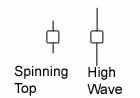

| Spinning Top and High Wave Candles |

CANDLES THAT

EXPRESS DOUBT AND CONFUSION

In a recent educational lesson we explored the "marubozu" candle. The

marubozu, as you may remember, is a long candlestick that lacks either

an upper or lower shadow (and in some cases has no shadows at all).

Here is an interesting question -- which candle is most opposite of the

marubozu? Since the marubozu can be either white or black, the correct

answer here cannot be another marubozu candle. Instead, in my mind,

opposite candles include both spinning tops and high waves.

I've provided you with an illustration of both of these candles below.

Why should these candles be considered

opposites relative to the marubozu? Well, when a marubozu candle occurs,

it shows a great deal of conviction on the part of the market. A black

marubozu portrays a very weak market in which the sellers are eager to

exit and willing to get out of their positions at almost any price.

Meanwhile, a white marubozu portrays the opposite situation, where

buyers are willing to pay higher and higher prices to enter the stock.

By contrast, spinning tops and high wave candles denote situations where

the market is having difficulty coming to a consensus on a security's

value. They portray a market in which uncertainty and indecision

prevail. Neither the buyers nor the sellers have a clear sense of which

direction the market will head. The forces of supply and demand are

equally balanced.

What is the difference between the spinning top and the high wave? In

the spinning top, the shadows are relatively small and the candle has a

very small range. When combined with low volume, traders may be

expressing disinterest.

A high wave candle, on the other hand, portrays a situation where there

is an active tug of war between the bulls and the bears. This candle

shows a market that has lost a clear sense of direction. If it occurs on

high volume, then it indicates the market's general confusion about the

direction prices are headed.

Below is a chart of Barrick Gold (ABX). The last several days of trading

show a spinning top immediately followed by a high wave candle. Volume

on both days was moderate. What the two candles indicate to me is

uncertainty on the part of traders as to which direction Barrick is

headed next.

Along with many other gold stocks, ABX recently broke down from an

Intermediate topping formation when it fell below $21. Since old support

often becomes new resistance, the stock has since encountered selling

pressure near $21. On the other hand, ABX also had strong support at $19

going back to a November consolidation. On the day of the high wave

candle, in one volatile day ABX came close to testing both support and

resistance!

|

Are the bulls or bears correct? Despite the choppy market, stochastics is on a buy signal. The trend-following MACD indicator is also about to give a buy signal on the daily chart. On the weekly chart (not shown here), MACD is still falling hard. What that suggests to me is that ABX may experience a countertrend rally, but one that may not carry very far.

As the old cliché goes -- "when in doubt, stay out." The spinning top and high wave candles express doubt and confusion on the part of the market when it comes to ABX. Until the situation is clear, swing traders should focus on stocks marked by less confusion