|

|

Posted - 08/16/2005 05:59:35 Posted - 08/16/2005 05:59:35   |

| Thanks,

tachyonv, for this great indicator! I´ve incorporated it into my tools

for past few months now and very happy with it. Thanks for the great

contribution for this and other thoughts, ideas, tips, point of views,

among others. |

|

|

|

Posted - 11/08/2005 11:51:59 Posted - 11/08/2005 11:51:59   |

Thank's Mr tachyonv for your nice work. I like KC very much.

Is it possible (with you parameters) to reset the channel (on ID chart) at the start of each new day ? |

|

|

|

Posted - 11/23/2005 07:54:39 Posted - 11/23/2005 07:54:39   |

Tachyonv,

Sorry

for the delay of my answer. I were anxious to study all your

documentation before, then make trading for a few day with Keltner

Channel incorporated into my tools. Great indicator ! It is a great

completion at my actual tooling. I use it like if I had worked since

always with it. I make trading through the scalping. With the addition

of the Keltner Channel I have gained much more safety !

Thank

you very much for your documentation on Keltner Channels. I have not

never met before someone that had provided me a documentation so very

educational and unheard of. Thank you very much again, Tachyonv, for

your generous contribution.

var finance |

|

|

|

Posted - 11/23/2005 11:05:48 Posted - 11/23/2005 11:05:48   |

quote:

Originally posted by tachyonv

Today I updated the KC All indicator to add a fast and a slow moving average.

Now the indicator can (optionally) display either a fast and/or moving average in addition to the Keltner Channels.

This

is an example of how what were once multiple indicators, can be

combined into a single indicator, because of the additional plot

statements provided by TS 8.1.

The primary advantage is to

ensure that these are in synch, for situations where they are combined

for generating signals. I have not combined these in this indicator to

create signals, although I commonly do this in my proprietary

indicators. Of course, you are most welcome to do this if you wish.

A

secondary advantage is that supposedly by having fewer indicators,

there is a performance advantage. I am not so sure about this.

TS

8.1 still does not provide for the means to display (plot and text) in

multiple panes from a single indicator. There is an enhancement request

to provide this capability at https://community.tradestation.com/Discussions/Topic.aspx?Result=1&Topic_ID=36565 . What this would permit doing,

is combining %R and Volume Average Exp and this indicator into a single

indicator for display purposes in three different panes (and with three

different vertical scales).

Currently,

indicators which display on different scales in different panes must

remain separate indicators because of the TS plot and text display

limitations.

This causes redundancy when the multiple

indicators are incorporated into a single indicator for the purpose of

creating signals, but must also be individually duplicated in order to

display in their separate scales and panes.

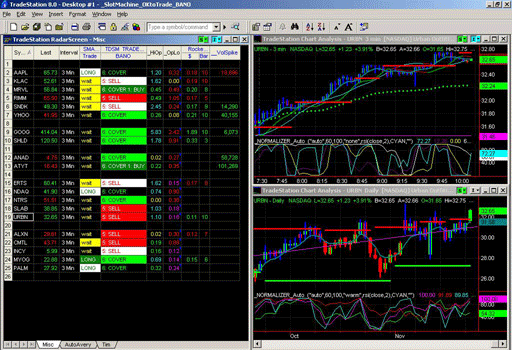

I

wrote THE NORMALIZER.. this allows you to plot indicators indicators

that have different scales in the same window. The 8.1 version allows

up to 8 different indicators. 8.0 version limited to 4 indicators.

Click to enlarge.

In

the top right chart, the yellow line is MACD, the blue line is RSI, the

darkmagenta line is Detrend and the white line is EMA(5). The values

for each indicator are normalized to a scale from 0 - 100 and plotted in

the same window.

In the bottom right chart, the red line is

accumalation/distribution, the blue line is rsi, the magenta line is %r

and the green line is momentum.

The number of periods to normalize over can either be automatically calculated or user specified.

You can find the ELD for THE NORMALIZER here:

Attachment:DATA/20051024203556NORMALIZER.ELD 4350 bytes

MAY ALL YOUR FILLS BE COMPLETE.

Over

and over again, in this newsletter or in any of our products I keep

saying "make your goals smaller", "take one step at a time", "make

$1,000 before you try to make $10,000", "you need to grow a little bit

each day, "you don't have to get it right, you just have to get it

going"... Mike Litman

|

|

|

|

Posted - 01/06/2006 23:30:25 Posted - 01/06/2006 23:30:25   |

Tach,

Thank

you very much for your generosity in making this indicator freely

available and including such thorough documentation. Your insights on KC

have really opened my eyes on possible ways to use them. It is rare

that somebody is so willing to help others find their way. Thanks! |

|

|

|

Posted - 02/02/2006 21:45:49 Posted - 02/02/2006 21:45:49   |

Nice work on the indicator, Tachyonv!!

