Volume Breakdown (VB)

|

The Formula . . . |

|

Delta = Buy Volume -

Sell Volume

Buy Volume (Ask Volume) = volume that traded at or

above the ask price.

Sell Volume (Bid Volume) = volume that traded at

or below the bid price.

See the Preferences section below

for information on the various results and calculations that are

available from within Volume Breakdown, including accumulation,

statistics, and applying indicators to VB Results.

|

| |

|

The Presentation . . . |

|

|

Above is a 5-minute of the

S&P E-mini Futures Contract (ES #F, eSignal). The second pane

shows the per-bar Delta. The third pane shows the accumulated

Delta Bars for the day. The bottom pane shows a 14 period

triangular moving average of the per-bar Delta. |

| |

|

The Preferences . . . |

|

|

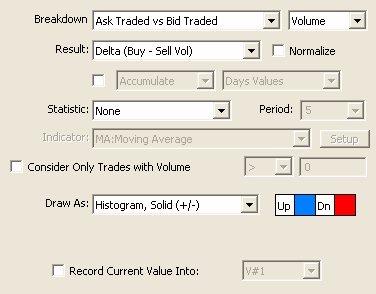

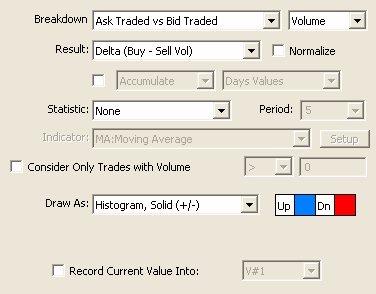

|

-

Breakdown Volume -

Volume can be broken down based on either of two methods:

- Ask Traded vs Bid Trade Volume

- Volume that trades at the ask price is considered buy

volume, while volume that trades at the bid is considered

sell volume

- Up Tick vs Down Tick Volume

- Volume that trades on or subsequent to an up tick is

considered buy volume, while volume that trades at or

subsequent to a down tick is considered sell volume.

-

Result - This list

dictates what the VB indicator will compute (before applying

any accumulation or statistics to it). Result options

include:

- Delta (Buy - Sell Vol)

- difference between the buy volume and the sell volume

- Delta Bars - same

as "Delta", except drawn in a candle bar format, which

displays the opening de

- Buy Volume - Volume

that traded at or above the ask.

- Sell Volume -

Volume that traded at or below the bid.

- Sell Volume (Negative)

- Volume that traded at or below the bid, expressed as a

negative value. This option is there so that Buy Volume and

Sell Volume histograms may be added to the same pane, but

drawn on different sides of the zero line.

- Total Volume -

Total volume traded.

- Total Trades/Ticks

- Total number of trades or ticks.

- Buy Volume % -

Percent of volume within each bar which was classified as

Buy Volume.

- VWAP - Volume

weighted average price of each bar. Each tick is weighted by

it's volume to produce a weighted average price of all ticks

within each bar.

- Big Volume % -

Percent of volume within each bar which was classified as

"Big Volume". "Big Volume" is defined as any trade with a

size greater than a size specified to the right of the

"Consider Only Trades With Volume" checkbox. That Volume Box

will be editable whenever "Big Volume %" or "Big Trade %"

results are selected.

- Big Trade % -

Percent of Trades within each bar which was classified as

"Big Volume". This result simply deals with the number of

trades, as opposed to the size of those trades.

- Average Size -

Average size of the trades which occurred within any given

bar.

- Max Delta - The

maximum delta value achieved within each bar. This is

equivalent to the high seen for each deltabar.

- Min Delta - The

minimum delta value achieved within each bar. This is

equivalent to the low seen for each deltabar.

- Delta Momentum -

Delta Momentum essentially sums up the delta values while

the per bar delta remains on the same side of the zero line.

When delta turns from positive to negative, the result will

reset to that negative values, and the result will continue

to accumulate while the deltas remain negative. When delta

becomes positive, the result will reset back to that

positive value, and accumulate from there while delta

remains positive.

- Delta Mom Count -

Delta Mom Count works in the same way, except it simply

counts how many bars delta has remained positive or negative

consecutively. A value of -5 means we've had 5 consecutive

negative delta bars.

- Matching Volume - High

- Amount of volume that traded on both sides (buy and

sell volume) at the high of the bar. In general, at the

high of the bar, most (if not all) volume will trade at the

ask (buy volume).

- Matching Volume - Low

- Amount of volume that traded on both sides (buy and

sell volume) at the low of the bar. In general, at the low

of the bar, most (if not all) volume will trade at the bid

(sell volume).

