These contributions are from Mike Bruns, world class trader.

Mike's clear thinking and charts have allowed for many traders to finally

"get it". His generous sharing and teachings have helped me raise my level

of trading. Reinforcing the concepts of trading with the trend, his

knowledge of the bond market and other markets. Mike also gives after market

hours seminars for members, they are exceptional. My personal thanks

Mike...NQoos

If you desire to be a profitable trader and understand the

value of learning from other successful traders then efuturevsion.com is a

perfect vehicle to accomplish this. This is only a sampling of the expertise

in trading education available in the efuturevision chat room, website and

after hour seminars for members. The education section and

Trading notes section

on efuturevision is open to the public. These contain setups and information

from Victoria, Mike, Jimmer, Brian, Ross and others. All profitable traders.

Members can access much more valuable trading information than what is in

the general public areas.

If this is still you,

choose today to change.

MACD Aggressive Setup

MACD

Conservative Setup

DeMark REI

REI

Stochastic Setup

REI

Note

9/30

Setup

MACD Aggressive Setups

Location: With the Trend

The MACD is a momentum indicator composed

of two moving averages, a Fast Line (FL), a Slow Line (SL). A Base Line

(BL) is the third component of the standard MACD.

The values used are:

3, 11, 17

We are comparing the

relationships of all three lines to each other to establish the set up in a

“zone of opportunity.” Once in the zone, the price bars decide the point of

entry.

The chart plots the Moving

Average (MA). I prefer the 30-period weighted moving average. The

20-period exponential moving average is fine also.

We are looking to take the trade in the

direction of the Moving Average (MA).

The Slow Line (SL) has

crossed over the Base Line (BL) in the direction of the Moving Average (MA).

The Fast Line

crosses over the Slow Line in the opposite direction. At this point, we are

looking for and anticipating a conservative setup. Instead, the prices

reverse back to the direction of the Moving Average and the Fast Line turns

in the direction of the Moving Average. All without the Fast Line crossing

over the Base Line to set up the conservative zone.

There is no time or place

to set a stop or stop limit order. We enter immediately at the market in

the direction of the Moving Average. We place our initial stop loss at the

opposite end of the last completed price bar.

The exit for profit is

based on price action as it develops and the relationship of the entry in

this time frame with the larger time frames.

| |

|

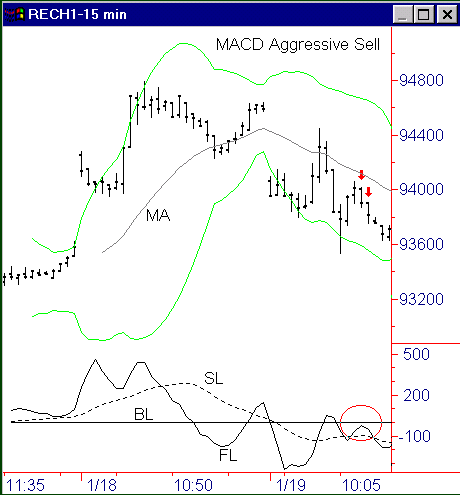

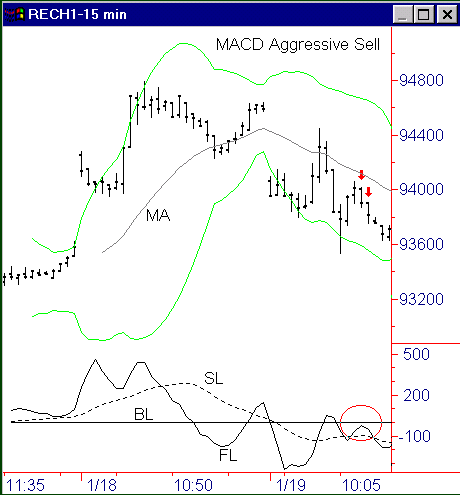

In this example

of the Eurocurrency, the MA is down so we are looking to sell.

We just completed a nice MACD Conservative Sell and let’s see if

we can get another one. The SL < BL. The FL > SL but turns down

before reaching the BL. We sell at the market on one of the

price bars indicated by the two arrows. It depends on how fast

we are at recognizing what just happened. And we are short the

market. |

|

| |

|

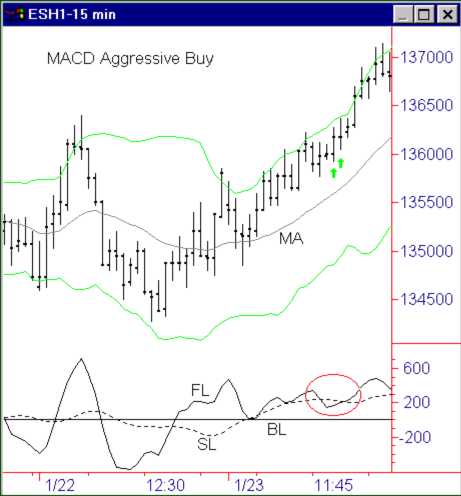

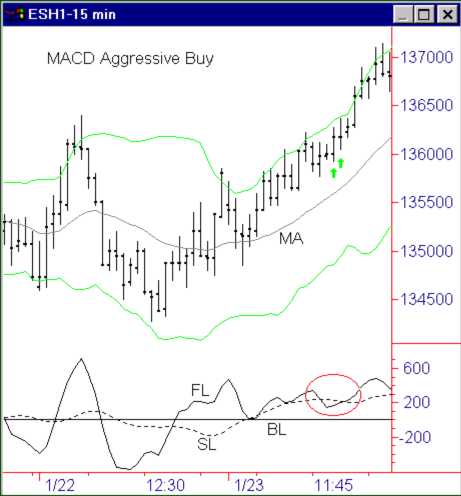

In this example

of the SP mini contract (ES), the Moving Average is up and we

want to go long. The SL > BL and the FL < SL. Then, the FL

turns up. We immediately enter a market order to go long at the

area of the bars with the arrows, depending on how fast we

recognize what just happened. Initial stop loss is placed at

the opposite end of the last completed price bar.

|

|

| |

| |

| |

.