A price channel is a continuation pattern that slopes up or down and is bound

by an upper and lower trendline. The upper trendline marks resistance and the

lower trendline marks support. Price channels with negative slopes (down) are

considered bearish and those with positive slopes (up) bullish. For explanatory

purposes, a "bullish price channel" will refer to a channel with positive slope

and a "bearish price channel" to a channel with negative slope.

- Main trendline: It takes at least two points to draw the main

trendline. This line sets the tone for the trend and the slope. For a bullish

price channel, the main trendline extends up and at least two reaction lows

are required to draw it. For a bearish price channel, the main trendline

extends down and at least two reaction highs are required to draw it.

- Channel line: The line drawn parallel to the main trendline is

called the channel line. Ideally, the channel line will be based off of two

reaction highs or lows. However, after the main trendline has been

established, some analysts draw the parallel channel line using only one

reaction high or low. The channel line marks support in a bearish price

channel and resistance in a bullish price channel.

- Bullish price channel: As long as prices advance and trade within

the channel, the trend is considered bullish. The first warning of a trend

change occurs when prices fall short of channel line resistance. A subsequent

break below main trendline support would provide further indication of a trend

change. A break above channel line resistance would be bullish and indicate an

acceleration of the advance.

- Bearish price channel: As long as prices decline and trade within

the channel, the trend is considered bearish. The first warning of a trend

change occurs when prices fail to reach channel line support. A subsequent

break above main trendline resistance would provide further indication of a

trend change. A break below channel line support would be bearish and indicate

an acceleration of the decline.

- Scaling: Even though it is a matter of personal preference,

trendlines seem to match reaction highs and lows best when semi-log scales are

used. Semi-log scales reflect price movements in percentage terms. A move from

50 to 100 will appear the same distance as a move from 100 to 200.

In a bullish price channel, some traders look to buy when prices reach main

trendline support. Conversely, some traders look to sell (or short) when prices

reach main trendline resistance in a bearish price channel. As with most price

patterns, other aspects of technical analysis should be used to confirm signals.

Because technical analysis is just as much art as it is science, there is

room for flexibility. Even though exact trendline touches are ideal, it is up to

each individual to judge the relevance and placement of both the main trendline

and the channel line. By that same token, a channel line that is exactly

parallel to the main trendline is ideal.

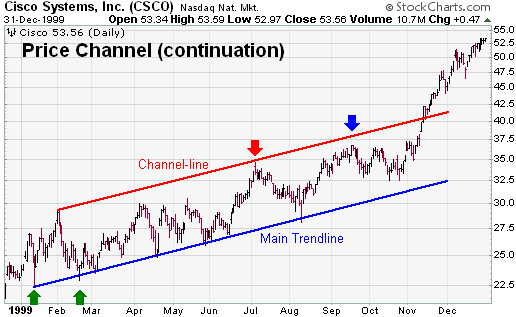

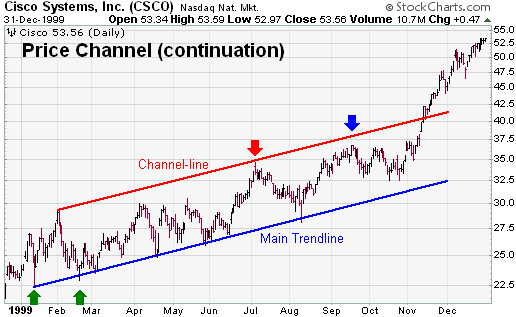

CSCO provides an example of an 11-month bullish price channel that developed

in 1999.

- Main trendline: The January, February and March reaction lows

formed the beginning of the main trendline. Subsequent lows in April, May and

August confirmed the main trendline.

- Channel line: Once the main trendline was in place, the channel

line beginning from the January high was drawn. A visual assessment reveals

that these trendlines look parallel. More precise analysts may want to test

the slope of each line, but a visual inspection is usually enough to ensure

the "essence" of the pattern.

- Bullish price channel: Subsequent touches along the main trendline

offered good buying opportunities in mid April, late May and mid August.

- The stock did not reach channel line resistance until July (red arrow) and

this marked a significant reaction high.

- The September high (blue arrow) fell short of channel line resistance, but

only by a small margin that was probably insignificant.

- The break above channel line resistance in Dec-99 marked an acceleration

of the advance. Some analysts might consider the stock overextended after this

move, but the advance was powerful and the trend never turned bearish. Price

channels will not last forever, but the underlying trend remains in place

until proven otherwise.