The Geometry

of Draw Tools

by Howard Arrington

Draw tools are used by technicians to analyze chart

patterns. They are a convenient way to measure price and

time relationships and embody such characteristics as slope,

parallelism, channeling, and retracement percentages. Many

tools are related to each other with just a slight variation

in a construction principle. Seminars, trading systems, and

books are frequently based upon draw tools wherein the

author expounds his special insight as to their use in

trading the markets. I have used the name of the tool that

I am familiar with, and apologize if you recognize the draw

tool by some other name. The draw tools are simply

geometrical constructions, and this article will show how

they are constructed.

Trend Lines

Trend Lines |

|

| Trend Lines are the

fundamental construction tool. They are drawn

most often between two significant turning

points. This type of trend line is often called

a swing line.

Variation: A Linear Regression trend line is

determined mathematically so that it is a 'best

fit' line. The least squares method plots the

line through the prices so as to minimize the

distances between the prices and the trend line.

Variation: A Linear Regression trend line is

determined mathematically so that it is a 'best

fit' line. The least squares method plots the

line through the prices so as to minimize the

distances between the prices and the trend line.

Variation: Extend the lines forward and/or

backward in time. |

|

Channel Lines

Channel Lines |

|

| Channel Lines are

constructed parallel to a Trend Line with a

spacing that contains the highest high and

lowest low of the chart bars.

Variation: The spacing is based on the

Standard Deviation of the prices.

Variation: The spacing is based on a

percentage of the price.

Variation: Raff Regression Channel lines are

equidistant channel lines drawn parallel to a

Linear Regression trend line.

Variation: Raff Regression Channel lines are

equidistant channel lines drawn parallel to a

Linear Regression trend line. |

|

Pesavento Patterns

Pesavento Patterns |

|

| This draw tool is

named after Larry Pesavento, who popularized

this analysis method in his book 'Profitable

Patterns for Stock Trading'. The technique

labels the X-B line with the price percentage

relationship of A-B compared to X-A.

In the example: (Price A - Price B) /

(Price A - Price X) = 0.618 |

|

Support and Resistance Lines

Support and Resistance Lines |

|

| Support trend lines

are drawn underneath chart bars by connecting

swing lows. Resistance trend lines are drawn

above chart bars by connecting swing highs. The

most popular use of such lines is to watch for

the trend to break through the trend line, at

which time a position is taken in the direction

of the new trend.

Variation: Add a channel line parallel to a

Support or Resistance trend line. For example,

a channel line could be drawn through point A

that is parallel to the X-B line. |

|

Fibonacci Extension

Fibonacci Extension |

|

| The X-A-B pattern

is often used to forecast future price action.

The Fibonacci Extension technique constructs the

next trend line B-C parallel to the X-A trend

line. The length of B-C will be a Fibonacci

percentage of the length of the X-A line. The

three most common lengths considered are 0.618,

1.000 and 1.618. The example shows these three

target price levels.

Variation: Point C (the 1.000 Fibonacci

Extension) can be obtained by moving the X-B

line to point A. The line A-C is equal in

length to X-B and parallel to X-B. The A-C line

is a measured move to the Price Time Target. The

expression Price Time Target (PTT) comes from

the book 'Precision Trading with Stevenson

Price and Time Targets'.

Variation: Point C (the 1.000 Fibonacci

Extension) can be obtained by moving the X-B

line to point A. The line A-C is equal in

length to X-B and parallel to X-B. The A-C line

is a measured move to the Price Time Target. The

expression Price Time Target (PTT) comes from

the book 'Precision Trading with Stevenson

Price and Time Targets'. |

|

Parallel Lines

Parallel Lines |

|

| A line is drawn

parallel to the X-A line to create a channel

through point B. The channel is sub-divided

with more lines that are equally spaced.

Variation: Use different percentages to

sub-divide the A-B line, such as the Fibonacci

percentages of 0.214, 0.382, 0.50, 0.618, and

0.7856

Variation: Use larger percentages to draw

additional parallel lines outside of the A-B

channel.

