Descending triangles are bearish biased patterns that are characterized

by a series of at least two lower highs along with a series of at least two

lows that stop or find support out at around the same price. The lower highs

can be connected with a downtrend line, while the lows can be connected with

horizontal or near horizontal line that forms the support area. Keep in mind

that descending triangles MUST have at least two minor highs forming the top

trendline and at least two minor lows forming the bottom. Many people

incorrectly identify descending triangles, for instance consider a pattern

that has 3 lower highs but only has 1 low – this is not a descending triangle

even though it might look exactly like one.

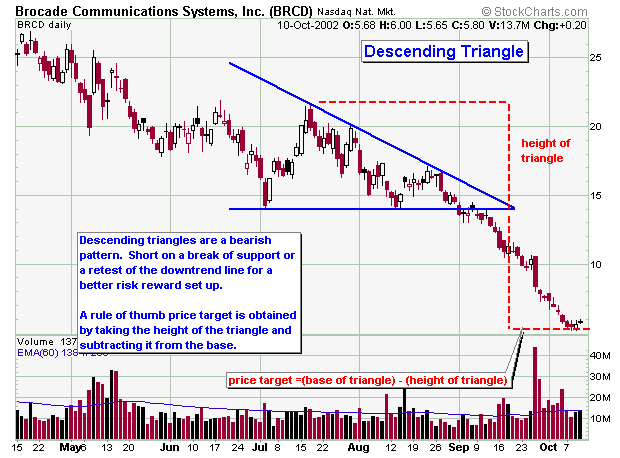

The volume tends to decrease during the formation of the pattern. A generic

price target can be calculated by measuring the height of the triangle and

subtracting it from the horizontal support line that forms the bottom of the

pattern.

Below are two tables of statistical information from the book “Encyclopedia

of Chart Patterns” by Thomas N Bulkowski

Statistics: based on a population of 689 examples in 500 stocks from 1991 - 1996.

| STATISTICAL DESCRIPTION |

STATISTICAL %

|

| Failure rate |

45%

|

| Failure rate if waited for downside breakout |

4%

|

| Average decline after downside breakout |

19%

|

| Most likely decline after downside breakout |

10 - 20%

|

| Average # that meet price target by height measurement |

67%

|

| Average # that pulled back to retest the breakpoint |

64%

|

| Average breakout distance to the apex |

69%

|

| Premature downside breakouts |

22%

|

General Statistics for Descending Triangles that fail or break to the upside

| STATISTICAL DESCRIPTION |

STATISTICAL %

|

| Average rise of failed formations |

42%

|

| Average # that pulled back to retest the breakpoint |

39%

|

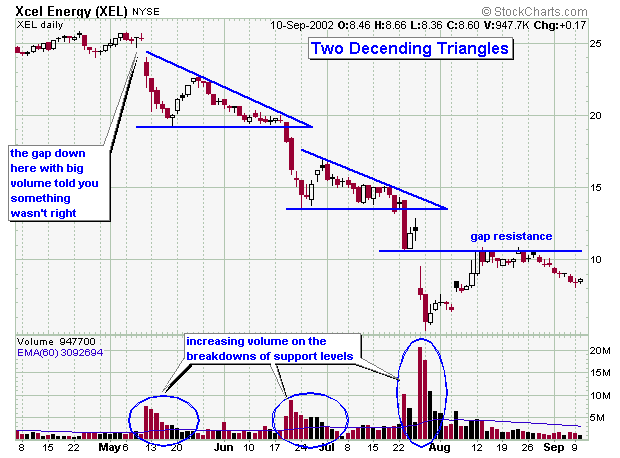

Now that you understand something about descending triangles, it's time for some real time examples. Please note that I will be adding more examples as I find them.