THE LAW OF CHARTS™

At Trading Educators we only use Price and Volume Charts to identify high probability trades. The Law of Charts™ describes only four chart formations on the price charts which present trading opportunities, then specifies entry and exit targets based upon those four chart formations. In the following we will present you these four major chart formations and how to trade them.

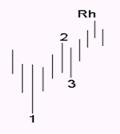

1-2-3 HIGHS AND LOWS

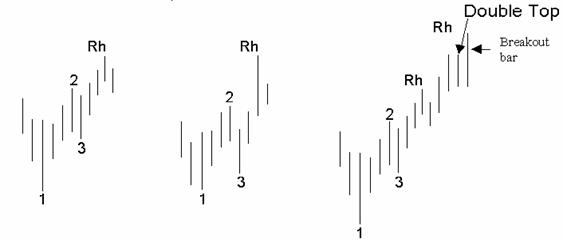

A typical 1-2-3 high is formed at the end of an up-trending market. Typically, prices will make a final high (1), proceed downward to point (2) where an upward correction begins; then proceed upward to a point where they resume a downward movement, thereby creating the pivot (3). There can be more than one bar in the movement from point 1 to point 2, and again from point 2 to point 3. There must be a full correction before points 2 or 3 can be defined.

A number 1 high is created when a previous up-move has ended and prices have begun to move down.

The number 1 point is identified as the last bar to have made a new high in the most recent up-leg of the latest swing.

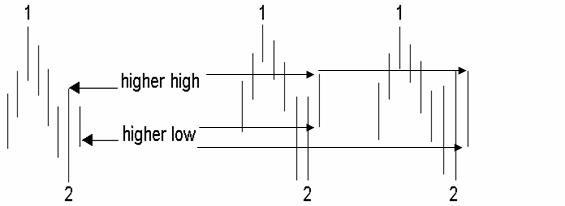

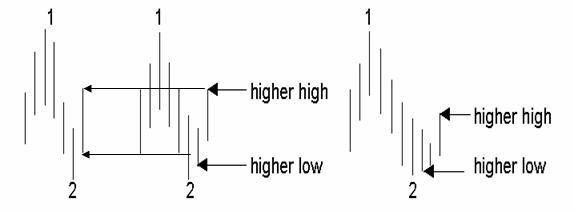

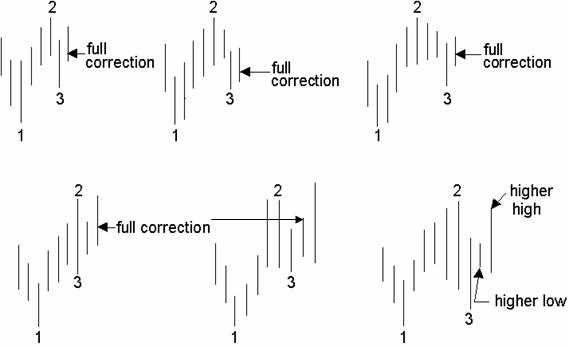

The number 2 point of a 1-2-3 high is created when a full correction takes place. Full correction means that as prices move up from the potential number 2 point, there must be a single bar that makes both a higher high and a higher low than the preceding bar or a combination of up to three bars creating both the higher high and the higher low. The higher high and the higher low may occur in any order. Subsequent to three bars we have congestion. Congestion will be explained in depth later on in the course. It is possible for both the number 1 and number 2 points to occur on the same bar.

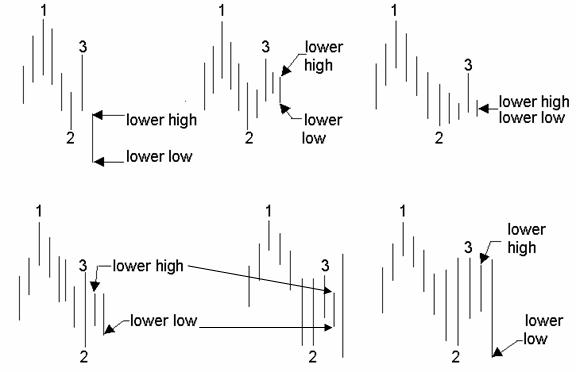

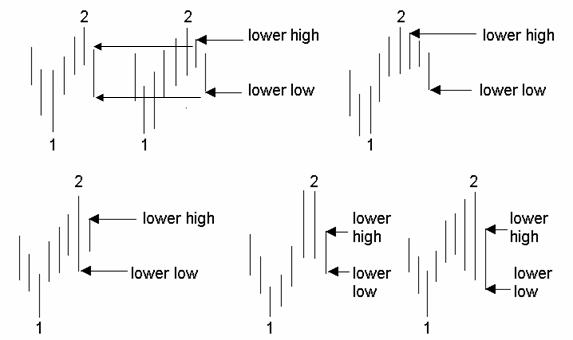

The number 3 point of a 1-2-3 high is created when a full correction takes place. A full correction means that as prices move down from the potential number 3 point, there must be at least a single bar, but not more than two bars that form a lower low and a lower high than the preceding bar. It is possible for both the number 2 and number 3 points to occur on the same bar.

Now, let’s look at a 1-2-3 low.

A typical 1-2-3 low is formed at the end of a down-trending market. Typically, prices will make a final low (1); proceed upward to point (2) where a downward correction begins; then proceed downward to a point where they resume an upward movement, thereby creating the pivot (3). There can be more than one bar in the movement from point 1 to point 2, and again from point 2 to point 3. There must be a full correction before points 2 or 3 can be defined.

A number 1 low is created when a previous down-move has ended and prices have begun to move up. The number 1 point is identified as the last bar to have made a new low in the most recent down-leg of the latest swing.

The number 2 point of a 1-2-3 low is created when a full correction takes place. Full correction means that as prices move down from the potential number 2 point, there must be a single bar that makes both a lower high and a lower low than the preceding bar, or a combination of up to three bars creating both the lower high and the lower low. The lower high and the lower low may occur in any order. Subsequent to three bars we have congestion. It is possible for both the number 1 and number 2 points to occur on the same bar.

The number 3 point of a 1-2-3 low exists when a full correction takes place. A full correction means that as prices move up from the potential number 3 point, there must be at least a single bar, but not more than two bars, that form a higher low and a higher high than the preceding bar. It is possible for both the number 2 and number 3 points to occur on the same bar.

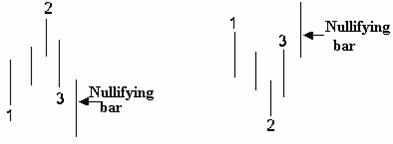

The entire 1-2-3 high or low is nullified when any price bar moves prices equal to or beyond the number 1 point.

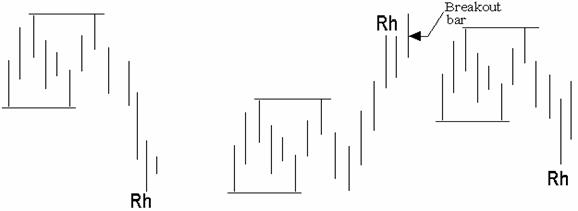

Ledges

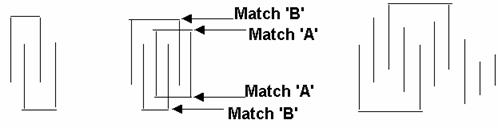

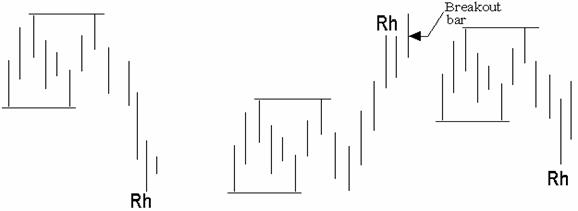

A LEDGE CONSISTS OF A MINIMUM OF FOUR PRICE BARS. IT MUST HAVE TWO MATCHING LOWS AND TWO MATCHING HIGHS. THE MATCHING HIGHS MUST BE SEPARATED BY AT LEAST ONE PRICE BAR, AND THE MATCHING LOWS MUST BE SEPARATED BY AT LEAST ONE PRICE BAR.

