|

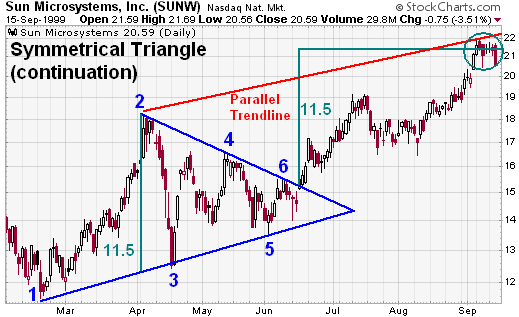

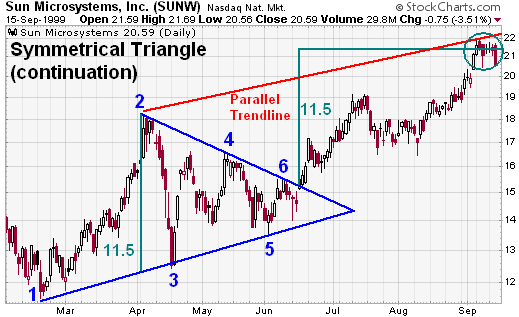

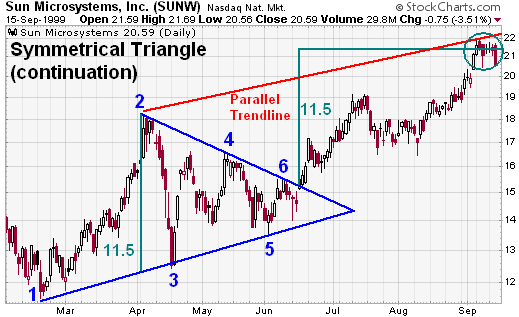

Symmetrical Triangle (Continuation) |

The symmetrical triangle, which can also be referred to as a coil, usually

forms during a trend as a continuation pattern. The pattern contains at least

two lower highs and two higher lows. When these points are connected, the lines

converge as they are extended and the symmetrical triangle takes shape. You

could also think of it as a contracting wedge, wide at the beginning and

narrowing over time.

While there are instances when symmetrical triangles mark important trend

reversals, they more often mark a continuation of the current trend. Regardless

of the nature of the pattern, continuation or reversal, the direction of the

next major move can only be determined after a valid breakout. We will examine

each part of the symmetrical triangle individually and then provide an example

with Consesco.

- Trend: In order to qualify as a continuation pattern, an

established trend should exist. The trend should be at least a few months old

and the symmetrical triangle marks a consolidation period before continuing

after the breakout.

- 4 points: At least 2 points are required to form a trendline and

two trendlines are required to form a symmetrical triangle. Therefore, a

minimum of 4 points are required to begin considering a formation as a

symmetrical triangle. The second high (4) should be lower than the first (2)

and the upper line should slope down. The second low (3) should be higher than

the first (1) and the lower line should slope up. Ideally, the pattern will

form with 6 points (3 on each side) before a breakout occurs.

- Volume: As the symmetrical triangle extends and the trading range

contracts, volume should start to diminish. This refers to the quiet before

the storm, or the tightening consolidation before the breakout.

- Duration: The symmetrical triangle can extend for a few weeks or

many months. If the pattern is less than 3 weeks, it is usually considered a

pennant. Typically, the time duration is about 3 months.

- Breakout Timeframe: The ideal breakout point occurs 1/2 to 3/4 of

the way through the pattern's development or time-span. The time-span of the

pattern can be measured from the apex (convergence of upper and lower lines)

back to the beginning of the lower trendline (base). A break before the 1/2

way point might be premature and a break too close to the apex may be

insignificant. After all, as the apex approaches, a breakout must occur

sometime.

- Breakout Direction: The future direction of the breakout can only

be determined after the break has occurred. Sound obvious enough, but

attempting to guess the direction of the breakout can be dangerous. Even

though a continuation pattern is supposed to breakout in the direction of the

long-term trend, this is not always the case.

- Breakout Confirmation: For a break to be considered valid, it

should be on a closing basis. Some traders apply a price (3% break) or time

(sustained for 3 days) filter to confirm validity. The breakout should occur

with an expansion in volume, especially on upside breakouts.

- Return to Apex: After the breakout (up or down), the apex can turn

into future support or resistance. The price sometimes returns to the apex or

a support/resistance level around the breakout before resuming in the

direction of the breakout.

- Price Target: There are two methods to estimate the extent of the

move after the breakout. First, the widest distance of the symmetrical

triangle can be measured and applied to the breakout point. Second, a

trendline can be drawn parallel to the pattern's trendline that slopes (up or

down) in the direction of the break. The extension of this line will mark a

potential breakout target.

Edwards and Magee suggest that roughly 75% of symmetrical triangles are

continuation patterns and the rest mark reversals. The reversal patterns can be

especially difficult to analyze and often have false breakouts. Even so, we

should not anticipate the direction of the breakout, but rather wait for it to

happen. Further analysis should be applied to the breakout by looking for gaps,

accelerated price movements and volume for confirmation. Confirmation is

especially important for upside breakouts.

Prices sometimes return to the breakout point of apex on a reaction move

before resuming in the direction of the breakout. This return can offer a second

chance to participate with a better reward to risk ratio. Potential reward price

targets found by measurement and parallel trendline extension are only meant to

act as rough guidelines. Technical analysis is dynamic and ongoing assessment is

required. In the first example above, SUNW may have fulfilled its target (42) in

a few months, but the stock gave no sign of slowing down and advanced above 100

in the following months.

Conseco formed a rather large symmetrical triangle over a 5-month period

before breaking out on the downside.

- The stock declined from 50 in Mar-98 to 22 in Oct-98 before beginning to

firm and consolidate. The low at 22 probably was an over-reaction, but the

long-term trend was down and established for almost a year.

- After the first 4 points formed, the lines of the symmetrical triangle

were draw. The stock traded within the boundaries for another 2 months to form

the last 2 points.

- After the gap up from point 3 to point 4, volume slowed over the next few

months. There was some increase in volume in late June, but the 60-day SMA

remained in a downtrend as the pattern took shape.

- The red square marks the ideal breakout time-span from 50% to 75% of the

pattern. The breakout occurred a little over 2 weeks later, but proved valid

nonetheless. While it is preferable to have an ideal pattern develop, it is

also quite rare.

- After points 5 and 6 formed, the price action moved to the lower boundary

of the pattern. Even at this point, the direction of the breakout was still a

guess and its was prudent to wait. The break occurred with an increase in

volume and accelerated price decline. Chaikin Money Flow declined past -30%

and volume exceeded the 60-day SMA for an extended period.

- After the decline from 29 1/2 to 25 1/2, the stock rebounded, but failed

to reach potential resistance from the apex. The weakness of the reaction

rally foreshadowed the sharpness of the decline that followed.

- The widest point on the pattern extended 10 1/2 points. With a break of

support at 29 1/2, the measured decline was estimated to around 19. By drawing

a trendline parallel to the upper boundary of the pattern, the extension

estimates a decline to around 20.