These contributions are from Mike Bruns, world class trader.

Mike's clear thinking and charts have allowed for many traders to finally

"get it". His generous sharing and teachings have helped me raise my level

of trading. Reinforcing the concepts of trading with the trend, his

knowledge of the bond market and other markets. Mike also gives after market

hours seminars for members, they are exceptional. My personal thanks

Mike...NQoos

If you desire to be a profitable trader and understand the

value of learning from other successful traders then efuturevsion.com is a

perfect vehicle to accomplish this. This is only a sampling of the expertise

in trading education available in the efuturevision chat room, website and

after hour seminars for members. The education section and

Trading notes section

on efuturevision is open to the public. These contain setups and information

from Victoria, Mike, Jimmer, Brian, Ross and others. All profitable traders.

Members can access much more valuable trading information than what is in

the general public areas.

If this is still you,

choose today to change.

MACD

Aggressive Setup

MACD

Conservative Setup

DeMark REI Setup REI Stochastic Setup

REI

Note

9/30

Setup

Fast Stochastic (REI Substitute)

Location: With the Trend

Much

has been written about stochastics and how to trade them. In this

case, we are interested in having an indicator duplicate the action of the

DeMark REI as much as possible and to be reliable. I am not interested in

where the indicator turns over or crosses over. I want the entry into buy

and sell zones to be as accurate as possible and let the price action

control the trade entry using the same techniques as the REI.

The values are 5, 2, 2; overbought is 60 and oversold

in 35. Midpoint is 48.

Additionally, I am only interested in the K line (slow

line), not the D line (fast line).

So if you can blend the D line into the background,

all the better. I would use this arrangement only in the direction of the

Moving Average. Personally, I would never trade against the Moving Average

with this. As in the Range Expansion Index, there are two types of the

entries. They are the Market-On-Bar-Close and Buy/Sell Stop Method. Refer

to the section on the REI for the specifics.

Guidelines

We are looking

to take the trade in the direction of the Moving Average (30WMA).

With price bars and Moving Average going in the same

direction, the stochastic will reach an extreme zone. On any retracement or

consolidation, the indicator will pull back in a direction opposite the

Moving Average. Once the indicator enters the zone to initiate a trade in

the direction of the Moving Average, we initiate the entry methods outlined

in the earlier REI Section. This would be a conservative entry.

There is a school of thought on the use of stochastics

that enables a more aggressive entry. One can get on moves that the

conservative entry misses but will have some additional failures as well.

In a rapidly trending market, this aggressive entry may be the only one you

get due to the retracement of only a bar or two. This setup begins when the

indicator has retraced to midpoint (48) between the values of 60

(overbought) and 35 (oversold). At this point, the aggressive zone of

opportunity has been entered. The entry methods are the same as in the

conservative.

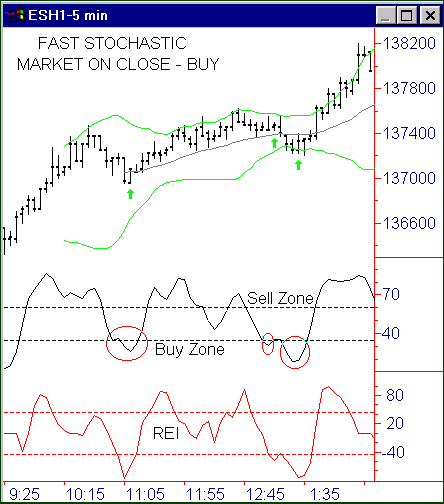

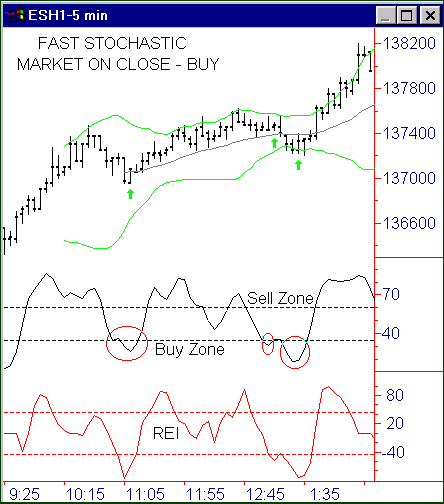

To illustrate how this works the following charts will

show both the REI and the fast Stochastic. The REI will be below the fast

stochastic (5,2,2).

| |

|

Here we see the Fast Stochastic above the

REI and the Moving Average is up. We want to go long. When the

indicator drops into the Buy Zone, we begin to look for the

opportunity to enter long. We have three examples. Note that

the second one would have resulted in a loss. Here is where it

takes conviction to reenter three bars later. And if you

examine the second entry closely, you’ll see that it really did

not qualify as an entry. The reason it did not meet the

qualifying condition is discussed in the REI Section. But some

will be lulled into taking #2 just because the indicator dropped

into the buy zone. |

|

| |

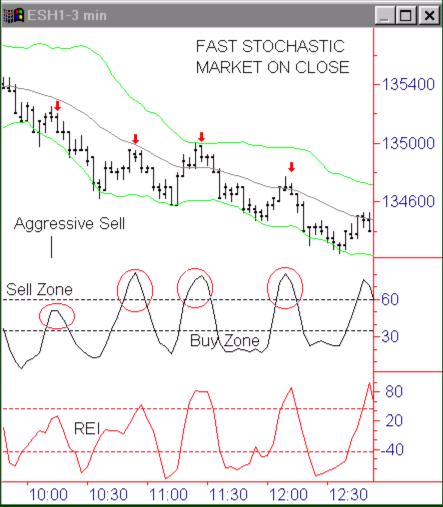

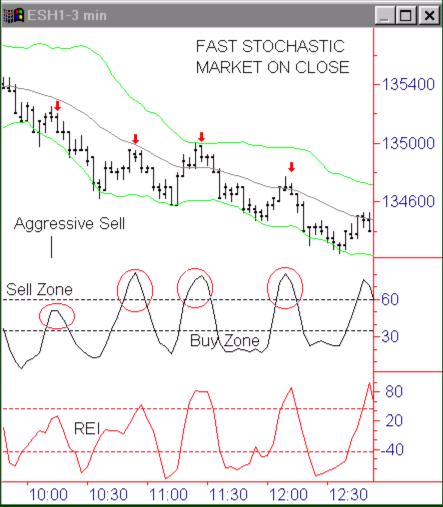

| In this sell example, I show an aggressive

setup first. Note the indicator retraced above the 48 midpoint

value. The next three sell setups are conservative. Note that

#3 (2nd conservative sell) does not meet the

qualifying requirement but is touching the upper BB. As John

Bollinger says, “Sell when touched.” |

|

| |

| |