The Patterns

There are currently 8 patterns in Woodies CCI.

Woodie has defined all of them. Do not follow any other

methods, patterns or systems. They will add another level of complexity and

will only serve to confuse you while you are learning this system.

Do not rename any of the patterns. I’m sure it is very

obvious why this shouldn’t be done but some still try to do it. You could go

ask the traders that tried this but they are no longer trading. Just stick

to the system as Woodie has defined it.

Woodie is researching and testing new patterns all the

time. He will let us know when he finds another great new pattern.

Woodies CCI Patterns can be used on any time frames. It

can even be used very successfully on daily charts and larger time frames as

well. Note that Woodie uses a CCI 20 period on charts with daily time frames

and larger. He does not use the TCCI at all on the daily or larger time

frame charts.

You want to take CCI patterns that are robust,

full-bodied, and clear. Not ones that are constricted, tightly wrapped

around the zero-line, condensed or strange looking. There are far too many

trades to take during the day for you to force a bad trade. Re-read this

again and again. Follow it closely. This is one of the parts of Woodies CCI

system that keeps you from over trading. You do not need to think about

overtrading. Just follow the guidelines and it will be taken care of

automatically.

The Woodie CCI Patterns that we use to trade are as

follows and are not necessarily listed in order or winning percentages.

#1 - Woodies CCI Zero-line Reject

(ZLR) Pattern:

A zero-line reject (ZLR) pattern is a CCI bounce off of

or near the zero-line (ZL). It can bounce off of or near the zero-line

anywhere from +100 to –100 for both long and short trades. Some people like

to narrow the range down to +/- 50 which can provide a better pullback. The

entry would be the first bar that rejects or flips up away from the

zero-line.

The market psychology behind Woodies CCI ZLR pattern is

that it shows traders when to buy the dips and sell the pullbacks. No other

indicator in the trading world can do that except for the CCI.

You can combine the ZLR pattern along with a trend line

break (TLB) pattern to add strength to the signal for a greater probability

of success. If using the ZLR along with the TLB then you would wait for the

CCI to cross the TLB pattern to enter. You will learn more about the trend

line break (TLB) pattern later in this document.

