|

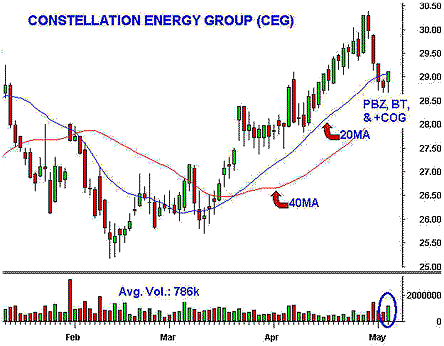

Multiple Bottoming Tails in the Buy Zone

|

Trading Strategy:

Buy Setup (BS - at least 2 days

down), Bottoming Tails (BT),

and Bullish Changing of the Guard

(+COG), in the Buy Zone (BZ -

area between rising 20MA and 40MA, where 20MA is

above 40MA). CEG is in a powerful Stage 2 on the

daily chart, as shown by the series of higher

highs (HH) and higher lows (HL). It has sold off

for four days, before the bulls took over

control as shown by the +COG. Also interesting

are the three BT were all in the same general

area, showing demand underneath. Although not

shown, the hourly chart closed with a bullish

bar on increased volume (+Vol.), a bullish sign.

Finally, the BS and BT occurred in between the

rising 20MA and 40MA (BZ), where strong

snap-backs often happen.

chart courtesy of

Mastertrader.com

Tip: A Buy Setup with

multiple Bottoming Tails, in the Buy Zone, is a

powerful combination suggesting a tradable

bounce over the +COG.

The Play:

Buy over previous day's high, with a protective

stop under previous day's low.

NOTE: If some economic news, that can cause

additional volatility, are supposed to be out

that day, raise the stop to the 30-min. low

after the their announcement.

Objective:

Target in the area of $30.

MEDIUM RISK

Play Review:

CEG rallied 5 trading days in

a row, surpassing the target. |