| MACD CONSERVATIVE SELL | MACD CONSERVATIVE BUY | |

|

|

|

|

|

|

| X |

These contributions are from Mike Bruns, world class trader. Mike's clear thinking and charts have allowed for many traders to finally "get it". His generous sharing and teachings have helped me raise my level of trading. Reinforcing the concepts of trading with the trend, his knowledge of the bond market and other markets. Mike also gives after market hours seminars for members, they are exceptional. My personal thanks Mike...NQoos

If you desire to be a profitable trader and understand the value of learning from other successful traders then efuturevision is a perfect vehicle to accomplish this. This is only a sampling of the expertise in trading education available in the efuturevision chat room, website and after hour seminars for members. The education section and Trading notes section on efuturevision is open to the public. These contain setups and information from Victoria, Mike, Jimmer, Brian, Ross and others. All profitable traders. Members can access much more valuable trading information than what is in the general public areas. If this is still you, choose today to change.

[MACD Aggressive Setup] [MACD Conservative Setup] [DeMark REI Setup] [REI Stochastic Setup] [REI Note ] [9/30 Setup]

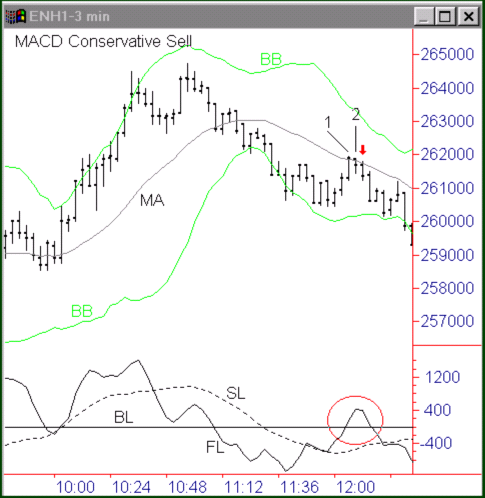

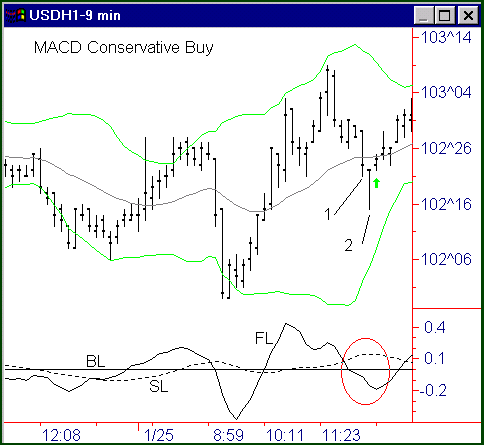

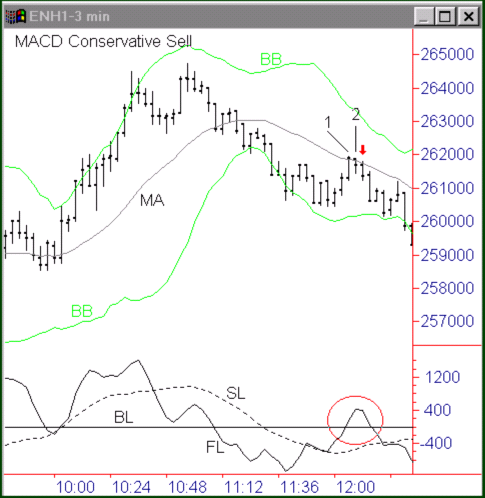

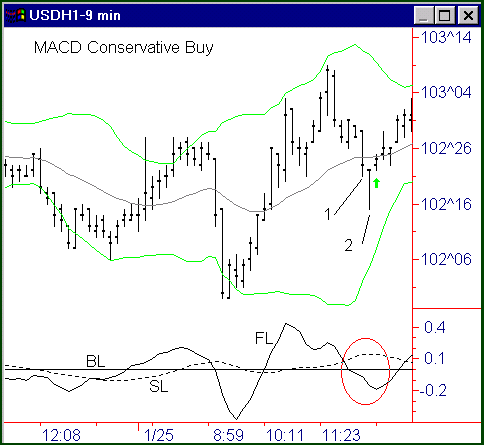

MACD Conservative Setups

Location: With the Trend

The MACD is a momentum indicator composed of two moving averages, a Fast Line (FL), a Slow Line (SL). A Base Line (BL) is the third component of the standard MACD.

The values used are: 3, 11, 17

The chart plots the Moving Average (MA). I prefer the 30-period weighted moving average. The 20-period exponential moving average is fine also.

Guidelines

We are looking to take the trade in the direction of the Moving Average (MA).

The Slow Line (SL) crosses over the BL in the direction of the moving average.

The Fast Line (FL) then crosses over the Base Line (BL) in the opposite direction.

We are now in the “zone of opportunity” to take a low risk sell in the direction of the Moving Average.

Once in the zone, we place stop orders or stop limit orders to initiate the trade in the direction of the Moving Average. The first order is placed when the first completed price bar has moved the indicators into the appropriate relationship to create the zone.

As the price bars continue to form, the order is moved upon completion of each new price bar. Eventually, the order is hit as prices return to the direction of the Moving Average and we are in the trade.

A stop loss order may be placed at the opposite end of the price bar entry. This may be an actual stop loss order or one can monitor the trade and exit only if a close occurs beyond the stop loss point.

Exit for the profit point depends on use of multiple contracts and the relationship of the time frame of the entry compared to the larger time frames.

| MACD CONSERVATIVE SELL | MACD CONSERVATIVE BUY | |

|

|

|

|

|

|

| X |