The ZLR trade is a trend trade. New traders of Woodies CCI

should be taking this type of trade. In fact this could be the only Woodies

CCI pattern trade you take during your entire trading career and still

create excellent profits for yourself

|

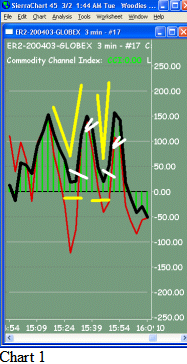

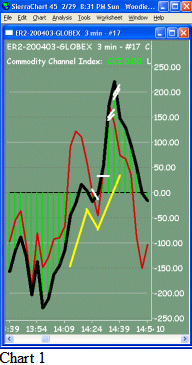

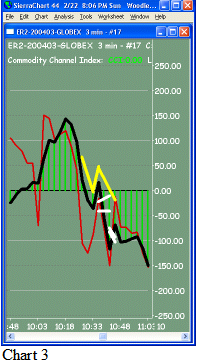

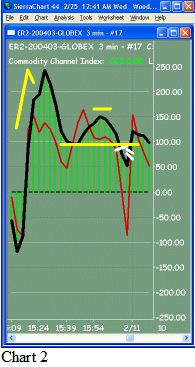

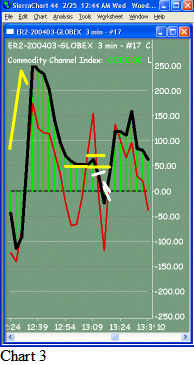

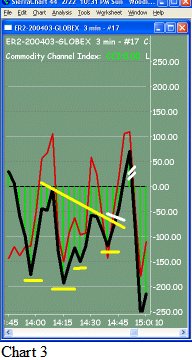

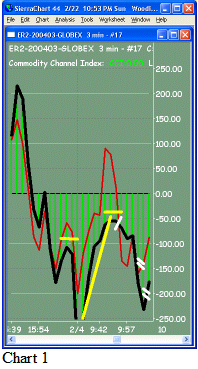

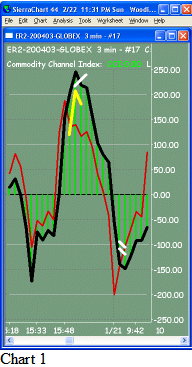

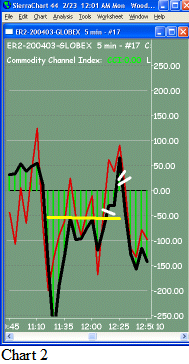

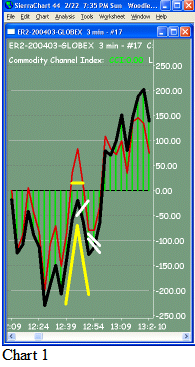

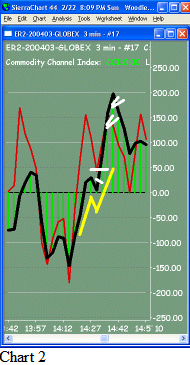

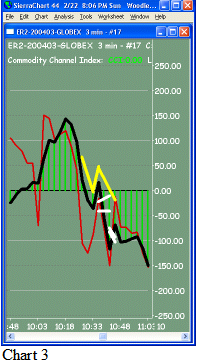

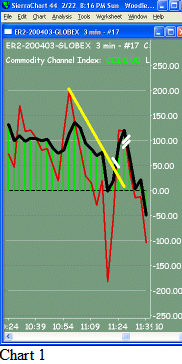

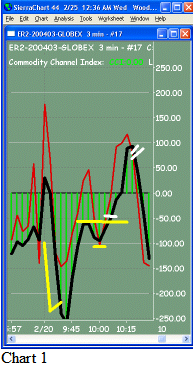

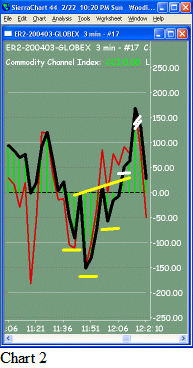

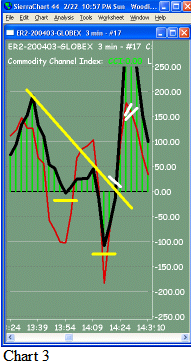

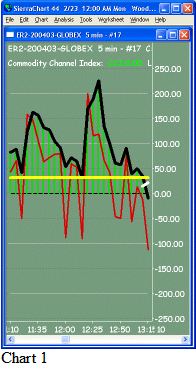

3 Charts Below –

Zero-line Reject (ZLR) long trades.

The yellow lines show the ZLR patterns. The

single white lines show where the entry would be and the double

white lines show where the exit would be |

|

|

|

|

|

| Zero-line

Reject (ZLR) long

TREND TRADE

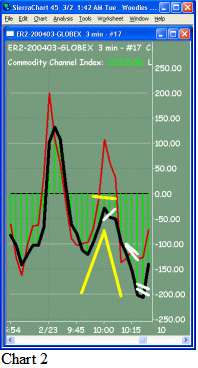

Notice that chart 1 above shows two ZLR long trades. They

both bounce off the ZL within the +/-100 area. We enter a ZLR

when the CCI line first starts to reject the ZL or we can say

the first bar that flips away from the ZL.

In chart 1 above we exit the first ZLR on a CCI hook and the

second ZLR we exit on a TCCI cross into CCI. |

|

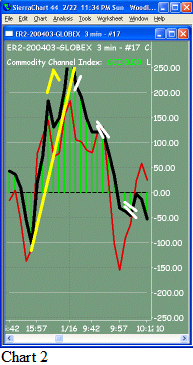

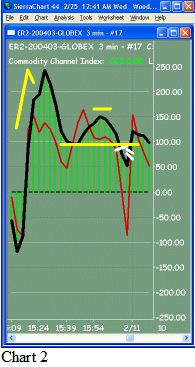

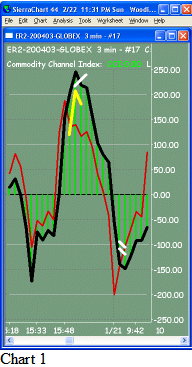

Zero-line Reject (ZLR) long

TREND TRADE

In chart 2 above we exit on a CCI hook. |

|

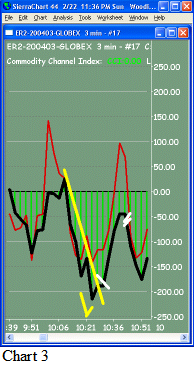

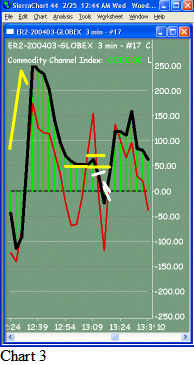

Zero-line Reject (ZLR) long

TREND TRADE

In chart 3 above we exit on a TCCI cross into CCI.

Notice that on chart 3 above the CCI hooks at the same time the

TCCI hooks which gives us two exits signals at the same time.

