| Commodity Channel Index (CCI) |

| Introduction |

Developed by Donald Lambert, the Commodity Channel Index (CCI) was designed to identify cyclical turns in commodities. The assumption behind the indicator is that commodities (or stocks or bonds) move in cycles, with highs and lows coming at periodic intervals. Lambert recommended using 1/3 of a complete cycle (low to low or high to high) as a time frame for the CCI. (Note: Determination of the cycle's length is independent of the CCI.) If the cycle runs 60 days (a low about every 60 days), then a 20-day CCI would be recommended. For the purpose of this example, a 20-day CCI is used.

| Calculation |

There are 4 steps involved in the calculation of the CCI:

(Click here to download an Excel spreadsheet that contains a example of the CCI being calculated.)

DELL

For scaling purposes, Lambert set the constant at .015 to ensure that approximately 70 to 80 percent of CCI values would fall between -100 and +100. The CCI fluctuates above and below zero. The percentage of CCI values that fall between +100 and -100 will depend on the number of periods used. A shorter CCI will be more volatile with a smaller percentage of values between +100 and -100. Conversely, the more periods used to calculate the CCI, the higher the percentage of values between +100 and -100.

Lambert's trading guidelines for the CCI focused on movements above +100 and below -100 to generate buy and sell signals. Because about 70 to 80 percent of the CCI values are between +100 and -100, a buy or sell signal will be in force only 20 to 30 percent of the time. When the CCI moves above +100, a security is considered to be entering into a strong uptrend and a buy signal is given. The position should be closed when the CCI moves back below +100. When the CCI moves below -100, the security is considered to be in a strong downtrend and a sell signal is given. The position should be closed when the CCI moves back above -100.

Since Lambert's original guidelines, traders have also found the CCI valuable for identifying reversals. The CCI is a versatile indicator capable of producing a wide array of buy and sell signals.

Traders and investors use the CCI to help identify price reversals, price extremes and trend strength. As with most indicators, the CCI should be used in conjunction with other aspects of technical analysis. CCI fits into the momentum category of oscillators. In addition to momentum, volume indicators and the price chart may also influence a technical assessment.

| Example |

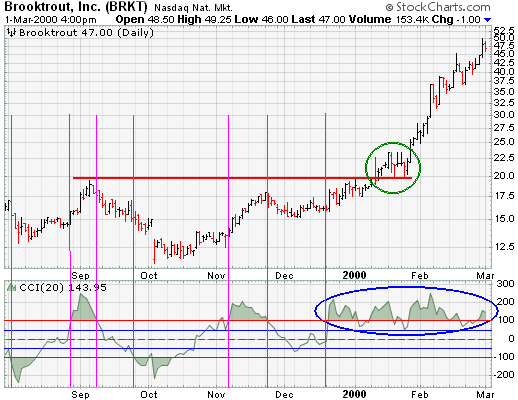

Brooktrout

The 25-day CCI for Brooktrout (BRKT) provides an example using Lambert's guidelines. Even though a few signals are good, using crosses above and below +100/-100 resulted in plenty of whipsaws. In January, the stock broke resistance at 20 and proceeded to double in the next few weeks. The CCI moved above and below +100 several times, but the stock remained in a strong uptrend. The CCI did manage to remain above +50 for about 7 weeks (blue oval), but the whipsaws below +100 could have caused an early exit. Whipsaws do not make an indicator bad. However, traders and investors should learn to use the CCI in conjunction with other indicators and chart analysis. In addition, various time frames for the CCI should be tested as well as buy and sell points. For Brooktrout, a buy point on a cross above and below +50 may have worked better. What works for one stock may not necessarily work for another stock.