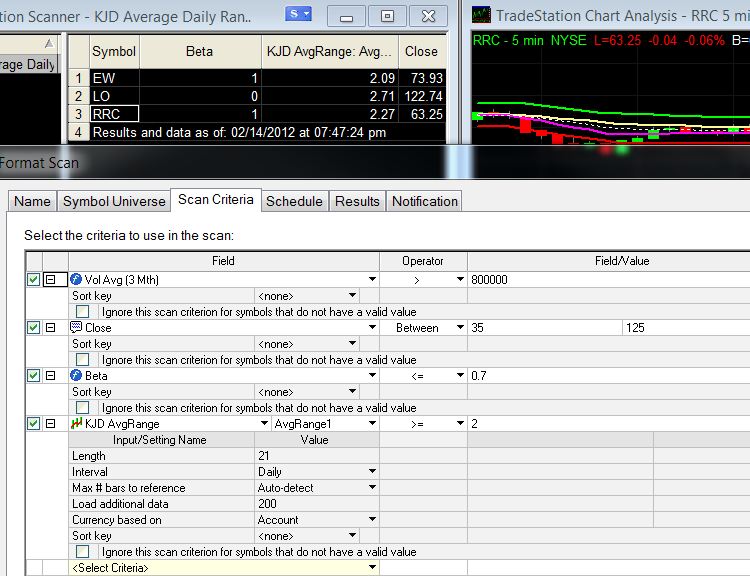

Split,

Don't know anything about the yahoo Beta.

I changed my scan to 3 months Avg Vol and found ALXN, ASEI, EW, GOLD, LO, MNST, NFLX, PRGO, RGLD, & RRC.

Here's the innards:

Attachment:DATA/20120214155419JW Screen 155.jpg 52460 bytes

|

|

|

|

Posted - 02/14/2012 16:05:38 Posted - 02/14/2012 16:05:38   |

Here is a scan from outside TS using StockFetcher. It returned the following this AM.

Attachment:DATA/20120214155430Scan.JPG 236411 bytes

Tachyonv,

many thanks for your sharing a quality setup, i'm pretty green so this

is a real "gift" from someone with your knowledge and experience. I'll

let you know how i do.

On the health front, wish you all the best. Father's been through similar, just turned 80, going strong! |

|

|

|

|

|

|

Posted - 02/14/2012 18:44:02 Posted - 02/14/2012 18:44:02   |

quote:

Originally posted by kevinkdog

I just ran it at 4:45 PM ET, and got 3: EW, LO, RRC

Can someone confirm?

Are u talking about a Scanner scan or a RadarScreen Tradeable Symbols run?

ant___ |

|

|

|

Posted - 02/14/2012 18:51:28 Posted - 02/14/2012 18:51:28   |

Scanner scan. Is that the wrong thing to run? What would the difference be?

Sorry for the ignorance on my part. Believe it or not, in 6 years I've never done either of these things until now! |

|

|

|

Posted - 02/14/2012 19:03:32 Posted - 02/14/2012 19:03:32   |

quote:

Originally posted by kevinkdog

Scanner scan. Is that the wrong thing to run? What would the difference be?

Sorry for the ignorance on my part. Believe it or not, in 6 years I've never done either of these things until now!

I've run Scanner scans aplenty; but never ran the RadarScreens...am not sure of diff either.

Pleading same ignorance. |

|

|

|

Posted - 02/14/2012 19:28:13 Posted - 02/14/2012 19:28:13   |

quote:

Originally posted by kevinkdog

I just ran it at 4:45 PM ET, and got 3: EW, LO, RRC

Can someone confirm?

Kevin, my end of day run returned the following: OPEN, NFLX, LNKD, ALXN, RRC, TQQQ, LO & V

Hope that helps.

|

|

|

|

Posted - 02/14/2012 19:50:25 Posted - 02/14/2012 19:50:25   |

quote:

Originally posted by Tripk

quote:

Originally posted by kevinkdog

I just ran it at 4:45 PM ET, and got 3: EW, LO, RRC

Can someone confirm?

Kevin, my end of day run returned the following: OPEN, NFLX, LNKD, ALXN, RRC, TQQQ, LO & V

Hope that helps.

Thanks

Trip. Maybe a screen shot of how you're getting that will help me.

Here is mine. It runs it on 7937 stocks, and ends up with 3. My

averagerange calc is the 21 day average of the high-low.

|

|

|

|

|

|

|

Posted - 02/14/2012 22:14:26 Posted - 02/14/2012 22:14:26   |

quote:

Originally posted by kevinkdog

quote:

Originally posted by Tripk

quote:

Originally posted by kevinkdog

I just ran it at 4:45 PM ET, and got 3: EW, LO, RRC

Can someone confirm?

Kevin, my end of day run returned the following: OPEN, NFLX, LNKD, ALXN, RRC, TQQQ, LO & V

Hope that helps.

Thanks

Trip. Maybe a screen shot of how you're getting that will help me.

Here is mine. It runs it on 7937 stocks, and ends up with 3. My

averagerange calc is the 21 day average of the high-low.