|

|

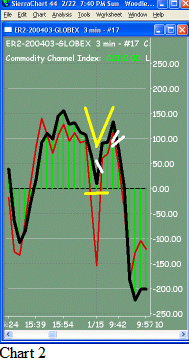

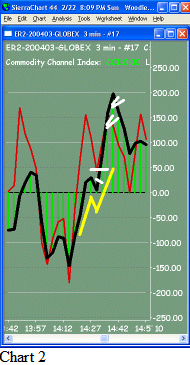

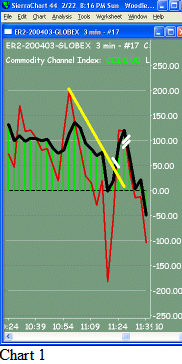

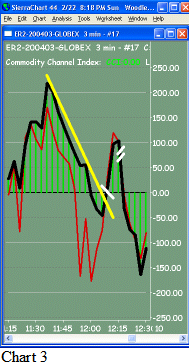

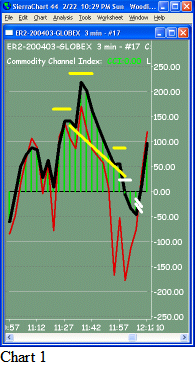

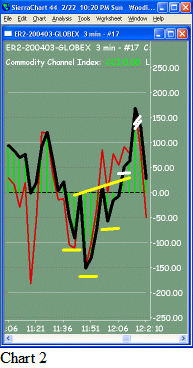

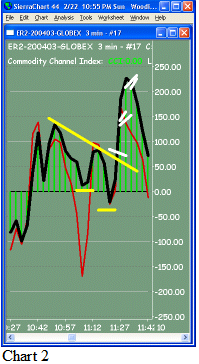

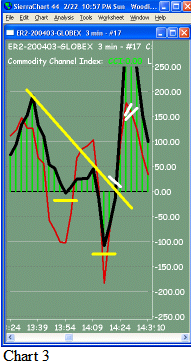

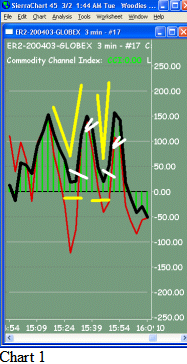

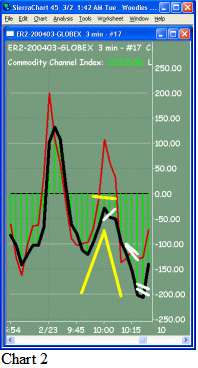

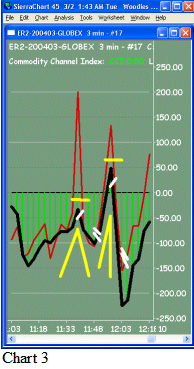

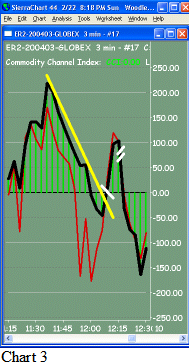

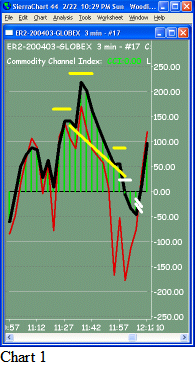

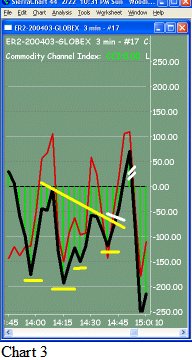

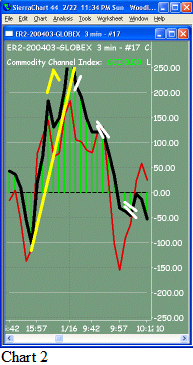

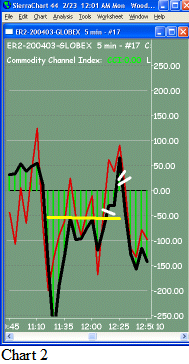

3 Charts Below –

Zero-line Reject (ZLR) short trades.

The yellow lines show the zero-line reject patterns.

The single white lines show the entry for this type of trade and the

double white lines are the exit signals.

The exit signals are the same as in any other

trade. Go review the section on how to enter and exit trades.

It is very important to remember that when you take

one of these trades it does not mean you are supposed to stay in it

forever. Always follow Woodies CCI exit signals |

|

|

|

|

|

|

In chart

1 above we see that the ZLR was close to the ZL. The exit on this

trade was a CCI hook.

Zero-line Reject (ZLR) short

TREND TRADE

|

|

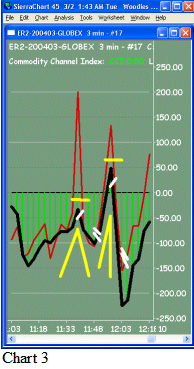

In chart

2 above we also see a ZLR close to the ZL. There are two exits on

this chart. One is a TCCI cross of CCI and the second exit is a CCI

hook. We don’t know what the trade will give us before we get in and

we don’t care. We take the exits as they come and it works out very

well.

Zero-line Reject (ZLR) short

TREND TRADE

|

|

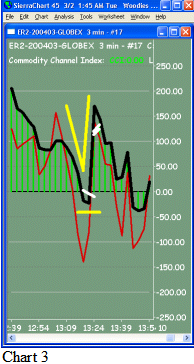

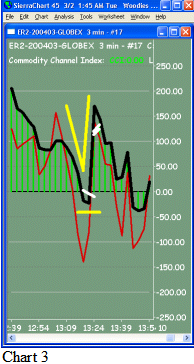

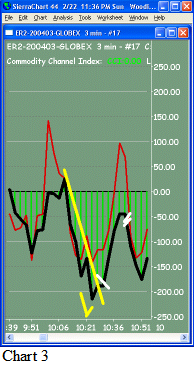

In chart

3 above we see two ZLR trades. The first ZLR exit is a CCI hook.

