|

|

|

|

|

|

|

|

Posted - 03/14/2012 20:56:22 Posted - 03/14/2012 20:56:22   |

traded QCOR +.32 (trading a few smaller stocks that fit all criteria except $2 range due to account size)

traded LNKD B/E in too early. |

|

|

|

Posted - 03/15/2012 10:26:32 Posted - 03/15/2012 10:26:32   |

tachyonv

would you mind commenting on your cycle thread and split's tape reading thread when you have a chance?

hope you feel better soon. |

|

|

|

|

|

|

Posted - 03/15/2012 12:19:36 Posted - 03/15/2012 12:19:36   |

| I am simply following this thread. I don't know but would it be helpful for people to post their entry times and exit times? |

|

|

|

Posted - 03/16/2012 08:01:55 Posted - 03/16/2012 08:01:55   |

Tach,

Once

again, thanks for sharing this volatility method. I am but one of the

flock who have found this rewarding and educational, not to mention some

of the indicators and EL code that I have adapted. I think it has been

over one month since you teased us with additional strategies to come.

I will look forward to your next strategy and wish you all the best

with some of your health issues. Keep enjoying those grandkids. They

keep you young. |

|

|

|

|

|

|

Posted - 03/16/2012 12:18:29 Posted - 03/16/2012 12:18:29   |

NFLX

11:14 - 11:28 +.52 (actually got a bit more than that as scaled out

above .52 but posting trade within the guidelines of the method)

Been

having quite a good run on NFLX, just wish I knew why, still dont realy

get or understand cycles, just feels like i'm getting lucky |

|

|

|

Posted - 03/16/2012 12:30:21 Posted - 03/16/2012 12:30:21   |

split

glad to see you are doing well. There are reasons why tachyonv's

cycles work, they are fairly close to mine and what LBR taught in the

past. Learning the why on your own will make you a much better trader

and will influence your decision when to enter/exit the trade...I don't

think you are simply lucky at this point.

Be sure to study NFLX

carefully, you might find it trades a little different than other

instruments, as tachyonv has pointed out about instruments in general in

the past. |

|

|

|

Posted - 03/16/2012 13:11:40 Posted - 03/16/2012 13:11:40   |

nirvana

are you trading tachyonv's strategy...how are you doing daily? I don't trade equities and am simply watching the thread. |

|

|

|

Posted - 03/16/2012 18:01:52 Posted - 03/16/2012 18:01:52   |

| quark,

I have played around with tach's strategy, but I find it performs best

in trending and up markets. For his strategy, I have used ALXN, RRC,

OPEN, PANL, and PRGO as his candidates. I have also been playing with

FFIV, and QLD using his method with discretion. I usually only trade

when the TRIN is < 0.9. I have been relatively successful, however

with these up markets, a dartboard approach may also work well. I have

not had the time to do any thorough back testing yet. I think his

modified Keltner method combined with low %R provides some excellent

entry points for these markets. |

|

|

|

Posted - 03/16/2012 18:14:42 Posted - 03/16/2012 18:14:42   |

| thanks

nirvana, was just curious. Perhaps you can explain why you use the

TRIN for selection. It appears tachyonv may not be adding to the forum

for certain reasons. Please continue your ideas here and on the Keltner

method...You have been a member of the forum going on a decade. |

|

|

|

Posted - 03/17/2012 20:45:44 Posted - 03/17/2012 20:45:44   |

quote:

Originally posted by quark

I am simply following this thread. I don't know but would it be helpful for people to post their entry times and exit times?

I too am interested in the times that traders are taking positions with the tachyonv method.

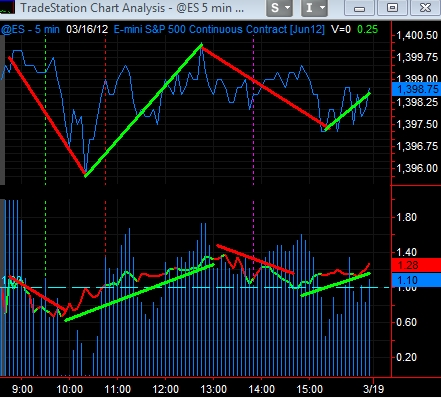

Typical intraday price turning points for the past 22 days for @ES, start time 8:30 am.

This past Friday price followed the regime switching protocol fairly closely.

10:00 am

13:00 pm

15:00 pm

|

|

|

|

Posted - 03/18/2012 19:18:44 Posted - 03/18/2012 19:18:44   |

Quark,

At

times I like to trade on the long side and I either like to see a

trending or up market; that is why I sometimes trade when the TRIN <

0.9. I might miss some good opportunities when certain stocks dont

correlate well with the NYSE. I also tend to use this when I run

unattended automated strategies. Otherwise, when I am watching tick by

tick, I tend to be more aggressive but I do watch relative strength

(%R), TRIN, TICK, and TRIX. As stated in some of the earlier posts,

entry times might fall between 1030 and 1130 est. I also tend to look

for quick scalps later in the day. |

|

|

|

|

|

|

Posted - 03/20/2012 07:03:46 Posted - 03/20/2012 07:03:46   |

quote:

Originally posted by benuchcale

Had someone traded today 1000 shares on each symbol using Tachyonv's Tradable List and top $APR you would get this.

Attachment:DATA/20120319200312Tachynov 03192012.xlsx 10635 bytes

You would need a 3.5 Mil account or you could reduce to 100 shares per symbol.

