Momentum

Momentum measures the rate of change in closing prices and is used to detect

trend weakness and likely reversal points. It is often underrated because of its

simplicity.

High Momentum readings (positive or negative) occur when a trend is at its

strongest. Lower readings are found at the start and end of trends.

Overbought and oversold levels are set separately for each security, based on

the performance of the indicator over past cycles.

Trading Signals

Different Momentum signals are used for ranging markets and trending markets.

Ranging Markets

First, you will need to set overbought and oversold levels based on your

observation of past ranging markets. The levels should cut across at least

two-thirds of the peaks and troughs.

Go long when:

- Momentum crosses to below the oversold level and then rises back above it;

or

- On bullish divergences - where the first trough is below the oversold

level.

Go short when:

- Momentum crosses to above the overbought level and then falls back below

it.

- On a bearish divergence - with the first peak above the overbought level.

Trending Markets

First, identify the trend direction using Momentum or a

trend

indicator. Momentum tends to stay above zero during an up-trend and below

zero during a down-trend.

Only take signals in the direction of the trend.

-

Up-trend: go long if Momentum turns upwards when below zero.

-

Down-trend: go short if Momentum turns downward when above zero.

Exit using a trend indicator.

Trend lines are also drawn on the Momentum indicator. A break in the trend

line often occurs in advance of a similar break on the price chart.

Take profits on

divergences and trend line breaks.

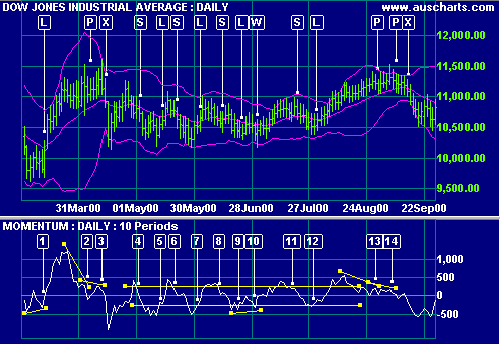

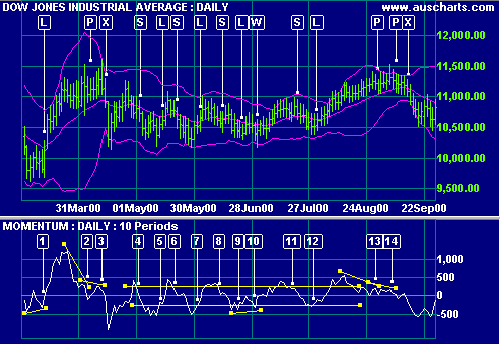

Example

Dow Jones Industrial Average with

10-day Momentum

indicator and

10-day Momentum

indicator and  Bollinger bands at 2.5 standard deviations around a 21-day

exponential moving average.

Bollinger bands at 2.5 standard deviations around a 21-day

exponential moving average.

- Go long [L] when the MA turns upwards after a bullish Momentum

divergence.

- Take profits [P] on a bearish divergence.

- Exit [X] when price closes below the MA.

- Price has started ranging, shown by the fluctuation of price around the MA

and Momentum around the zero line. Set overbought and oversold levels based on

observation of previous ranging markets. Go short [S] when Momentum turns back

below the overbought line.

- Go long [L] when Momentum crosses back above the oversold line.

- Go short [S] again when Momentum crosses back below the overbought line.

- Go long [L].

- Go short [S].

- Go long [L] when Momentum crosses back above the oversold line. The long

position is stopped out by a lower Low at [W].

- Go long again at [W] - the signal is supported by a bullish divergence.

- Go short [S].

- Go long [L]. Price then breaks out of the ranging market and stays above

the MA. Switch to trending signals.

- Take profits [P] on a bearish divergence.

- Take further profits [P] on a bearish triple divergence. Exit [X] the

trade when price closes below the MA.

Setup

The default indicator window is 12 days. To alter the default settings - see

Edit Indicator Settings.

See

Indicator Panel for directions on how to set up an indicator.

Related Topics

Closing Price / Previous Close

How to identify trends, control, commitment, uncertainty, inside and outside

days...

Rate Of Change (Price)

A refinement of Momentum - Rate of Change is designed to fluctuate as a

percentage around the zero line...

Momentum Construction

First, select the indicator period. Then, calculate Closing Price [today] -

Closing Price [n days ago]...

External Links

Technical Charting Archives : January 14, 2000

Momentum - Part 1 What it is and what it can do for you.

Technical Charting Archives : January 21, 2000

Momentum - Part 2 Overbought and oversold, divergences

Technical Charting Archives : January 28, 2000

Momentum - Part 3 Momentum Patterns and using moving averages on momentum

indicators

Technical Charting Archives : December 10,1999

Momentum and the Momentum Indicator. Measure Twice-Cut Once

Momentum & Rate of Change

Momentum -- Chart School

Learn the How, the What, and the Where of technical analysis and stock

charting.

Momentum -

Technical Analysis from A to Z

Momentum - Steve Achelis' best-selling book, Technical Analysis from A to Z

![]() 10-day Momentum

indicator and

10-day Momentum

indicator and ![]() Bollinger bands at 2.5 standard deviations around a 21-day

exponential moving average.

Bollinger bands at 2.5 standard deviations around a 21-day

exponential moving average.