How to Identify High Probability Set-ups

In the previous two installments of this

ongoing series of FX Trading Basics I outlined

the methods I use for determining the trend

(read part I and part II here). In todayís

installment I want to discuss, how I combine

multiple time frame analysis and stochastics in

identifying high probability set-ups versus low

probability set-ups.

First, some bullet points to outline my

thoughts:

- Higher time frames, generally, but not

always, take precedent over lower time

frames.

- Stochastics, for me, are a filtering

mechanism; not a timing. mechanism.

To review, I use three primary time frames in

day-to-day analysis:

- 60-minute

- 240-minute

- Daily chart

I do use a weekly chart to identify key

support and resistance levels, rarely as a

timing mechanism.

Identifying the trend is simply but one piece

to the puzzle, once the trend is correctly

identified, you then need to determine whether

or not prices will continue to exhibit the

trend. There are many times when the trend is

easily identified, but is actually on the verge

of changing trend direction. For purposes of

this article, letís assume that the time frame

that we do the primary analysis (i.e. the time

frame we will execute on) is the 60-min chart.

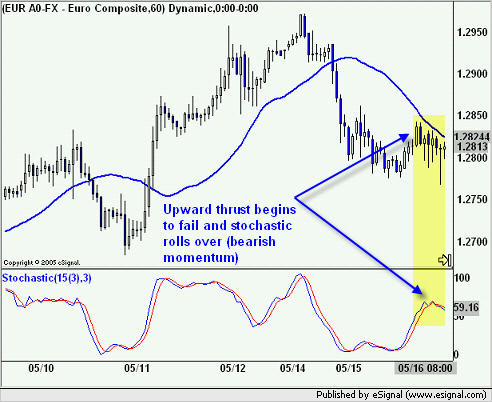

The charts below are the 60 & 240-min of

EUR/USD. On each chart, the trend is quite

clear. If we then defer to bullet point # 1

above -- Higher time frames, generally, but not

always, take precedent over lower time frames --

we would have to resist the temptation to short

EUR/USD based on the 60-min chart.

However, this simple analysis, will often

lead you to miss trades. In order to make a

proper assessment, you need to add one more

indicator to your chart in order to conclusively

know to not short EUR/USD based on the 60-min

chart -- stochastics.

In this case, the stochastics simply confirm

the conclusion we drew from looking at the first

2 charts we posted without the stochastics.

However, there are many times when this will not

be the case.

In the next installment, I will provide

several examples of how to properly use

stochastics and inflection points in order to

properly identify high probability trade

entries. |