The matches need not be exact, but should not differ by more than three minimum tick fluctuations. If there are more than two matching highs and two matching lows, then it is optional whether to take an entry signal from either the latest price matches in the series (Match ‘A’) or those that represent the highest and lowest prices of the series (Match ‘B’). [See below]

A LEDGE CANNOT CONTAIN MORE THAN 10 PRICE BARS. A LEDGE MUST EXIST WITHIN A TREND. The market must have trended up to the Ledge or down to the Ledge. The Ledge represents a resting point for prices, therefore you would expect the trend to continue subsequent to a Ledge breakout.

TRADING RANGES

A Trading Range (See below) is similar to a Ledge, but must consist of more than ten price bars. The bars between ten and twenty are of little consequence. Usually, between bars 20 and 30, i.e., bars 21-29, there will be a breakout to the high or low of the Trading Range established by those bars prior to the breakout.

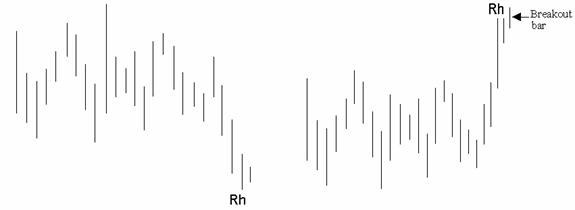

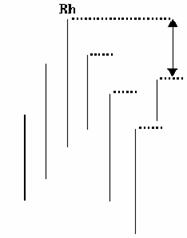

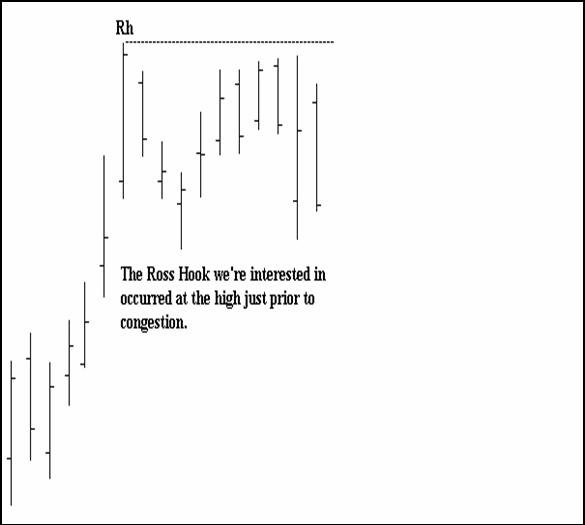

ROSS HOOKS

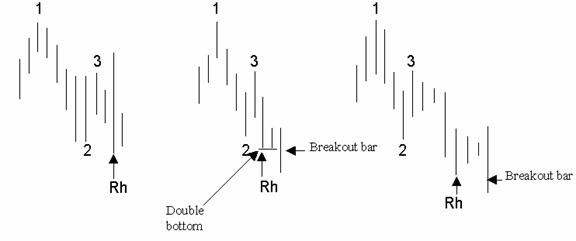

A Ross Hook is created by:

1. The first correction following the breakout of a 1-2-3 high or low.

2. The first correction following the breakout of a Ledge.

3. The first correction following the breakout of a Trading Range.

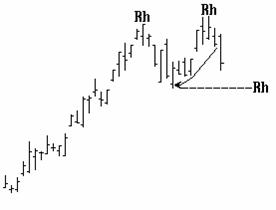

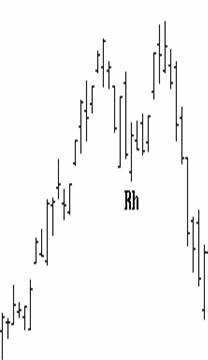

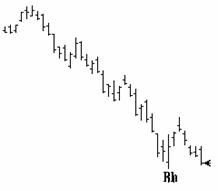

In an up-trending market, after the breakout of a 1-2-3 low, the first instance of the failure of a price bar to make a new high creates a Ross Hook. (A double high/double top also creates a Ross Hook).

In a down-trending market, after the breakout of a 1-2-3 high, the first instance of the failure of a price bar to make a new low creates a Ross Hook. (A double low/double bottom also equals a Ross Hook).

If prices breakout to the upside of a Ledge or a Trading Range formation, the first instance of the failure by a price bar to make a new high creates a Ross Hook. If prices breakout to the downside of a Ledge or Trading Range formation, the first instance of the failure by a price bar to make a new low creates a Ross Hook (A double high or low also creates a Ross Hook).

We’ve defined the patterns that make up the Law of Charts. Study them carefully.

What makes these formations unique is that they can be specifically defined. The ability to formulate a precise definition sets these formations apart from such vague generalities as “head and shoulders,” “coils,” “flags,” “pennants,” “megaphones,” and other such supposed price patterns that are frequently attached as labels to the action of prices.

TRADING IN CONGESTION

Sideways price movement may be broken into three distinct and definable areas:

1. Ledges - consisting of no more than 10 price bars

2. Congestions - 11-20 price bars inclusive

3. Trading Ranges - 21 bars or more with a breakout usually occurring on price bars 21-29 inclusive.

Trading Ranges consisting of more than 29 price bars tend to weaken beyond 29 price bars and breakouts beyond 29 price bars will be:

• Relatively strong if the Trading Range has been growing narrower from top to bottom (coiling).

• Relatively weak if the Trading Range has been growing wider from top to bottom (megaphone).

We have written considerable material about breakouts from Ledges, primarily that since by definition, Ledges must occur in trending markets, the breakout is best traded in the direction of the prior trend, once two matching highs and two matching lows have taken place.

The next discussion deals primarily with Congestions and Trading Ranges:

Under the topic of the Law of Charts, we have defined the first correction following the breakout of a Trading Range or Ledge as being a Ross Hook.

The same is true after a breakout from Congestion, i.e., the first retracement (correction) following a breakout from Congestion also constitutes a Ross Hook.

A problem most traders have in dealing with sideways markets is determining when prices are no longer moving sideways and have indeed begun to trend. Apart from an outright breakout and correction which defines a Ross Hook, how is it possible to detect when a market is no longer moving sideways, and has begun to trend?

In other writings, we have stated that the breakout of the number 2 point of a 1-2-3 high or low formation ‘defines’ a trend, and that the breakout of the point of a subsequent Ross Hook ‘establishes’ the trend previously defined.

1-2-3 high and low formations may be satisfactorily traded using the Trader’s Trick entry. All Ross Hooks may be satisfactorily traded using the Trader’s Trick entry.

However, while a 1-2-3 formation occurring in a sideways market still defines a trend, the 1-2-3 formation, when it occurs in a sideways market, is not satisfactorily traded using the Trader’s Trick. This is because Congestions and Trading Ranges are usually composed of opposing 1-2-3 high and low formations.

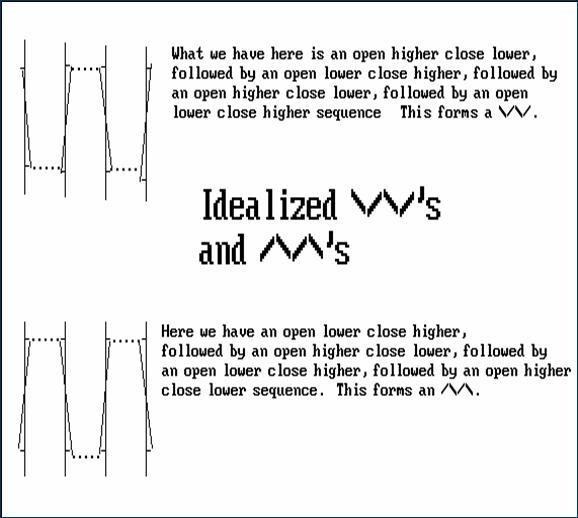

If a sideways market has assumed an /\/\ formation, or is seen as a \/\/ formation, these formations will more often than not consist of a definable 1-2-3 low followed by a 1-2-3 high, or a 1-2-3 high followed by a 1-2-3 low. In any event, the breakout of the number 2 point is usually not a spectacular event, certainly not one worth trading.

