MACD: Moving Average Convergence Divergence

The MACD is basically a refinement of the

two moving averages system and measures the distance between the two moving

average lines. Signals are taken when MACD crosses its signal line, calculated

as a 9 day

exponential moving average of MACD.

The indicator is primarily used to trade trends and should not be used in a

ranging market.

MACD was developed by Gerald Appel and is discussed in his book, The

Moving Average Convergence Divergence Trading Method. For further details,

see

MACD Construction.

Trading Signals

First check whether price is trending. If MACD is flat or stays close to the

zero line, the market is ranging and signals are unreliable.

Trending Market

-

Go

long

when the MACD line crosses the signal line from below.

-

Go

short when the MACD line crosses the signal line from above.

Signals are far stronger if there is either:

- a

divergence on the MACD line; or

- a large swing above or below the zero line.

Unless there is a divergence, do not go long if the signal is above the zero

line, nor go short if the signal is below zero.

Place

stop-losses below the last minor Low when long, or the last minor High when

short.

Example

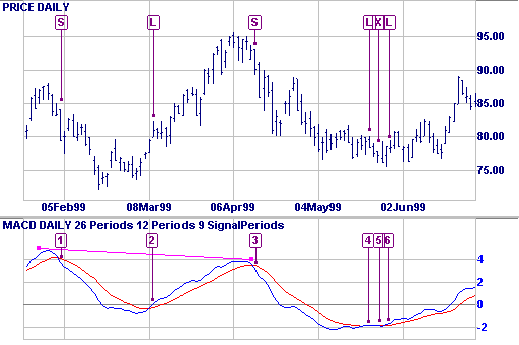

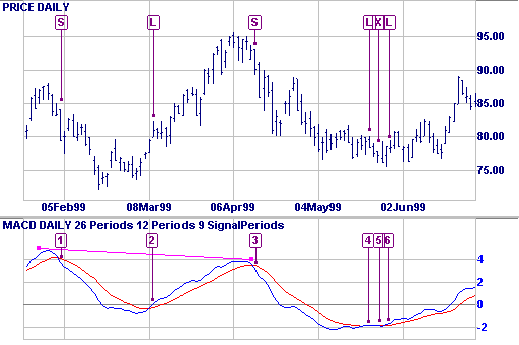

Microsoft Corporation chart with:

MACD, and

MACD, and  MACD signal line.

MACD signal line.

- Go short [S] - MACD crosses to below the signal line after a large swing.

- Go long [L] when MACD crosses to above the signal line.

- Strong short signal [S] - the MACD crosses after a large swing and bearish

divergence (shown by the

trendline).

trendline).

- Go long [L]. Flat MACD signals that the market is ranging - we are more

likely to be whipsawed in/out of our position.

- Exit long trade [X] but do not go short - MACD is significantly below the

zero line.

- Re-enter your long trade [L].

Setup

The default settings for the MACD are:

- Slow moving average - 26 days

- Fast moving average - 12 days

- Signal line - 9 day moving average of the difference between fast and

slow.

- All moving averages are

exponential.

Edit Indicator Settings to change the settings. See

Indicator Panel for directions on how to set up an indicator.

Captions and trendlines: Use MACD Histogram if you want to draw trendlines or

place captions on the histogram. Otherwise, they are left "hanging in the air"

if you zoom or change time periods.

Related Topics

Moving Averages

A powerful measure of trend direction, achieved by smoothing price data...

Two Moving Averages

Fast and slow moving averages provide a powerful measure of trend strength and

direction...

MACD

Histogram

The histogram provides far earlier and more responsive signals than the

original MACD. Unfortunately it is also more volatile...

MACD Construction

MACD is calculated as the difference between a fast (12-day) and slow (26-day)

moving average...

External Links

Divergence (MACD)

Moving Average Convergence/Divergence (MACD) -- Chart School

Learn the How, the What, and the Where of technical analysis and stock

charting.

MACD Part 1 -- Chart School

One of the simplest and most reliable indicators available, MACD uses moving

averages, which are lagging indicators, to include some trend-following

characteristics.

MACD Part 2 -- Chart School

One of the simplest and most reliable indicators available, MACD uses moving

averages, which are lagging indicators, to include some trend-following

characteristics.

MACD Part 3 -- Chart School

One of the simplest and most reliable indicators available, MACD uses moving

averages, which are lagging indicators, to include some trend-following

characteristics.

MACD Part 4 -- Chart School

MACD is one of the most popular and easy to use tools available to the

technical analyst. By using an average of prices, moving averages smooth a

data series and make it easier to spot trends.

MACD -

Technical Analysis from A to Z

MACD - Steve Achelis' best-selling book, Technical Analysis from A to Z

MACD

![]() MACD, and

MACD, and ![]() MACD signal line.

MACD signal line.