Variation: Draw the X-B leg first, and then

move to point A. This will draw the lines

parallel to the X-B line instead of parallel to

the X-A line. |

|

Andrews Pitchfork

Andrews Pitchfork |

|

| The Andrews

Pitchfork is constructed using parallel lines

using three points labeled X-A-B. X, A, and B

are typically swing peaks. The pitchfork

handle is constructed from point X through the

midpoint of the A-B trend line. Two lines

(tines) are drawn parallel to the handle from

points A and B.

Variation: Addition lines (tines) are drawn

at the quarter and eighth points along the A-B

trend line, i.e.. at 0.125, 0.25, 0.375, 0.625,

0.75, and 0.875.

Variation: Fibonacci percentages are used

instead of the eighth points, i.e.. 0.214,

0.382, 0.618, and 0.786.

Variation: Draw tines outside of A-B by

using higher percentage levels.

|

|

Schiff Lines

Schiff Lines |

|

| Schiff Lines are

constructed like the Andrews Pitchfork. The

difference is the end of the pitchfork handle

begins at the midpoint of the X-A line instead

of from point X. Thus, the tines are parallel

to the X-B line. |

|

Speed Lines (general form)

Speed Lines (general form) |

|

| Speed Lines are

another variation of the Andrews Pitchfork.

All lines (rays) are drawn from point X. The

rays pass through sub-division points on the A-B

line. A-B may be sub-divided into eighths or

Fibonacci percentages. |

|

Fibonacci Levels

Fibonacci Levels |

|

| Fibonacci Levels is

one of the most popular tools. It is basically

the Schiff Lines variation of the Andrews

Pitchfork with point B relocated to form a right

triangle with the X-A line. This is a two point

construction because point B is automatically

aligned horizontally with point A and vertically

with point X.

The A-B line is sub-divided using Fibonacci

percentage levels of 0.382, 0.50, 0.618, and

0.786.

Variation: Add Fibonacci extension levels at

1.272, 1.618, 2.00, etc.

Variation: Sub-divide A-B into eighths:

0.25, 0.375, 0.50, 0.625, 0.75, etc. |

|

Speed Lines (Fibonacci form)

Speed Lines (Fibonacci form) |

|

| Speed Lines are a

variation of the Fibonacci Levels tool. Instead

of horizontal lines being drawn at the

sub-division points on the A-B line, rays are

drawn from point X through the sub-division

points on the A-B line. This is the special

case where point B forms a right triangle with

the X-A line.

Variation: Sub-divide A-B into eighths:

0.25, 0.375, 0.50, 0.625, 0.75, etc. |

|

Gann Fan

Gann Fan |

|

| The Gann Fan was a

primary construction technique used by the

famous trader W. D. Gann. The A-B line is

divided into eighths (or thirds), and rays are

drawn from point X to or through the A-B

sub-division points. Likewise, the horizontal

distance is sub-divided into eighths (or

thirds), and rays are drawn from point X to the

horizontal division points.

The unique characteristic is that the A-B

length should equal the X-B length. This means

there is a specific relationship between price

(A-B line) and time (X-B line). Therefore,

some unit of price equals some unit of time.

The 1x4 label means the line moves 1 unit of

price in 4 units of time. This is 25 percent of

the A-B height. The 1x2 line passes through

the A-B midpoint.

|

|

Gann Square

Gann Square |

|

| The Gann Square is

created by drawing a Gann Fan from each of the

four corners of a square. The example shows the

3 primary fan lines of 2x1, 1x1, and 1x2 drawn

from each corner.

Variation: Draw additional fan lines for the

quarter point sub-divisions.

Variation: Arrange additional Gann Squares

to be adjacent to each other to form a grid for

the chart bars to overlay. |

|

Pyrapoint

Pyrapoint |

|

| Pyrapoint is an

automation of the Gann Square principle. A

unit of time is automatically derived from a

price to create a square. The 1x1 fan lines

are drawn from corner to corner to create the

ascending and descending channels.

Variation: The tool is based on degrees of

rotation around Gann's Square of Nine. Larger

or smaller squares can be selected by changing

the parameter for the degrees of rotation.