What is needed is a tie-breaker. The tie-breaker will not only increase the likelihood of a successful trade, but will also be a strong indicator of the direction the breakout will most probably take. That tie-breaker is the Ross Hook.

When a market is moving sideways, the trader must see a 1-2-3 formation, followed by a Ross Hook, all occurring within the sideways price action. The entry is then best attempted by using the Trader’s Trick ahead of a breakout of the point of the Ross Hook.

Of course, nothing works every time. There will be false breakouts. However, on a statistical basis, a violation of a Ross Hook occurring when price action is sideways, consistently results in a low risk entry with a heightened probability for success. Since the violation of a Ross Hook occurring in a sideways market is an acceptable trade, then an entry based upon a Trader’s Trick entry ahead of the point of the Ross Hook being violated offers an even better entry.

POINTS OF CLARIFICATION FOR 1-2-3 FORMATIONS

We have had a number of people ask about the trading of the 1-2-3 high or low formation.

They ask, “When do you buy and when do you sell?”

Although we prefer to use the Trader’s Trick entry whenever possible (See

Appendix B), the illustration should be of help when not using the Trader’s

Trick.

The Breakout of a 1-2-3 High Or Low

Let's illustrate what a 1-2-3 is:

Sell a breakout of the # 2 point of a 1-2-3 high

===============================================

Buy a breakout of the # 2 point of a 1-2-3 low

Note: The #3 point does not come down as low as the #1 point in a uptrend, or as

high as the #1 point in a down trend.

We set a mental or computer alert, or both, to warn us of an impending breakout

of these key points. We will not enter a trade if prices gap over our entry

point. We will enter it only if the market trades through our entry point.

1-2-3 Highs and Lows come only at market turning points that are in effect major or intermediate high or lows. We look for 1-2-3 lows when a market seems to be making a bottom, or has reached a 50% or greater retracement. We look for 1-2-3 highs when a market appears to be making a top, or has reached a 50% or greater retracement.

Exact entry will always be at or prior to the actual breakout taking place.

POINTS OF CLARIFICATION FOR ROSS HOOKS

We are asked the same question with regard to the Ross Hook as we are about 1-2-3 formations: “When do I buy, and when do I sell?” Our answer is essentially the same as for the 1-2-3 formation. Although we prefer entry via the Trader’s Trick (See Appendix B), such entry is not always available. When the Trader’s Trick entry is not available, enter on a breakout of the point of the Ross Hook itself.

Buy on a breakout of the point of the Ross Hook.

But keep in mind this warning: When the point of a Ross Hook is taken out, it

very often is nothing more than stop running, and the breakout will be a false

one.

Sell on a breakout of the point of the Ross Hook.

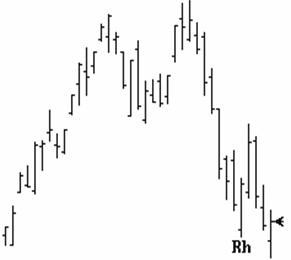

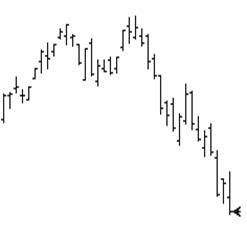

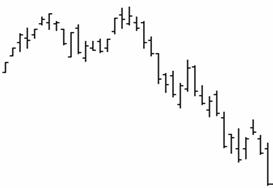

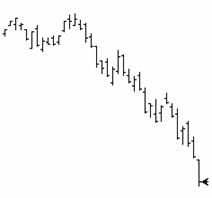

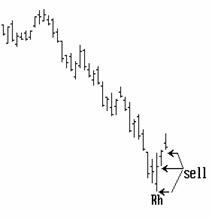

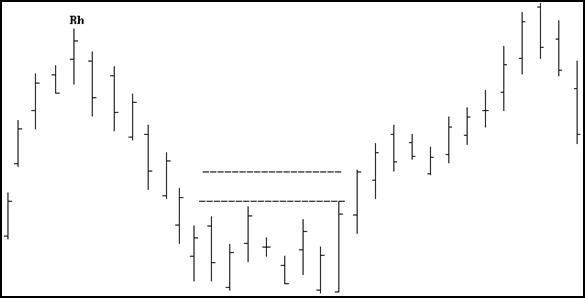

Some comments about the series of graphs that follow might clear up a few questions:

This is important! Prices make a double top at the last Ross Hook shown, and then retreat. Many professional traders would go short as soon as they felt the double top was in place.

Notice that we are able to connect a True Trend line from the point of the lower Ross Hook to the correction low that gave us the #3 point, and then to the correction low that created the double top Ross hook.

That leaves us with a 1-2-3 low and a Ross Hook in the event of a breakout to the upside. It also leaves us with a 1-2-3 high and a Ross hook in the event of a breakout to the downside. A breakout of the double top (Rh) will set us up for any subsequent upside Ross Hooks if prices take out the double resistance area and then later correct.

The double top Ross Hook represents a low risk entry for a short position. However, in this example we will wait for an entry at the violation of the Ross Hook itself. A more advanced trader might wish to go short as prices move away from the double top. This is a low risk trade because a stop can temporarily be placed above the high. Notice we are saying temporarily. The double top could be a terrible place to have a stop should the insiders engineer a move up to run the stops they know are there.

The Trader’s Trick Entry (See Appendix B) would enable us to enter by going long earlier than waiting for the double top Ross Hook to be taken out. The more conservative trade is to use the Trader’s Trick entry, figuring that prices will at least test the high as prices move up. The Trader’s Trick Entry in this case is just above the third bar of correction. All or part of the position can be put on at the Trader’s Trick Entry point. It’s simply a matter of choice. If you want to know what our choice is, it is to place the entire position on at the Trader’s Trick Entry.

However, prices continue down and take out the lower Ross Hook. We should have had a resting sell stop below that Ross Hook as well. We can sell short all or part of our position as the lower Ross Hook itself is violated.

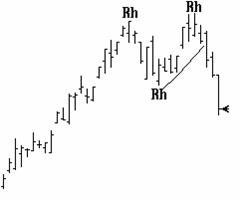

We see that prices are plunging. However, we should not be jumping in front of the market at each lower bar, because by the time prices take out the Ross Hook, the market will have already been moving down for four consecutive bars. If you will recall the lessons learned from our section in ELECTRONIC TRADING ‘TNT’ I on finding the trend while it is still in the birth canal, you know that the market may be getting ready to correct.

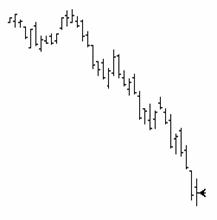

Note the intraday correction at the arrow on the right of the chart. An important event has taken place. The intraday correction makes it okay to jump in front of the market. The fact that the market opened, traded above the previous bar’s high, and then took out the previous day’s low, signifies at least one more good day to be short. If trading intraday, jump in front of the Ross Hook created by the intraday correction. In fact, if trading intraday, and it becomes available, use a Trader’s Trick Entry to enter ahead of prices taking out the previous day’s low.

