These contributions are from Mike Bruns, world class trader.

Mike's clear thinking and charts have allowed for many traders to finally

"get it". His generous sharing and teachings have helped me raise my level

of trading. Reinforcing the concepts of trading with the trend, his

knowledge of the bond market and other markets. Mike also gives after market

hours seminars for members, they are exceptional. My personal thanks

Mike...NQoos

If you desire to be a profitable trader and understand the

value of learning from other successful traders then efuturevsion.com is a

perfect vehicle to accomplish this. This is only a sampling of the expertise

in trading education available in the efuturevision chat room, website and

after hour seminars for members. The education section and

Trading notes section

on efuturevision is open to the public. These contain setups and information

from Victoria, Mike, Jimmer, Brian, Ross and others. All profitable traders.

Members can access much more valuable trading information than what is in

the general public areas.

If this is still you,

choose today to change.

MACD

Aggressive Setup

MACD

Conservative Setup DeMark REI Setup

REI

Stochastic Setup

REI

Note

9/30

Setup

Range Expansion Index by Tom

DeMark Setup

Location: With the Trend

Tom DeMark

developed this indicator. He discussed it in his book, “New Science

of Technical Analysis,” and published articles in various trading journals.

He has described the workings of the formula and how to trade it. Capital

West Investment has an excellent reprint of one on their website. I believe

the REI to be so fine, it is one of the few indicators I would pay extra to

a software company to have available for use.

The indicator has a buy zone, a sell zone and a neutral

zone. There are two entries that Mr. DeMark presents. I have a third one

that I use. We shall discuss one of his, which I shall call

“Market-On-Bar-Close” and my entry, which I call the “Buy/Sell Stop Method.”

We want to take a trade in the direction of the Moving

Average (30WMA). While prices are moving in the direction of the MA, they

will begin to retrace in the opposite direction and the REI will follow

suit. First, the indicator enters the zone in the direction of the move and

we are preparing to put on the trade.

Market-On-Bar-Close (MOBC) - there are two

conditions to be met, requiring 4 completed price bars:

The close of the just completed price bar is in the

direction of the MA compared to the close of the previous price bar (called

bar # 1). We enter at the “market” if the next condition has been met.

In the case of a buy set up, the low of the bar # 2

(preceding bar # 1) is below the low of bar # 3 (preceding bar # 2). Unlike

Mr. DeMark, I personally do not require bar # 2 and bar # 3 to have occurred

in, what I call, the “zone of opportunity.”

Buy/Sell Stop Method – is very straightforward

and could involve any number of price bars but usually less than 5.

Place a Stop (or Stop Limit) Order upon completion of

the first completed price bar after the indicator has entered the zone for

entering the trade in the direction of the Moving Average. Move the Order

to the next completed price bar until the stop is hit and we are in the

trade. The initial stop loss is the opposite end of the entry bar or last

completed bar.

| |

|

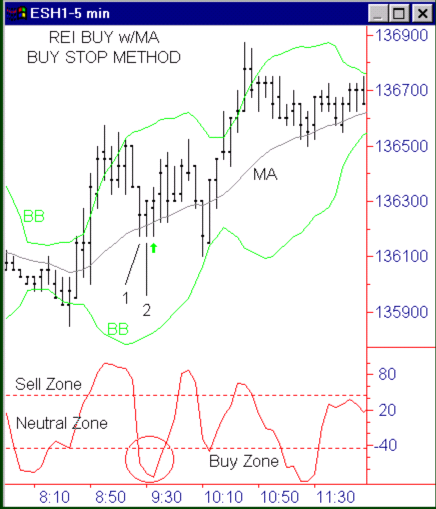

This SP mini (ES) example shows the Moving

Average is up, so we want to go long.

The REI drops into the Buy Zone. As we

monitor the price action, we see that lower lows have been

established. Then at the bar with the arrow, we prepare for the

close > previous close, in the direction of the Moving Average.

Bar # 2 and # 3 have established the precondition. We enter

long, “market” on the close of the arrowed bar. |

|

| |

|

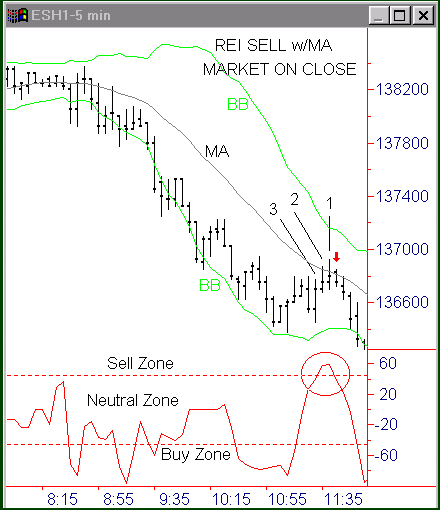

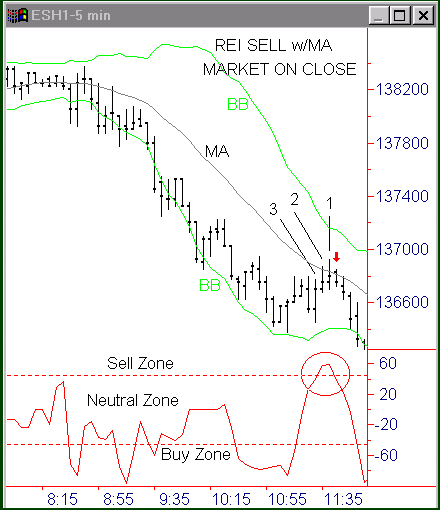

In this ES example, the Moving Average is

down. We want to go short. The REI rises into the Sell Zone.

As we watch the price bars, we note that the condition of higher

highs is satisfied (bars 2 and 3). We wait for the close below

the previous close.

It comes on the bar with the arrow. We

enter short at the ‘market.” Our stop loss can be placed at the

high of the entry bar. |

|

| |

|

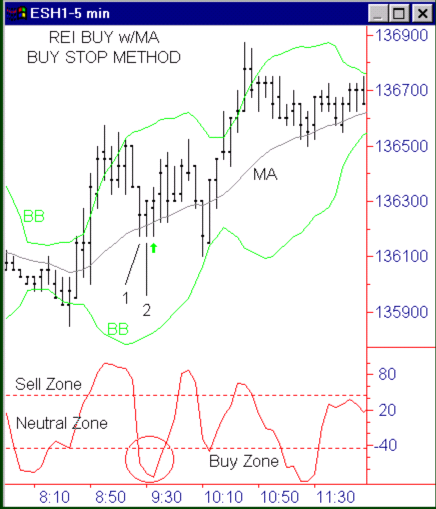

In this SP mini (ES) example, we desire to

go long. The first completed price bar where the indicator

enters the Buy Zone is bar # 1. We place a Buy Order just above

it. The next bar, # 2, is completed and we move the Buy Order

to just above it’s high. On the very next bar, the Buy stop is

hit and we are long. The initial stop loss is placed just below

the low of bar # 2. |

|

| |

This chart shows that we want to go

short with the Moving Average. As the price bars are

completed once the indicator enters the Sell Zone, we enter

a Sell Stop Order (or Stop Limit). After each bar is

completed, we advance the Order to the next bar. Three bars

are completed and the Sell Stop is hit on the fourth (arrow)

bar and we are in the short trade. The initial stop loss is

placed above the last completed price bar.

|

|