|

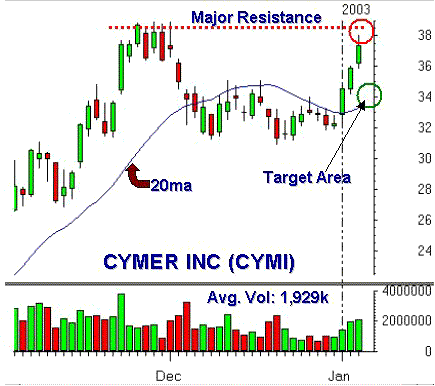

The Double Top Play - A Rally into

Resistance |

Trading Strategy:

The Double Top Play: A Rally

into Resistance. CYMI has rallied very

impressively over the past three days; however,

this rally has brought the stock into an area of

major price resistance. While another up day

could very well materialize, the prior high

formed in late November will serve as a

troublesome area for the stock.

chart courtesy of

Mastertrader.com

Tip: Prior highs

represent areas of pain for those who bought

near the high previously, only to see the stock

decline sharply before finally rebounding. The

battered traders who suffered through the long

wait in stock to get their money back are

extremely likely to sell now that the stock has

revisited their initial entry area. This is

partly why prior highs often serve as major

price resistance, which sets up the much talked

about double tops.

The Play:

Look to sell short once it trades below the low

established in its first 30-minutes of trading.

Once entered, place a stop $.25 above previous

day's high or above the day's high, whichever is

higher. Note: Keep in mind that a gap up at the

open will not necessarily invalidate this play.

A gap up will be viewed as a "last hurrah" move

to which you can apply 30-minute

sell rule. A gap down, unless it is too

excessive, will also only confirm expectation.

Objective:

A $2.50 plus move back toward the stock's

20-period moving average.

Play Review:

CYMI hit 30-min. low entry

and immediately reversed direction to trade back

above the day's high resulting in a $1.86 loss.

This has been the type of intra-day volatility

within the market at this time. |