| Outside days can

occur frequently on daily charts. The secret of

the outside day is the bigger the better and it

has more meaning if found at the end of a trend.

They can be short lived and I always take my

profit quickly. The outside day (OD) should

completely encompass the previous day. It must

have a higher high than the previous day and a

lower low than the previous day.

One of the most important things about this

pattern is that the bar closes in the opposite

direction of the trend. If the trend is down the

close on the OD must be near the high or in the

upper part of the bar. The opposite is true of

the up trend. The OD may still work if this is

not the case but my research show that it is

more effective if it does close in the opposite

direction.

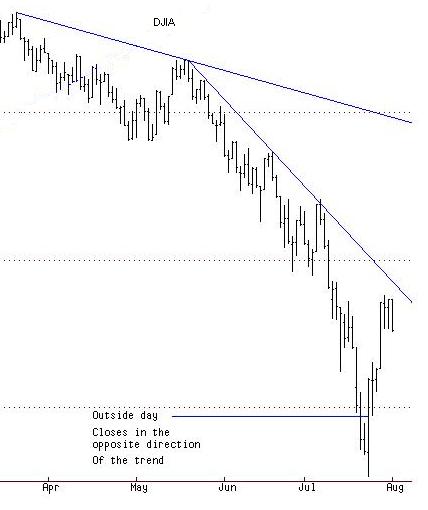

A great example of this happened on the cash

Dow as I was trading it (24th July 02, refer to

chart). I like to trade this in two ways. First,

depending on what the market has been doing

prior to the outside day I will place a entry

order a few ticks above the high of the OD if

the trend has been down and I am looking to get

long. Once I am in the market I will place my

stop loss either as a dollar amount or at the

.618 fibonacci retracement of the OD.

If you don't know anything about fibonacci

don't worry, we will cover that in future

lessons. The same applies to the short trade. If

the OD occurred at the end of an up trend and I

am trying to get short, I will place my entry

order a few ticks below the low of the OD. Once

taken short I will place my stop loss order in

the same way as the long trade, either as a

dollar amount or as the .618 fibonacci

retracement.

The second way I like to trade this pattern

is to trade it intraday. I closely monitor what

happens at the high of the OD if I intend to go

long and the low of the OD if I intend to go

short.

Once the high or low has been taken as the

case may be I will then enter the market on a 5

minute or 1 minute chart. For long position I

will buy the first retracement with a tight stop

loss order under an intraday support and if

trying to get short I will sell the first rally

with a stop loss order above an intraday

resistance.

Below are two examples of Outside Days. The

first occurred at the end of a down trend and

the second occurred at the end of an up trend.

|