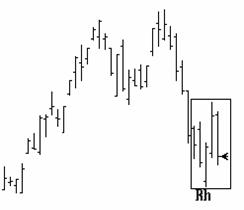

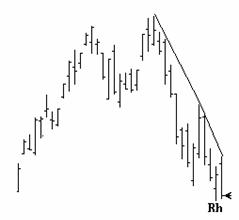

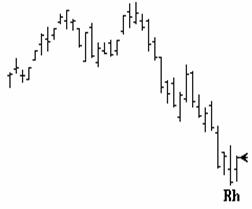

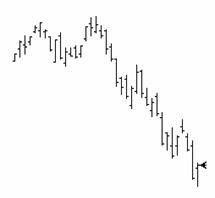

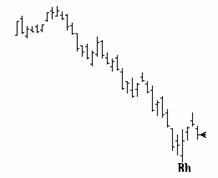

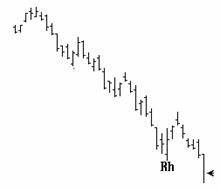

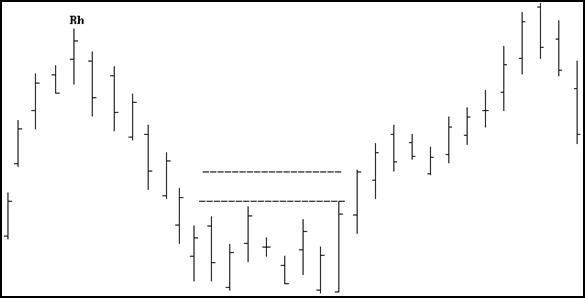

We now have an intraday correction followed by a reversal bar. The market is

talking! Note the gap open beyond the previous bar’s low. Then notice the price

action for the remainder of the day. Professional traders will go long on a gap

open like that, some of them as soon as possible after the open, and others when

prices trade through the open to the upside. When you see a gap open like that

in a strongly trending market, take profits. If your guts are under control,

take profits and reverse. Most of the time you will be glad you did. In fact,

many professionals, if they think the market is beginning to congest, will

double up on a gap opening and trade twice as many contracts against the trend

as they would with the trend.

The market was telling us to expect a correction. Were you listening?

When prices are correcting and prices open in the upper part of the previous bar’s range, and then move above the previous bar’s high, chances are you haven’t seen an end to the correction.

This latest price bar places the chart into a 5 bar consolidation area. We’ll place a box around that area. This area is considered to be congestion by alternation and is described in Electronic Trading ‘TNT’ III – Technical Trading Stuff, and in Appendix C of this manual.

Although not shown, you can picture that a 3x3 moving average of the close, is running through the middle of the 5 bar congestion.

You may recall from ELECTRONIC TRADING ‘TNT’ III that the 3x3 moving average is a filter for Reverse Ross Hooks. It is also a filter here for the same reasons – we are in a defined congestion by reason of alternation.

Since the trade doesn’t pass our filter because of a “gap opening beyond the low of the Rh,” we must remove any order to sell a breakout of the Rh. The gap opening below the previous bar’s range has brought in a double load of orders from the insiders.

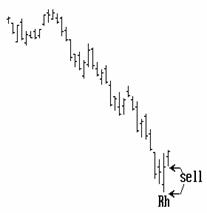

Prices move up on a reversal day. Remember, when the insiders feel that a market

is congesting or correcting, they will double their orders on openings that gap

beyond the price range of the previous day. This doubling can serve as a filter

for our trades, because we can expect the insiders to try to fill the gap. Day

traders can use this to trade right along with the insiders who know to expect

this type of price action.

As prices gap past the Rh, and then correct, we can place a sell order below the new Rh.

The following day, we get a gap opening to the upside. This time it is above the high of the previous day. It, too, will bring a double load of sell short orders. This is a correction day and so we can connect some segment lines.

Prices hit our sell stop below the Rh. Our sell stop has been placed one tick below the point of the Rh. We want a violation of the Hook before we will accept entry.

There are many problems with getting filled on a gap opening below our sell stop, the least of which is slippage. Therefore, if at all possible, we do not enter orders until we see where the open occurs. Brokers can be instructed in that manner if you have to use one for the actual placement of your order. On the chart to the left, prices opened exactly one tick below the Rh.

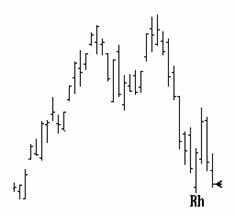

The next price bar makes an unusual close. We must do all we can to protect profits. There is apt to be further correction on the next price bar.

We protect profits by moving our stop one tick above the high of any bar that closes very close to the high when we feel that prices should be continuing to move down.

The correction comes intraday, creating an intraday hook situation. Day traders may have been able to scalp a few ticks of profit here.

Day traders may have been able to profit by selling under the low of the previous day. Any day trader at any time should consider a breakout of the low of the previous day a strong reason to sell short.

The correction by prices on the last bar shown gives us another Rh.

As prices correct, we try to sell a breakout of the low of the correcting bar.

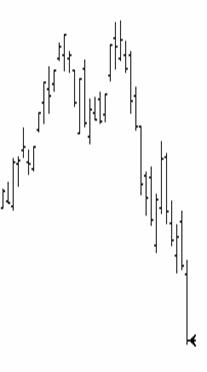

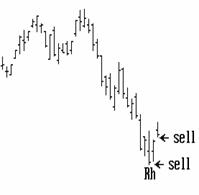

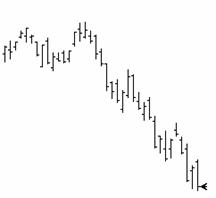

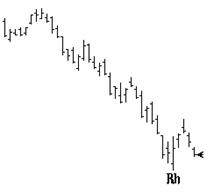

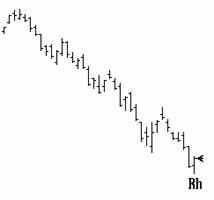

The following comments apply to the chart above and the one below. We may want to put on our entire position but we have only two opportunities. It may be best to put on 2/3 of the position at the higher of the two entry points, and only 1/3 at the hook, if we are given the choice. Once prices start back down, we try for 2/3 immediately. If we still cannot get our position on, then we will have to place the entire position on at the hook. You may recall in a similar situation we looked at the 3x3 moving average of the close and considered it a filter for the trade because the 3x3 was running through a five bar consolidation. In this instance, the 3x3 moving average was still displaying containment of the downtrend.

A trade at the low is missed because of the gap opening. We then try to sell a breakout of the next low, as well as the Rh.

Our position is filled at both entry points.

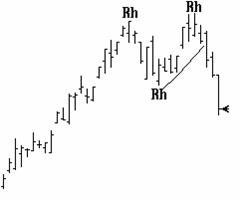

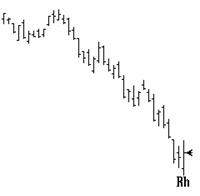

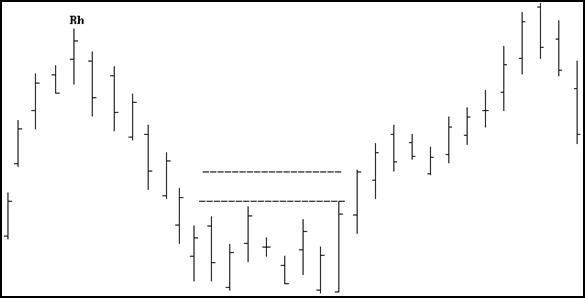

The following comments apply to the chart above and the chart below: As we take profits out of the market, we come to a point where we have accumulated sufficient profits that if we wish to risk those profits, we can begin to keep our stop further away from the price action.

If we don’t want to take additional risk, then it’s best to trail a 50% stop as the market moves down, and pull stops even tighter on reversal bars, or any indication that something is amiss.

Because of the reversal bar, we tighten stops. We don’t want a win to turn into a loss.

Another intraday correction gives day traders an opportunity to sell short.

All traders can jump in front of the market and get filled as the low is taken out.

Prices break nicely to the downside.

The downtrend is fully intact. If we are willing to take more risk, we can allow our stop to lag further back.

Here we see the value in keeping our trailing stop a bit further away, once we have established acceptable profits.