Notice that the second ZLR is a bounce off the zero-line from the

opposite side. This is fine. In fact it could go as high as +100 and

we could still take it as a ZLR short trade. Remember that some

people prefer to take ZLR trades that are closer to the ZL within

the +/-50 area.

Zero-line Reject (ZLR) short

TREND TRADE |

#2 - Woodies CCI Shamu Trade (shamu)

Pattern:

A shamu pattern is when the CCI passes through the

zero-line (ZL), flips back around and comes through the ZL again, and then

once again turns around and crosses through the zero-line to continue its

original direction. It’s sort of a zigzag pattern around the ZL. It doesn’t

have to be directly on the zero-line but it’s better when it is. When the

zigzags on the CCI happen within the +/-50 area it makes for a better

pattern.

Notice that the shamu trade pattern is a failed

zero-line reject pattern. Originally it was a ZLR pattern. But the ZLR

turned around and failed so we had to exit. This is why you do not wait

around and hope a trade is going to correct itself and go back your way. If

you were in all of these trades as the initial ZLR trade and it turned on

you but you did not exit then you would be racking up potentially large

losses. You must exit based on the guidelines Woodie has created. That is

the defined system. You have no choice.

The shamu trade is a counter-trend trade and was developed as

a type of stop-and-reverse (SAR) trade to the failed ZLR. New students of

Woodies CCI should not be taking this type of trade. However,

keep your eye on it and learn as you progress

|

3 Charts below – Shamu Trade

Pattern.

The yellow lines show the CCI pattern. The

single white lines show where the entry would be and the double

white lines show where the exit would be. The single white lines

show the entry for this type of trade and the double white lines are

the exit signals.

A Shamu Trade failure pattern is not shown. A

failure of the Shamu Trade would be yet another swing back through

the zero-line after our trade entry to take out the other side of

the prior swing low/high. It does happen and all you do is exit

based on the rules defined by Woodies CCI.

On all 3 charts there are

two possible entry points shown as single white lines. It depends on

if you always add confirmation signals to your trades. If you do

then when taking the shamu trade then let it take the swing high/low

out for the entry signal. However, most people would enter the trade

on the first white line. If however the shamu pattern is a perfect

one and is evenly split across the zero-line then the entry could be

the zero-line cross (ZLC).

The exit signals are the same as in any other

trade. Go review the section on how to enter and exit trades.

It is very important to remember that when you

take one of these trades it does not mean you are supposed to stay

in it forever. Always follow Woodies CCI exit signals. |

|

|

|

|

|

|

Shamu Trade long pattern

Counter-trend trade |

|

Shamu Trade long pattern

Counter-trend trade |

|

Shamu

Pattern Short

Counter-trend trade |

| X |

| Chart 2 shows two

possible exits for the trade. The first set of double lines is when

the TCCI is crossing into the CCI. You would exit your first

contract at that point. If you were trading more than one contract

you would then set the rest to b/e+1 and wait for the next exit

signal to come. We see that the second exit signal is the second set

of double white lines showing the HFE exit signal. Chart 2

shows a shamu trade pattern that doesn’t quite come down below

the zero-line. That’s ok. Not every pattern can be perfect. It's

still a valid shamu trade.

|

#3 - Woodies CCI Trend Line Break

(TLB) Pattern:

A Trend Line Break pattern uses two or more decent

sized bumps, using CCI or TCCI, to lay the trend line across them. Then when

the CCI crosses or breaks that trend line (tl) that is the signal to enter

the trade. One end of the trend line should be at CCI value +/-100 region or

greater for it to be valid. Also, the more bumps you lay it across the more

valid that trend line is. Using only two bumps is normal and creates a

perfectly valid TLB. You can also mix the use of CCI and TCCI bumps for each

trend line. This pattern is also used as one of the exit signals and as a

CCI confirmation signal too. It comes in quite handy and is widely used in

Woodies CCI system.

The TLB trade can be both a trend and a counter-trend

trade. New students of Woodies CCI should be taking this type of trade if it

is a TLB with the trend. Do not take this trade against the trend. However,

keep your eye on it and learn as you progress.

You can combine the zero-line reject (ZLR) pattern and

the reverse divergence (rev diver) pattern along with a TLB pattern to add

strength to the signal for a greater probability of success. When combining

these together you would still enter on the break of the trend line, as it

will occur last.

Another method of entry on a TLB trade is to use the

CCI confirmation signal cross of the +/- 100 value. This provides a greater

chance that the trade will be successful. You do not have to use this method

and you may get more profit on the TLB trade if you get in well before this

point. However, if you do not add the CCI confirmation of a +/- 100 cross

then your TLB trade might not work out so often. Pick a method and stick

with it. Don’t change daily.

