|

|

Posted - 03/21/2012 13:10:14 Posted - 03/21/2012 13:10:14   |

| Hello,

just to say thank you, i had jumped one step: Select those symbols

having $2.00 or greater recent APR. I found now just 5 symbols. Just

will keep triying, i like the system, thanks Tachyonv for sharing it. |

|

|

|

Posted - 03/21/2012 13:22:53 Posted - 03/21/2012 13:22:53   |

quote:

Originally posted by theHook

I agree -- but I don't have RadarScreen so my post have been removed.

RadarScreen is FREE with the minimum trades per month 5,000 shares (2,500 in and 2,500 out) or 10 roundturns per month.

TradingDude

|

|

|

|

Posted - 03/21/2012 14:16:31 Posted - 03/21/2012 14:16:31   |

quote:

Originally posted by TradingDude

quote:

Originally posted by theHook

I agree -- but I don't have RadarScreen so my post have been removed.

RadarScreen is FREE with the minimum trades per month 5,000 shares (2,500 in and 2,500 out) or 10 roundturns per month.

TradingDude

I use TS but trade somewhere else! |

|

|

|

Posted - 03/21/2012 14:24:22 Posted - 03/21/2012 14:24:22   |

quote:

Originally posted by theHook

quote:

Originally posted by TradingDude

quote:

Originally posted by theHook

I agree -- but I don't have RadarScreen so my post have been removed.

RadarScreen is FREE with the minimum trades per month 5,000 shares (2,500 in and 2,500 out) or 10 roundturns per month.

TradingDude

I use TS but trade somewhere else!

For general information:

Me too, but trade enough to cover Platform and Radarscreen

fees/costs...Subscriber Platform Fee plus Exchange Fees gets real

expensive...

Tradestation Subscription: $249.95 / month

Limited to simulated trading

Brokerage $99/month PLatform Fee

Otherwise, looking at over $400 per month...$5,000 plus per year...

Trade YM or NQ for 1 or a 2 tick profit...covers commisions, $100 Platform Fee plus $59 RadarScreen...

1 tick in ES, even the micro Euro (M6EM12) for $1.25 per tick can be traded to cover costs without any significant $$$ risk...

makes economic sense for me.... |

|

|

|

|

|

|

Posted - 03/22/2012 12:58:23 Posted - 03/22/2012 12:58:23   |

Not so good today.

Only

been trading NFLX recently but thought I should try some other symbols

for practice and diversification. Only traded small size as still

practicing.

WPI - .17

GMCR +.08 Got to +.30 so trailed a stop.

NFLX

+.03 Took 3 entrys, first 2 small loss then 3rd went to +.52 target

(this is outside the method mentioned by tachyonv as should only be 1

trade per symbol per day but been doing quite well on NFLX, untill

today)

BIIB -.47 (.17 slippage on stop order) Wish TS had stoplimit

orders in charttrader, would have got filled at stop as price

emmediatley bounced back to stop position.

Been good practice though with multiple positions.

Of course the 2 entry's after my exits went to target on NFLX and GMCR |

|

|

|

|

|

|

|

|

|

Posted - 03/22/2012 13:31:25 Posted - 03/22/2012 13:31:25   |

fair point tachyonv, looking back through the post seems you have mentioned this before.

typical I should try trading multiple symbols on a bad day.

Will put it on my no trade days list. |

|

|

|

Posted - 03/22/2012 13:51:16 Posted - 03/22/2012 13:51:16   |

quote:

Originally posted by quark

split

what times did you enter/exit?....which time zone

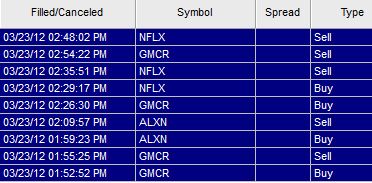

quark Here you go...

trades are in GMT so take off 4hrs for exchange trade time (EDT) I think

|

|

|

|

Posted - 03/22/2012 14:08:15 Posted - 03/22/2012 14:08:15   |

split we went EDT Mar 11 and you change this weekend on the 25th

Currently GMT:18:07

EDT:14:07

Frankfurt :19:07 |

|

|

|

Posted - 03/22/2012 14:38:14 Posted - 03/22/2012 14:38:14   |

Hello

Tachyonv, today i tried GMCR at 0955 East time at $55.12. Things didn't

go well. For the future, i won't entry in a down day, may take the Dow

down more than 50 points to not entry, as part of this system.