- Avg Buy Size -

Average size of all trades that came in on the buy/ask side.

- Avg Sell Size -

Average size of all trades that came in on the sell/bid

side.

- VWAP(Day) - Volume

Weighted Average Price of all tick accumulated throughout

each session.

- VWAP(All) - Volume

Weighted Average Price of all tick accumulated throughout

the entire view period of the chart.

- Delta Finish

- This is the pullback of delta from it's last high or low.

If Delta last bounced off it's high before completing bar,

the finish will be negative (or zero). If Delta last

bounced off it's low before completing bar, the finish will

be positive (or zero).

- Time in Bar (Secs)

- Amount of time, in seconds, spent in each bar.

Especially useful for tick-based periodicities like

tickbars, volume bars, range bars, PNF, Renko, etc.

-

Normalize - An

option was added to the Volume Breakdown indicator to allow

the user to "Normalize" the result. When the "Normalize"

checkbox is checked, the VB Result (such as Delta) is

divided by the volume and then multiplied by 100, to give in

effect a positive or negative percent of total volume. For

instance, a normalized delta of 34 would mean that the delta

was positive, and 34% of the total volume. A result of -100

would mean that all the volume traded in that bar was

sell/bid volume (negative).

-

Accumulate/Avg/Max/Min

- The Accumulate option allows the user to accumulate the

values computed from the Result choice throughout the day

(or throughout the entire chart). If "Days Values" is

chosen, the accumulation will begin fresh each day, and

accumulate throughout the day. If "All Values" is chosen,

the accumulation will start at the begin of the chart and

continue throughout the chart. In addition to "Accumulate",

options are also available to compute the Average, Maximum,

or Minimum value of the day (or entire chart).

-

Statistic - A

Statistic (or indicator) calculation can also be applied to

the Result. Choices include.

- None - No statistic is applied. Just use the

raw Result computed above.

- Average - Average the values using the Period

specified to the right.

- Sum - Sum the values over the period specified to

the right.

- Maximum - Find the Maximum value over last n bars

(n = Period)

- Minimum- Find the Minimum value over last n bars (n

= Period)

- Avg (Least Square) - Performs a least square

average using the Period specified.

- Indicator - When this option is chosen, the user is

then presented with a list of technical indicators from

which to choose (all built-in indicators that I/RT offers).

Select the desired indicator and then click the "Setup"

button just to the right to specify the indicator

preferences. This indicator will be applied to the Result

to compute the final values.

- Speed (Per Second) - divides the "result" by the

number of seconds in the bar.

- Speed (Per Tick) - divides the "result" by the

number of ticks in the bar.

- Speed (Per Unit Volume) - divides the "result" by

the volume of the bar.

- Tick Momentum (T/t) - multiplies the "result" by

the number of ticks in the bar, then divides by the time (in

seconds) of the bar.

- Volume Momentum (V/t) - multiplies the "result"

by the volume of the bar, then divides by the time (in

seconds) of the bar.

-

Consider Only Trades

with Volume (Filter) - This option gives the user the

ability to apply a filter to the trades consider in the

calculation. The user can choose to consider only trades >

than a given size, < than a given size, or = to a given

size.

-

Draw As - Style used to draw the indicator in the

chart.

|

| |

|

The Description . . . |

| The Volume

Breakdown is a powerful and flexible indicator used to gauge

buying and selling pressure, and has attracted quite a bit of

attention in recent months. It looks inside each bar, breaking

down and classifying each tick and then accumulating the

results, and further giving the user a variety of statistical

measures (including all built-in technical indicators) to apply

the these results. The most common use of the VB indicator is to

calculate the delta (difference between the buy (ask-traded) and

sell (bid-traded) volume) of each bar. Positive deltas signify

more buying pressure, while negative deltas signify more selling

pressure. The magnitude of the delta determines the strength of

that pressure. Expect to see positive deltas during uptrends and

negative deltas during downtrends, but look for delta turning

negative at highs, or turning positive at lows...a sign of

possible market turns and good entry/exit points.

With the VB indicator, the Delta can be

computed, accumulated, and run through a variety of

statistical/indicator computations.