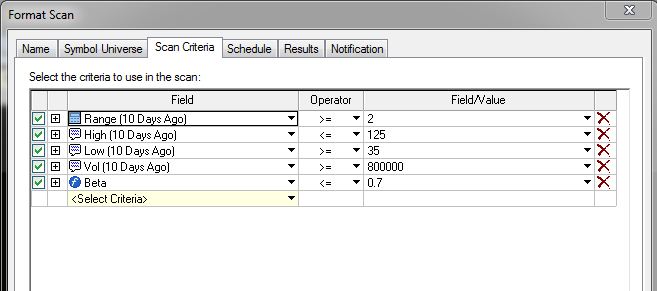

Kevin,

i'm not using the TS scanner but my inputs are the same with the

exception of Range, i'm using the 21dayavg + 34dayavg /2, i think that's

the difference. I tried to duplicate your TS settings but not having

the range indicator you use left me with no real range other than ATR.

see attached. I also filter out AMEX for ETF's.

Attachment:DATA/20120214220456Scan.JPG 215828 bytes

|

|

|

|

Posted - 02/15/2012 07:33:34 Posted - 02/15/2012 07:33:34   |

My

scanner produced 8 symbols although I am not able to get the exact

parameters, they would seem to be in the ball park. I have loaded them

all on a five minute chart with the indicators provided. Here is the

chart for LO on which I have circled a couple of low breakouts on the

Keltner channel. I've also added some dots to locate the time window.

Are these the type of entries you're looking for? Do you ever get in on

the opening bar? I was also wondering about putting them in different

desktops as opposed to workspaces. Is that so you can put them on

different monitors?

|

|

|

|

|

|

|

Posted - 02/15/2012 07:44:06 Posted - 02/15/2012 07:44:06   |

quote:

Originally posted by kevinkdog

Can you show a screenshot how you got 8? I only have 3, so I must be doing something wrong!

|

|

|

|

Posted - 02/15/2012 07:49:28 Posted - 02/15/2012 07:49:28   |

Thanks

Tom. I understand now. We have Beta calc the same, all others a

little different. Like "vol" for example. I'm using "vol avg (10 day)"

and you are using "vol (10 days ago)"

It looks like we are doing things the same, just with different criteria. I thought I may just have been doing it all wrong.

I appreciate it! |

|

|

|

Posted - 02/15/2012 07:58:43 Posted - 02/15/2012 07:58:43   |

quote:

Originally posted by kevinkdog

Thanks

Tom. I understand now. We have Beta calc the same, all others a

little different. Like "vol" for example. I'm using "vol avg (10 day)"

and you are using "vol (10 days ago)"

It looks like we are doing things the same, just with different criteria. I thought I may just have been doing it all wrong.

I appreciate it!

My

lack of familiarity with the scanner caused me to make some incorrect

settings, such as the volume one, but as I said, they are probably in

the ball park. I don't even have the RadarScreen. |

|

|

|

Posted - 02/15/2012 08:03:33 Posted - 02/15/2012 08:03:33   |

Tom -

It is fun to watch futures guys like me flounder and flop around in the stock world. Now I remember how the newbs feel! |

|

|

|

Posted - 02/15/2012 10:59:55 Posted - 02/15/2012 10:59:55   |

EDITED:

Before starting this day, I had the wrong idea of the method's normal

trading times and though that an open very shortly after open was

normal; so, do not read the following seriously. See tachyonv's replies

later in thread regarding entry times.

ant___

Trade experience 2/15/12 0930 - 1030.

Had scanned & found ALXN, EW, GOLD, LO, MNST, NFLX, PRGO, RGLD & RRC beforehand.

Typed those into RadarScreen that had tachyonv's Tradeable Symbols indicator running.

RadarScreen quickly showed that GOLD and RGLD were REJECTED; all the rest showed TRADEABLE.

ALXN:

Yesterday in Downtrend (I look at the Keltner Bands for the day and

gauge whether the day was up/down/neutral). Did not see good buying

price till 0955, but since in Downtrend, did not trade. Even at 1042

upmoves seeming sluggish....maybe should have but technicals were not

there.

EW: Yesterday in neutral to Downtrend. Did not see good

buying price till possibly 1010, but I wanted a lower price so did not

trade. After 1010 to 1030 price gradually moved up, but at 1046 am still

glad didn't trade.

LO: Yesterday was in neutral. Open was

strongly up and did not see any price in buying territory. At 1047

price is up well into tachyonv profit range/

MNST: Yesterday

was in neutral to slightly up, especially at Closing. Price today was

not in buying territory until about 1020, but was not low enough for me.

NFLX: Yesterday was up then neutral. Price today quickly rose

too high to enter, then next bar dropped into buying territory. I didn't

trade at that point due to neutral volume and %R was not low enough.

There was a profit to be had here, but technicals didn't support a Long.

PRGO: Yesterday was neutral. Price today quickly rose too high

to enter, then about 1000 dipped into buying range; volume did not

support a Long, and %R was almost low enough.

RRC: Yesterday

was neutral, until closing upward. Today strong up Open and price

didn't reach buying territory till possibly 1025, but that was not low

enough for me.

All in all - a No Trade day for me using tachyonv's very helpful method....not trading is good on days like this.

Edited: Have adjusted my Keltner Bandwidth...should have taken the NFLX trade.

Thanks tachyonv, for the method!

ant___ |

|

|