But i

put an Stop Loss, $1 dollar down. So, the SL still doesn't touched

(very close to) but i could go out at the breakeven 1230, and i didn't

thinking that on this recover things could go in my favor. After, if i

have to go out at 0130, the price is so close the SL that i let it run,

but SL didn't touched and i'm still taking a round on the same trade.

The

question, how you take the decision to go out in this case? And other

thing: the green dot on your KCAll indicator is the better signal to

entry according this indicator (of course without looking the %R)? Thank

you. (English is not my language, sorry if you find some mystakes). |

|

|

|

Posted - 03/22/2012 14:49:56 Posted - 03/22/2012 14:49:56   |

| yitana

I do not pay any attention to the green dots on the KC All indicator. I

would not have entered today (and did not enter today), so would not

have the decision to make, regarding when to exit. |

|

|

|

Posted - 03/23/2012 11:26:27 Posted - 03/23/2012 11:26:27   |

quark, if your interested

A bit better today.

GMCR +.12 Stop too tight

ALXN -.31

NFLX +76 Stop too tight on 2nd half

|

|

|

|

Posted - 03/23/2012 11:43:15 Posted - 03/23/2012 11:43:15   |

split

may

I make a suggestion...set your trading computer to either Central

Daylight (Texas...tachyonv's zone) or Eastern Daylight (New York City

time). Review your trades and tachyonv's suggestions. Both GMCR and

ALXN were winning trades if you waited a little longer before entering,

if I am not mistaken. Review intraday cycles as well. Time and cycles

can get confusing at times. |

|

|

|

Posted - 03/23/2012 15:31:09 Posted - 03/23/2012 15:31:09   |

| I

m following this method since one week, i found it very interesting and

profitable (after triying and triying with automated strategies that

seems to works for a period or on the backtesting but make me broke my

head with EL to not reach the goal)...QUESTION: i just want to ask if

somebody develope a good money management (rules) for exits with Stop

loss, or the decidion is totally personal, going out -0.50 or -0.25 if

the trade dosn't go in the way we expect. |

|

|

|

Posted - 03/23/2012 17:11:43 Posted - 03/23/2012 17:11:43   |

yitana

Please

read tachyonv rules on the first pages. He developed this

strategy...read and study his rules...I believe the key to this strategy

being 85-90+% correct depends upon the correct entry time.

Remember this is a discretionary approach to the market...non-automated.

I

believe you can keep the stoploss < 1.00 IF you enter correctly,

understand the strategy/indicators and ???????exit (based on the

indicators) if the trade turns against you before the stoploss of 1.00

is hit. Please clarify the last idea (early exit)with tachyonv before

taking my word...that's simply what I do...sometimes I reverse my

position....Note, this is very important, tachyonv NEVER spoke about

reversing his position.

I am giving some advice/suggestions

since I am a discretionary trader and do not use automated strategies.

Remember I trade futures and not equities so do not take my word as the

"truth". I am responding since tachyonv said he is occupied with other

things and may not be on the forum some times.

just a question...it your name yitana or gitana

http://www.youtube.com/watch?v=QL8-8badzks

|

|

|

|

Posted - 03/23/2012 18:03:52 Posted - 03/23/2012 18:03:52   |

quark

I

agree that the key to this system is entering at the 'correct time' but

also entering on a limit order, the slippage can be quite severe if

using stop entrys.

With NFLX there can be 2-4 opportunities in

the first 2hrs so you have a resonable chance to get one but on other

symbols I have watched and done some basic testing, there is maybe only 1

chance and the 'correct entry' time seems to be a changing target. I

can see that generally the best entry is between the times mentioned on

the first page of this post but along the way there might be a couple

of false entry points.As you have mentioned in the cycles post,

understanding cycles can help to avoid losing trades.