In any case, we would place a sell stop below the Rh and the next correction bar, in effect opting for the Trader’s Trick.

We now have three possible selling points. Whenever we get 3 bars of correction, we move our lagging stop (if we have one) to one tick above the high of the third correction bar. This is because, if we were to get more than three correcting bars, we would have to assume that the trend is at least temporarily over, and prices may now move higher, or at the very least move into a congestion phase.

The gap open misses our highest entry point. Because it does, it would cause us to try to fill 2/3rds of our position on a breakout of the low of the gap down bar.

Once again the entry point was missed on the gap opening. We will try again for entry on the next price bar.

This bar brings a fill near the close.

At this point our entire position should be in place.

We do not need a sell order below the Rh if our entire position is in place.

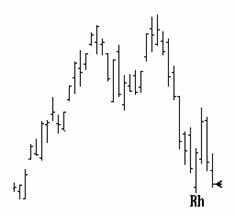

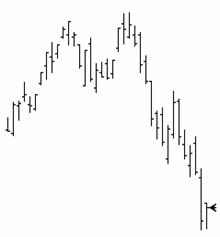

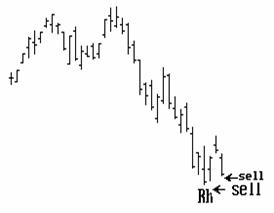

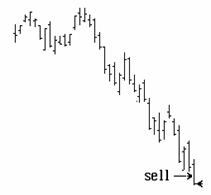

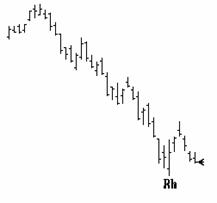

Note with regard to the last four charts: An adequate trailing stop would have kept us in the market throughout the four days show on these charts. We would have been able to build a position by adding contracts.

But keep in mind that adding contracts also adds all new risk. Furthermore, the risk which is incurred may be greater in nature than the risk originally accepted. Why? Because each time we add to our position, we are closer in time to the end of the move being made.

The method of trade management that we have been showing you in this entire

series of charts is here is to demonstrate to you an alternative method of trade

management. It is up to the trader to decide how to manage his/her own

positions. In our minds there are two basic approaches, both of which may be

acceptable to some.

The first is that of putting on the entire position upon the initial entry and

then liquidating portions of that position to cover costs, take a small profit,

and finally to ride the trade as far as it will go with what remains of the

position after partial liquidation.

The converse of this method is to build the position by entering a portion of it to test the waters. If the initial portion becomes profitable, you then add to the position by adding contractss in stages until you have put on the entire position.

Much of any acceptability depends upon your personal comfort level in handling risk, and your financial capacity for handling risk.

We’ll look at two more charts now. In actuality, the market continued downward for quite some time after the last chart below.

Here we see a reversal day. By now you should know that it usually means some sort of correction is due.

Sure enough, prices correct. We would start by trying to sell a breakout of the correction low. We would also place a sell stop below the Rh for part of our position.

Remember, it is up to you to decide how much of your position you want to place at any given level. It is a matter of comfort and style. Where do you feel best about placing your entry orders?

THE TRADER'S TRICK ONE MORE TIME

The purpose of the Trader's Trick entry (TTE) is to get us into a trade prior to entry by other traders.

Let's be realistic. Trading is a business in which the more knowledgeable have the advantage over the less knowledgeable. It's a shame that most traders end up spending countless hours and dollars searching for and acquiring the wrong kind of knowledge. Unfortunately, there is a ton of misinformation out there and it is heavily promoted. What we are trying to avoid here is the damage that can be done by a false breakout.

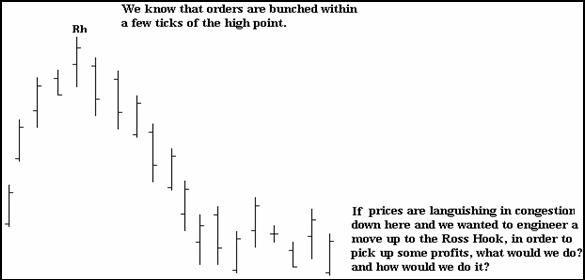

Typically, there will be many orders bunched just beyond the point of a Ross Hook. This is also true of the number two point of a 1-2-3 formation. The insiders are very much aware of the bunching of orders at those points, and if they can make it happen, they will move prices to where they see the orders bunched together, and then a little past that point in order to liquidate as much of their own position as possible. This action by the insiders is called “stop running.”

Unless the pressure from the outsiders (us) is sufficient to carry the market to a new level, the breakout will prove to be false.

The Trader's Trick is designed to beat the insiders at their own game, or at the very least to create a level playing field on which we can trade. WHEN TRADING HOOKS, WE WANT TO GET IN AHEAD OF THE ACTUAL BREAKOUT OF THE POINT OF THE HOOK. IF THE BREAKOUT IS NOT FALSE, THE RESULT WILL BE SIGNIFICANT PROFITS. IF THE BREAKOUT IS FALSE, WE WILL HAVE AT LEAST COVERED OUR COSTS AND TAKEN SOME PROFIT FOR OUR EFFORT.

Insiders will often engineer moves aimed at precisely those points where they realize orders are bunched. It is exactly that kind of engineering that makes the Trader's Trick possible.

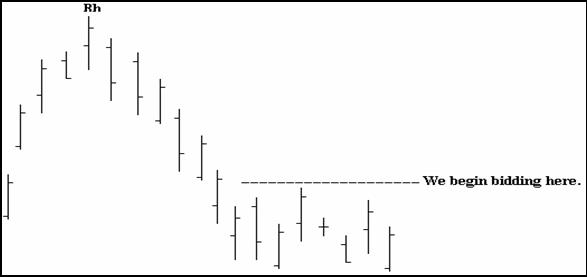

The best way to explain the engineering by the insiders is to give an example. Ask the following question: If we were large operators down on the floor, and we wanted to make the market move sufficiently for us to take a fat profit out of the market, and know that we could liquidate easily at a higher level than where the market now is because of the orders bunched there, how would we engineer such a move?

We would begin by bidding slightly above the market.

By bidding a large number of contracts above the market, prices would quickly move up to our price level.

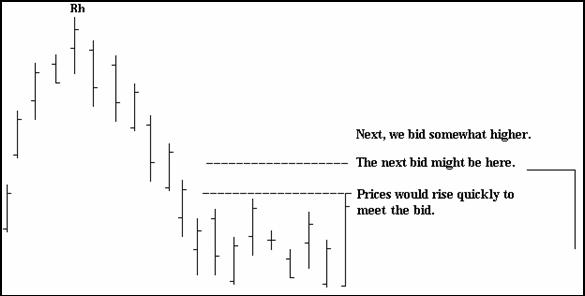

Once again by bidding a large number of contracts at a higher level, prices would move up to that next level.

The sudden movement up by prices, to meet our large-order overpriced-bid, will cause others to take notice. The others are day traders trading from a screen, and even insiders.

Their buy orders will help in moving the market upward towards where the

stops are bunched. It doesn't matter whether this is a daily chart or a five

minute chart, the principle is the same.

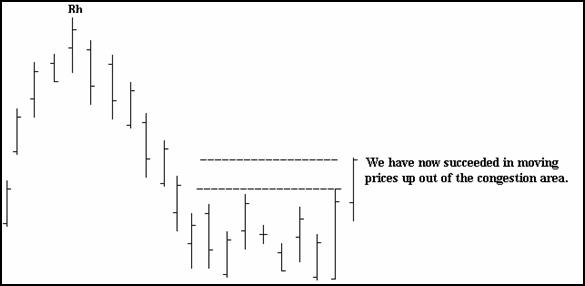

In order to maintain the momentum, we may have to place a few more buy orders

above the market, but we don't mind. We know there are plenty of orders bunched

above the high point. These buy orders will help us fill our liquidating sell

orders when it's time for us to make a hasty exit.