You will very often find the TLB and ZLR show up

together. Sometimes the rev diver pattern will show up with them as well.

You should start to notice that CCI patterns all come one after another and

also form together to make stronger signals. Do not let this confuse you.

You only need one CCI pattern to take a trade. However if you combine more

than one signal it adds to the probability of success for that trade.

|

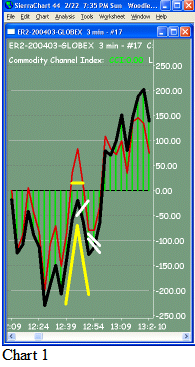

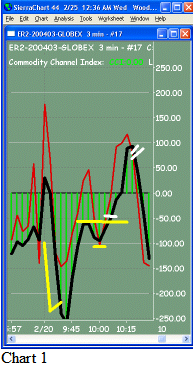

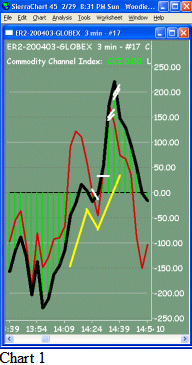

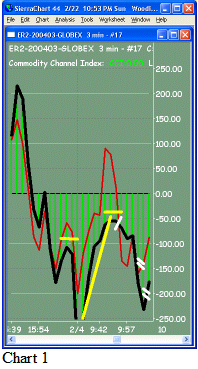

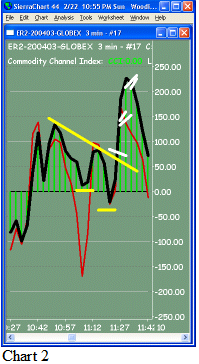

3 Charts below – Trend Line

Break Patterns.

The yellow lines show the CCI pattern. The

single white lines show the entry for this type of trade and the

double white lines are the exit signals.

Note that all 3 charts show the Trend Line

Break pattern with the trend. No TLB counter-trends are shown. In

the 1st chart we can see how the TCCI was used to draw the Trend

Line Break trade. This is valid and works well.

The exit signals are the same as in any other

trade. Go review the section on how to enter and exit trades.

It is very important to remember that when you take

one of these trades it does not mean you are supposed to stay in it

forever. Always follow Woodies CCI exit signals. |

|

|

|

|

|

| Trendline

Break Pattern Long |

|

Trendline Break Pattern Long

There are two exit signals. One is where the TCCI crossed into

the CCI. The second exit is when the CCI hooks.

The entry method of waiting for the CCI cross of the

+/-100 is shown in the 2nd chart but just happens to be

there by coincidence |

|

Trendline

Break Pattern Long |

#4 - Woodies CCI Vegas Trade (VT)

Pattern:

The Vegas Trade Pattern is a combination of several

things. First it needs the hook from extreme (HFE) CCI pattern and then a

set of CCI bars shaped into a partial circular or rounding pattern following

that. These rounding bars must be at least 3 bars minimum and can occur

toward the zero-line or against it. In other words the rounding can be in

any direction regardless of what side of the zero-line (ZL) the entire

pattern is being formed on. However, the entire VT pattern must form on the

same side of the zero-line.

This means that the swing high/low part of the pattern

doesn’t have to be the rounding part of the pattern. However, it is a

stronger signal when the swing high/low is the rounded part. Also, it can

even have two or more swing high/lows as well. The rounding is very

important to the overall pattern and indicates a struggle that may well lead

to a strong trend reversal.

That last part of the pattern is the trend line drawn

straight across from the recent swing high or low. A break of this swing

high/low is our entry into the trade.

The entire Vegas Trade pattern can have anywhere from

around 8 to 12+ bars but when it gets too far spread out past that before an

entry signal is seen then the probability of success is lowered and the

strength of move could be less.

The Vegas Trade pattern indicates a potential for a

very strong change in the trend.

Also, Woodie strongly recommends the use of the 25-lsma

indicator as an additional criterion for VT entry. When the 25-lsma

indicator shows that price is on the side of the direction of the VT entry

then there is a greater likelihood that the trade will be successful. LSMA

stands for Least Squares Moving Average and can also be found in some

charting packages as Linear Regression Curve.

In other words, if the VT is setting up for a long

entry then you want price to be above the 25-lsma indicator and, if

possible, you also want the 25-lsma to be pointing in the upward direction

as well. If a VT short is setting up then you want the price to be below the

25-lsma and, if possible, you want the 25-lsma to be pointing downward.