Thing is, I have no idea of which cycle the market is in.

I'm sure it will click soon

|

|

|

|

Posted - 03/23/2012 18:24:28 Posted - 03/23/2012 18:24:28   |

split

study

the excel speadsheet that tachyonv posted...it is very reasonable. Ask

yourself "why"....when you have the answer you will see when you can

enter early...when you should hold off and wait. I doubt tachyonv, will

give you the "whys"...read his posts carefully over this weekend.

Hint: I bet next week will be better for you...cycles shift. |

|

|

|

Posted - 03/23/2012 18:42:35 Posted - 03/23/2012 18:42:35   |

quark,

I

have to admit, I have never investigated WHY? the times are important.

Read the xls many times but probably been thinking about it the wrong

way by trying to backtest the next best entry I can think of based on

the times.

Will give it some more reading and thought.

cheers |

|

|

|

Posted - 03/23/2012 18:48:52 Posted - 03/23/2012 18:48:52   |

split

Hint: note when tachyonv first posted the excel file (what year)....how were the markets then...how are the markets in 2012.

again

this is discretionary scalping....I don't care what the optimization

was in 1987 or 1992 or whatever...I am a scalper I only care about how

is the market today / or how was the market the last x number of days

ago.

split hope you and your family have a peaceful and relaxing weekend

quark |

|

|

|

|

|

|

Posted - 03/23/2012 23:32:51 Posted - 03/23/2012 23:32:51   |

Quark,

Thank

you for anwer me. I have read the rules of Tachyonv, but since english

is not my languages maybe my understanding is about 80%.Some words or

states scape of my knowdlegde even if i search on a dictionary. Anyway i

think i understood most of the rules, and i m not having problems with

the entries but yesterday (march22) i entried on GMCR and things didnt

go in my favor and i have felt skirt because the SL of $1 compared with a

target of 0.50; first i have to said that i should avoid entry on very

down days, also i can take the idea from The Hook about the price should

attack the KC and not the KC come to the price. But i was looking on

this post that most of the traders posting the trades, cut the bad

trades before the $1 that propose Tach.Other way it cost 2 good trades

to recover 1 bad trade. Of course Tachy talk about an SL of $1 or about

going out at 1.30 exchange time. But if someone have other reason to cut

the trade to not have a 2-1 risk -reward i would prefere. When the

price turn back it always make a pivot, i was thinking maybe to can cut

the trade if the price goes down of this pivot floor. Any suggestions

are welcome!

About my name is Yitana, i m also a singer like shakira, and have my own web site, but just for hobby!!! |

|

|

|

Posted - 03/25/2012 22:02:39 Posted - 03/25/2012 22:02:39   |

quote:

Originally posted by yitana

Quark,

Thank

you for anwer me. I have read the rules of Tachyonv, but since english

is not my languages maybe my understanding is about 80%.Some words or

states scape of my knowdlegde even if i search on a dictionary. Anyway i

think i understood most of the rules, and i m not having problems with

the entries but yesterday (march22) i entried on GMCR and things didnt

go in my favor and i have felt skirt because the SL of $1 compared with a

target of 0.50; first i have to said that i should avoid entry on very

down days, also i can take the idea from The Hook about the price should

attack the KC and not the KC come to the price. But i was looking on

this post that most of the traders posting the trades, cut the bad

trades before the $1 that propose Tach.Other way it cost 2 good trades

to recover 1 bad trade. Of course Tachy talk about an SL of $1 or about

going out at 1.30 exchange time. But if someone have other reason to cut

the trade to not have a 2-1 risk -reward i would prefere. When the

price turn back it always make a pivot, i was thinking maybe to can cut

the trade if the price goes down of this pivot floor. Any suggestions

are welcome!

About my name is Yitana, i m also a singer like shakira, and have my own web site, but just for hobby!!!

Pretty good. "Eres mi alma". |

|

|

|

|