However the interestingis 3 loosers to 36 winners.

benuchcale

What are you using as the entry point for these figures ?

The key to this strat (as far as I can tell) is WHEN to get long on a limit order at a low.

From

my own stats testing I can see that 90% of the time, the profit target

will get hit but only as long as you get in at the best time. This is

the bit I struggle with, knowing when to get in.

I have been

experimenting with various methods for finding the best time of day to

enter, one of which is to use a simple strategy and optimize the start

time and then examine the optimization results for %profitable and

netprofit for each minute between 930 and 1145.

Anyone else use this method or can suggest alternatives, would be appreciated. |

|

|

|

Posted - 03/20/2012 08:56:26 Posted - 03/20/2012 08:56:26   |

split, a few ideas to consider:

Hard code (10:00 am long) into your strat, optimize the target.

Incrementing by 1 bar, back and forward, from 10:00am, collecting frequency of win/loss.

To get a better idea of what time to use,

you could even weight the win/loss results by the total points taken accross all time frames tested.

Compare the frequency and size of wins at each time increment.

Take a look at the e-ratio article for more ideas of how to evaluate your results.

https://community.tradestation.com/Discussions/Topic.aspx?Topic_ID=118928

fyi: Found reading scholarly articles, 5 min bars chart get's you out of the noise of the market.

|

|

|

|

Posted - 03/20/2012 09:06:02 Posted - 03/20/2012 09:06:02   |

quote:

Originally posted by split

quote:

Originally posted by benuchcale

Had someone traded today 1000 shares on each symbol using Tachyonv's Tradable List and top $APR you would get this.

Attachment:DATA/20120319200312Tachynov 03192012.xlsx 10635 bytes

You would need a 3.5 Mil account or you could reduce to 100 shares per symbol.

However the interestingis 3 loosers to 36 winners.

benuchcale

What are you using as the entry point for these figures ?

The key to this strat (as far as I can tell) is WHEN to get long on a limit order at a low.

From

my own stats testing I can see that 90% of the time, the profit target

will get hit but only as long as you get in at the best time. This is

the bit I struggle with, knowing when to get in.

I have been

experimenting with various methods for finding the best time of day to

enter, one of which is to use a simple strategy and optimize the start

time and then examine the optimization results for %profitable and

netprofit for each minute between 930 and 1145.

Anyone else use this method or can suggest alternatives, would be appreciated.

Split,

The

entry and exit are simple. Get in at 10:30 get out at 1:30 PM no

optimization. However, it varies from Tachy's strategy in that this one

does not take the 0.52 points as the max gain.

The point of my post

is to show that there is no reason to over-think this strategy. At least

for the past 3 months. You got in at 10:30 and you got out at 1:30

period. One thing I would add as protection is a stop loss.

|

|

|

|

Posted - 03/20/2012 12:29:19 Posted - 03/20/2012 12:29:19   |

When to perform the scan, the night before or in the morning before it opens?

I

have observed the method for a few days, it appears the entry point is

vert important to get out with the target profits. Tried one today PRGO,

got in and out within less than 30 min when the target profit was

reached. Another one RRC is still in the process, I will try to close

it out by 12:30 win or lose :) Thank you for help. |

|

|

|

Posted - 03/20/2012 12:32:52 Posted - 03/20/2012 12:32:52   |

quote:

Originally posted by PACER123

When to perform the scan, the night before or in the morning before it opens?

I

have observed the method for a few days, it appears the entry point is

vert important to get out with the target profits. Tried one today PRGO,

got in and out within less than 30 min when the target profit was

reached. Another one RRC is still in the process, I will try to close

it out by 12:30 win or lose :) Thank you for help.

Pacer123

If

your referring to the TS scan to find the symbols matching the search

criteria then I dont think it matters what time of day you run it as you

only need to run it periodically, not every day.

|

|

|

|

Posted - 03/20/2012 14:10:29 Posted - 03/20/2012 14:10:29   |

| Hello,

seems interesting this methods, just a simple question for TheHook, on

my scanner when i entry the indicator criteria of AvgRange, i couldn't

get the rows below to format and put the interval, lengh 34 , sort,etc.

How can i find these options to format? thank you |

|

|

|

Posted - 03/20/2012 18:01:14 Posted - 03/20/2012 18:01:14   |

| I

got it. Thank you anyway. But now other question, today is posible that

i can find 116 symbols under these parameters. I ask this because on

the first, it show me that ^no symbols met this criteria, so i create a

new scanner and now i find 116 symbols. And i was looking that normally

on the forum they find 4 or 5 symbols. |

|

|

|

Posted - 03/20/2012 19:49:17 Posted - 03/20/2012 19:49:17   |

quote:

Originally posted by yitana

I

got it. Thank you anyway. But now other question, today is posible that

i can find 116 symbols under these parameters. I ask this because on

the first, it show me that ^no symbols met this criteria, so i create a

new scanner and now i find 116 symbols. And i was looking that normally

on the forum they find 4 or 5 symbols.

I've

been getting around 100 or so from the scanner, then when I put into

the RadarScreen, it usually comes back with around 40 options that are

"Tradable" from there I look up beta on Yahoo finance (note I don't use

beta in my original scans) and typically am left with 5-10 candidates

(typcially the same ones) Here is the final list from the scan I ran on

Mar 11th UCO(D)LULU,CERN,REGN,NFLX,GOLD,HUM,ALXN,PANL,PRGO,OPEN,RRC,GMCR

|

|

|

|

|