A technical charting

interpretation of the

Donchian's Four Week

Rule/Price Channel

By Alex Martin

The Four-week Rule is a

basic method that may

not seem glamorous in

the company of Fibonacci

Numbers and Japanese

Candlesticks - but it is

a profitable method that

is still used today.

Despite its obvious

shortcomings, as a

trend-following system,

- it works well in up or

down trends, but not

sideways trends - the

Four-week Rule is a tool

that should be in every

technical analyst's

repertoire. It was

developed by Richard

Donchian in the early

1970s for commodities

and futures, and has

been successfully

applied to stock

analysis.

The question is: How can

you make it work for

you?

Also known as the "Price

Channel" or "Donchian

Channels," the Four-week

Rule may be a basic

tool. But in the right

hands, it can be

powerful. In other

words, the rules may be

simple, but applying

them is not. It works to

the extent of the

analyst's abilities.

The rules according

to Donchian

The Four-week Rule is a

method that includes a

set of charting rules

that are generated from

the price channel as

well as a set of trading

rules. The mistake that

some analysts make is to

use the price channels

without the trading

rules. It is the

combination of both sets

of rules that make the

method effective.

The charting rules

The price channel

generates the following

signals when applied to

stock charts:

-

buy signals are

produced when

the price closes

above the upper

band of the

price channel;

and,

-

sell signals are

generated when

the price closes

below the lower

band of the

price channel.

The trading rules

-

When the price

is at its

highest in a

four week

period, buy long

and cover short

positions.

-

When the price

falls below the

lows of a four

week period,

sell short and

liquidate long

positions.

-

This last

rule only

applies to

future traders,

which is "to

roll forward, if

necessary, into

the next

contract on the

last day of the

month prior to

expiration.

As you can see from

Figure 2,

trend-following systems

react to movements

rather than attempting

to predict them. The

trend breaks before the

price closes below the

lower band of the price

channel.

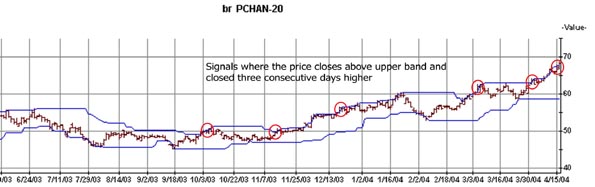

When interpreting the

price channel on charts,

buy signals are

generated when the price

channel has closed above

the upper band as shown

in Figure 3. The price

channel tends to create

quite a few signals

during the course of the

up trend.

For those who use

technical stock

screeners, use a screen

with a rising close

condition where the

price closes higher than

the day before for three

days, as well as a price

that closes above the

upper band. When we

include a three-day

rising close as well as

a price channel

breakout, the number of

false signals is reduced

as can be seen in Figure

4 below.

The stock used in all of

the chart illustrations,

was found using the

following stock screen:

-

price-channel

buy, where the

price penetrates

the upper band,

as well as the

condition that

the close for

the last three

days was higher

than the day

before it.

(The reverse does not

apply during sell

conditions, three

consecutive days down is

not the best pattern to

wait for.)

Complimenting the

Four-week Rule

So what can you do to

increase the

effectiveness of the

Four-week Rule so that

you don't miss

opportunities due to the

lagging indicators? And

equally as important,

how can you ensure that

you aren't going to lose

money in a volatile or

sideways-trending market

due to false signals?

One way to add certainty

to the Four-week Rule is

to use complimentary

indicators or methods to

generate additional

signals that provide a

warning or confirmation.

For example, you can use

another trend-following

system, the Five- and

20-day Moving Averages

Method, also developed

by Donchian, in

conjunction with the

Four-week Rule, to

create combined signals

that help you determine

if the price has really

generated a strong

trend. Note: The rules

in these two systems do

not conflict with one

another.

The Five- and 20-day

Moving Averages Method

The Five- and 20-day

Moving Averages Method

includes several general

and supplemental rules.

These rules where

initially intended for

currency markets but can

also be used to analyze

stocks.

The method consists of

the following rules:

Basic Rule A: Act on all

closes that cross the

20-day moving average by

an amount exceeding by

one full unit the

maximum penetration in

the same direction of

any previous closing

when the closing was on

the same side of the

moving average.

Basic Rule B: Act on all

closes that cross the

20-day moving average

and close one full unit

beyond the previous 25

closes.

Basic Rule C: Within the

first 20 days after the

first day of a crossing

that leads to a trading

signal, reverse on any

close that crosses the

20-day moving average

and closes one full unit

beyond the previous 15

closes.

Basic Rule D: Sensitive

five-day moving average

rules for closing out

positions and for

reinstating position in

the direction of the

20-day moving average

are:

-

Close out

positions

when the

currency closes

below the 5-day

moving average

for long

positions and

above the 5-day

moving average

for short

positions, by at

least one full

unit more than

the greater of

either the

previous

penetration on

the same side of

the 5 day moving

average, or the

maximum point of

any penetration

within the

preceding 25

trading days.

Should the range

between the

closing price in

the opposite

direction to the

Rule D closeout

signal be

greater than the

prior 15 days

than the range

from the 20-day

moving average

in either

direction within

60 previous

sessions, do not

act on Rule D

closeout signals

unless the

penetration of

the 5-day moving

average exceeds

by one unit the

maximum range

both above and

below the 5-day

moving average

during the

preceding 25

sessions.

-

Reinstate

positions in

the direction of

the basic trend

(a) when the

condition in

paragraph 1 are

achieved, (b) If

a new Rule A

basic trend is

given, or (c) if

new Rule B and

Rule C signals

in the direction

of the basic

trend are given

by closing in a

new low or new

high ground.

-

Penetrations of

two units or

less do not

count as points

to be exceeded

by Rule D unless

at least two

consecutive

closes were on

the side of the

penetration when

the point to be

exceeded was set

up. (Richard

Donchian,

December 1974

Futures

article), as

quoted by

Cornelius Luca

in Technical

Analysis

Applications in

the Global

Currency Markets,

1997.

When we look at the

charting signals in

Figure 5 generated by

the 5- and 20-day

method, we can see that

signals are generated

earlier on in the trend

than the price channel

shown in Figure 6.

To better interpret the

signals generated by the

5- and 20-day method, it

is advisable to include

an MA cross system such

as Japanese Crosses.

Combining the 5- and 20-

day moving average cross

system with the

Four-week Rule can help

to confirm information

about the potential

trend change. These

modifications are not

intended to replace

basic trend-following

techniques - but to

provide more information

about the trend when

price channel signals

are generated.

In summary, getting the

Four-week Rule to work

for you may be as simple

as - following the

rules.

-

Use it right -

as a method with

a set of trading

rules and

charting.

-

Have discipline

- buy and sell

strictly

according to the

trading rules.

-

Compensate for

its shortcomings

- no system is

perfect