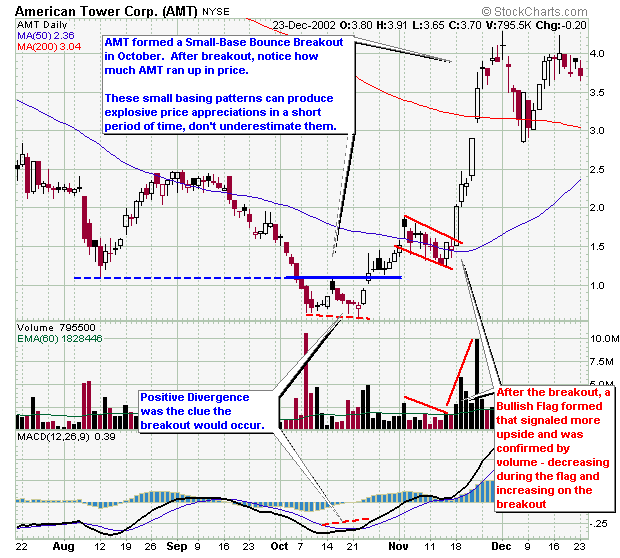

There is a misperception among many traders that after a stock has been in a long downtrend, it needs to form a nice long base in order for it to be a good long candidate. However, this is not the case, stocks can form very short bases of a few weeks and offer huge upside potential. The base of these patterns is short term, and definate resistance line can be drawn that signals the trader to enter long once broken. Typically, these patterns also exhibit Positive Divergence which signals the stock is going to breakout. These short-term basing patterns sometimes resemble the letter W, where the resistance would be at the top of the middle hump (see the picture above). These types of patterns should not be ignored because they can produce huge upward price movements after breakout.

Below I've placed some examples of stocks that classify as Short-Term Base Breakouts.