Since we do not use prices to trade Woodies CCI system it is recommended

that you do not view prices just to see a 25-lsma indicator. Rather, use a

25-lsma indicator placed in the CCI region that displays colors showing

these four conditions.

|

|

|

|

|

|

|

| Vegas Trade

Pattern Long

counter-trend Trade |

|

Vegas Trade

Pattern Short

counter-trend Trade |

|

Vegas Trade

Pattern Short

counter-trend Trade |

| x |

| Chart 1

shows very limited rounding. Neither the swing high after the HFE

nor the swing low after that shows very good rounding. It has 3 bars

of rounding minimum so it’s still valid. However, be careful as it

could likely fail as a result of that. It may be best to stay away

from this trade since it does not have the good rounding expected.

There will be many other vegas trade (VT) patterns that could be

taken so passing on a lame one won’t hurt.

Chart 2 shows rounding on the swing low and the swing high. The

entry signal is still the break of the swing low since it is above

the zero-line. Notice that the entire pattern is more than 12 bars

so the probability for success is far less

Chart 3 shows very nice rounding after the HFE pattern. The best

Vegas Trade patterns have the swing high/low part as the rounding

section. It also shows an interesting sharp flip of the CCI bar

downward that happens next and breaks the swing low. Since it broke

the recent swing low, in this case, it gives us our CCI entry signal

to take the trade

All CCI patterns can’t be perfect but keep in mind that the

closer the pattern conforms to the definition the greater the

likelihood that it will be successful.

Remember that you will want to only take trades

where the 25-lsma indicator shows that prices are on the side of the

trade and, if possible, the 25-lsma indicator also is pointing

toward the direction of the trade. The 25-lsma indicator is not

shown in these charts. If it were shown you would see it located on

the zero-line in the CCI section using a multi-color indicator to

display it.

The exit signals are the same as in any other

trade. Go review the section on how to enter and exit trades.

It is very important to remember that when you

take one of these trades it does not mean you are supposed to stay

in it forever. Always follow Woodies CCI exit signals.

|

#5 - Woodies

CCI Ghost Trade Pattern:

Ghost

article

The Ghost Trade pattern has 3 bumps in it. It has an

arm, a head and then another arm in its pattern. The bumps used to spot this

pattern can be made from the CCI or the TCCI. However, most people use CCI

bumps for this pattern. It is preferable that the head is larger then the

arms. To determine the entry point for the Ghost trade you draw a trend line

across the underside of the Ghost across its neckline.

You can gauge the expected CCI movement for the Ghost

Trade by measuring the distance from the top of the head to the neckline.

The expected movement would then be a movement of that same distance from

the neckline in the opposite direction to that of the head. You do not need

to bother calculating the potential CCI move from the neckline as you will

be exiting the trade as soon as the CCI gives you an exit signal anyways.

All you need to do is follow the exit signals as defined in Woodies CCI.

Notice that when you draw the neckline (trend line) on

the Ghost pattern you combine a trend line break (TLB) pattern along with

the Ghost pattern which adds strength to the signal for a greater

probability of success. Sometimes the neckline will slant toward the

zero-line. These are the preferred Ghost patterns over the ones in which the

neckline slants away from the zero-line. However, both are fine to take.

|

The yellow lines show the CCI pattern. The

single white lines show where the entry would be and the double

white lines show where the exit would be.

Notice how all the necklines slant different

ways. Some slant toward the zero-line and some away from it. Do not

let this confuse you. Just enter the trade once it breaks the

neckline, which is otherwise known as the TLB CCI pattern as well.

This is yet another example of how the CCI patterns can and quite

often do run together.

Be aware that the majority of the drawn Ghost

pattern must be on the same side of the CCI zero-line. Sometimes a

bit of it does form on the opposite side. This is perfectly fine if

it is only a very small portion.

The exit signals are the same as in any other

trade. Go review the section on how to enter and exit trades.

It is very important to remember that when you

take one of these trades it does not mean you are supposed to stay

in it forever. Always follow Woodies CCI exit signals.

|

|

|

|

|

|

| Ghost Trade

Pattern Short

counter-trend Trade |

|

Ghost Trade

Pattern Long

counter-trend Trade |

|

Ghost Trade

Pattern Long

counter-trend Trade |

|

Chart 1 has a very weak right arm.

Notice that the trade didn’t go very far before it hooked back up

and we had to exit.

Chart 3 shows a Ghost pattern that had a

double head. That’s fine. Not all CCI patterns can be perfect.

|

#6 - Woodies

CCI Reverse Divergence (rev diver):

The Reverse Divergence (Rev Diver) pattern is very

simple. Do not let if confuse you. However, many people find it hard to

understand and even harder to spot. This shows us two things. One, the

documents and explanations are too hard to understand and just possibly

confuse the matter. Two, and more interesting, is that it may show us that

by bringing in your prior ‘knowledge’ into Woodies CCI system will give you

headaches when trying to understand it.

This pattern was named using words that remind you of

things you have tried to learn before. Maybe that is the reason why people

find it so hard to spot. Forget the name and do not let it conjure up your

past knowledge. None of that will help you and is absolutely not needed any

longer. So forget everything you think you know about it. Do not question

the pattern or why it works at this stage. Just learn to spot its ‘look’.

It’s a very simple pattern I assure you.

