|

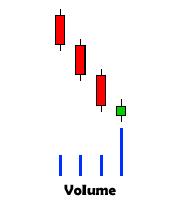

Above Average

Volume--a total daily volume of shares traded which is

greater than the average of the daily volumes over the

previous few days.

Examples: DWTI |

|

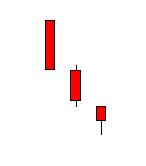

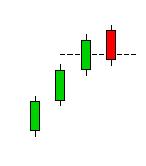

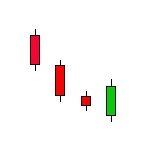

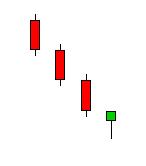

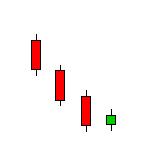

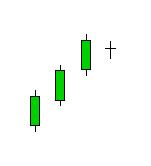

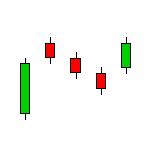

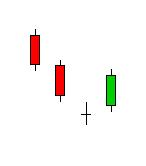

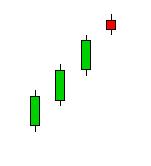

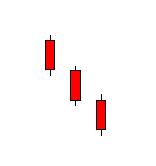

Advance Block

(Bearish)--a three candlestick pattern in which the

last two candlesticks show weakening upside

drive. |

|

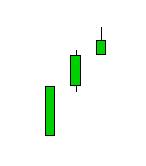

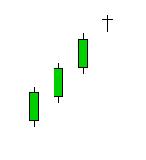

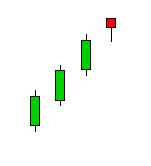

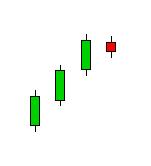

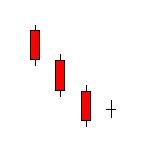

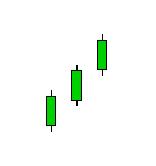

Advance Block

(Bullish)--a three candlestick pattern in which the

last two candlesticks show strengthening downside

drive. |

|

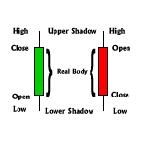

Candlestick

Lines--a traditional Japenese chart which consists of

a real body, representing the open and close, and upper and

lower shadows, representing the high and low of the

day. |

|

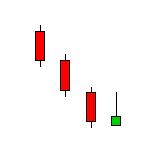

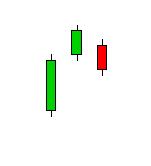

Dark-cloud

cover (Bearish)--a bearish reversal signal. In

an uptrend, a long green candlestick is followed by a long

red candlestick that opens above the prior green

candlestick's high. The second candlestick must close

well into the first candlestickís real body. |

|

Doji star

(Bearish)--a doji line which gaps from a long green

candlestick.

Examples: MCWS |

|

Doji star

(Bullish)--a doji line which gaps from a long red

candlestick. |

|

Engulfing

Pattern (Bearish)--a bearish engulfing pattern occurs

when selling pressure overwhelms buying pressure

reflected by long red real body engulfing a small green real

body in an uptrend. |

|

Engulfing

Pattern (Bullish)--a bullish engulfing pattern occurs

when buying pressure overwhelms selling pressure

reflected by long green real body engulfing a small red

realbody in an downtrend. |

|

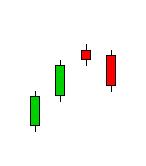

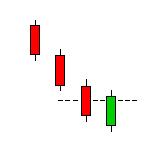

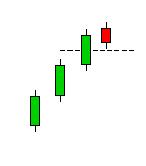

Evening Star

(Bearish)--a top reversal pattern where the first is a

tall real body, the second is a small real body (green

or red) which gaps high to form a star. The third

is a red candlestick which closes well into the first

session's green real body. |

|

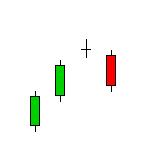

Evening Doji

Star (Bearish)--the same as an evening star except the

middle candlestick is a doji instead of a small real

body. |

|

Falling Three

(Bearish)--comprised of five candlesticks, a tall red

real body candlestick preceded three small green real bodies

which hold within the first session's range. Then a red

candlestick closes at a new low. |

|

Hammer

(Bullish)--a bottoming candlestick line where a small

real body (red or green) at the top of the trading range

with a very long shadow with little or no upper shadow.

Examples: FSCO |

|

Hanging man

(Bearish)--a small real body (green or red) with

little or no upper shadow. It is a bearish reversal

pattern when appearing during an uptrend.

Examples: PFSW |

|

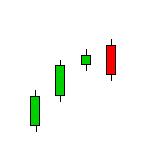

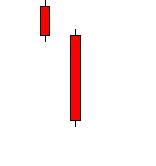

Harami

(Bearish)--a two candlestick pattern in which a small

real body holds within the prior session's unusually large

real body. The harami implies that the preceding

trend is getting ready to conclude. |

|

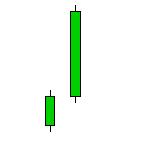

Harami

(Bullish)--a two candlestick pattern in which a small

real body holds within the prior session's unusually large

real body. The harami implies that the preceding

trend is getting ready to conclude.

