| |

|

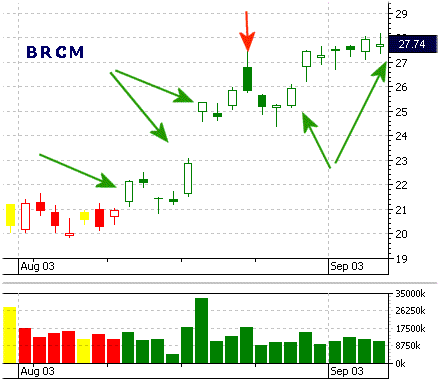

TRADING TACTICS - Swing Trading Stock Picks |

Swing Trading Stock Picks

Swing Trading Stock Picks identifies

profitable trading opportunities in stocks after their brief period of

consolidation or correction for a quick 5-25% move in 1-5 trading days.

Whether you are a first time investor, a seasoned pro, an "in and out"

day trader or a long term investor, Trading Picks will provide you with

the necessary information you need for maximum profits and success in

today's dynamic markets.

FREE Swing Trading Stock Picks

How to enter a Swing Trade

Do not enter your orders immediately

at the open. Wait for a few minutes for the market to settle

down before entering your orders.

Entry techniques:

| Technique

1: Long Swing Entry |

Technique

1: Short Swing Entry |

|

Buy the stock

from the moment it trades above its BUY ABOVE

trigger price. As soon as you buy, make sure to place a

stop-loss order. |

Sell the stock

short the moment it trades below its SELL BELOW

trigger price. Once you sell short, make sure to place

your stop loss order. |

| Technique

2: Long GAP Entry |

Technique

2: Short GAP Entry |

|

If the stock gaps up

above the trigger price, wait for 30 minutes and then

put a buy stop order above the high of the day.

|

If the stock gaps

down below the trigger price, wait for 30 minutes and

then put a sell stop order below the low of the day. |

How to exit a Swing Trade

Exit techniques and riding the

trend:

- Stop-Loss Order - place

your stop the moment you enter a trade. Exit your trade the

if the stop-loss gets triggered. After each day, simply move

your stop-order to under the low of that day for long

swings, and above the high of that day for short swings.

However.. never set the stop loss at a lower/higher price

than the day before.

- The 50 percent rule -

when you have a 7% gain on your swing trade, book

profits on 50% of your position.

- Riding the wave - ride

the rest of your trade using a trailing stop. After

each day, move your stop-order to the low of that day for

long swings and the high of that day for short swings.

- Gaps - be prepared to

sell your positions if the stock gaps UP for long swings and

to cover your short positions if the stock gaps DOWN for

short swing.

|

|