You do not need prices to trade the Rev Diver

pattern. You do not need to verify that it is a true reverse

divergence pattern against price before you enter the pattern. We do not use

prices to trade Woodies CCI system. Woodie has done many years of research

and live trials on this pattern. He has determined that it truly is reverse

divergence when compared to price over 95% of the time. This is why we as

traders do not have to verify it against prices. We just react and take the

trade. Besides, lets say it turns out not to be a true rev diver pattern

when compared to price bars. The CCI will warn us anyways by showing us one

of the Woodies CCI exit signals.

The following two rules are all you need to spot the

Rev Diver pattern:

- Rev Diver long – CCI above zero-line for 6 or more

bars, two lower inside bumps

- Rev Diver short – CCI above below line for 6 or

more bars, two higher inside bumps

The Reverse Divergence Trade is a trend trade. New

students of Woodies CCI should be taking this type of trade.

You can combine the Rev Diver trade with a zero-line

reject (ZLR) trade or the trend line break (TLB) trade to add strength to

the signal for a greater probability of success. You most always have a ZLR

pattern along with a Rev Diver pattern. In fact you usually have two ZLR

patterns that make up a Rev Diver since both inside bumps usually occur

within the +/- 100 CCI area. The inside bumps actually represents the CCI

ZLR pattern. Look at the charts closely and you will see both of them on

each chart.

|

The yellow lines show the CCI pattern. The two

short yellow lines show the Reverse Divergence Trade pattern. The

longer yellow line shows the Trend Line Break pattern that usually

accompanies this trade. The single white lines show where the entry

would be and the double white lines show where the exit would be.

Each chart shows a short yellow line where each

inside bump can be see within the pattern. Notice that the inside

bumps are closer to the zero-line as they move across the chart. Two

of the inside bumps shown actually go over the zero-line. In chart 2

you can see one inside bump goes over the zero-line a little bit.

|

|

|

|

|

|

|

Reverse

Divergence (rev diver) Pattern Short

Trend Trade |

|

Reverse

Divergence (rev diver) Pattern Long

Trend Trade |

|

Reverse

Divergence (rev diver) Pattern Long

Trend Trade |

|

Chart 3 one inside bump goes down under

the zero-line a great deal. Technically this turned into an outside

bump since it went down below the zero-line.. Don’t let this

confuses you. It is still a rev diver pattern but you may want to

avoid ones that do this. You could instead take this as a ZLR trade

on the first bar that flipped up since it only went down to –100.

Again, all of these patterns melt together in some fashion all the

time. Don’t worry about it. You will be fine. Just keep on reading.

However, as you know by now, we look for the

more perfect CCI patterns to trade and the rev diver in chart 3

might not be a trade to take since it does go over the zero-line

quite a bit and for 3+ bars as well. It is interesting enough to

note that the trade was really strong and went quite far upward

anyways. In fact, you could just ignore the rev diver pattern on

chart 3 and take it as a simple TLB trade. I hope you are seeing by

now that all of Woodies CCI patterns mix together or come one right

after the next.

Notice that there is a zero-line reject (ZLR) pattern

just before each of these rev diver entries on all 3 charts. This is

not a coincidence. Lots of CCI patterns run together. Some will add

to the potential for success and some will signal you

to exit immediately because they are setting up a CCI trade signal

against your current position. Don’t let this confuse it. It’s

normal to see multiple Woodies CCI patterns combined together.

All 3 charts are showing the trend line break

(TLB) pattern drawn as well. Most people use a rev diver pattern

along with a TLB pattern as a signal for more confirmation to enter

the trade. You can clearly see this in charts 2 and 3 where the

entry is shown after the TLB is broken However, you could enter the

trade right after the second ZLR CCI turn up/down that forms the

complete rev diver pattern. This entry by itself would be a rev

diver trade with the added confirmation of a TLB.

Chart 1 shows two exits using the double

white lines. Again, the first contract or set of contracts would be

exited at the first set of double lines. The remainder of the

position would be set to b/e+1 and you would wait for the next exit

signal.

Chart 3 shows a lower inside bump that

actually goes onto the other side of the zero-line. This is a nuance

and does happen. That is fine. Important to point out is that this

is actually a valid zero-line reject long signal since it doesn’t go

past the CCI –100 area. This one goes a bit further so it could be

taken with caution.

The exit signals are the same as in any other

trade. Go review the section on how to enter and exit trades.

It is very important to remember that when you

take one of these trades it does not mean you are supposed to stay

in it forever. Always follow Woodies CCI exit signals.

|

#7 - Woodies

CCI Hook From Extremes (HFE) Pattern:

The hook from extreme (HFE) trades are formed when the

CCI prints a bar at or past the +/- 200 and then starts hooking back toward

the zero-line. This trade is a very difficult trade. The HFE pattern is used

as one of the Woodies CCI exit signals as well.