Who has placed the buy orders above the market? The outsiders, of course. They are made up of two groups. One group are those who went short sometime after the high was made, and feel that above the high point is all they are willing to risk. The other group are those outsiders who feel that if the market takes out that high, they want to be long.

Because of the action of our above-the-market bidding, accompanied by the action of other inside traders and day traders, the market begins to make a strong move up. The move up attracts the attention of others, and the market begins to move up even more because of new buying coming into the market.

This kind of move has nothing whatsoever to do with supply and demand. It is purely contrived and engineered.

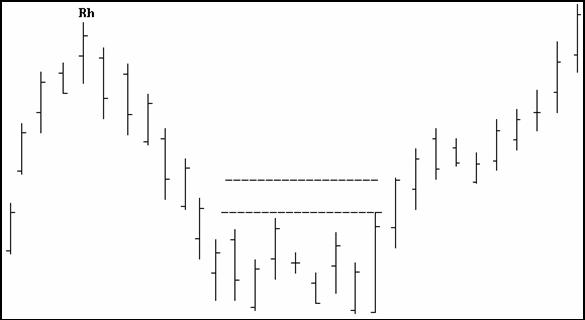

Once the market nears the high, practically everyone wants in on this “miraculous” move in the market. Unless there is strong buying by the outsiders, the market will fail at or shortly after reaching the high. This is known as a buying climax.

What will cause this failure? Selling. By whom? By us as big operators, and all

the other insiders who are anxious to take profits. At the very least, the

market will make some sort of intraday hesitation shortly after the high is

reached.

If there is enough buying to overcome all the selling, the market will continue up. If not, the insiders will have a wonderful time selling the market short, especially those who know this was an engineered move. NOTE: DON’T THINK FOR ONE MOMENT THAT THERE IS NOT COLLUSION BY INSIDERS TO MANIPULATE PRICES.

What will happen is that not only will selling be done for purposes of liquidation, but also for purposes of reversing position and going short. This means the selling at the buying climax may be close to triple the amount it would normally be if there were only profit taking.

Why triple? Because if prices were engineered upward by a large operator

whose real intention is to sell, he will need to sell one set of contracts to

liquidate all of his buying, and perhaps double that number in order to get

short the amount of contracts he originally intended to sell.

The buying from the outsiders will have to overcome that additional selling.

Because of that fact, the charts will attest to a false breakout. Of course, the reverse scenario is true of a downside engineered move resulting in a false breakout to the downside.

WARNING: MOVING THE MARKET AS SHOWN IN THE PREVIOUS EXAMPLE IS NOT SOMETHING THE AVERAGE TRADER SHOULD ATTEMPT!

It is very important to realize what may be happening when a market approaches a Ross Hook after having been in a congestion area for awhile. The prior pages have illustrated this concept.

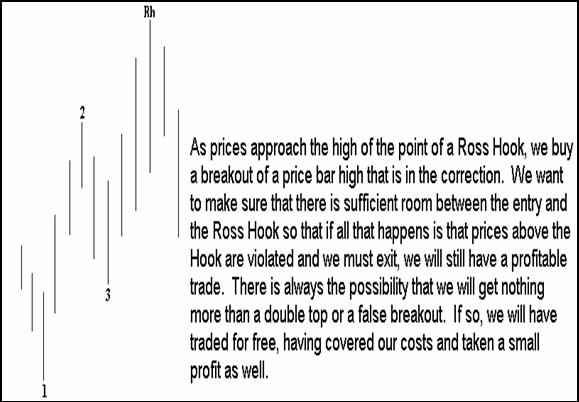

With the preceding information in mind, let's see how to accomplish the Trader's Trick.

On the chart above the Rh is the high. There were two price bars following the high: one is the bar whose failure to move higher created the Hook, and the other is one that simply furthered the depth of the correction.

Let’s look at that again by breaking it down in detail in an example.

Following the high is a bar that fails to have a higher high. This failure

creates the Ross Hook, and is the first bar of correction. If there is

sufficient room to cover costs and take a small profit in the distance between

the high of the correcting bar and the point of the Hook, we attempt to buy a

breakout of the high of the bar that created the Hook, i.e., the first bar of

correction. If the high of the first bar of correction is not taken out, i.e.,

violated, we wait for a second bar of correction.

Once the second bar of correction is in place, we attempt to buy a violation of its high, again provided that there is sufficient room to cover costs and take a profit based on the distance prices have to travel between our entry point and the point of the Hook.

If the high of the second bar of correction is not violated, we will attempt to buy a violation the high of a third bar of correction provided there is sufficient room to cover costs and take a profit based on the distance prices have to move between our entry point and the point of the Hook. Beyond three bars in the correction, we will cease in our attempt to buy a breakout of the correction highs.

What if the fourth bar did as pictured on the left? As long as prices are moving back up in the direction of the trend that created the Ross Hook, and as long as there is sufficient room for us to cover costs and take a profit, we will buy a breakout of the high of any of the three previous correction bars. In the example, if we were able to enter before prices violated the high of the second bar of correction, we would enter on a violation of the high of the second correcting price bar. If not, and there is still room to cover and profit from a violation of the first correcting price bar, we would enter there. Additionally, we could choose to enter on a takeout of the high of the latest price bar as shown by the double arrow, even if it gaps past one of the correction bar highs.

REMINDER: ONCE THERE ARE MORE THAN THREE BARS OF CORRECTION, WE NO LONGER ATTEMPT TO ENTER A TRADE. THE MARKET MUST BEGIN TO MOVE TOWARD THE HOOK AT THE TIME OF OR BEFORE A FOURTH BAR IS MADE.

Although not shown, the exact same concept applies to Ross Hooks formed at the end of a down move.

Risk management is based upon the expectation that prices will go up to at least test the point of the Hook. At that time, we will take, or already have taken some profit and have covered costs.

We are now prepared to exit at breakeven, at the very worst, on the remaining contracts. Barring any horrible slippage, the worst we can do is having to exit the trade with some sort of profit for our efforts.

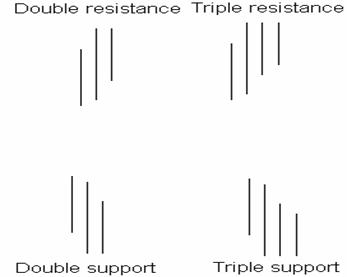

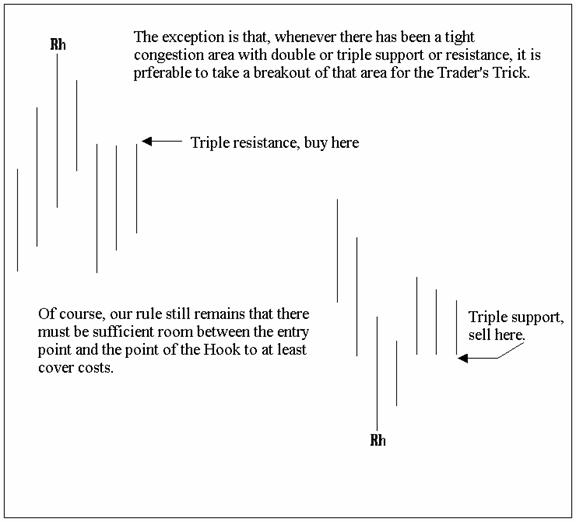

We usually limit the Trader's Trick to no more than three bars of correction following the high of the bar that is the point of the Hook. However, there is an important exception to this rule. The next chart shows the use of double or triple support and resistance areas for implementing the Trader's Trick.

Please realize that “support” and “resistance” on an intraday chart does not have the usual meaning of those terms when applied to the overall supply and demand in the market place. What is referred to here is given in the following four examples:

Any time a business can consistently make profits, that business is going to

prosper. Add to that profit the huge amount of money made on the trades that

take off and never look back, and it’s readily apparent that enormous profits

are available from trading.