The VB indicator is unique in that it

loads tick data (when initially computing) regardless of the

timeframe of the chart, in order to breakdown the volume of each

trade, and calculates on each tick. While it may take a few

moments to initially add VB to a chart, or load a chart which

involves VB, the VB indicator is designed to calculate very

efficiently on a tick-by-tick basis, regardless of the

combination of settings selected. |

|

RTL Token . . .

|

| The RTL Token

for the Volume Breakdown indicator is VB. A common system for

trading the VB might be to look for VB turning positive after 3

negative values:

VB > 0 AND MAX(VB.1, 3) <=

0

|

|

User Strategies . . . |

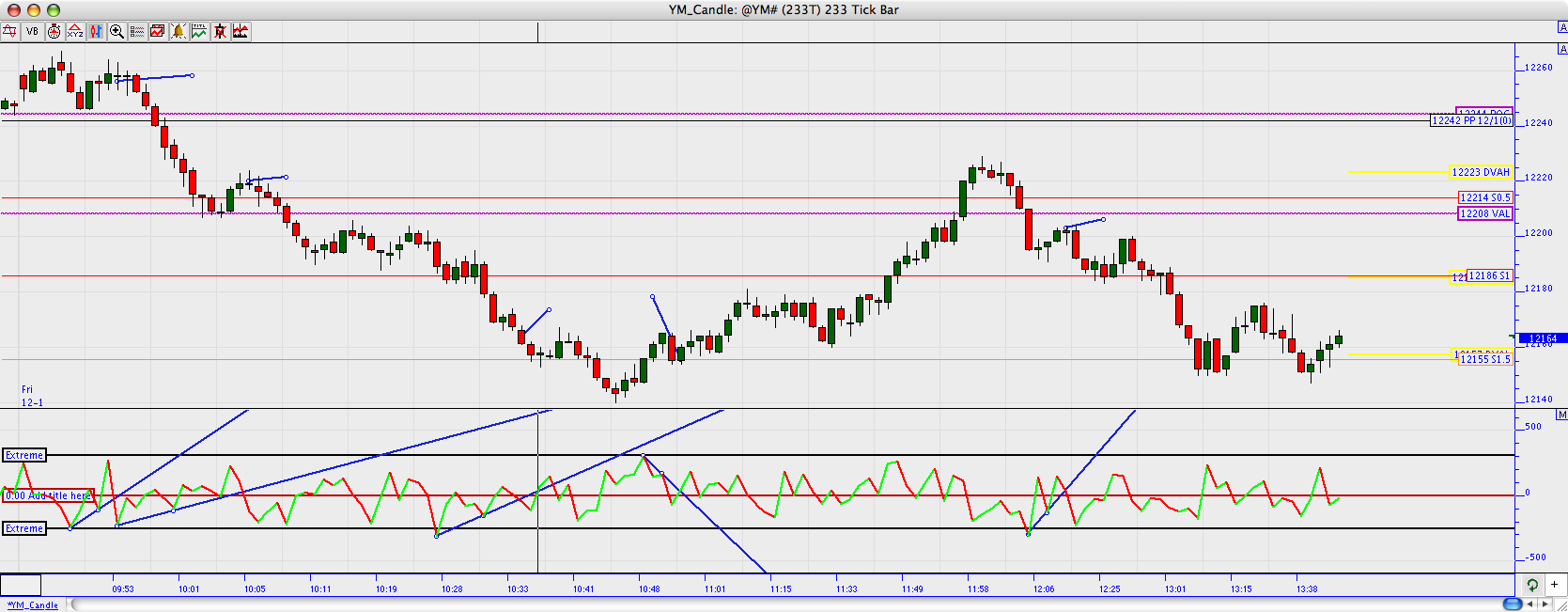

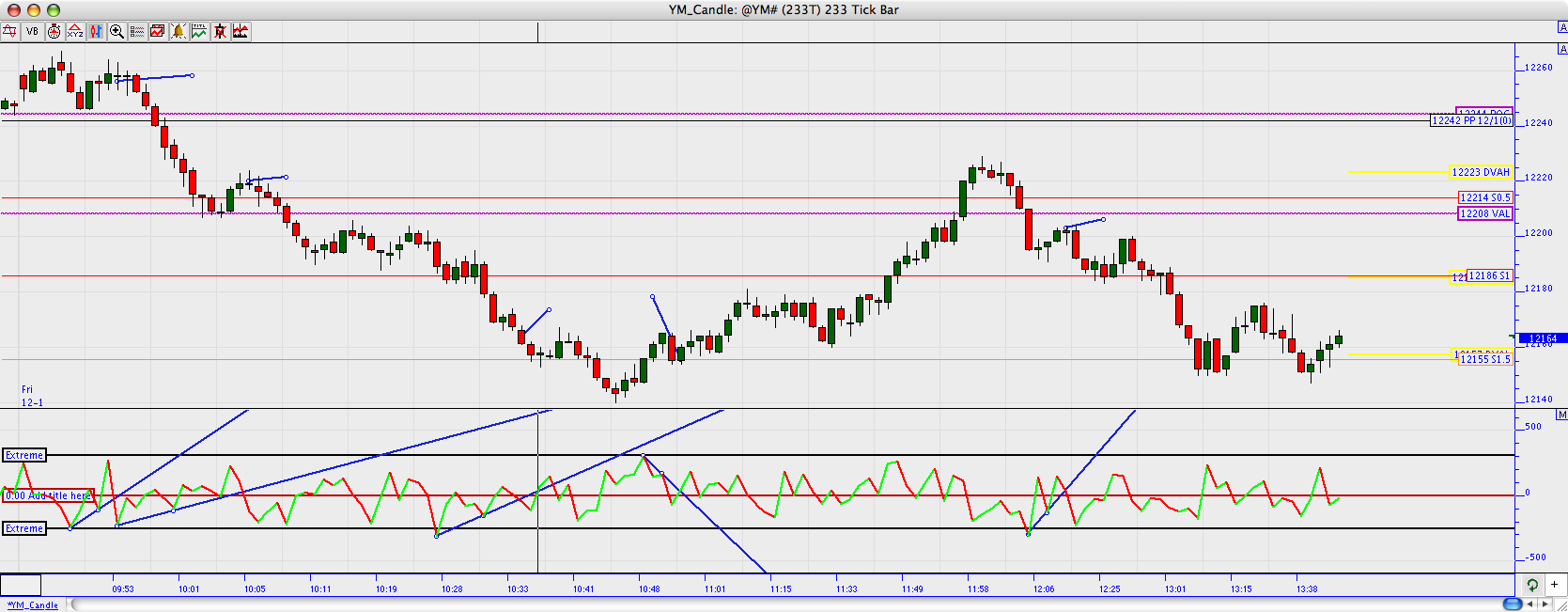

Here's how I use

the VB indicator:

Basically, when we hit that extreme reading, this is where I

start drawing a trendline on my volume breakdown indicator. We

need to have one more high/low from that initial point to

connect 2 points for a line. Once we get a break above or below

that trendline, I put in an order to go with the direction of

the momentum. Here’s some examples with the chart below.

- The first of the day was right after

9:30. I got my short signal at 12256. The pivot below at 242

was completely taken out, and quickly, so my next exit point

is at 12208, VAL. 48 points.

- The second of the day was right back

after a bounce off of VAL. Short was at 12218. There was

continually lower highs until 12165, or right about S1.5. 53

points.

- The third was right after that signal

to get out, and it was long right at S1.5 as it broke 12157.

12208 was the pivot to exit at. 51 points.

- The fourth was on a retracement to

VAL after it broke through it at about 12198. I’d watch for

S1.5 as that has been good support at 12155. 43 points.

So, 4 amazing setups, none were stopped

out and it was good for 198 points. I had about 130 points off

of these similar pivots for yesterday.