A HFE trade can happen very fast. As soon as you see it

hook back toward the zero-line you enter. Make sure you have your hard

stop-loss orders in as soon as you get filled on entry, as this trade can

get away from you very quick. As soon as you see a signal to exit then you

exit immediately.

You will get stopped out of this trade often and this

can happen even without seeing a CCI exit signal. This trade has around a

50% chance of success if you take every single HFE trade you see. However it

can provide you with much larger profits than losses. You must use hard

stop-loss orders when trading Woodies CCI or any other system for that

matter.

You can combine the HFE trade with either a trend line

break or a +/- 100 cross CCI confirmation signal to add strength to the

trade for a greater probability of success. Again, when new you are not to

take this trade. There are a great many experienced traders that do not take

this trade either.

|

The yellow

hooking lines show the CCI pattern. The long yellow lines show the

TLB pattern that also exists on these charts. The single white lines

show where the entry would be and the double white lines show where

the exit would be.

The exit signals are the same as in any other

trade. Go review the section on how to enter and exit trades.

It is very important to remember that when you

take one of these trades it does not mean you are supposed to stay

in it forever. Always follow Woodies CCI exit signals. |

|

|

|

|

|

|

Hook

From Extremes (HFE) Pattern Short

counter-trend Trade |

|

Hook

From Extremes (HFE) Pattern Short

counter-trend Trade |

|

Hook

From Extremes (HFE) Pattern Long

counter-trend Trade |

|

Chart 1 we enter on the first CCI bar

that flips back toward the zero-line when outside of the +/-200 CCI

area. There is no real defined trend line since we do not have any

nice bumps to draw it on. This is fine.

Chart 2 shows the entry after the break

of the trend line and two exit points. The first exit is when the

tcci hooks through the CCI. The second exit is also a tcci hook into

the cci and the cci is starting to hook at the same time as well.

Charts 2 and 3 are showing

the TLB added to the HFE trade. That provides a greater probability

of success. The entry would be when the CCI line breaks the TLB

pattern. |

#8 - Woodies

CCI Horizontal Trend Line Break (HTLB) Pattern:

The horizontal trend line break (HTLB) trade is when a

trend line is drawn horizontally across a series of bumps that are lined up

in a nice straight row. You can use a mix of both CCI and TCCI bumps to draw

the htl but most often you will see the CCI used in these patterns.

You can draw the trend line across these bumps

regardless of whether they are inside or outside bumps as well as on either

side of the zero-line. Of course since it is a horizontal trend line all the

bumps will be on the same side of the zero-line. It is best to have the

break of the HTLB pattern within the +/- 50 area so that there will be a

greater possibility of success.

You would ideally like to have 3+ bumps on which to

draw the htl. However, you must have at least 2 bumps and this is fine. Each

bump at the same horizontal level can show that there is some type of

support/resistance building up at that area. When broken through it can lead

to a strong movement and a great trade. You will usually see a HTLB pattern

in a choppy market. The HTLB trades can make for some of the very best

trades during that choppy market.

The HTLB trade can be both a trend and a counter-trend

trade. New students of Woodies CCI should be taking this type of trade if it

is a HTLB trade with the trend. Do not take this trade against the trend.

However, keep your eye on it and learn as you progress.

The exit signals are the same as in any other trade. Go

review the section on how to enter and exit trades.

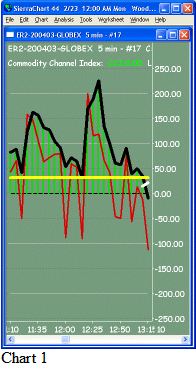

|

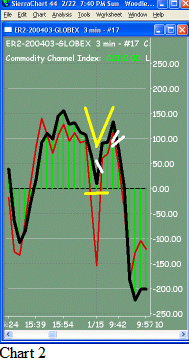

The yellow lines show the CCI pattern. The

single white lines show where the entry would be and the double

white lines show where the exit would be.

Note

that the charts are 5 min charts. Woodie says that you can have a

good HTLB pattern on the 3 min chart but that the HTLB pattern on

the 5 min charts are even stronger in terms of probability for

success. |

|

|

|

|

|

|

Horizontal Trend Line Break (HTLB) Pattern Short

counter-trend Trade |

|

Horizontal Trend Line Break (HTLB) Pattern Long

counter-trend Trade |

|

Horizontal Trend Line Break (HTLB) Pattern Long

Trend Trade |

|

Chart 1 does not show the

exit signal to the trade. Rather the snapshot was used to show a

long term HTLB forming. This led to a very powerful move but is not

shown on the chart.

Charts 1 and Chart2 show HTLB patterns

that are counter-trend trades. These are counter-trend trades

because the CCI is on the opposite side of the trade entry direction

for 6+ CCI bars. If you are new to Woodies CCI you should not

take these two trades since they are counter-trend trades.

Chart 3 shows

a HTLB trade with the trend. The entry is when the CCI line breaks

through the long horizontal trend line. If you are new to Woodies

CCI then you should take this type of trade |