|

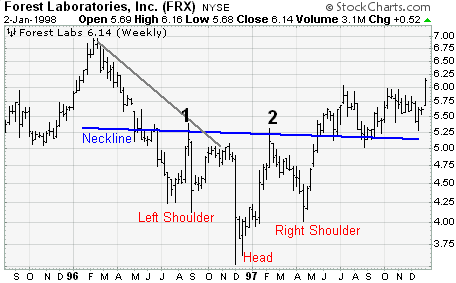

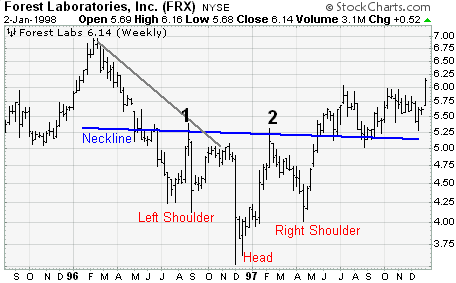

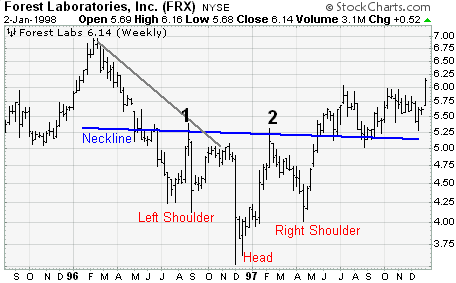

Head

and Shoulders Bottom (Reversal) |

The head and shoulders bottom is sometimes referred to as an inverse head and

shoulders. The pattern shares many common characteristics with its comparable

partner, but relies more on volume patterns for confirmation.

As a major reversal pattern, the head and shoulders bottom forms after a

downtrend, and its completion marks a change in trend. The pattern contains

three successive troughs with the middle trough (head) being the deepest and the

two outside troughs (shoulders) being shallower. Ideally, the two shoulders

would be equal in height and width. The reaction highs in the middle of the

pattern can be connected to form resistance, or a neckline.

The price action forming both head and shoulders top and head and shoulders

bottom patterns remains roughly the same, but reversed. The role of volume marks

the biggest difference between the two. Generally speaking, volume plays a

larger role in bottom formations than top formations. While an increase in

volume on the neckline breakout for a head and shoulders top is welcomed, it is

absolutely required for a bottom. We will look at each part of the pattern

individually, keeping volume in mind, and then put the parts together with some

examples.

- Prior Trend: It is important to establish the existence of a prior

downtrend for this to be a reversal pattern. Without a prior downtrend to

reverse, there cannot be a head and shoulders bottom formation.

- Left Shoulder: While in a downtrend, the left shoulder forms a

trough that marks a new reaction low in the current trend. After forming this

trough, an advance ensues to complete the formation of the left shoulder (1).

The high of the decline usually remains below any longer trendline, thus

keeping the downtrend intact.

- Head: From the high of the left shoulder, a decline begins that

exceeds the previous low and forms the low point of the head. After making a

bottom, the high of the subsequent advance forms the second point of the

neckline (2). The high of the advance sometimes breaks a downtrend line, which

calls into question the robustness of the downtrend.

- Right Shoulder: The decline from the high of the head (neckline)

begins to form the right shoulder. This low is always higher than the head and

usually in line with the low of the left shoulder. While symmetry is

preferred, sometimes the shoulders can be out of whack and the right shoulder

will be higher, lower, wider or narrower. When the advance from the low of the

right shoulder breaks the neckline, the head and shoulders reversal is

complete.

- Neckline: The neckline forms by connecting reaction highs 1 and 2.

Reaction high 1 marks the end of the left shoulder and the beginning of the

head. Reaction high 2 marks the end of the head and the beginning of the right

shoulder. Depending on the relationship between the two reaction highs, the

neckline can slope up, slope down or be horizontal. The slope of the neckline

will affect the pattern's degree of bullishness: an upward slope is more

bullish than downward slope.

- Volume: While volume plays an important role in the head and

shoulders top, it plays a crucial role in the head and shoulders bottom.

Without the proper expansion of volume, the validity of any breakout becomes

suspect. Volume can be measured as an indicator (OBV, Chaikin Money Flow) or

simply by analyzing the absolute levels associated with each peak and trough.

Volume levels during the first half of the pattern are less important that in

the second half. Volume on the decline of the left shoulder is usually pretty

heavy and selling pressure quite intense. The intensity of selling can even

continue during the decline that forms the low of the head. After this low,

subsequent volume patterns should be watched carefully to look for expansion

during the advances.

The advance from the low of the head should show and increase in volume and/or

better indicator readings (e.g. CMF > 0 or strength in OBV). After the

reaction high forms the second neckline point, the right shoulder's decline

should be accompanied with light volume. It is normal to experience

profit-taking after an advance. Volume analysis helps distinguish between

normal profit-taking and heavy selling pressure. With light volume on the

pullback, indicators like CMF and OBV should remain strong. The most important

moment for volume occurs on the advance from the low of the right shoulder.

