|

Trading Strategy:

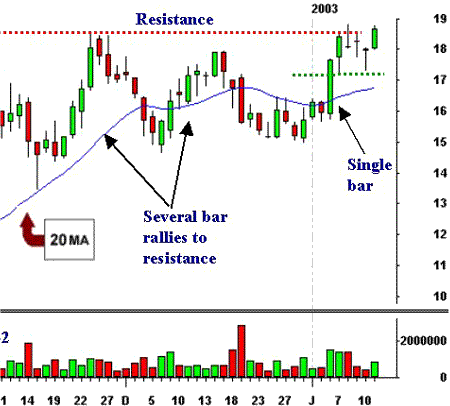

Breakout from a base. PALM is consolidating at

the top of its trading range over the last five

trading sessions and may be ready to break out

above this area. What we like about this pattern

is the fact that PALM moved to the top of the

range in one bar or trading session verses 4 to

5 as it did in the past. This shows strength and

a higher probability of continuation.

chart courtesy of

Mastertrader.com

Tip: Several bar rallies

into resistance verse a single bar has a higher

probability of experiencing profit taking. When

traders have been buying over several days they

often take profits more aggressively once that

issue nears its prior highs. A single bar that

moves into that area, as with the pattern in

PALM is ignites momentum typically continuing in

the direction of the wide range bar. PALM's

ability to stay in the upper 50% of that wide

range bar increases those odds.

The Play:

We will look to buy PALM once it trades above

18.80, which was last week's high. Once entered,

our stop will be placed .25 cents below the low

made on Friday at 17.08.

Objective:

Look for a move back toward the stock's $24 -

$25 area. This is the base area that PALM gapped

down from July 2002. If you refer to a weekly

chart you will see this clearly, as well as the

extensive base that has been built since the

August low.

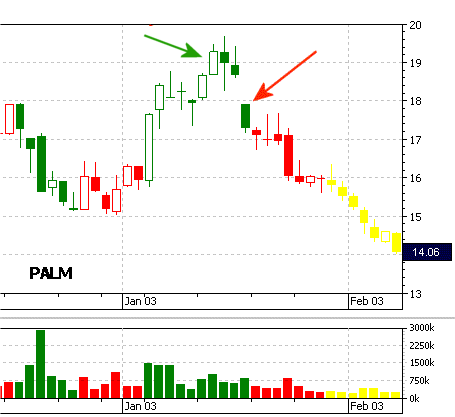

Play Review:

PALM fell hard three days

after entering with the overall market but the

stop was not hit at that time. Next day's

negative open caused that to happen. One option

was to only exit half the position as PALM was

nearing an area of support and could bounce from

there, and the weekly chart still looked

attractive, but in the end support did not held,

and price proceeded down. |