Examples: PLCM, CPTL, ABY |

|

Harami Cross

(Bearish)--a harami with a doji on the second session

instead of a small real body. |

|

Harami Cross

(Bullish)--a harami with a doji on the second session

instead of a small real body. |

|

Inverted

Hammer (Bullish)--a candlestick that has a long upper

shadow and a small real body at the lower end of the

session. It is a bullish bottom reversal signal.

Examples: DWTI |

|

Long Green

Real Body (Bearish)--a relatively long real body with

closing price far above the opening price. |

|

Long Red Real

Body (Bullish)--a relatively long real body with

closing price far Below the opening price.

Examples: FCS, CBCX, AHAA, ASDV |

|

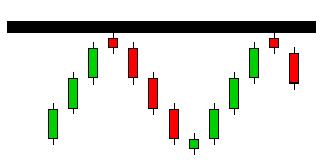

Major Price

Resistance--an area of price where a stock hits

resistance, reverses direction, and then retests the same

general area of resistance a second time.

Examples: PFSW |

|

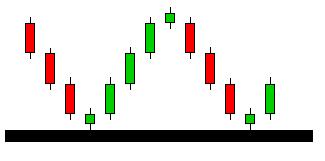

Major Price

Support--an area of price where a stock hits support,

reverses direction, and then retests the same general area of

support a second time. |

|

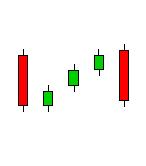

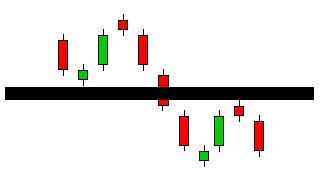

Mat-hold pattern

(Bearish)--a red candlestick is followed by a small

green real body which gaps lower. Then there are two

small green candlesticks which are followed by a bearish red

candlestick. |

|

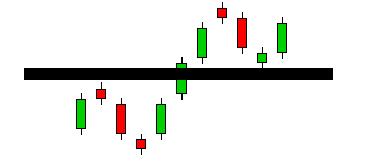

Mat-hold pattern

(Bullish)--a green candlestick is followed by a small

red real body which gaps higher. Then there are two

small red candlesticks which are followed by a strong green

candlestick |

|

Minor Price

Resistance--an area of price which previously acted as

support, but now serves as price resistance.

Examples: USWB, HIG |

|

Minor Price

Support--an area of price which previously acted as

resistance, but now serves as price

support.

Examples: FCS, GSLI, CPTL, AHAA |

|

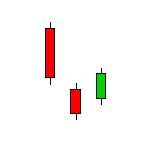

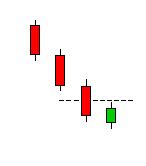

Morning Star

(Bullish)--a candlestick pattern where the first is a

long red real body, the second is a small real body (green or

red) which gaps lower to form a star. The third is a

green candlestick that closes well into the first session's

red real body. |

|

Morning

Doji Star (Bullish)--the same as a morning star except

the middle candlestick is a doji instead of a small real

body.

|

|

Moving Averages

(Simple)--calculates the average value of price over a

period of time. As the stock price changes each day, its

average price moves up and down. For example, the 10 Day

Simple Moving Average would be the sum of the price over the

past 10 days divided by 10. The average is called

'Moving' because each new day is added to the total while the

earliest date is removed from the

calculation. |

|

Piercing

Pattern (Bullish)--a long red candlestick is followed

by a gap lower during the next session. This session

finishes as a bullish green real body which closes more than

halfway into the previous sessions real body. |

|

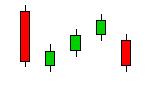

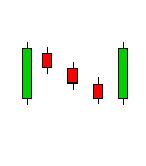

Rising Three

(Bullish)--comprised of five candlesticks, a tall

green real body candlestick preceded three small red

real bodies which hold within the first session's range. Then

a green candlestick closes at a new high. |

|

Shooting Star

(Bearish)--a candlestick with a long upper shadow with

little, or no lower shadow, and a small real body near the

lows of the session. |

|

Star

(Bearish)--a small real body which gaps away from the

previous long body. |

|

Star

(Bullish)--a small real body which gaps away from the

previous long body |

|

Tasuki Gap

(Bearish)--a red real body gaps lower followed by a

green candlestick of about the same size, which opens in the

redís real body, and then closes above the redís real

body. |

|

Tasuki Gap

(Bullish)--a green real body gaps higher followed by a

red candlestick of about the same size, which opens in the

greenís real body, and then closes below the greenís real

body. |

|

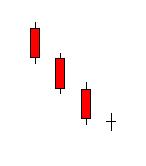

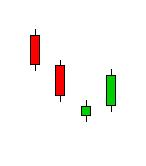

Three Crows

(Bullish)--three relatively long consecutive red

candlesticks which close near or on their

lows. |

|

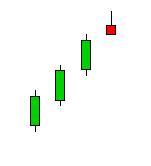

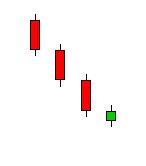

Three White

Soldiers (Bearish)--three relatively long consecutive

green candlesticks which close near or on their highs

Examples: HIG, ACS |

|

Thrusting

Line (Bearish)--a red candlestick which closes in the

prior green's real body, but still above the middle of the

prior session's real body. |

|

Thrusting

Line (Bullish)--a green candlestick which closes in

the prior red's real body, but still below the middle of the

prior session's real body.

Examples: GSLI |