Pyrapoint is copyrighted by Don E. Hall and

discussed in detail in his book titled 'Pyrapoint'. |

|

Fibonacci Retracement

Fibonacci Retracement |

|

| Fibonacci

Retracement combines a Gann Fan being drawn from

point A and Fibonacci Levels drawn between the

fan lines. The tool draws the 2x1, 1x1, and

1x2 fan lines. The 1x1 line in the retracement

fan is a mirror image of the X-A line reflected

about point A.

Variation: Draw an inverted fan from point

B, which is the point that forms a right

triangle with the X-A line.

Variation: Draw the retracement fan from the

midpoint of the A-B line.

Variation: Use eighth division levels:

0.25, 0.375, 0.50, 0.625, 0.75, etc. |

|

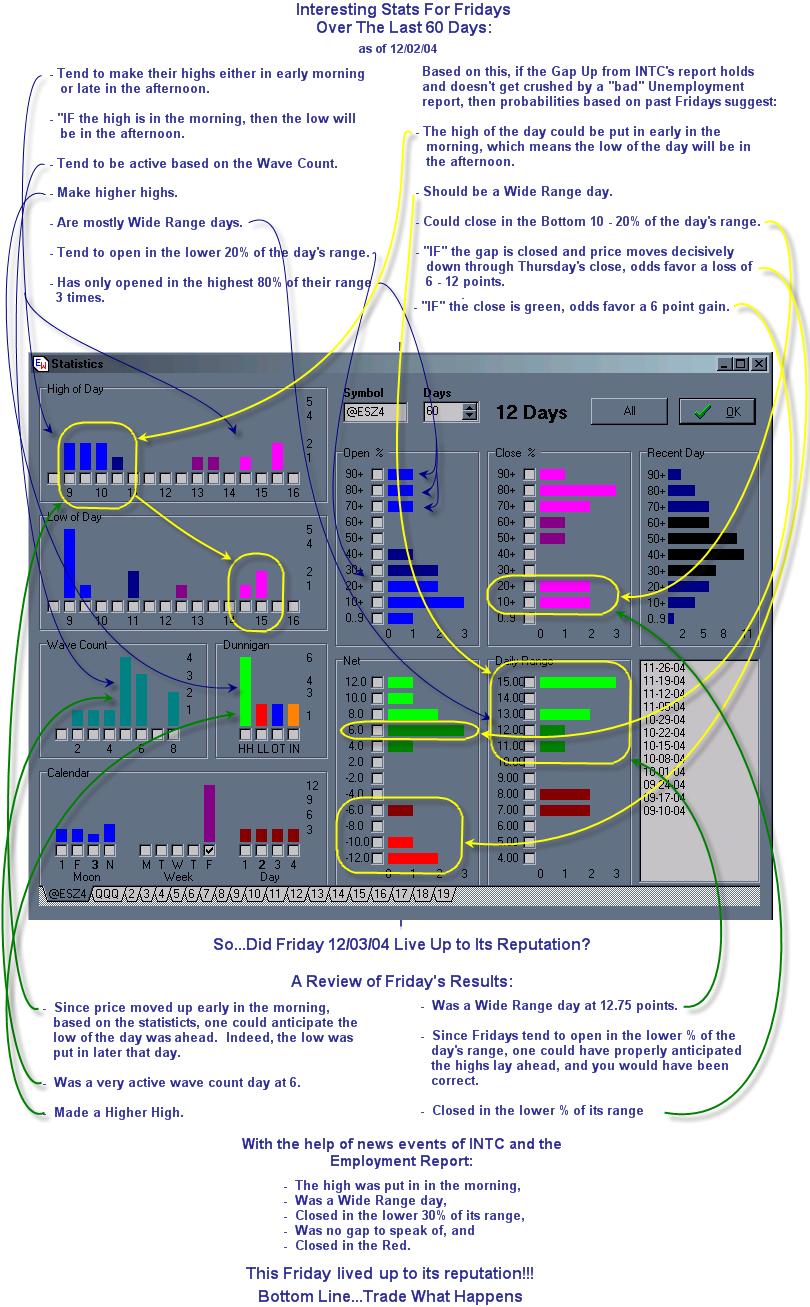

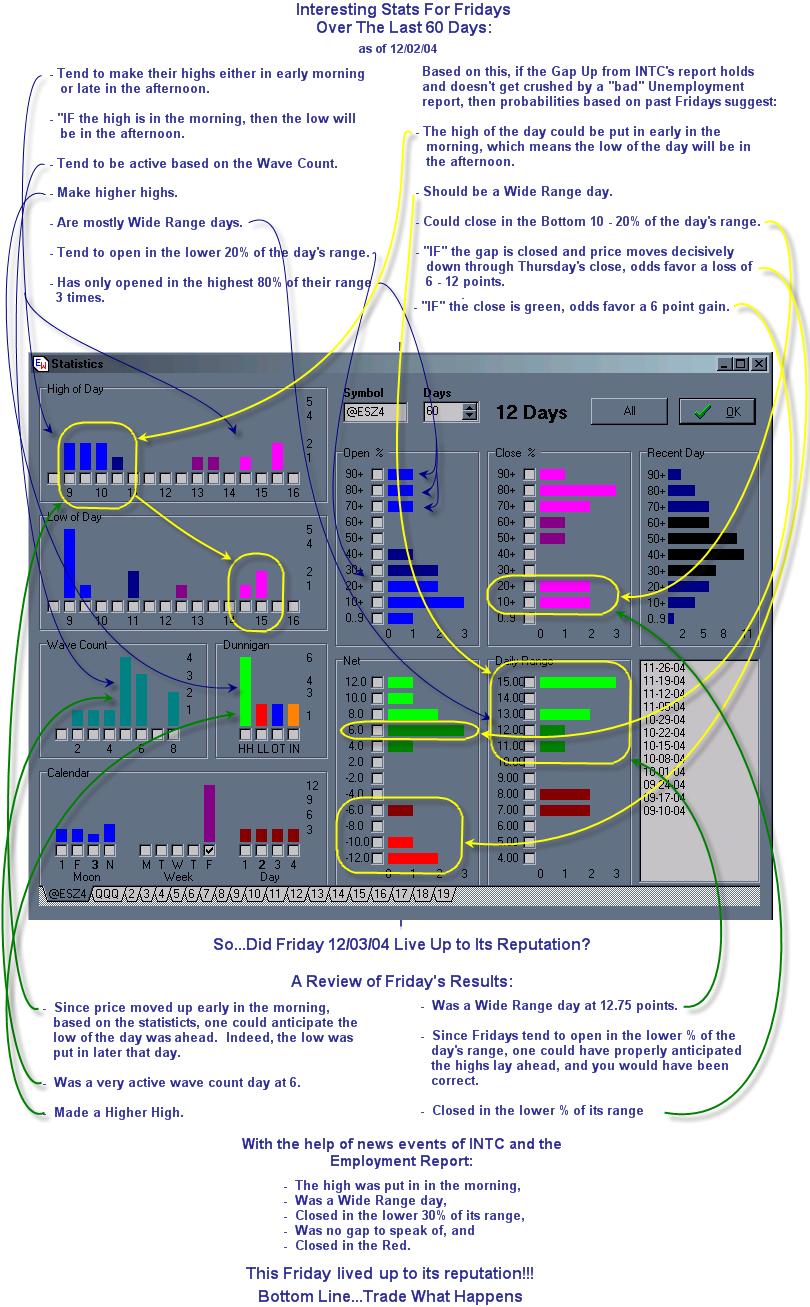

Trading Tip:

Friday Statistics

by Donald Dix

Trading Tip:

Volume Alert

by Howard Arrington

The following chart shows when the volume is above the

average volume.

The visual shows volume with the Blue

histogram bars, and a 10 period simple average of volume

plotted as the Red line curve. When the volume moves above

the average volume, a fat Green histogram bar is plotted

through the height of the average volume curve. The

following study alert was used to create this visual effect.

Panel A returns a 10 period simple average

of the volume. The period for the average function is the

Number field, which can be changed to plot a different

average volume. The alert test is True when the average

volume is below the panel B value which returns the bar's

volume. When the condition is True, the Green histogram is

plotted. When the condition is False, the Red curve is

plotted. The value plotted is the average volume

calculated by panel A |