I especially like the commentary box.

Looks like I'll be studying your code for tricks.

Thanks for sharing.

I appreciate your efforts.

MAY ALL YOUR FILLS BE COMPLETE.

|

|

|

|

Posted - 02/06/2006 00:41:44 Posted - 02/06/2006 00:41:44   |

"The

plot code changes introduced to this indicator an undesirable display

of extra columns in RadarScreen, because TS has still not provided the

EasyLanguage capability to control suppressing unneeded chart plots in

RS tables. I'll fix this when TS fixes EL to provide this needed

capability."

In my code (still 8.0), I have been using an input iPlotType, where "C" for charts and "R" for radar.

This allows me, the programmer, to control what is displayed and when it is displayed.

So with your indicator, I would bracket the unwanted radar plots with

If iPlotType = "C"

then begin

Plot... ; // plot on chart only

Plot... ; // plot on chart only

end;

Of course, in 8.1 you can detect if the indicator is being called from chart or radar.

HTH. |

|

|

|

Posted - 02/06/2006 11:48:41 Posted - 02/06/2006 11:48:41   |

quote:

Originally posted by tachyonv

For

those herein who wish to be sent a copy of my "Trading with Keltner

Channels" presentation from the October 2004 TradeStation World

Conference, please private message me with your email address, real

name, city and state (or city and country if not USA). Latter info is

so that I can track to whom I've given the copy righted presentation.

The

file size as a transmitted attachment is about 6 mb, which most of the

free email services will not accept, therefore please be sure that your

email provider will accept an attachment of this size.

That size also makes it too large to post here.

Like

all presentations, the greater value is in the verbal portion. If I

happen to present this in your city someday, it may be helpful to hear

that portion.

|

|

|

|

|

|

|

Posted - 02/06/2006 23:29:10 Posted - 02/06/2006 23:29:10   |

KC_All Ver.4.3 Build 23 02/05/2006 has raised questions in RS.

MY Current Settings:

Daily Interval is used.

KC_Alert is True.

UpDate IntraBar is ON.

Problems Encountered:

Unable to Disable the Commentary.

During the Trading Day the $Predict Column only indicates the"Caution" condition.

The "Bullish" and "Bearish" conditions are not indicated until immediately after the close.

The VolPred Value of the Volume Average Exp Indicator updates correctly during the trading day.

Do You have a workaround for these conditions?

Thank You,

Radar |

|

|

|

|

|

|

Posted - 02/07/2006 13:29:53 Posted - 02/07/2006 13:29:53   |

Many

many thanks to Tachynov for sharing your Keltner Channels presentation

at the 2004 TradeStation Conference. The indicators, stategy and

explanations are excellent.

I have been trading for 5 years and

have been stuck to the old style of MACD and Stochastic. I am very

grateful to be able to learn a new trading system. I have searched and

read all your postings with great joy. Again, thank you so much for

sharing and your willingness to go an extra step to help. |

|

|

|

|

|

|

Posted - 05/06/2006 14:52:06 Posted - 05/06/2006 14:52:06   |

THANK YOU TACHYONV!

Started

using the Keltner Channel All Indicator, Williams %R and the Volume

Average Exponential Indicator....setting up the work space as you

suggested. I would like to say that I have been getting great results in

the short time I have been using these indicators. Combined with a few

other things, my trade profitability has increased to 75% which is

amazing. Entries are great, all I need to do now is improve my exit

strategies as I have been taking profits too early. My sincere

appreciation for your generosity and willingness to share and teach

those of us who are less experienced and less knowledgeable. |

|

|

|

Posted - 06/02/2006 14:15:29 Posted - 06/02/2006 14:15:29   |

Greetings Tachyonv or other helpful coders,

Can

someone help me as I'm new to TS and EL so I'm sorry for my lack of

coding skills. This request may be of help to others as well. I use

the KC range (diff between UKC and LKC) as a profit target and stop loss

indicator and would like to display this value on my charts. Would it

be too much to ask if an input (true/false) could be added that would

place the UKC/LKC delta text in the space to the right near the

top/bottom (inputs ?) of the current bar KC? Or anywhere that is easy

to view the range of the KC's. I know this will help me and I hope it

will help others as well.