For a breakout to be considered valid, there needs to be an expansion of

volume on the advance and during the breakout.

- Neckline Break: The head and shoulders pattern is not complete and

the downtrend is not reversed until neckline resistance is broken. For a head

and shoulders bottom, this must occur in a convincing manner with an expansion

of volume.

- Resistance turned support: Once resistance is broken, it is common

for this same resistance level to turn into support. Often, the price will

return to the resistance break and offer a second chance to buy.

- Price Target: After breaking neckline resistance, the projected

advance is found by measuring the distance from the neckline to the bottom of

the head. This distance is then added to the neckline to reach a price target.

Any price target should serve as a rough guide and other factors should be

considered as well. These factors might include previous resistance levels,

Fibonacci retracements or long-term moving averages.

Alaska Air (ALK) formed a head and shoulders bottom with a downward sloping

neckline. Key points include:

- The stock began a downtrend in early July and declined from 60 to 26.

- The low of the left shoulder formed with a large spike in volume on a

sharp down day (red arrows).

- The reaction rally at around 42 1/2 formed the first point of the neckline

(1). Volume on the advance was respectable with many gray bars exceeding the

60-day SMA. (Note: gray bars denote advancing days, black bars declining days

and the thin red horizontal is the 60-day SMA).

- The decline from 42 1/2 to 26 (head) was quite dramatic, but volume did

not get out of hand. Chaikin Money Flow was mostly positive when the lows

around 26 were forming.

- The advance off of the low saw a large expansion of volume (green oval)

and gap up. The strength behind the move indicated that a significant low

formed.

- After the reaction high around 39, the second point of the neckline could

be drawn (2).

- The decline from 39 to 33 occurred on light volume until the final two

days, when volume reached its highest point in a month. Even though there are

two long black (down) volume bars, these are surrounded by above-average gray

(up) volume bars. Also notice how trendline resistance near 35 became support

around 33 on the price chart.

- The advance off of the low of the right shoulder occurred with above

average volume. Chaikin Money Flow was at its highest levels and surpassed

+20% shortly after neckline resistance was broken.

- After breaking neckline resistance, the stock returned to this newfound

support with a successful test around 35 (green arrow).

AT&T (T) formed a head and shoulders bottom with a flat neckline. The

shoulders are a bit shallow, but the neckline and head are well pronounced. Key

points include:

- The stock established a 6-month downtrend with the trendline extending

down from Mar-98.

- After a head fake above the trendline in late June, the stock fell from 66

to 50 with a sharp increase in volume to form the left shoulder.

- The rally to 61 met resistance from the trendline and the reaction high

became the first point of the neckline.

- The decline from 61 to 48 finished with a piercing pattern to form the low

of the head. Even though volume was heavy when the long black candlestick

formed, the subsequent reversal occurred on even higher volume. This reversal

was followed with a number of strong advances and up gaps. Also notice that

Chaikin Money Flow was above +10% when the low of the head formed.

- The advance from the low of the head broke above the trendline extending

down from Mar-98 and met resistance around 61. This reaction high formed the

second point of the neckline.

- The right shoulder was quite short and shallow. The low was recorded at 57

and Chaikin Money Flow remained above +10% the whole time. Support was found

from the trendline that offered resistance a few weeks earlier.

- The stock advanced sharply off of lows that formed the right shoulder and

volume increased three straight days (blue arrow). This is a bit early, but

volume remained just above average for the neckline breakout a few days later.

Also Chaikin Money Flow remained above +10% the whole time.

- After the break of neckline resistance, the stock tested this newfound

support twice while consolidating recent gains. The power arrived a few weeks

later with a strong move off support and a huge increase in volume. The stock

subsequently advanced from the low sixties to the low eighties.

Head and shoulder bottoms are one of the most common and reliable reversal

formations. It is important to remember that they occur after a downtrend and

usually mark a major trend reversal when complete. While it is preferable that

the left and right shoulders be symmetrical, it is not an absolute requirement.

Shoulders can be different widths as well as different heights. Keep in mind

that technical analysis is more an art than a science. If you are looking for

the perfect pattern, it may be a long time coming.

Analysis of the head and shoulders bottom should focus on correct

identification of neckline resistance and volume patterns. These are two of the

most important aspects to a successful read, and by extension a successful

trade. The neckline resistance breakout combined with an increase in volume

indicates an increase in demand at higher prices. Buyers are exerting greater

force and the price is being affected.

As seen from the examples, traders do not always have to chase a stock after

the neckline breakout. Many times, but certainly not always, the price will

return to this new support level and offer a second chance to buy. Measuring the

expected length of the advance after the breakout can be helpful, but don't

count on it for your ultimate target. As the pattern unfolds over time, other

aspects of the technical picture are likely to take precedent. Technical

analysis is dynamic and your analysis should incorporate aspects of the long,

medium and short term picture.