The management method we use shows why it is so important to be properly

capitalized. Size in trading helps enormously.

The method also shows why, if we are undercapitalized (most traders are), we must be patient and gradually build our account by taking profits quickly when they are there.

If you are not able to tend to your own orders intraday electronically or on

the Internet, it may be well worth your while to negotiate with a broker who

will execute your trading plan for you. There are brokers who will do this, and

you may be surprised to find that there are some who will perform such service

at reasonable prices if you trade regularly.

When we are trading using the Trader’s Trick, we don’t want to be filled on a

gap opening beyond our desired entry price unless there is sufficient room for

us to still cover costs and take a profit. Can you grasp the logic of that? The

reason is that we have no way of knowing whether a move toward a breakout is

real or not. If it is engineered, the market will move forward to the point of

taking out the order accumulations and perhaps a few ticks more. Then the market

will reverse with no follow through in the direction of the breakout. As long as

we have left enough room between our entry point and the point where orders are

accumulated to take care of costs and a profit, we will do no worse than

breakeven. Usually, we will also have a profit to show for any remaining

contracts, however small.

If the move proves to be real (not engineered), then the market will give us a

huge reward relative to our risk and costs. Remember, commission and time are

our only real investment in the trade if it goes our way.

The important understanding that we need to have about the Trader’s Trick is that by taking entry into a market at the correct point, we can neutralize the action by the insiders. We can be right and earn something for our efforts should the breakout prove to be false.

Some breakouts will be real. The fundamentals of the market ensure that. When those breakouts happen, we will be happy, richer traders.

With proper money management, we can earn something for our efforts even if the breakout proves to be false.

IDENTIFYING CONGESTION

One of the concepts every trader must learn is how to know when prices are in congestion. There are a few rules for the early discovery of this ever important price action, and they are explained in detail in this chapter.

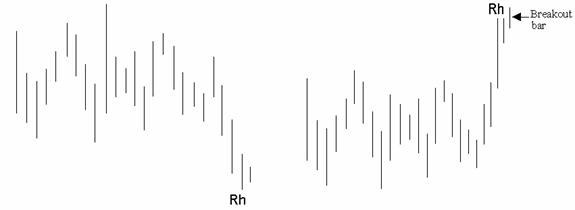

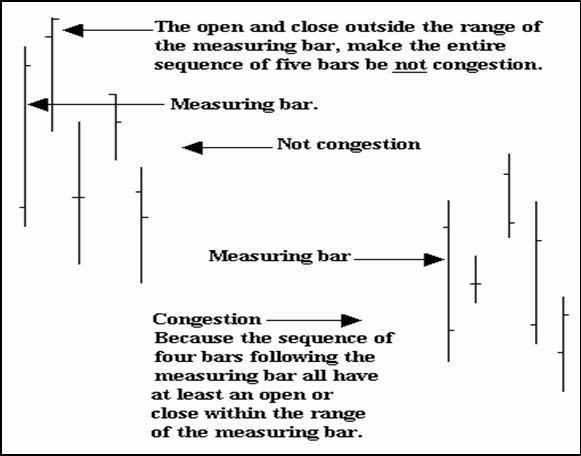

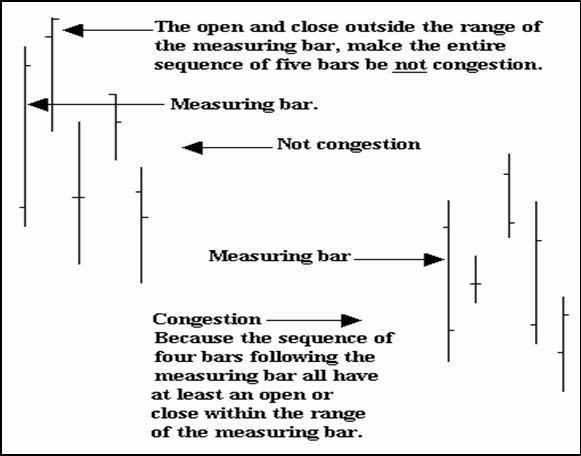

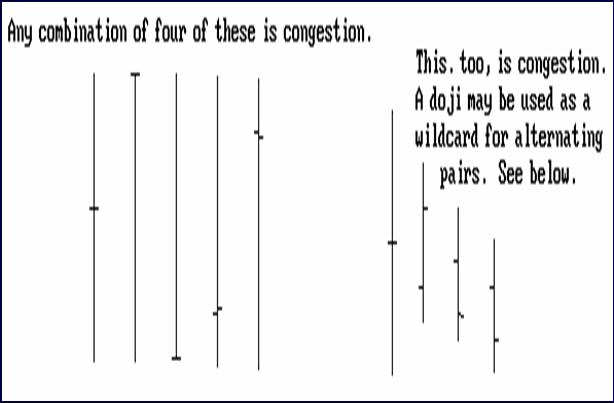

RULE: ANY TIME PRICES OPEN OR CLOSE ON FOUR CONSECUTIVE BARS, WITHIN THE CONFINES OF THE RANGE OF A “MEASURING BAR,” YOU HAVE CONGESTION. THIS IS REGARDLESS OF WHERE THE HIGHS AND LOWS MAY BE LOCATED. A “MEASURING BAR” BECOMES SUCH BY VIRTUE OF ITS PRICE RANGE CONTAINING THE OPENS OR CLOSES OF AT LEAST 3 OF 4 SUBSEQUENT PRICE BARS.

Closely and carefully study this chart again. Congestion can be very subtle in appearance. Often the difference between congestion or trend is the positioning of a single open or close.

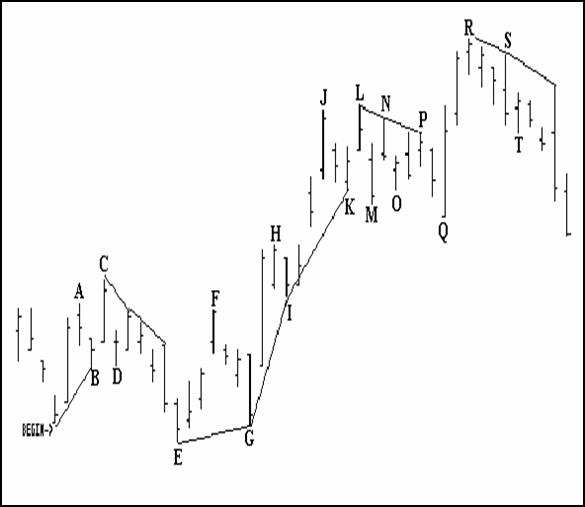

To further demonstrate this concept, let’s first look at the combination of points “K” through “M” on the chart below. Even though “M” closed below the range of the measuring bar “J,” the fact that “L” made a new high and then closed, dropping back into the Trading Range of “J”, tells us that prices are still in congestion. This will be explained on the following pages. In addition, we now have congestion by virtue of alternating bars, which will also be discussed next.

ANY TIME PRICES ARE NOT MAKING HIGHER HIGHS AND HIGHER LOWS, OR LOWER

HIGHS AND LOWER LOWS, AND WE CAN SEE FOUR ALTERNATING BARS, AT TIMES COUPLED

WITH INSIDE BARS AND AT TIMES COUPLED WITH DOJIS, WE HAVE CONGESTION.

ALTERNATING BARS ARE ONES WHERE PRICES OPEN LOWER AND CLOSE HIGHER ON ONE BAR, AND OPEN HIGHER AND CLOSE LOWER ON THE NEXT.

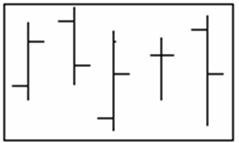

Inside bars look like this:

Doji Bars look like this:

Below are more Doji bars. The open and close are at the same price or very near to the same price, yielding a bar that looks like this:

A combination of alternate close-high-open-low, close-low-open-high pairs is congestion.