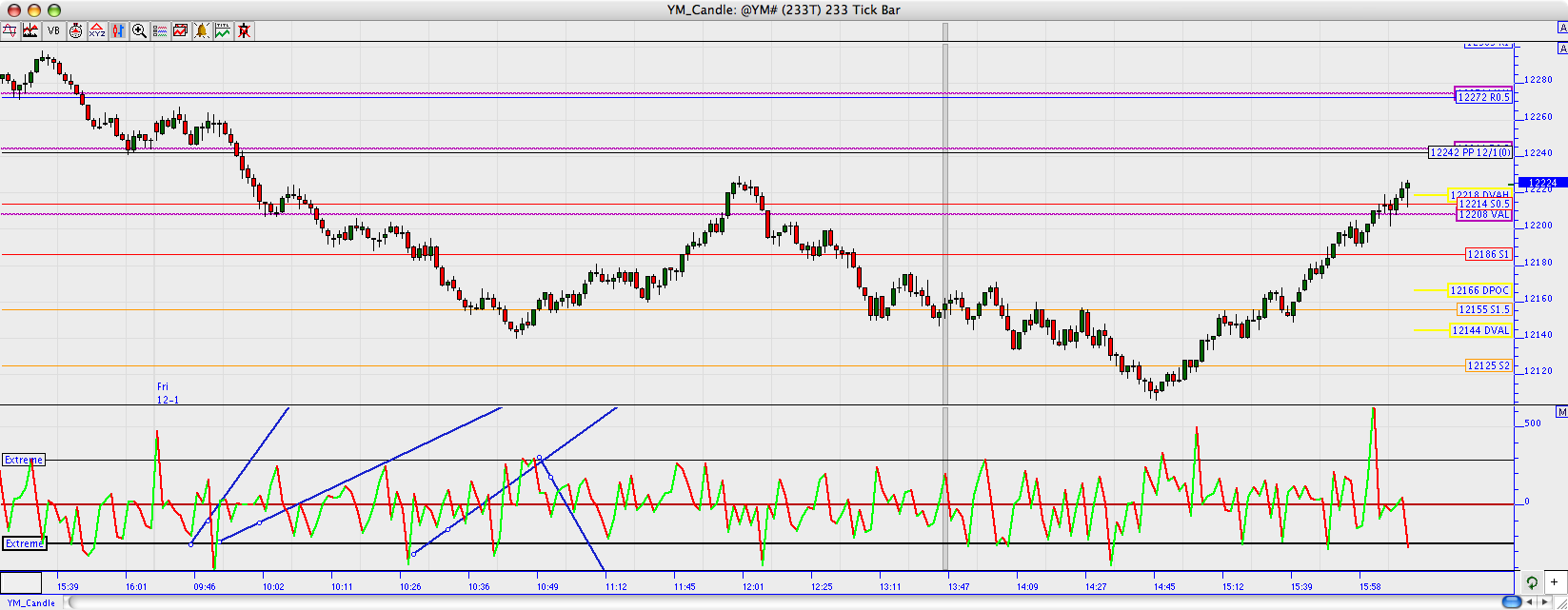

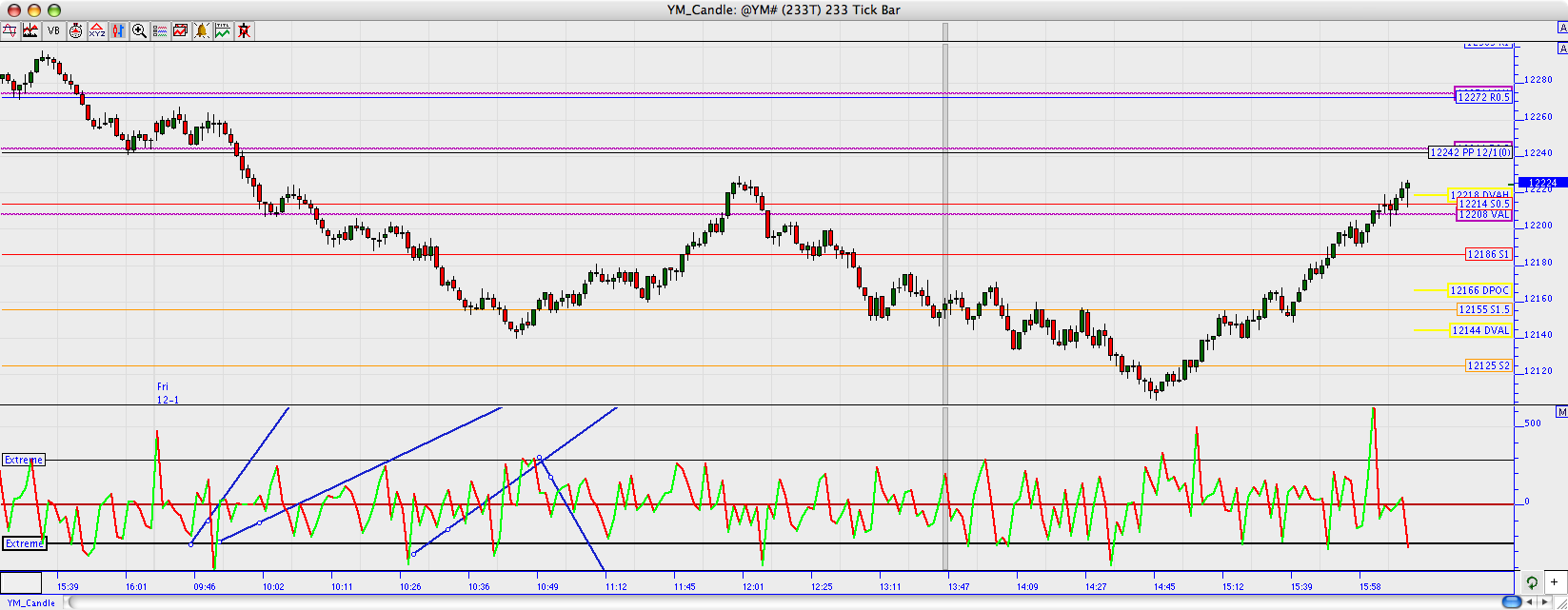

Here's the chart of what I was working

with yesterday:

Also, here at 14:45 you'll notice that the indicator called the

turnaround from just a little above the low of the day, yielding

100 points in 75 minutes.

**************************** |

|