Thanks for all the help and best regards,

Sky |

|

|

|

Posted - 06/30/2006 13:42:16 Posted - 06/30/2006 13:42:16   |

quote:

BTW, TradeStation EL classes are great. (Now if TS would only provide the advanced class here in Dallas area .)

TradeStation

Education should be able to provide all these courses on-line,over

weekends or over periods of evenings and weekends as to not miss out on

trading. Many organizations do.

Cost to participants should be a lot less.

TradingDude

|

|

|

|

Posted - 07/02/2006 01:26:44 Posted - 07/02/2006 01:26:44   |

| ...roger

that...BTW, what every happened to eKam....and the "where is eKam?"

post....did it get whacked?....never did find out what happened to ekam,

:0{ ... I hope all is well. Later...Sky |

|

|

|

Posted - 12/16/2006 12:14:57 Posted - 12/16/2006 12:14:57   |

Good Morning jdk !

I

am reading and studying your scalping strategy posted from you the

04/23/2005-18:15:47. I already downloaded your indicators posted into

ELD files. I work on the e-mini ES.D with Tick charts. Now I am

preparing the charts with the same time frames that you utilize.

Unfortunately my experience with TS is still young and I never utilized

before a chart of 30 minutes, so it, on the "time axis labels", don't

appear subdivided like your chart of 30Min.

I send you per attachment my 30M. ES.D chart and like that you will be able to understand what's my problem. Attachment:DATA/20061216115933ES.D - 30 Min.jpg 135681 bytes

Please

jdk, can you suggest me what I have to do so that I can get a chart of

30M. with the same time axis labels like yours. Thanks in advance,

steel |

|

|

|

Posted - 12/16/2006 12:30:33 Posted - 12/16/2006 12:30:33   |

steel,

that 30 minute chart is on the ER2 (mini Russell). The time axis will

be different from the ES. Perhaps I don't understand your question. If

you can clarify, maybe I can help.

jdk |

|

|

|

Posted - 12/17/2006 08:07:46 Posted - 12/17/2006 08:07:46   |

quote:

Originally posted by jdk

steel,

that 30 minute chart is on the ER2 (mini Russell). The time axis will

be different from the ES. Perhaps I don't understand your question. If

you can clarify, maybe I can help.

jdk

Hi jdk,

thank you very much for your prompt kind reply.

Yes, I seen that your 30 minute chart was on the ER2. What I mean is the following :

the

behaviour of indicators (MACD-CCIsmoothed-KeltnerSqueeze) on your 30

minute chart, is visible with a interval, on the time axis, of h.1.30 :

at the h.2 - 3.30 - 5 - 6.30...an so on, in a daily trading. My chart,

as you can see, shows, for a daily trading, only two intervals : at h.12

and h14(2pm). Why ?

On the other hand, also with a chart of 30

minute di ER2.D (look per attachment) I have only two intervals, the

same like ES.D. Why ?

Practically, my chart of 30 minute with ES.D or ER2.D

shows a space on the time axis for a daily trading much more restricted

than your chart. Consequently also the trend of the price and

indicators are seen in a much more restricted area. Attachment:DATA/20061217080011ER2.D and ES.D 30 Minute charts.jpg 149487 bytes

It's possible to get a 30 minute chart with time's interval on the time axis equal to your chart ?

Thanks for all the help and Best Regards,

steel

|

|

|

|

Posted - 12/17/2006 09:26:53 Posted - 12/17/2006 09:26:53   |

jdk,

sorry

but I have still a question : I can't find the indicator "Classic

Stochastic". In my TS8.1 build 3258, I have StochFast, StochSlow, Stoch

Coloured and StochRSI. Where can I find the Classic Stochastic ?

In

your 3minute chart, the Momentum indicator is applied like histogram ?

Sorry jdk if I am taking up to much your time, I thank you for your

patience and the help that you will give me.

Best regards,

steel |

|

|

|

Posted - 12/17/2006 10:36:28 Posted - 12/17/2006 10:36:28   |

steel,

the only thing I can think of is that you have the chart compressed.

Go to the top of the toolbar on the right, there are two icons with

arrows pointing in and out - you can increase or decrease bar spacing

with them. Try increasing the bars - this will expand the x axis.

Attached is the classic stochastic ELD. Attachment:DATA/20061217103621CLASSICSTOCH.ELD 17695 bytes

|

|

|

|

|

|

|

Posted - 07/15/2007 13:21:04 Posted - 07/15/2007 13:21:04   |

| Tachynov..would

like to pm you for a copy of your presentation on Keltner. HOw do I do

that? Or please send a copy.to me Thanks |

|

|

|

|