“Pointy” places made when the market is in congestion are not Ross Hooks. If a trend has been defined within congestion, you now have a trend, and any subsequent pointy place is a Ross Hook.

The first bar of the congestion may very well be the last bar of what had been a trend. A congestion may look similar to any of the following, as long as it consists of four or more bars. Study these formations carefully:

CONGESTIONS:

Frequently congestion will start or end with a doji. Frequently congestion will

begin or end with a long bar move, or a gap.

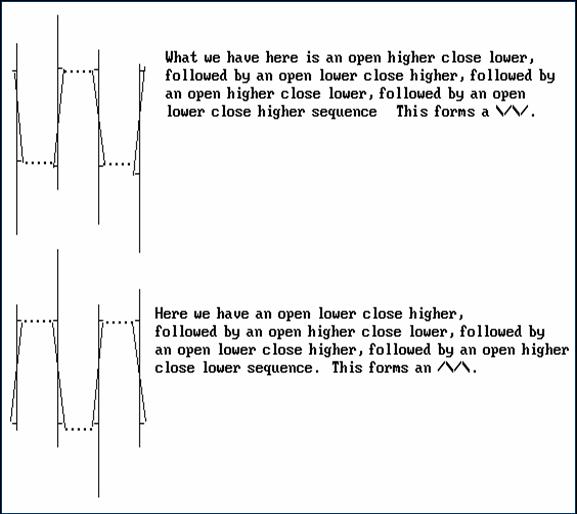

Another way to identify congestion is when you see /\/\ or \/\/ on the chart.

The smallest possible number of bars that can make up this formation is four. Let’s see how this can be done.

In reality, we may get something that looks more like the following:

If we were to get a formation that looked like the following, the Ross Hook would be as marked. If that Hook is taken out, we would want to be long prior to the violation. Notice that the bar that created the Ross Hook was the last bar of the trend and the first bar of the congestion.

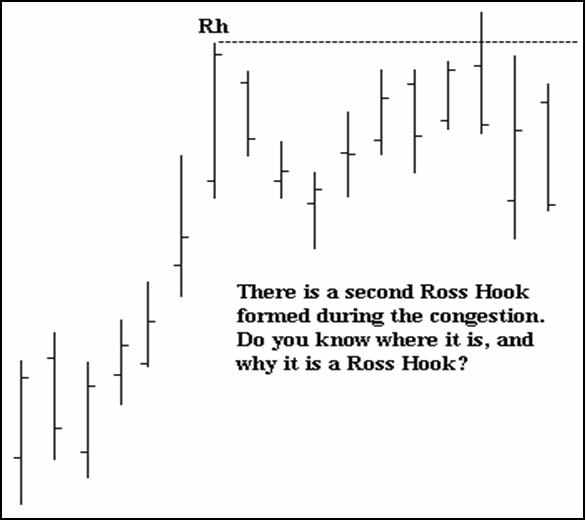

Now, let’s see if you’re really getting this. Assume that an established trend is in effect, with prices having trended up from much lower. We’ve changed the chart a bit, so pay attention.

The Ross Hook is as marked below.

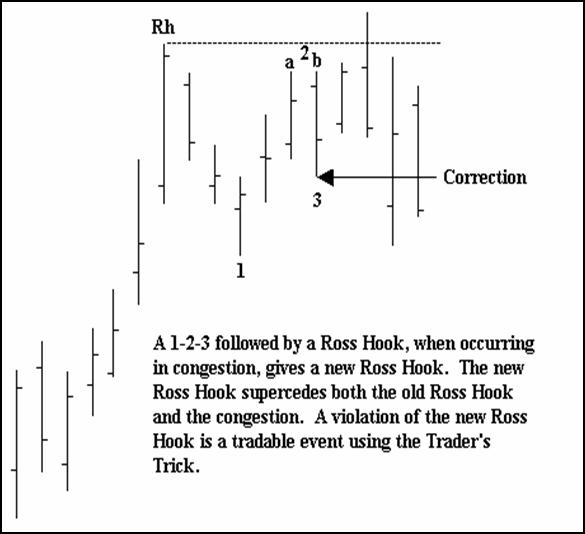

Note: A 1-2-3 FOLLOWED BY A BREAKOUT OF THE #2 POINT THAT SUBSEQUENTLY RESULTS IN A ROSS HOOK, SUPERCEDES ANY CONGESTION OR PREVIOUS ROSS HOOK. QUITE OFTEN, SUCH A SERIES OF PRICE BAR OCCURRENCES WILL BE THE WAY PRICES EXIT A CONGESTION AREA, I.E, A 1-2-3 FORMATION WITHIN A CONGESTION AREA, A BREAKOUT OF THE #2 POINT, FOLLOWED BY A ROSS HOOK .

The price bar labeled “b” made a new local low. The take out by prices of the local double resistance, “a” and “b,” is a significant event. “a” and “b”, together, constitute the number two point of a 1-2-3 low occurring in congestion. The low of bar “b” is also a #3 point, and two bars later we get the highest high of the congestion, which is also an Rh.

The new Ross Hook represents an even more significant breakout point. Combined with the old Rh, there is significant resistance. Within a few ticks of each other, the two constitute a double top. If prices take them both out, we would normally expect a relatively longer term, strong move up.

We use the term “relatively” here, because the intensity and the duration of the move would be relative to the time frame in which the price bars were made. Obviously such a move on a one minute chart would hardly compare with an equivalent move on a daily chart. While we are looking at the chart, there is something else of importance to notice. Prices retreated from the resistance point, thereby creating the second Ross Hook. This represented a failure to break out. This failure is why Reverse Ross hooks are important. When prices retreat from a resistance point and move towards a RRh, it may indicate that the only reason the resistance point was challenged or even violated was because prices were “engineered” in that direction by some party or parties capable of moving prices for their own benefit. The anticipation is that prices next may move in the opposite direction toward a violation of the RRh.

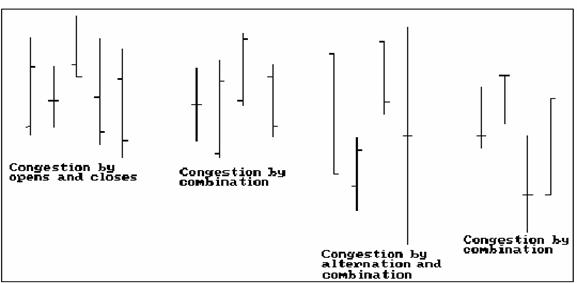

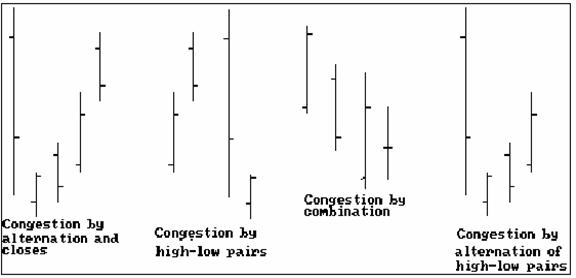

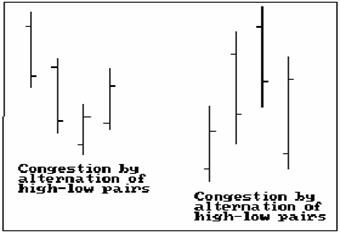

Now, go through a brief review of the various congestions. All of the three following conditions that define congestion must occur without consistently making higher highs or lower lows.

Congestion by Opens/Closes: Four consecutive closes or opens within the range of a measuring bar. If opens are used, there can be no correcting bars before or coincident with the bar in which the open is used.

Congestion by Combination: A series of four consecutive dojis, or at least one doji and any three alternating bars. The doji is a wild card and can be used to alternate with any other bar. If there are three non-doji bars, one of them must alternate high-to-low with the other two non-doji bars.

Congestion by Alternation: A series of four consecutive

alternating open high - close low, open low - close high bars in any sequence.

This definition includes Congestion by High/Low pairs.