The Directional Movement System is a fairly complex indicator developed by Welles Wilder and explained in his book, New Concepts in Technical Trading Systems.

Most indicators have one major weakness - they are not suited for use in both trending and ranging markets. The key feature of the Directional Movement System is that it first identifies whether the market is trending before providing signals for trading the trend.

Directional Movement System measures the ability of bulls and bears to move price outside the previous day's trading range. The system consists of three lines:

See Construction for further details.

Welles Wilder does not use the standard moving average formula. This should be taken into account when selecting indicator time periods. See Welles Wilder's Indicators.

A number of different trading systems have developed around Directional Movement. The following rules are based on the system presented by Dr Alexander Elder in Trading for a Living:

Exit when +DI crosses below -DI.

See ADX below for further details.

Exit when -DI crosses below +DI.

Use

stop-losses at all times.

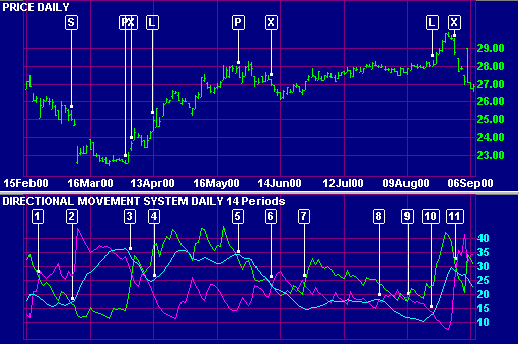

Declining ADX shows that the market is losing direction. When ADX falls below both +DI and -DI it signals a lifeless market. Do not trade with DMS until ADX has clearly turned off the bottom. Dr Elder suggests waiting until ADX rises 4 steps off its low (e.g. ADX rises to 19 from a low of 15). The longer that ADX has remained below both +DI and -DI the stronger the subsequent trend is likely to be.

When ADX rises above both +DI and -DI it signals that the market is becoming overheated. Take profits when ADX turns downwards from above +DI and -DI.

The Commonwealth Bank of Australia Limited is plotted with 14-day

![]() +DI,

+DI,

![]() -DI and

-DI and

![]() ADX.

ADX.

The default Directional Movement System uses 14 day smoothing. This is not equivalent to a 14 day EMA. Click here for details.

Edit Indicator Settings explains how to alter the default settings. Indicator Panel shows how to set up an indicator.

Technical Charting Archives : May 18, 2001

Technical Charting Archives : May 25, 2001

Technical Charting Archives : June 01, 2001

Technical Charting Archives : June 08, 2001

Technical Charting Archives : June 15, 2001

Technical Charting Archives : July 06, 2001

Directional Movement - Technical Analysis from A to Z