|

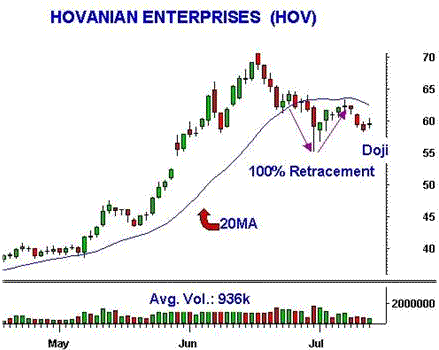

Buy Setup and Doji bar after 100%

Retracement |

Trading Strategy:

Buy Setup and Doji bar after 100% Retracement.

Although the daily chart of HOV is neutral,

there are a few things making for a good

reward-risk trade. After the stock collapsed in

late June, it made a 100% retracement of the

break down, which is bullish. Two days before it

was a Buy Setup, with yesterday being a neutral

doji bar. However, if this area holds, it will

be a higher pivot low from the June low.

Additionally, the sector showed relative

strength today, and the hourly chart of HOV is a

Buy Setup on the 20MA with above average volume.

New high is not seeked; however, there is not

much resistance until the $62 area on the hourly

chart.

chart courtesy of

Mastertrader.com

Tip: Buy Setups

following a 100% retracement of a prior break

down suggest a tradable bounce.

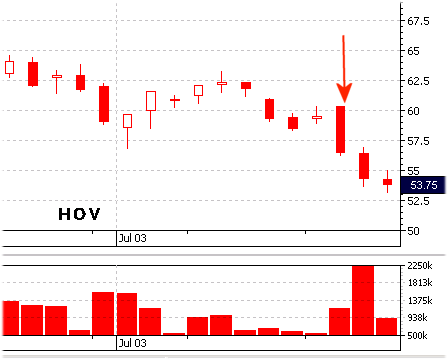

The Play:

Buy over the high made in the first 30-min of

trading, with a stop under the lower of the

30-min low or previous day's low.

Objective:

$1.00 to $2.25 move to the $62 area.

MEDIUM RISK

Play Review:

HOV did not meet the entry

criteria. |