|

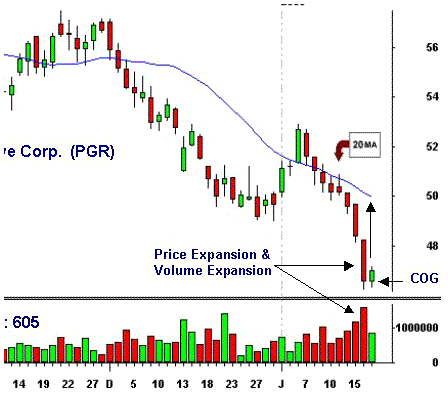

Trading Strategy:

Climatic Low. PGR fell a

distance from its 20-ma last week that suggests

it's likely ready for a tradable rebound. Then

the daily range expanded considerably wider than

the prior trading sessions and volume became

climatic. This also suggests a short-term

reversal is close. Next day was the day that now

tells us the turn is at hand as PGR closed above

its opening price for the first time in eight

trading sessions and held above the prior day's

low.

chart courtesy of

Mastertrader.com

Tip: Daily price range

expansion after a several bar decline suggest a

reversal is most likely close at hand. When its

pattern is accompanied by expanding volume it

increases that likelihood. This combination of

price and volume action suggests a capitulation

to the selling pressure and a tradable reversal

after a Change of Guards (COG).

The Play:

Buy once it trades above previous trading day's

high ($47.17). Once entered, stop will be placed

below the low made on previous day.

Objective:

A move of 1.50- 2.00 There is a small base of

resistance in the 48.50 area that can been seen

on the intra-day chart. A reaction there is

likely. The significant resistance area is

higher in the 49.50 area. Take it a step at a

time and monitor along the way. Entering is the

easy part. MEDIUM RISK

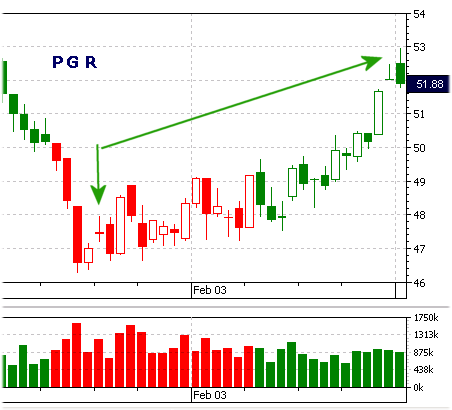

Play Review:

PGR went up almost $2.00

dollars from entry, the objective has been hit.

That said PGR looked like it can move higher if

the market does not fall apart.

|